Good Morning from San Francisco,

Google's antitrust victory writes the playbook for Big Tech's future defenses. Courts now treat technological disruption as monopoly cure. Meta can blame TikTok for reshaping social media. Amazon points to Walmart's online surge. Apple cites AI assistants disrupting mobile.

The judge's logic spreads fast. Why break up companies when innovation might do it naturally? Structural remedies look antiquated. Data-sharing requirements feel modern. Big Tech stocks celebrated accordingly.

Speaking of that Apple partnership: Cupertino just signed Google to power Siri's AI overhaul. Internal talent keeps fleeing to Meta for nine-figure packages. External partnerships fill the gaps.

DeepSeek admits what others won't: AI hallucinations remain "unavoidable." Their agent system launches Q4, trailing OpenAI by over a year. Honesty meets harsh timing.

Switzerland released Apertus—a fully transparent AI model that prioritizes compliance over capability. Europe chooses sovereignty. America chooses speed. China chooses control.

Different bets. Same future.

Stay curious,

Marcus Schuler

Light touch sets Big Tech precedent

Federal Judge Amit Mehta rejected government demands to break up Google Tuesday, allowing the search giant to continue its $20 billion annual payments to Apple for default placement. The same arrangements that created the monopoly.

Mehta cited ChatGPT and AI competitors as justification for restraint. "The emergence of GenAI changed the course of this case," he wrote, ordering data-sharing requirements instead of structural breakup. Google retains authority to classify shared data as "sensitive," creating substantial enforcement discretion.

The ruling provides other Big Tech defendants with a defense template. Meta can argue TikTok transformed social media since its Instagram acquisition. Amazon can cite Walmart's 22% online growth as evidence of evolving competition. Apple can point to AI assistants reshaping mobile computing.

Google stock surged 9% while Apple climbed 2.5%. The sequence wasn't subtle.

Why this matters:

• Judicial precedent: Courts increasingly view technological disruption as sufficient remedy for monopoly concerns, weakening structural enforcement across industries

• Payment structure preservation: Default placement arrangements—the mechanism behind Google's search dominance—remain available for securing AI market position

AI Image of the Day

Prompt:

stunningly beautiful young Korean woman, 20s, natural makeup, flawless fair skin, long silky black hair, delicate facial features, symmetrical face, charming smile, cinematic portrait, ultra realistic, 8k

Apple partners Google for Siri AI search launch

Apple and Google reached a formal agreement this week for Google's Gemini model to power Apple's delayed Siri overhaul, marking a strategic shift as internal AI talent continues bleeding to competitors.

The partnership positions Apple to launch "World Knowledge Answers"—an AI-powered answer engine—by spring 2026 as part of iOS 26.4. The system will transform Siri from basic voice assistant into a comprehensive search tool competing directly with ChatGPT, Perplexity, and Google's AI Overviews.

Financial dynamics proved decisive. Anthropic's Claude initially led Apple's quality evaluations but demanded over $1.5 billion annually. Google offered more favorable terms, securing the deal. The timing coincides with a federal ruling preserving Apple's $20 billion annual search partnership with Google, reducing pressure for homegrown alternatives.

Apple's Foundation Models team lost 13+ researchers recently, including leader Ruoming Pang to Meta for a $200+ million package. The exodus forced Apple's pivot to external partnerships while maintaining control over personal data processing.

Why this matters:

• Platform owners with billion-user bases can monetize AI innovation without building everything internally, reshaping competitive dynamics as distribution becomes the scarce resource

• Search optimization will expand beyond blue links to AI summaries and voice responses, fundamentally altering how brands reach consumers through Apple's ecosystem

DeepSeek targets Q4 agent launch amid reality check

DeepSeek plans an AI agent system for late 2025, designed to execute multi-step tasks autonomously.

The Hangzhou startup simultaneously published unusually candid safety documentation acknowledging that AI hallucinations remain "unavoidable". This is a disclosure driven by Beijing's expanding oversight requirements.

The timing creates strategic tension. OpenAI deployed agents in July; Microsoft shipped theirs in May. DeepSeek's Q4 timeline puts them 12-18 months behind in market deployment. Their bet: superior capability can overcome late entry.

The company's R1 reasoning model disrupted the industry in January, reportedly costing under $6 million while matching top US benchmarks. However, researchers question whether this figure includes data preparation and failed experiments, estimating true development costs at $50-200 million.

DeepSeek's founder Liang Wenfeng favors deliberate engineering over rapid iteration. The approach mirrors R1's development philosophy but faces a market racing to standardize on agent interfaces.

