💡 TL;DR - The 30 Seconds Version

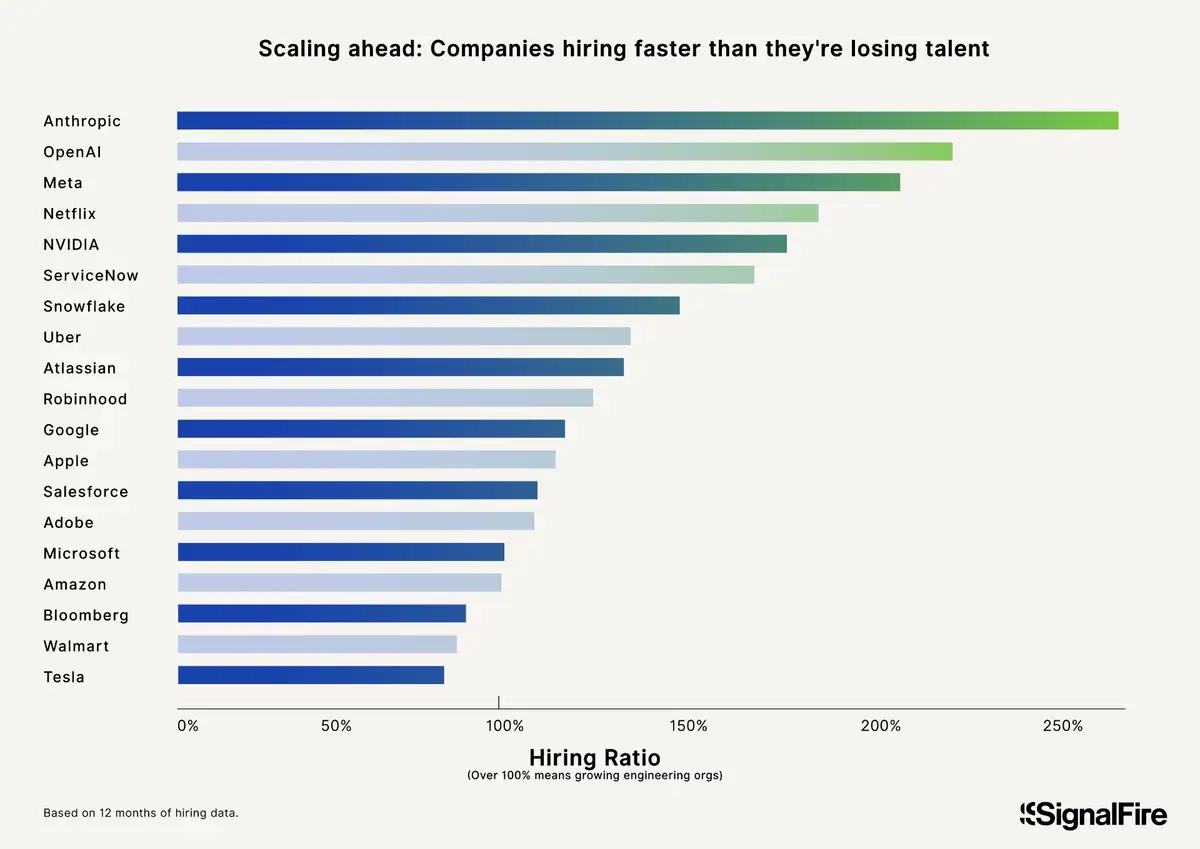

👉 Meta adds two engineers for every one who leaves, leading tech's talent war despite layoffs and market volatility

📊 Nine companies (M²A³GNUS group) dominate retention: Microsoft, Meta, Apple, Amazon, Adobe, Google, Netflix, Uber, and Stripe

🏭 Engineer-to-manager ratios jumped 30% over nine years (5.87 to 7.65), forcing companies to offer stronger technical career paths

🎓 Top tech firms hire 13-15% of engineers without degrees, with Microsoft, Adobe, and Walmart leading this credential shift

🌍 Open source contributions don't predict retention (negative correlation of -0.27), contradicting Silicon Valley assumptions

🚀 Winners create principal engineer roles rivaling VP compensation, enabling technical growth without forcing management transitions

