💡 TL;DR - The 30 Seconds Version

👉 Chinese AI startup MiniMax files for Hong Kong IPO targeting $4+ billion valuation, aiming to raise up to $637 million before year-end.

📊 The company's Talkie app ranks #5 in U.S. entertainment downloads with 11 million monthly users, generating $70 million annual revenue.

🏭 Founded in 2021 by SenseTime veterans, MiniMax raised over $850 million from Alibaba, Tencent, and Chinese state entities since 2023.

🌍 MiniMax competes with fellow "AI Tigers" domestically while facing OpenAI and Google globally, amid U.S. chip export restrictions.

🚀 The IPO tests whether Chinese AI companies can attract international investment during escalating US-China tech tensions.

Chinese AI startup MiniMax has filed for a Hong Kong initial public offering that could value the company at over $4 billion. The Shanghai-based firm aims to raise up to $637 million before the year ends, making it one of the first major Chinese AI companies to test public markets.

The move comes as China's AI sector reaches a fever pitch. MiniMax joins rival Zhipu AI in preparing for public listings, both backed by tech giants Alibaba and Tencent. The timing isn't coincidental. Beijing wants domestic AI champions, and Hong Kong offers a middle path between Chinese oversight and international capital.

MiniMax has hired China International Capital Corp and UBS as sponsors for the offering. The final size and valuation could change based on market conditions, but the company's ambitions are clear. It wants to join the ranks of publicly traded AI companies while the sector remains hot.

The SenseTime Connection

MiniMax emerged from respected pedigree. The company was founded in December 2021 by former SenseTime executive Yan Junjie, who served as vice president at the facial recognition giant. His co-founders include Zhou Yucong, who led algorithm development at SenseTime, and Yang Bin, who helped start Uber's Advanced Technologies Group.

This SenseTime diaspora gave MiniMax instant credibility. In early 2023, about one-third of the company's 100 employees held PhDs. The founding team brought expertise across natural language processing, computer vision, and speech recognition. For investors, backing proven talent beats gambling on unknowns.

The company's roots also explain its rapid funding success. MiniMax has raised over $850 million since 2023, attracting heavyweight backers including Alibaba, Tencent, and most recently, the Shanghai State-owned Assets Supervision and Administration Commission. State investment effectively makes MiniMax a quasi-national champion.

The Talkie Phenomenon

MiniMax's breakout success came from an unexpected source: virtual companions. The company launched Glow in late 2022, an app that let users create and chat with AI characters. Chinese users could discuss everything from relationship advice to hair loss remedies with their digital friends.

Glow attracted over 5 million users in four months before regulatory issues forced it offline in March 2023. Rather than surrender, MiniMax split the product for different markets. It relaunched internationally as Talkie and domestically as Xingye.

Talkie became a genuine hit in the United States, ranking as the fifth most-downloaded entertainment app by summer 2024. The app generates an estimated $70 million in annual revenue through subscriptions and in-app purchases. Over half of its 11 million monthly active users are American, with others spread across the Philippines, UK, and Canada.

Users can chat with AI versions of Donald Trump, Taylor Swift, or anime characters. They can design custom personas or engage in fantasy scenarios. The app even generates AI voices for characters, creating convincing conversations. One analyst compared it to "Character.AI on steroids."

Beyond Chat: The Technology Stack

MiniMax isn't just about virtual companionship. The company develops sophisticated multimodal AI models that process text, audio, images, video, and music. Its MiniMax-M1 model can handle an unprecedented 1 million tokens of context, equivalent to hundreds of pages of text.

The company's Hailuo AI platform showcases its technical prowess. The platform's Video-01 generator creates short video clips from text prompts, competing with tools like OpenAI's Sora and Runway's generators. Its Speech-02 model supports over 30 languages and can process extraordinarily long inputs.

MiniMax has also embraced open-source development. In January 2025, the company released its MiniMax-01 model family, including weights and code. CEO Yan Junjie admitted he would have gone open-source from day one if he could choose again. The decision invites developer collaboration while showcasing technical capabilities.

The company's dual strategy proves shrewd. Consumer apps like Talkie generate revenue and user data while demonstrating AI capabilities. Enterprise APIs monetize the underlying technology. This approach creates a virtuous cycle: profitable consumer products fund expensive AI research, which improves enterprise offerings.