Why this matters:

• Agent competition shifts evaluation metrics from model benchmarks to task completion reliability and cost efficiency

• DeepSeek tests whether transparency about limitations builds user trust in an industry prone to capability inflation

🧰 AI Toolbox

How to Create Professional Logos with AI

Brandmark generates custom logos, business cards, and social media graphics in minutes using artificial intelligence. Enter your business name and keywords, and the AI creates unique logo designs that you can customize and download instantly.

Tutorial:

- Go to the Brandmark website

- Enter your business name and related keywords that describe your brand

- The AI analyzes your input and generates multiple logo options based on your keywords

- Browse through the logo concepts and select your preferred design

- Customize colors, fonts, icons, and layouts using the built-in editor

- Preview your logo on business cards, letterheads, and social media mockups

- Purchase and download your complete brand package with logo files in multiple formats

Better prompting...

Email Writing Assistant

Write a [type of email] to [recipient details] about [subject].

Structure:

- Lead with your main point in the first sentence

- State your specific request clearly in the second paragraph

- End with a clear next step and timeline

Language:

- Use everyday professional words, not corporate jargon

- Write as if explaining to a colleague face-to-face

- Keep sentences short and direct

- Cut unnecessary words

Tone:

- Professional but conversational

- Direct without being blunt

- Skip flowery language and empty pleasantries

Avoid:

- Hedge words: "perhaps," "maybe," "possibly"

- Corporate speak: "leverage," "circle back," "touch base"

- Weak phrases: "I hope this finds you well," "per our conversation"

- Buried requests in long paragraphs

Include:

- Clear subject line that states the purpose

- Specific action needed from recipient

- Deadline or timeline when relevant

- Simple greeting and closing

Test: Can someone scan your email in 10 seconds and know exactly what you need?

Switzerland's regulatory bet on open AI

Switzerland released Apertus this week. A fully transparent language model where everything from training data to intermediate checkpoints is publicly documented.

The 8-billion and 70-billion parameter models match 2024's Llama 3 performance, not today's frontier capabilities.

The strategic calculation is clear. While US labs optimize for raw capability and China balances state control with selective disclosure, Switzerland prioritizes regulatory compliance and democratic accountability. The model respects opt-out requests, filters personal data, and complies with EU AI Act transparency requirements from day one.

Early deployment patterns reveal the positioning. Swisscom integrated Apertus into its sovereign platform for business customers. Swiss banks express interest in domestically controlled alternatives that don't route sensitive data through foreign platforms. The Public AI Inference Utility provides global access as "AI infrastructure."

The sequence represents Europe's digital sovereignty thesis in working code. Complete auditability over cutting-edge performance.

Why this matters:

• Regulatory compliance increasingly shapes AI development priorities, potentially disadvantaging companies that optimize for capability over transparency

• European institutions now have a domestically governed alternative to US and Chinese platforms, testing whether sovereignty concerns translate into practical adoption

AI & Tech News

Musk notably absent from power dinner guest list

Trump will host two dozen tech leaders including Zuckerberg, Cook, Gates and Altman Thursday night for the first event in the newly paved Rose Garden, which now features Mar-a-Lago-style tables and umbrellas. Elon Musk's absence from the invite list signals how the tech power center has shifted away from Trump's former top adviser, even as other CEOs court the administration.

Musk's AI company faces executive exodus amid Grok malfunctions

Mike Liberatore left his role as xAI's chief financial officer around the end of July, just three months after joining Elon Musk's AI company that recently raised $10 billion. The departure adds to a wave of high-level exits including the general counsel, senior commercial lawyer, and co-founder Igor Babuschkin, signaling leadership instability as xAI's Grok chatbot suffers repeated public malfunctions.

Universities create chief AI officer roles across major campuses

Major universities including George Mason, UCLA, and University of Utah appointed their first Chief AI Officers over the past year to coordinate research partnerships, curriculum changes, and campus-wide AI strategy. The new C-suite positions signal how AI is forcing institutional restructuring beyond traditional IT departments as the technology affects every academic discipline from humanities to medicine.

Army awards $98.9 million contract for battlefield AI

The US Army contracted San Francisco startup TurbineOne to provide AI software that runs on soldiers' devices without internet connections, identifying threats like drone launch sites and processing data 10-25 times faster than current systems. The deal shows how signal jamming and drone warfare are forcing the military away from cloud-based systems and traditional defense contractors toward edge computing solutions from four-year-old tech companies.

