Good Morning from San Francisco,

Meta's $72 billion talent splurge hits turbulence. ChatGPT co-creator Shengjia Zhao nearly bailed within a week of joining. Meta tripled his pay and granted chief scientist status to keep him. Four other elite hires already fled back to rival labs.

The exodus exposes a brutal truth: only 2,000 people globally can build foundational AI models. They know their worth. They leverage it ruthlessly.

Meanwhile, Arm throws shade at the mobile AI arms race. While competitors chase specialized neural processors, Arm bets on CPU ubiquity. Their new Lumex platform targets 3 billion devices by 2030. Smart money says compatibility beats peak performance.

Stay curious,

Marcus Schuler

Meta's talent hunt creates talent exodus

Meta's $72 billion AI recruitment offensive is backfiring. ChatGPT co-creator Shengjia Zhao nearly quit within a week of joining in June, forcing the company to triple his compensation and grant chief scientist status.

At least four other high-profile hires from a pool of 50+ recruits have already defected back to rival labs.

The crisis reflects competing dynamics across three perspectives. Meta sees talent concentration as essential after Llama 4's lukewarm reception against Chinese rival DeepSeek prompted the fourth AI division restructure in six months. Elite researchers—operating in a global talent pool of roughly 2,000 people capable of developing foundational models—leverage unprecedented mobility to extract maximum compensation and autonomy. Competitors benefit from Meta's expensive instability, with each visible defection signaling cultural integration failures.

The secretive TBD Lab, housed near Zuckerberg's desk with badge-restricted access, represents Meta's attempt to bridge academic research culture with corporate hierarchy. But early departures suggest the approach may create more organizational tensions than it resolves.

Why this matters:

• The finite pool of elite AI researchers transforms talent competition into zero-sum poaching rather than capability development, escalating industry-wide compensation inflation

• Organizational design, not just compensation, will determine which companies can successfully integrate academic research culture at corporate scale

AI Image of the Day

Prompt:

a nun dressed in white robes, holding an ak-47 rifle over her shoulder. she has religious symbols on her , in the style of fantasy art, fantasy concept art, with a warm-colored background, a full-body portrait, in the style of craig mullins.

Arm challenges mobile NPU consensus with CPU-first AI

Arm unveiled its Lumex compute subsystem Tuesday, positioning CPU-based AI acceleration as the answer to mobile neural processor fragmentation.

The platform integrates SME2 matrix instructions across four new C1 cores, claiming up to 5x performance gains versus previous generation chips.

The strategic calculation is straightforward. While Qualcomm, Apple, and MediaTek race toward specialized NPU architectures, Arm argues the CPU remains mobile's only universal constant. "The Arm CPU is the only compute unit you can rely on to be present in every mobile phone," explains AI platform fellow Geraint North. TECHnalysis Research confirms that "few software developers are actually using the NPUs" due to architectural inconsistency.

Real-world demonstrations show promise. Alipay and vivo collaborations achieved 40% faster large language model responses, while text-to-speech improved 2.4x in Smart Yoga Tutor applications. KleidiAI integration means thousands of Android apps gain SME2 acceleration without code changes across PyTorch, Google LiteRT, and Microsoft frameworks.

Both approaches carry merit—NPUs offer theoretical efficiency advantages, while CPU standardization provides immediate developer compatibility. The timing suggests Arm believes software fragmentation trumps hardware specialization concerns.

Why this matters:

• CPU versus NPU becomes the defining mobile AI architecture choice, with implications across billions of devices through 2030

• Developer adoption patterns may favor platforms prioritizing compatibility over peak performance specifications

