San Francisco | Tuesday, February 3, 2026

SpaceX absorbed xAI in a $1.25 trillion deal. The negotiation was brief, because both sides of the table were the same person. Elon Musk issued $250 billion in new shares, diluting existing investors without a vote or an independent board.

Software stocks posted their worst month since October 2008. The S&P North American software index fell 15% in January. Loan traders are calling it the "SaaSpocalypse." Private equity sits on $440 billion in software deals made before AI rewired the math.

OpenAI shipped a Codex desktop app and doubled rate limits. Over a million developers used it last month. The tool that helps replace software engineers arrived while the market priced that replacement in.

Stay curious,

Marcus Schuler

SpaceX Absorbs xAI in $1.25 Trillion Deal, Diluting Investors Without a Vote

Elon Musk merged his two most valuable companies over the weekend. SpaceX issued $250 billion in new shares to swallow xAI whole. No independent board approved the transaction. No shareholder voted.

Investor Ross Gerber captured the situation: "After a short negotiation with himself, Elon has decided to merge SpaceX and xAI." The combined entity carries a $1.25 trillion valuation. SpaceX's official announcement described a future of "sentient suns" and "Kardashev Type II civilizations." It did not disclose the price.

xAI shareholders saw their holdings converted to SpaceX stock at terms set by Musk, who controls both companies. Existing SpaceX investors woke up owning a stake in a money-losing AI subsidiary they never chose to back, at a valuation they never negotiated.

The timing points to an IPO. SpaceX plans to go public at a $50 billion valuation as early as June, a listing that would be the largest in history. Folding xAI into SpaceX first gives the AI subsidiary access to SpaceX's capital markets trajectory while shielding its losses inside a profitable vehicle.

For xAI, which has burned through capital building its Colossus supercomputer and training Grok models without a clear revenue engine, the merger solves an existential funding problem. For the investors who backed SpaceX, it creates one.

The deal raises governance questions that will follow SpaceX into its IPO roadshow. Public market investors typically demand independent boards and shareholder protections that Musk's corporate structure has historically avoided. Whether underwriters push for those safeguards, or accept the Musk premium, will shape the largest tech listing in years.

Why This Matters:

- SpaceX investors absorbed $250 billion in dilution from a money-losing AI subsidiary without standard governance protections

- The planned IPO will test whether public markets accept Musk's single-person deal-making structure at trillion-dollar scale

✅ Reality Check

What's confirmed: SpaceX issued $250 billion in new shares to absorb xAI. Combined valuation is $1.25 trillion. No shareholder vote or independent board approval took place.

What's implied (not proven): That xAI's technology justifies the valuation and that merger synergies exist beyond financial convenience for Musk.

What could go wrong: Investor lawsuits over dilution without consent could delay or complicate the planned June IPO.

What to watch next: Whether the $50 billion IPO launches on schedule and whether underwriters require governance reforms before listing.

The One Number

5,000 — South Korea's Kospi index crossed that threshold for the first time last week, even as the economy contracted 0.3% in Q4 and posted its weakest annual growth in five years. Markets are betting the AI chip boom will carry Samsung and SK Hynix through the tariff hangover. The economy shrank. The stock market didn't care.

Source: Wall Street Journal

OpenAI Ships Codex Desktop App for macOS as Developer Usage Passes One Million

OpenAI released a native macOS application for Codex, giving developers a desktop interface to manage multiple AI coding agents across projects simultaneously.

Built-in worktree support prevents merge conflicts when multiple agents modify the same codebase. Over a million developers used Codex last month, and overall usage doubled since the GPT-5.2-Codex model launched in mid-December. A single session consumed 7 million tokens to autonomously build a 3D racing game.

OpenAI doubled rate limits on Plus, Pro, Business, Enterprise, and Edu plans. Free and Go subscribers gained temporary access, a move designed to pull developers into the ecosystem before locking in paid conversions.

