Good Morning from San Francisco,

Coca-Cola swapped fifty crew members for five AI specialists. Production time collapsed from a year to a month. Consumer resistance is softening, but those creative jobs aren't coming back.

Meanwhile, Beijing is cutting data center power bills in half. The catch? You need Chinese chips, not Nvidia's. Trump just blocked Jensen Huang's export push days after lobbying hard in person. Washington widens the gap while Beijing pays to bridge it.

Inside this issue: workforce composition shifts that mask job losses, and electricity subsidies that reshape AI competition more than tariffs ever could.

Stay curious,

Marcus Schuler

Coca-Cola doubles down on AI holiday ads

Coca-Cola released its 2025 AI-generated holiday campaign Monday, collapsing production from a year to one month.

Five AI specialists at Silverside prompted and refined 70,000 video clips, replacing the 50-plus crew members typically required for animation of this complexity.

The workforce math reveals what efficiency narratives obscure. Coca-Cola maintains the campaign involved 100 people across the company, agency WPP, and two AI studios, matching previous productions. The composition shifted radically. Animators, riggers, lighting specialists, and frame-by-frame compositors disappeared from the roster.

Consumer opposition to AI in ads dropped from 49% to 46% year-over-year, according to Attest research. Not enthusiasm, declining resistance. The Interactive Advertising Bureau reports 30% of video ads now use generative AI, up from 22% in 2024, projected to hit 39% by 2026.

From executives' view, speed and cost efficiency justify deployment. From the creative workforce perspective, the math is zero-sum. Both readings are accurate.

Why this matters:

- Workforce restructuring in advertising accelerates through composition shifts rather than headcount reductions, masking displacement behind efficiency claims

- Consumer resistance softens faster than quality gaps close, creating operational runway for brands prioritizing cost reduction over emotional depth in creative production

AI Image of the Day

Prompt:

Ethereal close-up of a feminine face, porcelain

skin melting into misty whites and silvers, branches and crystalline leaves fuse into cheek and temple, tight crop three-quarter angle, macro detail, soft diffuse rim and cool backlight with gentle fill, textured impasto and torn-paper collage with translucent glaze brushstrokes, dream-surreal collage-mosaic style, dominant colors deep sapphire, icy blue, muted indigo, pearly white, silver

China cuts data center power bills in half

Beijing is slashing data center electricity costs by up to 50% in provinces like Gansu, Guizhou, and Inner Mongolia, but only for facilities running domestic chips from Huawei and Cambricon.

Nvidia hardware gets nothing. Days before Trump met Xi in Busan on October 30, Nvidia CEO Jensen Huang lobbied hard for Blackwell export approval. Secretary of State Rubio and other advisers killed the idea, citing national security. Trump's position hardened by Sunday: "We don't give that chip to other people."

The efficiency gap is stark. Chinese chips consume 30 to 50 percent more power than Nvidia's H20 for identical output. Post-subsidy rates drop to 5.6 cents per kilowatt-hour versus the 9.1-cent US average. Some packages cover an entire year of operating costs.

Beijing is paying to bridge the capability gap while domestic chips improve. Washington is using export controls to widen that gap and maintain negotiating leverage.

Why this matters:

• Industrial policy now runs through electricity subsidies and export licenses, not just product specifications or tariffs

• Market access increasingly requires technical constraints that transform private technology roadmaps into instruments of statecraft