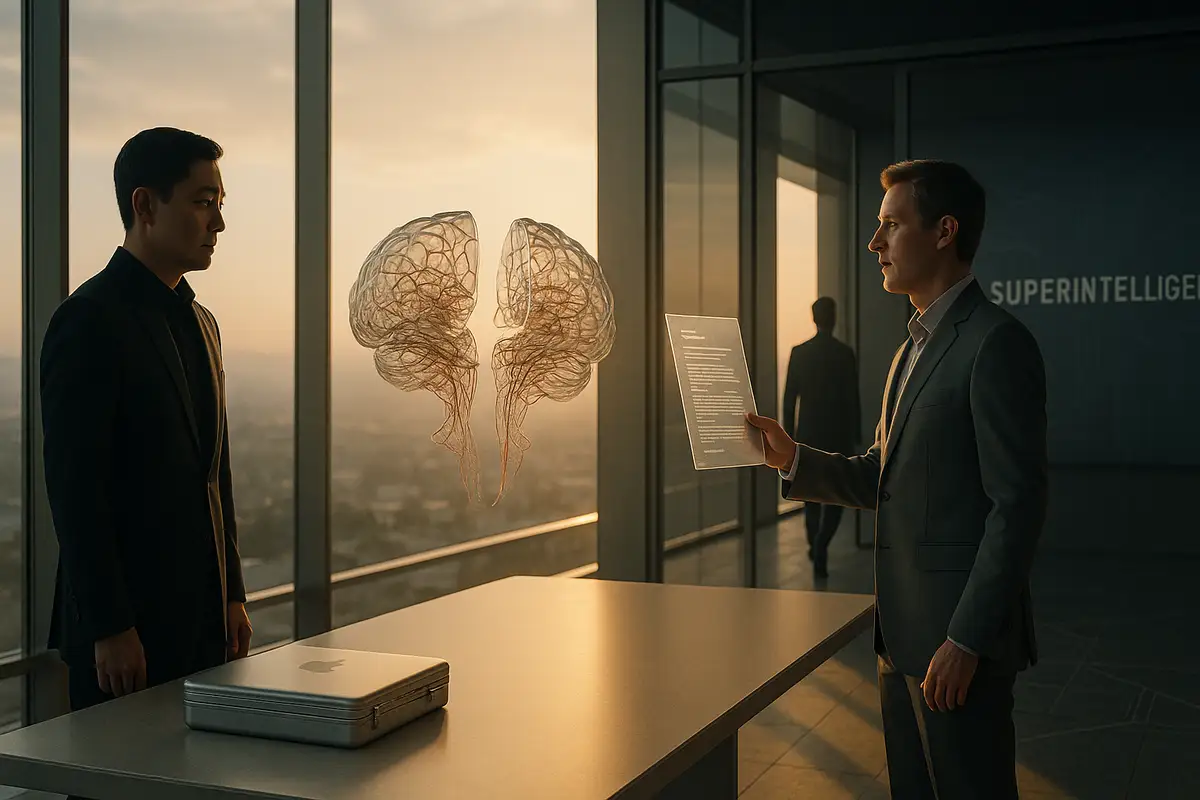

Meta added roughly two engineers for every one who left over the past year—a striking reversal of the doom-and-gloom storyline about churn, culture wars, and post-layoff malaise. That’s the central takeaway of SignalFire’s 2025 engineering-talent report, which parses headcount movements across major tech firms.

The broader picture: the winners aren’t just hiring fast; they’re keeping senior builders through volatility, and they’re doing it with leaner management and clearer technical ladders.

What’s actually new

SignalFire’s dataset (80M companies, 600M professionals) suggests a durable pattern: net engineering growth correlates with cultures that let experienced ICs ship without managerial detours. The firm’s “M²A³GNUS” cohort—Microsoft, Meta, Apple, Amazon, Adobe, Google, Netflix, Uber, and Stripe—emerges as the new retention bloc. Criteria are simple: 2,000+ engineers, high talent density, and above-average tenure.

Within that group, Meta stands out on momentum. Its hiring-to-attrition ratio sits near 2:1. Google and Netflix show steadier—if smaller—gains. Tesla, Walmart, and Palantir sit on the wrong side of the line, replacing departures rather than compounding talent. That’s not a vibe shift; it’s a structural edge.

The evidence in the numbers

One quiet upheaval: managers are thinner on the ground. Over nine years, the average engineer-to-manager ratio rose from 5.87 to 7.65—about two extra engineers per manager. The implication isn’t “management doesn’t matter.” It’s that coordination debt fell thanks to better tooling, async norms, and more capable ICs. Managers move from status policing to architecture and unblockers. Teams move faster.

Tenure looks surprisingly steady given the past five years: the share of engineers still around at four years dipped from ~59% (2015) to ~52% (2024). That’s a nudge, not a cliff. Meanwhile, open-source pedigree doesn’t predict stickiness. Across ~20 top companies, the correlation between public OSS activity and retention is slightly negative (r ≈ -0.27). OSS attracts great resumes; it doesn’t guarantee long stays.

Credentials are softening as a filter. Microsoft, Adobe, and Walmart each employ 15%+ engineers without degrees; Disney, Netflix, and Apple hover around 13%. This isn’t bootcamp charity. It’s proof that demonstrated skill and portfolio trajectories are displacing admissions-office signaling—especially for senior IC roles.

How the leaders are actually keeping people

Three mechanisms show up again and again:

Managed autonomy. With fewer managers, top orgs make autonomy a default and escalation a service. Architecture gets attention; implementation gets trust. Meetings shrink; design docs and RFCs grow.