The app introduces "Skills," extension packs that integrate external tools like Figma, Linear, Cloudflare, and Vercel. "Automations" let developers schedule background tasks that queue results for review. Engineer Michael Bolin disclosed that prompts grow quadratically with each turn, forcing the system to auto-compact conversations at token thresholds.

Anthropic's Claude Code with Opus 4.5 arrived on macOS months earlier. OpenAI's counter-strategy prioritizes access and pricing over feature differentiation, betting that a larger free user base creates a stickier paid funnel. Windows support is coming next.

Why This Matters:

- OpenAI is shifting from API-first to desktop-native, competing directly with Anthropic's Claude Code on the developer's local machine

- Doubling rate limits and opening free access signals a land-grab phase where market share matters more than margins

AI Image of the Day

Prompt: A black and white portrait photograph featuring a woman with long, wavy hair cascading over her shoulders. She has a fair complexion and is gazing directly at the camera with a serene expression. Her eyes are large and expressive, framed by well-defined eyebrows and long eyelashes. She rests her chin on her hand, with her fingers gently touching her cheek. The woman is wearing a denim jacket, adding a casual element to the composition. The background is softly blurred, keeping the focus on her face. The overall style is classic and elegant, with a timeless quality due to the monochrome palette.

Software Stocks Post Worst Month Since 2008 as AI Fears Hit Loan Markets

The S&P North American software index fell 15% in January, its worst month since October 2008. The damage is spreading from equities into credit markets and private equity portfolios.

The iShares Expanded Tech-Software Sector ETF dropped 22% from its recent high, entering bear market territory. ServiceNow shed 49% over the past year and fell 10% despite beating earnings. Its forward P/E collapsed from the upper 60s to under 28. SAP lost 15% after disappointing guidance. Microsoft posted its worst month in over a decade.

The pain is migrating into debt. Cloudera's loan lost 7 cents on the dollar in a single week. Deutsche Bank's $1.2 billion Conga loan stalled. Software now accounts for 12% of the Bloomberg US High Yield Loan Index, the largest single sector. A Jefferies trader summed it up: "We call it the 'SaaSpocalypse.' Trading is 'get me out' style selling."

Private equity is exposed. Firms poured $440 billion into more than 1,900 software acquisitions between 2015 and 2025. Buyout multiples already dropped from 24x to 18x last year. Apollo cut its software exposure from 20% to 10% during 2025. Blackstone's Jon Gray compared the risk to the Yellow Pages disruption of the 1990s.

The trigger keeps recurring. When Anthropic released a legal productivity plugin for Claude, RELX and Wolters Kluwer each dropped more than 10%. Every AI capability announcement now reprices the software stack beneath it. Vibe coding, where non-engineers use AI to write software, threatens the per-seat licensing model that underpins the entire sector.

Why This Matters:

- $440 billion in PE-backed software deals face repricing as AI erodes the subscription models those valuations assumed

- The selloff is migrating from public equities into credit markets, where contagion is harder to contain