OpenAI expands secondary sale to $10.3 billion

OpenAI increased its secondary share sale to $10.3 billion from $6 billion, allowing employees with two-plus years tenure to sell stock at a $500 billion valuation through October. The expansion shows how private companies use employee liquidity events to manage internal pressure for cash-outs while avoiding the scrutiny and requirements of going public.

OpenAI gives free users ChatGPT Projects feature

OpenAI rolled out its Projects feature to free ChatGPT users, allowing them to organize conversations by topic with up to 5 files compared to 25 for Plus subscribers and 40 for Pro users. The move continues OpenAI's pattern of trickling premium features down to free tiers with limits, using restricted access as a conversion tool to drive paid subscriptions.

Chinese tech giants still buying Nvidia despite Beijing pressure

Alibaba, ByteDance and Tencent remain eager for Nvidia's H20 chips and are monitoring a new B30A model that could cost double the current $10,000-12,000 price, even after Beijing summoned companies over their U.S. purchases. The continued demand highlights how China's push for tech self-reliance hits limits when domestic alternatives from Huawei and Cambricon can't match performance.

Mistral raises €2 billion at €12 billion valuation

French AI startup Mistral is finalizing a €2 billion funding round that values the company at €12 billion, more than doubling its €5.8 billion valuation from June 2024. The massive round shows European AI companies scaling up to match US rivals like OpenAI and Anthropic, which recently raised $13 billion at a $183 billion valuation.

France hits Google and Shein with record cookie fines

France fined Google €325 million and Shein €150 million Wednesday for placing advertising cookies without proper user consent, marking Google's third such penalty since 2020 with amounts nearly doubling each time. The record fines signal European regulators are moving from warnings to serious financial pressure as they reshape how tech giants handle user data.

Jury awards $425 million against Google for data collection

A San Francisco jury awarded nearly 100 million Google users $425 million Wednesday after finding the company collected app data even when users disabled "Web & App Activity" tracking in their privacy settings. The verdict establishes that user consent requires actual control over data collection, not just disclosure that some tracking continues regardless of privacy choices.

Roblox adopts biometric age verification and industry ratings

Roblox will scan all users' faces by year-end to verify ages and replace its content labels with standardized industry ratings from ESRB and international agencies, responding to multiple lawsuits alleging inadequate child protection. The shift from user-reported birth years to biometric verification signals how legal liability is pushing social platforms toward expensive but defensible age-assurance systems.

Tencent's Voyager turns photos into 3D worlds with 60GB GPU requirement

Tencent released Voyager, an AI model that turns single photos into explorable 3D worlds, requiring at least 60GB of GPU memory and scoring 77.62 on Stanford's WorldScore benchmark. The computational demands and licensing restrictions—banned in EU, UK, and South Korea—show how advanced AI capabilities increasingly split between accessible research demos and production systems few can actually deploy.

C3 AI revenue drops 19% as new CEO Stephen Ehikian takes over

C3 AI reported revenue fell to $70.3 million from $87.2 million a year earlier while announcing Stephen Ehikian as CEO, replacing Thomas Siebel who stepped down due to an autoimmune disease causing visual impairment. The combination of declining performance and leadership transition shows how the enterprise AI company faces operational challenges beyond its founder's health crisis.

Figma stock drops 14% after first earnings report

Figma shares fell 14% Wednesday despite beating revenue expectations with $249.6 million and breaking even on earnings, its first report since going public at $33 in July. The drop signals investor concern that design software growth is slowing as AI tools reshape how companies build products, even when financial results meet targets.

Synthflow adds memory to voice AI agents

Berlin based Synthflow launched Memory for its voice AI agents processing over 1 million daily conversations, allowing them to retain customer details and conversation history across multiple calls. The breakthrough removes a core barrier to AI adoption in contact centers, where customers previously had to repeat information each time they called, driving them to demand human agents instead.

Philips Hue launches cheaper bulbs and upgraded bridge

Philips Hue unveiled its biggest product launch ever at IFA with new Essential bulbs starting at $15 versus typical $45-60 pricing, plus a Bridge Pro that handles 150 lights compared to the current 50-light limit. The move signals how premium smart home brands are splitting their offerings between budget and flagship tiers as cheaper competitors erode their market dominance.