🧰 AI Toolbox

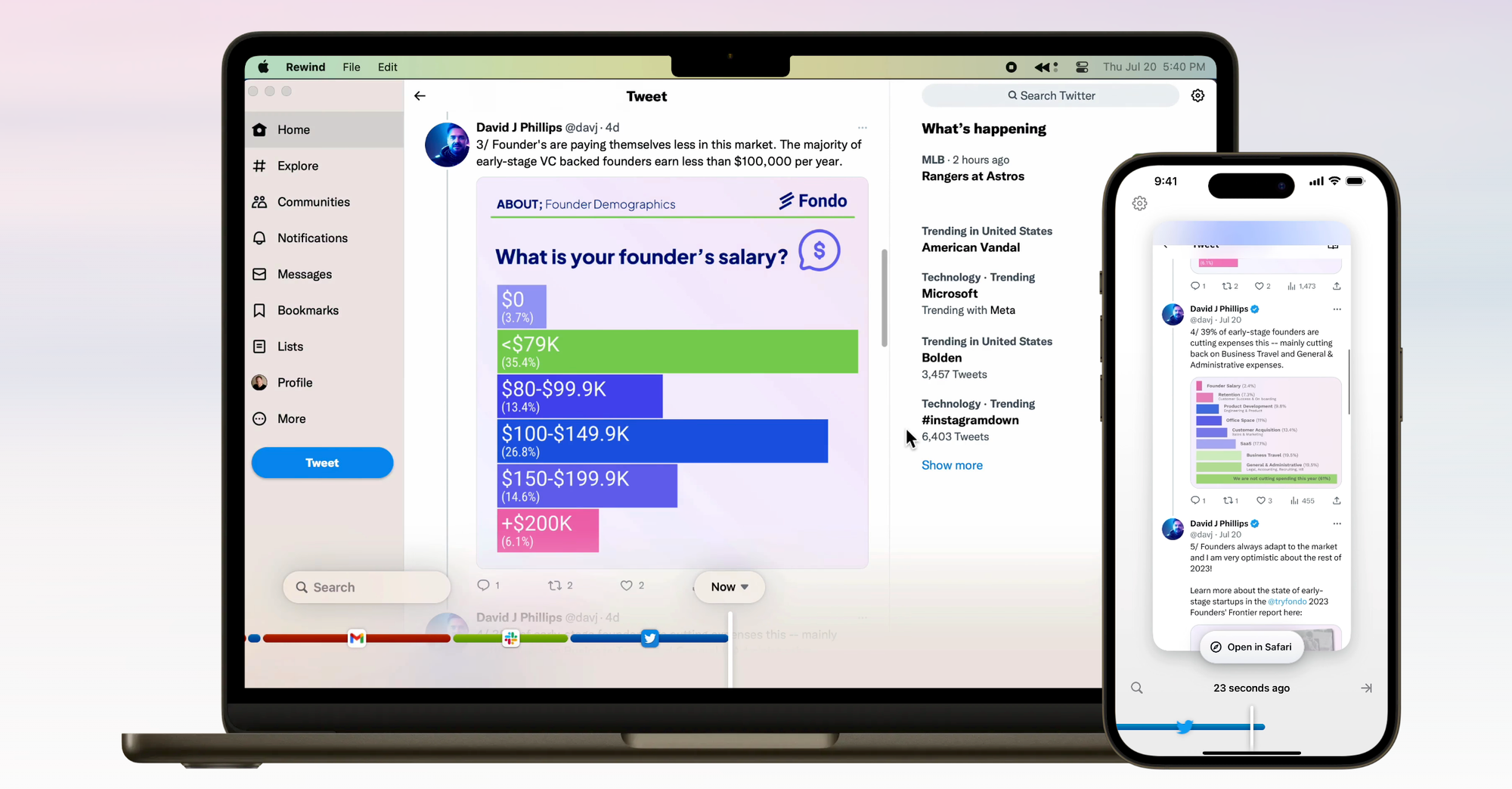

How to Remember Everything You've Ever Seen, Said, or Heard

Rewind.ai is a personalized AI that continuously records your screen and audio to create a searchable database of your digital life. It captures meetings, web browsing, documents, and conversations, then uses AI to help you instantly find and recall anything from your past activities.

Tutorial:

- Go to the Rewind.ai website and download the Mac/iPhone app

- Install and grant necessary permissions for screen and audio recording

- Let Rewind run automatically in the background capturing everything

- Use the search function to find specific content from your past activities

- Ask questions with "Ask Rewind" feature powered by GPT-4

- Get automatic meeting summaries and transcript generation

- Access perfect digital recall while keeping all data stored locally

AI & Tech News

Apple updated AI training rules after Trump inauguration

Apple revised its AI training guidelines in March 2025 at a Barcelona facility, removing "intolerance" and "systemic racism" as harmful categories while reclassifying diversity programs as "controversial" and adding 11 Trump mentions versus three in previous versions. The changes suggest major tech companies are recalibrating AI development based on political shifts rather than consistent principles, potentially reshaping how artificial intelligence systems handle sensitive topics across the industry.

Microsoft adds Anthropic AI to Office apps alongside OpenAI

Microsoft will pay to use Anthropic's AI models for some Office 365 features after developers found Claude Sonnet 4 outperforms OpenAI's models in tasks like generating PowerPoint presentations and Excel financial functions. The move breaks Microsoft's near-exclusive reliance on its $13 billion OpenAI investment, signaling that even the closest AI partnerships are giving way to performance-based tool selection as companies hedge their bets across multiple providers.