🧰 AI Toolbox

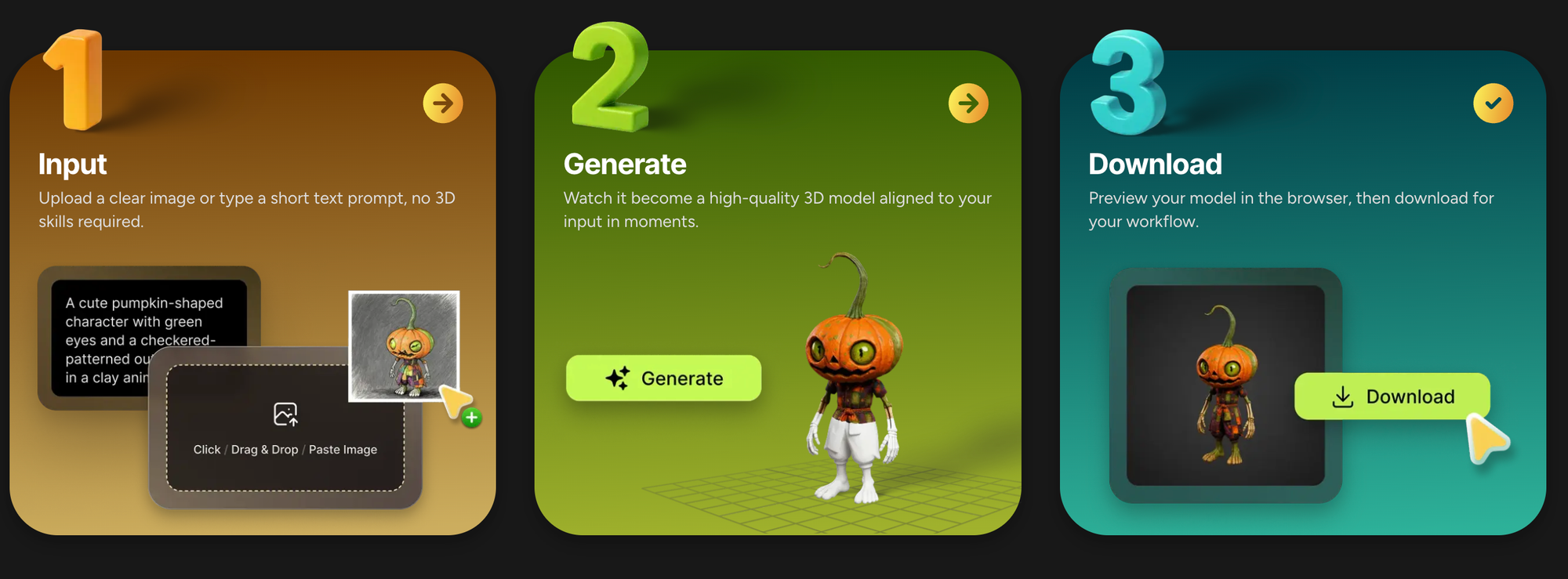

How to Turn 3D AI Models into Physical Products with Meshy Creative Lab

Meshy's new Creative Lab transforms AI-generated 3D models into print-ready files. Generate a 3D object from text or image, then export it for full-color 3D printing without technical expertise.

Tutorial:

- Visit meshy.ai and open Creative Lab

- Generate a 3D model from a text prompt or reference image

- Review and refine the model in the 3D viewer

- Click "Prepare for Print" to optimize for 3D printing

- Choose your print settings (size, material compatibility)

- Download the print-ready file with embedded color data

- Send to a 3D printing service or your own printer

URL: https://meshy.ai

What To Watch Next (24-72 hours)

- AMD Earnings: Reports today after market close at 2 PM PT. Data center revenue expected at $4.9 billion, up 29% year over year. MI350 GPU ramp and any MI455 production timeline will test whether Nvidia faces a real pricing challenger.

- Alphabet Earnings: Google reports Wednesday at 1:30 PM PT. Wall Street expects $111 billion in revenue and a 24% Cloud margin. The real tell is whether AI-driven Search revenue gets its own line item or stays buried in "Other."

- Amazon Earnings: Thursday at 2 PM PT. AWS backlog hit $200 billion, but free cash flow dropped 69% under $125 billion in AI capex. Investors want proof the infrastructure buildout converts to billable demand before 2026 spending climbs higher.

🛠️ 5-Minute Skill: Turn a Long Article Into a LinkedIn Post

You read a 3,000-word industry report that nails a point you've been making for months. You want to post about it on LinkedIn, but copying three paragraphs and adding "thoughts?" at the end won't cut it. You need a post that earns engagement without sounding like you outsourced your brain.

