💡 TL;DR - The 30 Seconds Version

💰 Nvidia will invest $100 billion in OpenAI through a progressive structure tied to 10 gigawatts of AI infrastructure deployment starting late 2026.

🔄 OpenAI will effectively return the investment by purchasing Nvidia chips—creating circular financing that benefits Nvidia regardless of OpenAI's commercial success.

📊 The buildout equals 4-5 million GPUs serving OpenAI's 700 million weekly users, more than double Nvidia's total 2024 shipments.

📈 Markets added $170 billion to Nvidia's value in one session, pushing the company's total worth toward $4.5 trillion.

🏛️ Federal regulators split AI oversight duties in June 2024, with both Justice Department and FTC investigating potential anti-competitive behavior.

🚀 The deal crystallizes how infrastructure partnerships are becoming permanent architecture rather than temporary coordination in AI development.

OpenAI promises to spend it on Nvidia chips. The AI economy’s circular logic crystallizes

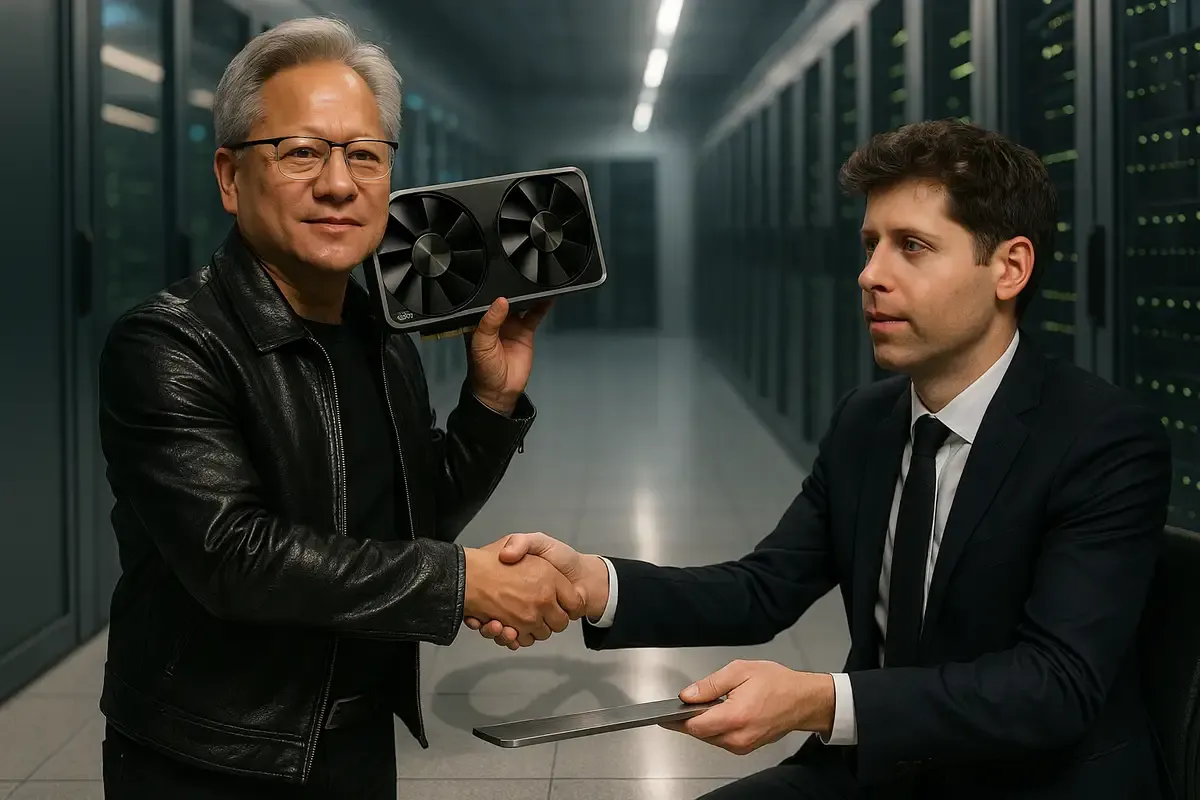

Nvidia will invest up to $100 billion in OpenAI as the ChatGPT maker builds 10 gigawatts of AI infrastructure—infrastructure that will primarily use Nvidia's own chips. The arrangement, announced Monday through a non-binding letter of intent, creates a financial loop that benefits both companies while raising questions about market concentration in AI's foundation layer.