Real IC tracks. Principal and distinguished titles aren’t consolation prizes. Compensation and scope rival VP roles, with influence over product direction, not headcount. Engineers can stay engineers and still climb.

Mobility without chaos. Internal transfers are a retention valve. Feeling boxed in on Search? Go to Android. Burned out on ads infra? Try safety tooling. The point is continuity of context—even when the problem set changes.

Netflix is the outlier worth watching: fewer engineers, high density, ruthless clarity. High performers thrive because the bar is explicit and politics is starved of oxygen. That model doesn’t transplant easily, but the principles scale: radical candor, focus, and compensation that matches expectations.

The strategic context (and a caution)

Retention is not HR trivia. Every resignation drains context—systems lore, partners, tradeoffs. High-retention orgs accrue compounding advantages: faster ramp times, cleaner architectures, lower coordination costs. Over time, that looks like velocity.

There are caveats. The underlying data leans on public profiles and inferred roles; cohort-based retention for AI labs is thin by definition. And a 2:1 hiring-to-attrition ratio can mask concentration risk if most inflows cluster in one org or location. But directionally, the signal is clear enough to act on.

If you’re building a team right now

Treat manager ratios as a design parameter, not an accident. Aim for fewer, deeper managers and ruthlessly prune coordination that doesn’t move code. Invest in IC prestige: pay bands, promotion criteria, and explicit influence over product. Create low-friction mobility so you don’t lose veterans to boredom.

Finally, stop over-optimizing for pedigree. The market is already arbitraging nontraditional talent that ships. If your pipeline still filters on alma mater, you’re handing competitors free wins.

Limitations and what’s next

SignalFire’s map is a snapshot, not destiny. Regulations, model-economics shifts, and supply-side shocks (power, GPUs, visas) can rewire demand quickly. But the second-order pattern—the culture/retention flywheel—has staying power. The companies that keep their best engineers while flattening bureaucracy will out-execute peers chasing headlines.

Why this matters

- Retention is a leading indicator of engineering velocity; teams that keep context ship faster and cleaner.

- Org charts are flipping from pyramids to diamonds: fewer managers, more principal ICs, and compensation to match.

❓ Frequently Asked Questions

Q: What does M²A³GNUS stand for and why use this acronym?

A: It's SignalFire's acronym for Microsoft, Meta, Apple, Amazon, Adobe, Google, Netflix, Uber, and Stripe. These nine companies excel at three metrics: 2,000+ engineers employed, high talent density, and above-average retention rates. The awkward acronym highlights how this new elite differs from the original FAANG group.

Q: How much do principal engineers actually make at these companies?

A: Principal engineers at Apple can reach $800K total compensation. Meta's senior AI engineers command packages around $900K. These IC roles now rival VP-level compensation, with similar influence over product direction but without managing teams. Netflix and Google offer comparable packages for their top individual contributors.

Q: Why is Tesla losing engineers faster than it can hire them?

A: Tesla shows negative net headcount growth, with more engineers leaving than joining. SignalFire's data suggests this stems from organizational instability and management structure issues. While the report doesn't specify exact causes, Tesla appears alongside Bloomberg and Walmart as companies struggling with retention compared to hiring rates.

Q: What happens when companies have 30% fewer managers?

A: Engineers gain more autonomy but lose direct guidance. Managers shift from oversight to architecture decisions and unblocking. Teams rely more on async communication, automated code reviews, and self-direction. Companies that handle this poorly, like Tesla and Walmart, see higher attrition. Those adapting well create stronger IC career paths.

Q: How does Netflix keep top talent with fewer engineers than competitors?

A: Netflix maintains extreme talent density through radical transparency, explicit performance bars, and compensation that exceeds even Meta's packages. They eliminate politics and focus ruthlessly on shipping. Engineers report that the technical bar is so high that leaving feels like a step down rather than advancement.

Q: Why doesn't open source contribution predict engineer retention?

A: SignalFire found a -0.27 correlation between open source activity and retention. While OSS attracts strong candidates and builds company reputation, it doesn't guarantee engineers stay. Companies like Meta, Stripe, and Netflix rank high in public contributions but don't consistently see longer tenures as a result.

Q: What makes those 5,000 elite infrastructure engineers so valuable?

A: They understand distributed systems, GPU optimization, and power management simultaneously—a rare combination needed for training frontier AI models. Only about 5,000 people globally possess this skillset. They can effectively name their price as every AI company needs them to build and scale model training infrastructure.

Q: How are OpenAI and Anthropic doing on retention compared to Big Tech?

A: Both are growing engineering teams 2-3x faster than they're losing them, showing strong momentum. However, they lack long-term retention data since they're relatively new. Their aggressive growth masks whether they can maintain talent long-term like Google's 5+ year averages or Apple's 6-year engineering tenures.