Your raw input:

Article: "The Hidden Cost of AI Automation" by Sarah Chen, Harvard Business Review

- Companies adopting AI see 23% productivity gains in first year

- But employee skill atrophy kicks in by month 14

- Internal study at Deloitte: teams using AI coding tools lost ability to debug manually after 8 months

- The "automation trap" - the better the tool works, the less people understand what it's doing

- Chen argues for "deliberate friction" - intentionally keeping some manual steps

- Counter-argument: you wouldn't make accountants do math by hand to "stay sharp"

- 67% of managers say they can't tell which team members actually understand the work vs. who just knows how to prompt

The prompt:

You are a senior professional writing a LinkedIn post about an article you just read. You have a strong point of view and you're not afraid to disagree with parts of the article.

From these notes, write a LinkedIn post that:

1. Opens with a bold, specific claim (not a question, not "I just read...")

2. References the article and author by name with one key stat

3. Adds your own interpretation or pushback (you partially agree, partially disagree)

4. Ends with a concrete opinion, not "what do you think?"

Source material:

[paste your notes here]

Rules:

- Under 200 words. LinkedIn rewards density.

- No hashtags in the body. Put 3-5 relevant hashtags after a line break at the end.

- Write in first person. Sound like a person at a dinner party, not a keynote speaker.

- No "let's break this down" or "here's why this matters." Just say the thing.

- One paragraph max. No bullet points, no numbered lists.

What you get back:

The 67% stat in Sarah Chen's new HBR piece stopped me cold. Two thirds of managers can't tell who understands the work and who just knows how to prompt. That's not an automation problem. That's a management problem wearing an AI costume. Chen's "deliberate friction" idea has merit, but it misses the real fix: if you can't evaluate your team's understanding without watching them do manual labor, your evaluation methods were broken before AI showed up. The Deloitte data on skill atrophy after 8 months is real. But the answer isn't slowing down tools. It's building assessment into the workflow, code reviews that test reasoning, not just output. We don't make pilots hand-fly every leg to prove they can. We put them in simulators.#AIStrategy #FutureOfWork #Leadership #Automation

Why this works

The prompt forces a stance, not a summary. "Partially agree, partially disagree" stops the model from writing a book report. The "dinner party" framing kills corporate language dead, and the word limit forces compression.

Where people get it wrong: Asking the AI to "summarize this article for LinkedIn." You'll get a bland recap that reads like a press release. The post needs your angle, which means the prompt has to demand one.

What to use

| System | Model | Best for | Watch out for |

|---|---|---|---|

| Claude | Claude Sonnet 4.5 via claude.ai | Best at maintaining a consistent first-person voice. Handles the "disagree with parts" instruction well. | Sometimes too measured. If your style is punchy, you may need to push it. |

| ChatGPT | GPT-4o | Strongest at LinkedIn-native formatting. Nails the rhythm of high-engagement posts. | Can default to inspirational tone. Watch for creeping "leadership wisdom" voice. |

Bottom line: Claude for authentic voice, ChatGPT for platform-native polish. Read the output aloud. If you wouldn't say it across a table, rewrite.

AI & Tech News

OpenAI Prioritizes ChatGPT as Senior Researchers Exit Over Strategy Shift

OpenAI is redirecting resources toward its flagship chatbot as senior staff leave over the pivot away from long-term research. Teams behind Sora and DALL-E report feeling neglected at the now $500 billion company.

French Authorities Raid X's Paris Offices With Europol Assistance

Paris prosecutors raided Elon Musk's social media platform with operational support from Europol. Both Musk and former CEO Linda Yaccarino have been summoned to court hearings in April.

UK Privacy Regulator Opens Investigation Into X and xAI Over Grok

The UK Information Commissioner's Office launched a formal probe into how Grok uses data and its potential to generate harmful content. Former X chief Linda Yaccarino faces a voluntary interview in April.

China's Memory Chip Giants CXMT and YMTC Plan Largest Expansion Yet

China's two leading memory chipmakers are planning their biggest production ramp as a global supply crunch opens a window to close the gap with Samsung and SK Hynix. The push signals continued semiconductor self-sufficiency efforts despite trade restrictions.