The scale is unprecedented. Ten gigawatts translates to roughly 4-5 million GPUs, according to Nvidia CEO Jensen Huang—more than double what the company shipped last year. The buildout will unfold progressively starting in late 2026, with Nvidia's investment tied to each deployment phase. OpenAI gets the computing power to pursue artificial general intelligence; Nvidia secures its largest customer through equity ownership.

Huang called it "a giant project" during a joint CNBC appearance with OpenAI's Sam Altman and Greg Brockman. Investors reacted decisively—Nvidia's stock climbed 4%, adding roughly $170 billion to its market capitalization and pushing the company's total value toward $4.5 trillion.

The compute hunger intensifies

OpenAI's infrastructure needs reflect the brutal mathematics of frontier AI development. The company serves 700 million weekly users through ChatGPT while racing to justify its $500 billion private valuation through breakthrough capabilities. Training next-generation models requires unprecedented scale—a reality that's reshaping how AI companies allocate capital.

The partnership addresses OpenAI's most pressing constraints. GPU scarcity has become acute as every major tech company competes for the same hardware. Traditional funding rounds would dilute existing shareholders just as the company approaches potential restructuring. And securing preferential hardware access requires aligning supplier incentives beyond standard purchase agreements.

But the circular financial structure creates unusual dynamics. OpenAI will effectively return Nvidia's $100 billion investment through chip purchases over time. Requisite Capital Management's Bryn Talkington captured the logic: "Nvidia invests $100 billion in OpenAI, which then OpenAI turns back and gives it back to Nvidia." The arrangement benefits Nvidia regardless of OpenAI's ultimate commercial success.

The timing reflects broader infrastructure competition. OpenAI recently committed approximately $350 billion to cloud services—primarily Oracle, but also Microsoft and Google. The separate Nvidia deal suggests the company is diversifying dependencies while maintaining access to cutting-edge hardware as it becomes available.

Nvidia's ecosystem strategy

For Nvidia, the deal extends beyond hardware sales into strategic control. The company has been taking equity positions across the AI value chain—$5 billion in Intel for custom CPU development, $700 million in UK data center startup Nscale, over $900 million to acquire AI startup Enfabrica's team and technology. The pattern suggests evolution from pure hardware vendor to AI infrastructure orchestrator.

The OpenAI investment hedges competitive pressure. AMD is pushing higher-performance alternatives to Nvidia's H100 chips. Cloud providers are developing custom silicon. OpenAI itself expects to begin mass production of internal chips next year. By taking equity stakes in key customers, Nvidia creates switching costs that extend beyond technical specifications.

The arrangement also provides insider visibility into OpenAI's technical roadmap. As the companies "co-optimize their roadmaps for OpenAI's model and infrastructure software and Nvidia's hardware and software," Nvidia gains intelligence that could inform its own development priorities. Even if OpenAI's internal chips eventually reduce hardware dependency, Nvidia benefits as an equity holder.

From a market perspective, the partnership validates massive AI capital expenditure. Nvidia's sales depend on continued belief that current investments will generate transformative capabilities. The progressive funding structure—tying investment to actual infrastructure deployment—demonstrates sustained commitment to that thesis.

The concentration calculations

The partnership intensifies existing concerns about AI industry structure. Three entities—Nvidia, Microsoft, and OpenAI—increasingly control critical infrastructure layers through overlapping investments. Microsoft holds significant OpenAI equity while providing cloud computing services. Nvidia now adds direct investment alongside hardware supply relationships.

Washington has taken notice. The Justice Department and Federal Trade Commission split AI oversight duties in June 2024, with both agencies examining potential anti-competitive behavior across the sector. Under Trump's administration, enforcement may prove more lenient than under Biden, but the structural questions persist.