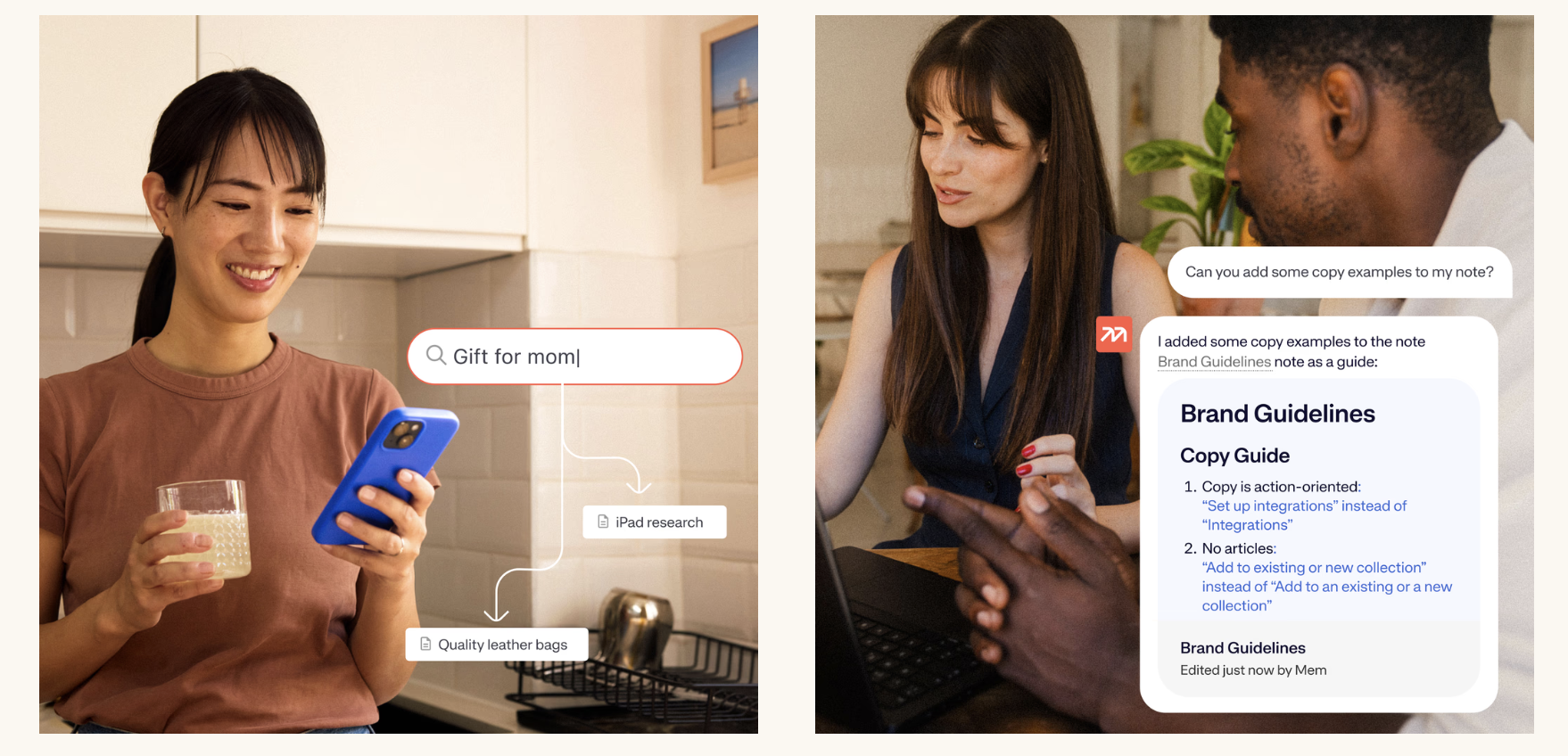

🧰 AI Toolbox

How to Store and Find Your Notes Without Manual Organization

Mem is an AI notes app that organizes your thoughts automatically. Write freely without folders or tags. The AI connects related notes, answers questions from your knowledge base, and surfaces information when you need it.

Tutorial:

- Go to the Mem website

- Create a note by typing whatever's on your mind

- The AI automatically connects related notes and surfaces them when relevant

- Ask Mem Chat questions to dig up information across all your notes

- Use Smart Search to find notes beyond keyword matching

- Let AI Collections organize your notes without manual tagging

- Access your synchronized notes on web, desktop, or mobile

URL: https://get.mem.ai

Better prompting...

Today: Multi-Perspective Expert Debate

Three experts debate my question. One is an academic researcher, one is a practical engineer, and one is a skeptical journalist. They disagree at first. Show them debating for several rounds, then arriving at a shared answer. Write their conversation, then summarize their agreement in clear, practical terms.

AI & Tech News

33 Counties Hold 72% of US Capacity

According to Goldman Sachs data, just 33 US counties accounted for 72% of all American data center capacity as of July, with places like Umatilla experiencing dramatic transformation due to major tech buildouts such as Amazon Web Services facilities. While local residents, politicians and agencies are capitalizing on this technology infrastructure boom and the economic prosperity it brings, communities are also grappling with significant costs and uncertainty about long-term sustainability once construction phases end.

AWS Announces Transatlantic Fastnet Subsea Cable Project

Amazon Web Services has announced plans to develop the Fastnet subsea cable, a high-capacity underwater data connection linking Maryland and Ireland with a planned capacity exceeding 320 terabits per second. The project, targeted for completion by 2028, will feature enhanced armoring protection and will be buried approximately 1.5 meters deep on the ocean floor to prevent cable cuts and damage.

Amazon Launches Enhanced AI Assistant in Music App

Amazon has rolled out Alexa+ integration on its Amazon Music app for iOS and Android devices, enabling Early Access users to make complex music requests and receive sophisticated recommendations. The enhanced AI assistant can create vibe-based playlists and provide nuanced song suggestions, allowing users to request obscure information about music with greater precision than previous versions.

Getty Images Loses AI Lawsuit Against Stability AI in UK High Court

Getty Images largely lost its high-profile lawsuit against AI company Stability AI at London's High Court on Tuesday, marking a significant legal defeat for the stock photo giant in its challenge over the company's AI image generator. The presiding judge characterized the ruling as "extremely limited in scope," suggesting the decision may have narrow implications for the broader legal landscape surrounding AI and copyright disputes.

Wikipedia Founder Challenges "Gaza Genocide" Page Over Neutrality Concerns

Wikipedia founder Jimmy Wales has publicly stated that the platform's "Gaza genocide" page fails to meet the site's neutrality standards, prompting editorial intervention. The controversial article has been placed under protection status until 21:47 UTC on November 4, restricting editing access amid ongoing disputes over its content.