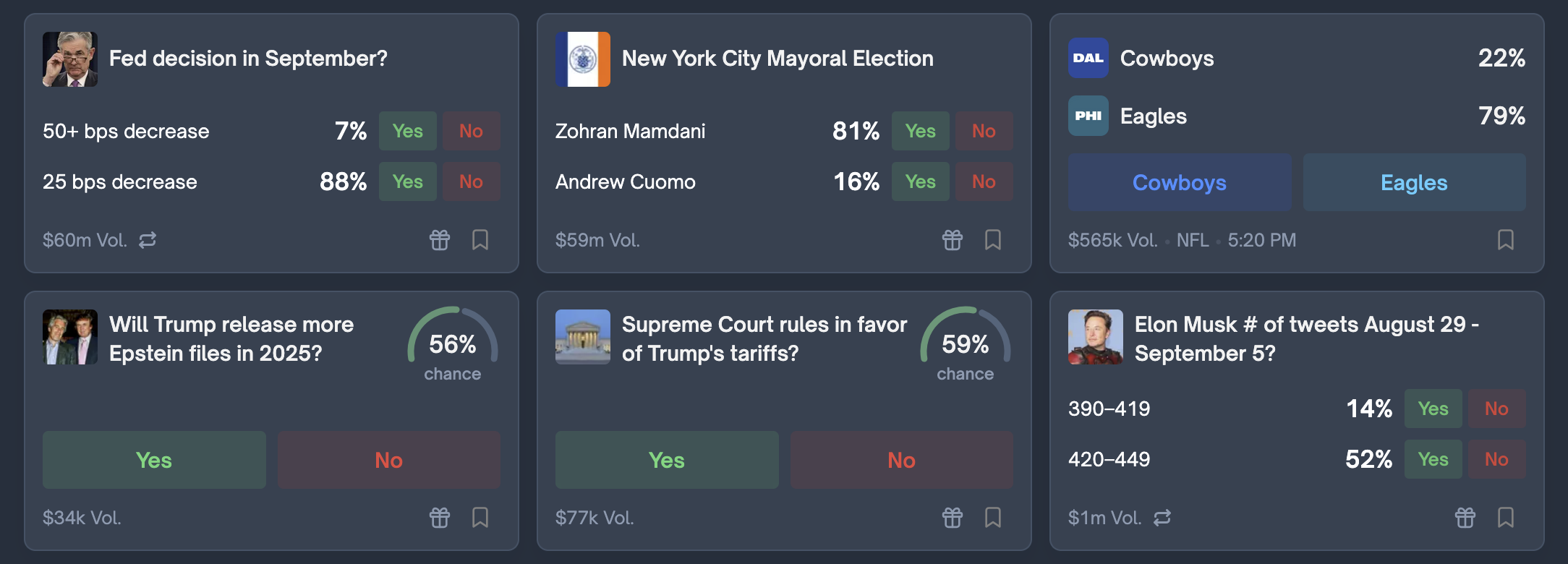

Polymarket gets CFTC approval to launch in US

The CFTC granted Polymarket a no-action letter today, allowing the crypto-based prediction market to avoid costly swaps reporting requirements after acquiring QCX whose exchange application was approved in July. The approval lets Polymarket return to the US market as a regulated exchange, creating direct competition with established platforms Kalshi and Crypto.com in the growing prediction market space.

🚀 AI Profiles: The Companies Defining Tomorrow

Polymarket

Polymarket turns news into numbers. Traders bet on future events, creating live odds that cut through media noise.

The Founders

Shayne Coplan launched Polymarket in 2020 from New York City. He dropped out to build crypto prediction markets after studying economists like Robin Hanson. The company (Blockratize Inc.) weathered a $1.4M CFTC fine in 2022 but kept building. Team size isn't public, but they've scaled fast.

The Product

Users trade YES/NO shares on anything—elections, Fed moves, Taylor Swift albums. Each share costs $0-1 USDC and pays $1 if correct, $0 if wrong. Prices = probabilities in real time. Runs on Polygon blockchain with zero platform fees. UMA's oracle system resolves outcomes transparently. Recently partnered with X/xAI for mainstream distribution 📈

The Competition

Kalshi leads regulated US prediction markets after beating the CFTC in court. PredictIt survived its own regulatory fight. International betting exchanges like Betfair grab attention. Manifold runs play-money markets that train users. Polymarket's edge: crypto rails, social integration, and now US compliance through its $112M QCEX acquisition.

Financing

Raised $74M publicly: $4M seed (Polychain), $25M Series A (General Catalyst), $45M Series B (Founders Fund + Vitalik Buterin). Reports suggest $200M more coming at $1B+ valuation. Founders Fund leading again. Money talks—VCs bet big on prediction markets going mainstream.

The Future ⭐⭐⭐⭐

Polymarket cracked the US market puzzle by buying a regulated exchange. No-action letter from CFTC opens the door. Media quotes their odds like polls now. The forecast economy is real, and they're positioned to own it. Risk: regulatory winds shift fast in DC.