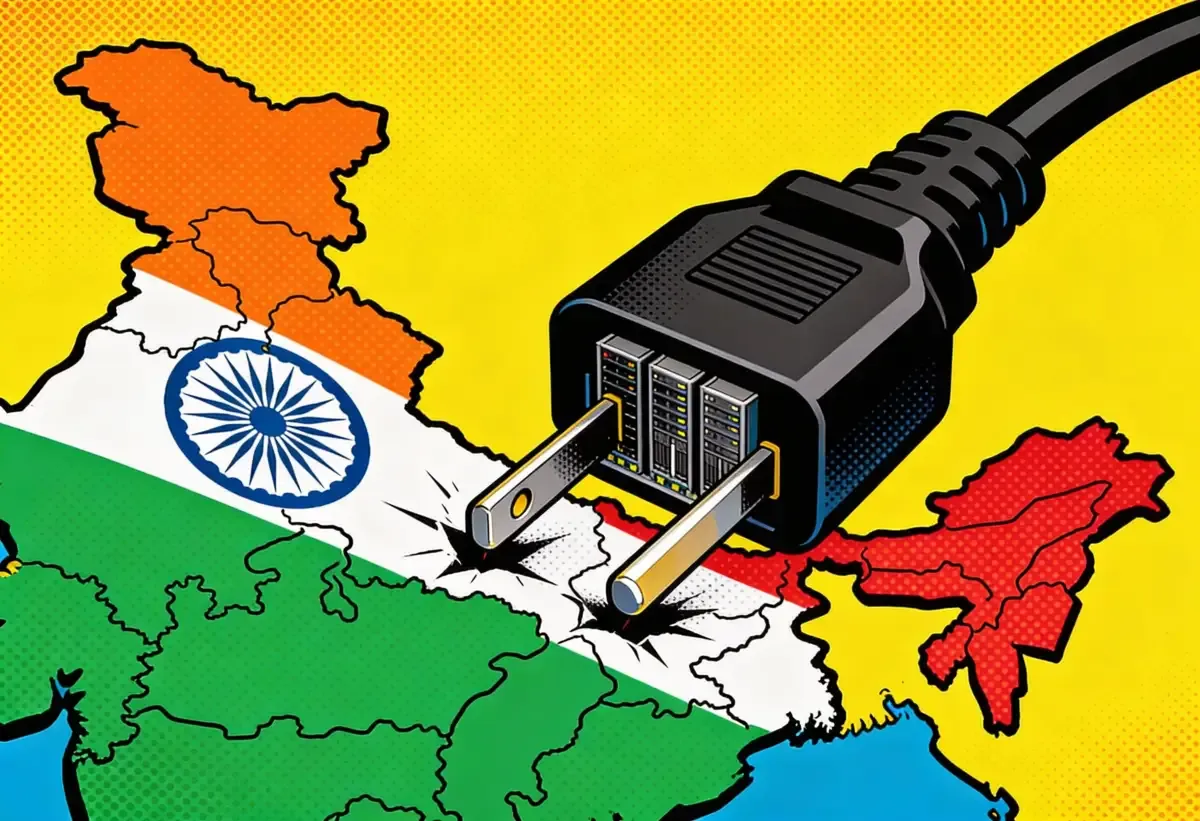

India announced a 20-year tax holiday for foreign companies that run cloud services from Indian data centers for global customers, Finance Minister Nirmala Sitharaman said during her Union Budget speech on Sunday. The exemption, which runs through 2047, eliminates corporate income tax on overseas revenue earned through Indian facilities, a rate that currently sits at 35% plus surcharges for foreign hyperscalers classified as having permanent establishment in the country. Services sold to Indian customers would still need to flow through a locally incorporated reseller entity and be taxed domestically.

The budget move lands at a moment when AWS, Microsoft Azure, and Google Cloud are collectively pumping more than $67 billion into Indian data center projects announced over the past four months alone. India's IT minister Ashwini Vaishnaw told reporters that total data center investment commitments could climb from $70 billion under execution today to $200 billion, and that the tax holiday would help India crack the top three countries for AI infrastructure globally. In effect, New Delhi has signed a 20-year lease and is now scrambling to build the power plant that makes the building habitable.

The tax math behind the bet

You can read the policy as India borrowing a page from Singapore's offshore finance playbook and Dubai's free zones. Don't tax what you want to attract.

The Breakdown

• India's Union Budget eliminates corporate income tax on cloud services exported from Indian data centers through 2047, down from 35%.

• Google, Microsoft, and Amazon have committed over $67 billion to Indian data center projects in the past four months, with total pledges reaching $90 billion.

• A separate 15% safe harbour provision resolves transfer pricing disputes that had deterred foreign investment for years.

• Power grid gaps, water scarcity, and state-level permitting remain the main obstacles to India's target of 8 gigawatts by 2030.