The Competitive Landscape

MiniMax operates in a crowded field. Domestically, it competes with fellow "AI Tigers" including Zhipu AI, Moonshot AI, and Baichuan Intelligence. All have achieved multi-billion dollar valuations and backing from major tech companies.

Chinese tech giants also pose competition. Baidu's ERNIE Bot, Alibaba's Tongyi Qianwen, and Tencent's Hunyuan represent in-house alternatives. These companies bring massive resources and existing user bases to the AI race.

Globally, MiniMax faces OpenAI, Anthropic, and Google. The comparison seems David versus Goliath, but MiniMax has shown it can compete. Talkie briefly outranked Character.AI in U.S. app stores. The company's text-to-video tools match Western competitors in quality benchmarks.

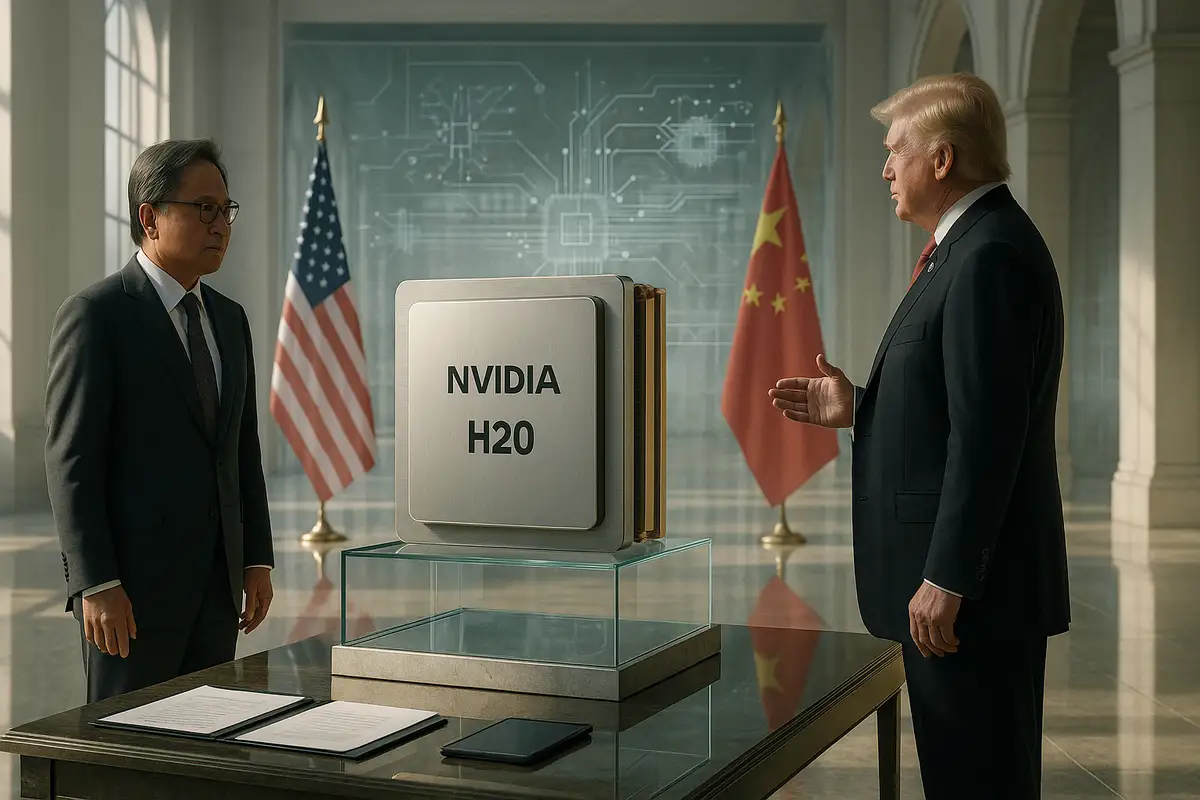

Geopolitical Headwinds

U.S. export controls complicate MiniMax's growth. Restrictions on advanced semiconductors limit access to cutting-edge chips needed for AI training. The company must optimize models for available hardware while competitors enjoy unrestricted access to top-tier processors.