PayPal Replaces CEO, Names HP's Enrique Lores as Stock Drops 15%

PayPal named HP CEO Enrique Lores as its new chief executive effective March 1, replacing Alex Chriss. Q4 revenue of $8.7 billion missed estimates, sending shares down 15% pre-market.

Disney Names Josh D'Amaro as CEO, Replacing Bob Iger

Walt Disney appointed theme parks chief Josh D'Amaro as its new CEO effective March 18, ending a two-year succession process. Dana Walden was named president and chief creative officer.

Fitbit Founders Launch AI Family Health Startup Luffu

James Park and Eric Friedman emerged from a two-year post-Google hiatus to launch Luffu, a self-funded AI-powered family care system. The startup monitors household health and is currently in private testing.

Docusign CEO Says AI Services Are No Longer Optional for Tech Companies

Docusign CEO Allan Thygesen told The Verge that "not providing an AI service isn't really an option" as the company pushes its Intelligent Agreement Management system. The company has grown to 7,000 employees.

Cryptography Expert Questions WhatsApp Encryption After Meta Lawsuit

Researcher Matthew Green published an analysis examining WhatsApp's protections following a lawsuit alleging Meta can access private data. The review highlights metadata collection and chat backup security as potential vulnerabilities beyond message encryption.

Nubank Targets US Market Entry Within 18 Months

Brazilian digital bank Nubank, with over 120 million users, plans to enter the US market within 18 months. Analysts project $2.9 billion in net income for 2025 as the neobank competes with Revolut to become the most valuable digital bank in the West.