Foreign hyperscalers operating out of Indian data centers had been nervous for years about how New Delhi might interpret their tax exposure. Lawyers told Reuters that companies worried the government could claim jurisdiction over their global income simply because they operated servers on Indian soil. That ambiguity kept some investment on the sidelines. Not anymore.

Sitharaman's budget tackles the problem from two angles. The tax holiday itself wipes out corporate income tax on exported cloud services. A separate "safe harbour" provision fixes the transfer pricing margin at 15% for Indian entities servicing related foreign companies. That second piece matters just as much. Transfer pricing disputes between multinationals and Indian tax authorities have dragged on for years in court, and a pre-agreed margin removes that friction entirely.

"This announcement helps in bringing clarity to foreign companies and lends stability in their tax position in India till 2047," Vaibhav Gupta, partner at tax firm Dhruva Advisors, told Reuters.

Grant Thornton Bharat partner Riaz Thingna put it more bluntly to CNBC: major foreign firms would now find India "a significantly cheaper base for global workloads" compared to Singapore, the UAE, and Ireland.

Ninety billion dollars and counting

The capital flooding into India reads like a bidding war where nobody wants to be outspent. Google committed $15 billion last October for a 1-gigawatt AI data center campus in Visakhapatnam, partnering with AdaniConneX. Microsoft came next. Seventeen and a half billion dollars pledged through 2029, announced in December. Amazon tried to top both, piling $35 billion more onto existing spending and pushing its total India commitment to roughly $75 billion. The three announcements landed within weeks of each other. Boardrooms in Seattle and Mountain View clearly don't want to cede ground.

Indian conglomerates are staking their own claims. Reliance Industries, Brookfield, and Digital Realty Trust formed a joint venture called Digital Connexion last November that plans to spend $11 billion on a 1-gigawatt campus in Andhra Pradesh. Adani Group committed $5 billion to its Google partnership.

Seventy billion dollars of those commitments are already under execution, Vaishnaw said, with announcements totaling $90 billion. He wants the budget to push that toward $200 billion. We'll see.

Where does all this hardware actually go? India's data center fleet runs somewhere around 1.2 to 1.4 gigawatts of capacity at the moment, which barely registers against the 103-gigawatt global total that JLL tallied in January. Jefferies projects a fivefold expansion to 8 gigawatts by 2030, an aggressive target that assumes the grid cooperates and the permits don't stall in state bureaucracies. The demand is there. Every major cloud provider is fighting for GPU rack space, and the global total is on course to double by decade's end.

Stay ahead of the curve

Strategic AI news from San Francisco. No hype, no "AI will change everything" throat clearing. Just what moved, who won, and why it matters. Daily at 6am PST.

No spam. Unsubscribe anytime.

Where the grid meets the GPU

This is where the lease-before-the-power-plant problem gets real. Cooling racks of GPUs in a tropical climate requires enormous amounts of electricity and water. India already struggles with patchy power availability in several states, and Reuters reported in December that resource constraints pose real barriers to data center expansion. Brownouts in Maharashtra. Water stress in Tamil Nadu. The physical inputs that keep servers running are the same ones Indian cities fight over every summer.

Moody's estimates India may need to invest 0.4% to 0.9% of its real GDP in grid expansion and storage over the next decade just to keep up. If you're betting on India's data center pitch, you're really betting on a power buildout that hasn't broken ground yet.

The government knows it's exposed. Vaishnaw pointed to a separate budget provision waiving customs duties on nuclear power equipment, calling nuclear energy "the base load clean power required for long-term sustenance of the AI economy." A revealing admission. India's data center pitch depends on solving an energy problem that most countries with established data center hubs have not yet solved either.

Singapore, one of the oldest data center markets in Asia Pacific, has run into land constraints that limit further large-scale deployment. Virginia's Loudoun County, the world's densest data center corridor, faces power grid bottlenecks. Ireland has imposed moratoriums on new data center connections in parts of the Dublin grid. Land, India has. Megawatts, not yet.

What the fine print protects

Buried in the budget details are provisions that protect India's domestic tax base while opening the door to foreign capital. Cloud services for Indian customers must pass through a local reseller, which gets taxed normally. The safe harbour margin only applies to related-party transactions, meaning independent Indian operators competing for the same business don't get the same cushion.

Sagar Vishnoi, co-founder of think tank Future Shift Labs, flagged this tension in comments to TechCrunch. Routing services through resellers could leave smaller domestic players "competing for thin margins" while foreign hyperscalers enjoy the full benefit of the tax holiday upstream. Local operators get squeezed by a policy designed for companies with trillion-dollar market caps.

The budget also raised the safe harbour threshold for IT services companies and global capability centers from 300 crore rupees to 2,000 crore, and collapsed multiple service categories into a single "information technology services" bucket with a 15.5% margin. That simplification ends years of litigation where tax authorities and companies spent months arguing in conference rooms over whether a given operation counted as software development, KPO, or R&D, each of which carried a different transfer pricing rate.