These constraints may prove beneficial long-term. Chinese firms have become adept at efficiency-focused design. MiniMax's hybrid-attention model M1 uses 25% fewer computing operations than competitors for similar outputs. Resource constraints breed innovation.

Beijing's support provides offsetting advantages. State investment brings political protection and preferential access to government contracts. The domestic market remains insulated from foreign competition, since ChatGPT isn't officially available in China.

The Hong Kong Gambit

MiniMax's Hong Kong listing reflects calculated strategy. The exchange offers access to international capital without U.S. regulatory scrutiny. Recent policy changes have made Hong Kong more attractive to tech companies, with over $13.66 billion raised in the first half of 2025.

The IPO will test investor appetite for Chinese AI companies. Success could encourage other startups to follow suit. Failure might force companies to rely more heavily on domestic funding or delay public market debuts.

For MiniMax, the listing provides crucial capital for the AI arms race. Training large models costs tens of millions of dollars. Competing with well-funded American rivals requires massive resources. Public markets offer the scale of funding needed.

The Road Ahead

MiniMax faces significant challenges. The AI industry moves quickly, with today's breakthroughs becoming tomorrow's commodities. The company must continue innovating while managing public market expectations.

Competition will intensify as more players enter the market. Consolidation seems inevitable, with weaker companies merging or getting acquired. MiniMax's strong backing positions it as a potential consolidator rather than target.

International expansion brings regulatory risks. Talkie's success in the U.S. could trigger scrutiny similar to TikTok's experience. The company may need to localize data or restructure operations to address geopolitical concerns.

Why this matters:

• MiniMax's IPO represents the first major test of whether Chinese AI companies can attract international investment amid escalating tech tensions

• The company's success with Talkie proves Chinese firms can create globally competitive consumer AI products, not just copy Western innovations

❓ Frequently Asked Questions

Q: What exactly is Talkie and why did it become so popular?

A: Talkie lets users chat with AI versions of celebrities, fictional characters, or custom personas. Users can talk to Donald Trump, anime characters, or even a talking block of cheese. The app generates AI voices for characters, creating realistic conversations that attracted 11 million monthly users.

Q: Why is MiniMax going public in Hong Kong instead of the US?

A: Hong Kong offers access to international capital without US regulatory scrutiny. American listings are risky for Chinese tech companies due to geopolitical tensions. Hong Kong raised over $13.66 billion in new listings during the first half of 2025, making it attractive for tech IPOs.

Q: How do US chip restrictions affect MiniMax's business?

A: Export controls limit MiniMax's access to advanced semiconductors needed for AI training. The company must optimize models for available hardware while competitors use top-tier processors. However, these constraints push Chinese firms to create more efficient AI models, potentially becoming an advantage.

Q: How does MiniMax make money?

A: MiniMax generates revenue through two channels: consumer apps like Talkie earn $70 million annually from subscriptions and in-app purchases, while enterprise APIs let businesses pay for AI model access. This dual approach creates steady consumer income to fund expensive AI research.

Q: What are the "AI Tigers" and how does MiniMax compare?

A: The "AI Tigers" are China's four leading AI startups: MiniMax, Zhipu AI, Moonshot AI, and Baichuan Intelligence. All achieved multi-billion dollar valuations and backing from major tech companies. MiniMax stands out with its global consumer success through Talkie, while others focus more on enterprise markets.

Q: When will the IPO happen and what could go wrong?

A: MiniMax aims to complete the IPO before year-end, but the final size and valuation depend on market conditions. The listing tests whether investors want Chinese AI stocks amid US-China tensions. Failure could force other Chinese AI companies to delay public debuts or rely on domestic funding.

Q: How does MiniMax's technology compare to OpenAI or Google?

A: MiniMax's models compete on quality benchmarks with Western rivals. Its Video-01 generator matches tools like OpenAI's Sora, while the M1 model handles 1 million tokens of context. The company's hybrid-attention architecture uses 25% fewer computing operations than competitors for similar outputs.

Q: What role does the Chinese government play in MiniMax?

A: The Shanghai State-owned Assets Supervision and Administration Commission invested in MiniMax's latest funding round, creating a "mixed ownership" structure. This state backing provides political protection, preferential access to government contracts, and alignment with Beijing's goal of technological self-sufficiency.