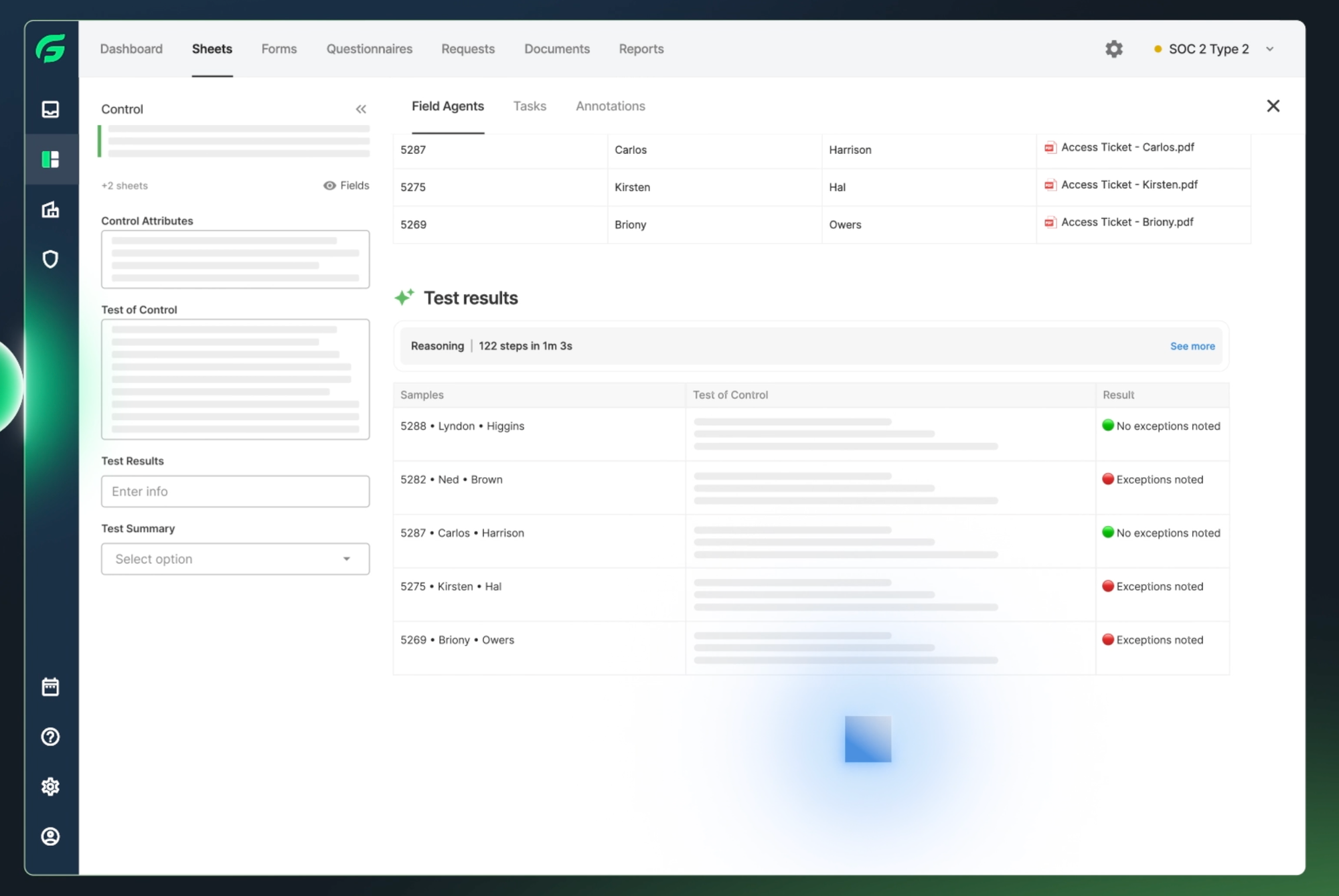

🚀 AI Profiles: The Companies Defining Tomorrow

Fieldguide

Fieldguide wants to automate the most tedious profession in finance. The company builds AI agents that handle audit planning, revenue testing, and procedure documentation so CPAs can focus on clients instead of checklists. 📊

Founders

Jin Chang founded Fieldguide in 2020 after watching Atrium, the AI-powered legal firm backed by Twitch co-founder Justin Kan, shut down beneath him. He took the lesson and picked a different target: accounting. Rather than building a firm, he built software. A quarter of his 160 employees are former auditors. The company plans to double headcount this year.

Product

An AI-native platform replacing the fragmented tech stacks accounting firms cobble together. AI agents conduct initial audit work, test revenue figures, plan engagements, and document procedures. Humans review what the machines produce. Half of the top 100 US accounting firms now use it, including KPMG. The pitch: shift auditors from data entry to judgment calls.

Competition

Legacy audit software from Wolters Kluwer (TeamMate) and Thomson Reuters dominates through inertia. Caseware modernizes workpapers. Newer entrants like Trullion target revenue recognition. Fieldguide's edge: purpose-built AI agents, not bolted-on features. The risk: Thomson Reuters is both a competitor and an investor.

Financing 💰

$75M Series C in February 2026 at a $700M valuation. Goldman Sachs Alternatives led. Geodesic joined as a new investor alongside existing backers Bessemer Venture Partners, 8VC, and Thomson Reuters. Previous rounds brought total funding well above $100M.

Future ⭐⭐⭐⭐

Fieldguide timed the market well. Accounting firms face a talent crisis, fewer graduates sit for the CPA exam each year, and AI fills the gap without demanding overtime pay. The risk: enterprise sales cycles in accounting move slowly, and switching costs from legacy tools are real. But if half the top 100 firms already use it, the other half is watching. 🧮

🔥 Yeah, But...

Moltbook, a social network "built exclusively for AI agents," exposed private messages, 6,000+ user emails, and over a million API credentials through an unsecured database. The site's creator said he "didn't write one line of code" for it. Cybersecurity firm Wiz found the flaw and called it a classic byproduct of vibe coding.

Sources: Reuters, February 2, 2026 | 404 Media, February 2, 2026

Our take: A social network for AI agents that leaks human data is peak 2026. The founder bragged about not writing a single line of code. Wiz found a million credentials sitting there like an unlocked bike in downtown San Francisco. No identity verification either, so you couldn't tell bots from humans on the site built exclusively for bots. As Wiz's cofounder put it: "I guess that's the future of the internet." He was laughing. We're not sure he should have been.