Uber adds helicopter rides to app through Joby deal

Uber will launch Blade helicopter rides on its app by 2026 after partner Joby Aviation completed its $125 million acquisition of the helicopter service in August. The move signals ride-hailing platforms are pushing beyond ground transportation into air mobility as regulatory approval for electric aircraft approaches.

Lyft launches first robotaxis in Atlanta through May Mobility deal

Lyft started its first customer robotaxi service in Atlanta's 7-square-mile Midtown area using Toyota Sienna minivans from partner May Mobility, with safety drivers monitoring each ride initially. The launch puts Lyft back in the autonomous vehicle race it exited in 2021 when it sold its self-driving division to Toyota, now competing directly with Uber's expanding robotaxi partnerships.

Robinhood launches social network inside trading app

Robinhood will launch a social media platform within its app starting with 10,000 beta users in Q1 2026, allowing traders to post verified trades, follow other investors, and track moves by public figures like Mark Zuckerberg and Nancy Pelosi. The move brings retail trading communities that currently organize on Reddit and X directly into Robinhood's platform, letting the company capture and monetize the social dynamics that already drive much of its user engagement.

Wyden calls for FTC probe of Microsoft after hospital hack

Senator Ron Wyden asked the FTC to investigate Microsoft after the company's security flaws enabled a 2024 ransomware attack on Ascension hospitals that affected over 5 million patients and suspended surgeries. The call for regulatory action targets Microsoft's use of outdated RC4 encryption that Wyden says creates systematic vulnerabilities across the company's enterprise software dominance.

Ramp hits $1 billion in annualized revenue milestone

Ramp reached $1 billion in annualized revenue, growing $300 million in six months since March and explaining its recent jump from a $16 billion to $22.5 billion valuation in just 45 days. The pace signals corporate expense management has become a winner-take-all market where growth rates determine which fintech companies can command premium valuations before competitors catch up.

CuspAI raises $100 million for chemistry AI models

CuspAI raised $100 million in Series A funding led by NEA and Temasek at a $520 million valuation, with participation from Nvidia's venture arm, Samsung, and Hyundai to build AI models that discover new materials for carbon capture and industrial applications. The round puts CuspAI behind competitors like Periodic Labs, which raised $200 million at a $1 billion valuation, signaling an arms race in AI-powered materials science where large funding rounds now determine which startups can compete for talent and compute resources.

🚀 AI Profiles: The Companies Defining Tomorrow

CuspAI

CuspAI built an AI search engine for materials that can design carbon capture sorbents and PFAS filters in months instead of years. The Cambridge startup raised $100 million to turn chemistry into code.

The founders

Dr. Chad Edwards (CEO) and Prof. Max Welling (CTO) started CuspAI in March 2024. Edwards commercialized quantum computing at Cambridge Quantum and worked at Google and BASF. Welling co-invented variational autoencoders and spent years as a machine learning professor at University of Amsterdam. The company employs about 20 people from its Cambridge base. They founded it to flip materials discovery from trial-and-error lab work to property-driven AI design.

The product

CuspAI's platform generates candidate materials based on target properties, then predicts performance before anything hits the lab. Users specify what they need—say, a membrane that separates CO₂ at specific temperatures—and the AI proposes thousands of structures, ranks them, and outputs shortlists for synthesis. Core strengths include speed (months vs years), scope (millions of candidates), and validation loops with industrial partners. Current focus areas span direct-air capture, PFAS removal, and semiconductor materials.

The competition

Schrödinger and BIOVIA dominate traditional molecular modeling. AI-native rivals include Citrine Informatics, Orbital Materials, and Kebotix. CuspAI differentiates through foundation models that generate rather than just analyze materials. The company collaborates on open datasets like Open DAC 2025 and partners with Kemira on PFAS solutions. It must prove superior hit rates against entrenched simulation suites.

Financing

$30 million seed from Hoxton Ventures in June 2024. $100 million Series A led by NEA and Temasek in September 2025, with NVIDIA, Samsung, and Hyundai as strategic investors. Current valuation sits around $520 million. The cash funds compute, hiring, and expansion into semiconductors.

The future ⭐⭐⭐⭐⭐

CuspAI reads the moment perfectly. AI unlocked computational tractability just as climate and chip materials became urgent. Strategic backers provide routes to scale, while partnerships with Meta and Kemira validate the approach. If it keeps compressing discovery timelines, CuspAI won't just search for materials—it'll define the materials-on-demand era.