Nasscom vice president Ashish Aggarwal called the framework something the industry had been "seeking for the past few years," noting the government had "collapsed multiple categories into one and set a margin rate much closer to what the industry was expecting."

Beyond data centers: semiconductors and Apple

The data center tax holiday was the headline act, but Sitharaman packed the budget with adjacent incentives aimed at pulling India deeper into the global technology supply chain.

A second phase of the India Semiconductor Mission will focus on producing chip-making equipment and materials domestically, developing full-stack Indian intellectual property rather than just assembling imported components. The government nearly doubled the outlay for its Electronics Components Manufacturing Scheme to 400 billion rupees, roughly $4.36 billion, after the program attracted investment commitments at more than twice its original target since launching last April.

Apple got its own carve-out. A five-year tax exemption will apply to foreign companies that supply equipment and tooling to contract manufacturers operating in bonded zones. Apple had been anxious about this one for months, lobbying New Delhi to change income tax rules that threatened to classify its ownership of high-end iPhone production machinery as a taxable "business connection," Reuters reported. That risk had forced Apple's partners Foxconn and Tata to spend billions on machines themselves rather than accepting equipment from Cupertino. A classification headache with billion-dollar consequences.

"This exemption removes a key deal-breaking risk for electronics manufacturing in India," said Shankey Agrawal, a partner at tax law firm BMR Legal. The move could accelerate Apple's India buildout at a time when iPhone's share of global shipments from India has already quadrupled to 25% since 2022, according to Counterpoint Research.

The early 2000s playbook, scaled up

Deloitte India partner S. Anjani Kumar told CNBC the data center tax holiday could do for India's cloud infrastructure what IT services incentives did in the early 2000s. That comparison carries weight. Tax breaks and a deep English-speaking talent pool turned Infosys, Wipro, and TCS from Bangalore startups into global operations during that earlier boom. Millions of jobs followed.

Data centers won't replicate that employment effect. They are capital-heavy, labor-light. A facility housing thousands of servers might employ a few hundred people. But the downstream effects could be larger: cloud services exports, AI model hosting for global customers, training infrastructure that keeps compute-hungry startups from defaulting to U.S.-based providers.

Anshuman Magazine at CBRE, who runs the firm's India, Southeast Asia, and Middle East operations, said the tax holiday removes "the single biggest friction point for global hyperscalers entering India." Twenty years to earn back your capital. That kind of runway changes the math for any CFO staring at a billion-dollar site selection spreadsheet. And the 2047 date carries symbolic weight too: one hundred years of Indian independence, a timeline the Modi government keeps returning to when it wants to signal generational ambition.

RackBank Data Centers founder Narendra Sen projected that India's data center capacity could reach 10 gigawatts with $70 to $100 billion in investment, and that the hardware sector alone could attract $400 billion over five years. Those are aspirational numbers. But the direction is clear: New Delhi wants to shift from being the back office of global technology to hosting the physical machinery that runs it.

Whether India can actually build 8 gigawatts of data center capacity by 2030 depends less on tax policy and more on power plants, water treatment facilities, and state-level land clearances. New Delhi has signed the lease. The money is committed. The permits, the transformers, the cooling systems, those are the parts that don't respond to a line in a budget speech.

Frequently Asked Questions

Q: What exactly does India's data center tax holiday cover?

A: Foreign companies that operate cloud services from Indian data centers for customers outside India pay zero corporate income tax through 2047. Services sold to Indian customers still get taxed through a mandatory local reseller entity. A 15% safe harbour margin also applies to transfer pricing between related Indian and foreign entities.

Q: How much are hyperscalers investing in Indian data centers?

A: Google committed $15 billion for a Visakhapatnam campus, Microsoft pledged $17.5 billion through 2029, and Amazon added $35 billion pushing its total to $75 billion. Indian conglomerates including Reliance and Adani have committed another $16 billion. Total announcements sit at $90 billion as of Sunday.

Q: Can India's power grid support the planned data center expansion?

A: Not yet. India runs 1.2 to 1.4 gigawatts of data center capacity today and targets 8 gigawatts by 2030. Moody's estimates India needs to invest 0.4% to 0.9% of GDP in grid expansion over the next decade. The budget waived customs duties on nuclear power equipment as a partial solution.

Q: How does India's tax holiday compare to Singapore and Ireland?

A: Singapore and Ireland are established data center hubs but face physical constraints. Singapore has limited land for large-scale facilities. Ireland has imposed moratoriums on new data center grid connections in parts of Dublin. India offers abundant land and lower power costs, but its grid reliability lags behind both competitors.

Q: What did the budget do for Apple's India manufacturing?

A: A five-year tax exemption lets foreign companies supply equipment to contract manufacturers in bonded zones without triggering income tax. Apple had lobbied for this change because existing rules threatened to classify its iPhone production machinery as a taxable business connection, forcing partners Foxconn and Tata to fund equipment themselves.