Augmented Intelligence Raises $20M in Bridge Round at $750M Valuation

Augmented Intelligence Inc., a New York City-based startup developing neuro-symbolic AI models, has secured $20 million in a bridge SAFE round at a $750 million valuation. The funding brings the company's total capital raised to approximately $60 million as it works to advance AI technology beyond current transformer-based approaches.

DeFi Platforms Face Major Security Risks as $140 Billion in Assets at Stake

Chainalysis CEO Jonathan Levin has warned that the rapid expansion of decentralized finance (DeFi) platforms is putting user assets at significant risk of cyberattacks, with security considerations often overlooked by start-ups in the space. According to data from DefiLlama, more than $140 billion in assets are currently held across DeFi protocols, highlighting the substantial financial exposure as the head of the world's largest crypto tracing company emphasizes that security "hasn't really been considered" by many emerging platforms.

Uber Q3 Results Show Strong Growth Across Key Metrics

Uber reported strong third-quarter results with revenue rising 20% year-over-year to $13.5 billion, while gross bookings increased 21% to $49.7 billion and total trips grew 22% to 3.5 billion. However, the ride-hailing company's operating profit of $1.1 billion fell below analyst estimates of $1.6 billion, though Uber expressed confidence about entering the busy holiday season with what it called "exceptional momentum."

Lyft CEO Discusses Company Turnaround and AI Strategy in Extensive Interview

The Verge published a comprehensive Q&A with Lyft CEO David Risher covering the rideshare company's recent business turnaround efforts and strategic initiatives including artificial intelligence integration and improved driver compensation. The interview also explored Lyft's competitive positioning against Uber and the company's partnership with Tensor for autonomous vehicle technology development.

Spotify Beats Q3 Revenue Expectations with 12% Growth

Spotify exceeded analyst expectations in its third quarter results, reporting revenue of €4.3 billion, up 12% year-over-year and above the estimated €4.23 billion. The music streaming platform saw strong user growth with subscribers reaching 281 million (up 12% YoY) and monthly active users hitting 713 million (up 11% YoY), while also posting a substantial operating income of €582 million.

Grab Beats Q3 Revenue Expectations with 22% Growth

Grab Holdings reported third-quarter revenue of $873 million, a 22% year-over-year increase that exceeded analyst estimates of $869 million, while posting an adjusted EBITDA of $136 million. The strong performance was driven by innovative service offerings including group food ordering and more affordable shared ride options, prompting the Southeast Asian super-app company to raise its full-year earnings forecast.

WeRide Raises $308 Million in Hong Kong Secondary Listing

WeRide Inc. successfully raised approximately $308 million (HK$2.39 billion) through its Hong Kong share offering, pricing shares at around $3.48 each. The pricing represents a roughly 4% discount to the autonomous driving company's Monday closing price on the Nasdaq, as WeRide joins other US-listed Chinese firms pursuing dual listings in Hong Kong.

🚀 AI Profiles: The Companies Defining Tomorrow

Hippocratic AI

Hippocratic AI built voice agents that call patients and do the work nurses don't have time for. The company went from zero to unicorn in two years by refusing to diagnose anything.

The Founders

Munjal Shah (CEO) and Dr. Meenesh Bhimani (CMO) started the company in Palo Alto in 2023. They recruited co-founders from health tech and AI research: Subho Mukherjee (science), Vishal Parikh (product), Saad Godil (engineering). The team hit around 200 employees by late 2025.

The Product

AI agents that call, text, and talk to patients. They handle appointment reminders, chronic care check-ins, medication adherence, post-surgery follow-ups, screening outreach. The agents don't diagnose. They don't prescribe. When something looks risky, they escalate to a human nurse immediately. Under the hood: Polaris 3.0, a constellation of 22 specialized models that check each other. The company claims 1,000+ skills and 115 million patient interactions with zero safety incidents.

The Competition

Notable, Hyro, and Syllable fight for patient access workflows. Kore.ai targets pharma use cases. Documentation tools like Nuance DAX and Abridge don't overlap features but steal budget dollars. Hippocratic wins by staying narrow: patient-facing, non-diagnostic, voice-first. That safety line calms legal teams.

Financing

$404 million total. $50M seed from General Catalyst and a16z (May 2023). $53M Series A at $500M (March 2024). $141M Series B at $1.64B led by Kleiner Perkins (January 2025). $126M Series C at $3.5B led by Avenir Growth (November 2025). NVIDIA, Premji Invest, and health systems joined later rounds.

The Future ⭐⭐⭐⭐

Four stars. Strong traction: 50+ customers, six countries, nine-figure interaction counts. Healthcare moves slow, but nurse shortages and burnout create real pull. The non-diagnostic boundary keeps regulators calm. Risk: competitors will copy the playbook, and one safety incident could crater trust. If the safety record holds, the checks get bigger. 💰