The letter of intent format preserves optionality. Unlike binding contracts, the arrangement allows both parties to modify terms as circumstances evolve. But the progressive investment mechanism creates strong completion incentives—Nvidia's capital flows only as infrastructure actually deploys.

International dynamics add complexity. China's AI development faces significant constraints from US export controls on advanced semiconductors. The Nvidia-OpenAI partnership represents a bet on maintaining American AI leadership through superior infrastructure access while concentrating critical capabilities among fewer players.

The infrastructure thesis

Both companies framed the partnership in transformational terms. Altman emphasized that "compute infrastructure will be the basis for the economy of the future." Huang described supporting "the next era of intelligence" through unprecedented data center buildout. The rhetoric reflects genuine belief in AI's economic potential—and justifies extraordinary capital deployment during broader economic uncertainty.

The Federal Reserve cut rates last week amid signs of labor market cooling. Chair Jerome Powell noted that "the labor market is really cooling off." Traditional economic indicators suggest caution. AI investments suggest acceleration.

The partnership structure manages this tension through progressive deployment. Nvidia limits immediate capital exposure while maintaining optionality on future phases. OpenAI secures infrastructure commitments without binding payment obligations beyond current capacity. Both companies hedge against economic shifts while betting on continued AI advancement.

Whether this proves sustainable depends on progress toward artificial general intelligence—a goal that remains definitionally unclear and temporally uncertain. The partnership assumes that infrastructure scale will accelerate capability development, creating economic returns sufficient to justify the investment.

The pattern hardens

The Nvidia-OpenAI deal crystallizes how AI industry dynamics are solidifying: hardware and software leaders creating financial interdependencies that reinforce technical partnerships. It's simultaneously a massive infrastructure bet and a sophisticated risk management strategy.

Multiple realities coexist. The partnership could accelerate AI development while concentrating market power. It could validate infrastructure investment while creating systemic vulnerabilities. It could strengthen American technological leadership while limiting competitive pathways.

The progressive structure provides tactical flexibility around a strategic commitment. But the underlying logic appears unavoidable—AI development demands unprecedented scale, and scale requires unprecedented partnerships. At first, this seemed like temporary coordination during a period of rapid growth. Now it looks like permanent architecture.

The question shifts from whether this pattern will continue to whether it remains manageable.

Why this matters:

• Infrastructure partnerships are becoming the primary mechanism for managing AI development risk while ensuring access to critical capabilities, potentially creating permanent interdependencies between key market players

• The circular investment model blurs traditional vendor-customer relationships in ways that may complicate future competitive dynamics and regulatory oversight as AI markets mature

❓ Frequently Asked Questions

Q: How does the "progressive investment" structure actually work?

A: Nvidia's $100 billion flows in stages tied to actual infrastructure deployment. The first phase starts late 2026 when OpenAI begins installing Nvidia's Vera Rubin systems. Each additional gigawatt of capacity deployed triggers more investment, spreading the commitment over several years.

Q: What does 10 gigawatts of computing power actually look like?

A: Ten gigawatts equals the electricity consumption of roughly 8 million homes or four Hoover Dams. In computing terms, it's 4-5 million individual GPUs—more processing power than most countries' entire tech sectors combined. For comparison, that's double Nvidia's total 2024 chip shipments.

Q: Why doesn't OpenAI just buy the chips normally instead of this complex arrangement?

A: Normal purchases require upfront cash OpenAI doesn't have for a $100 billion order. This structure provides capital without diluting existing shareholders and guarantees chip access during severe GPU shortages. It also aligns Nvidia's success with OpenAI's long-term performance, not just hardware sales.

Q: How does this affect other AI companies trying to compete with OpenAI?

A: It creates significant barriers. OpenAI gets preferential access to Nvidia's latest chips and co-development of future hardware. Competitors like Anthropic, Google, or Meta must compete for remaining GPU capacity or develop alternative chip strategies, potentially setting them back months or years in capability development.

Q: Is this the largest tech partnership deal in history?

A: By investment size, yes. Previous mega-deals include Microsoft's $69 billion Activision acquisition and Amazon's $8.5 billion MGM purchase. But this exceeds pure acquisitions—it's infrastructure partnership, equity investment, and strategic alliance rolled into one $100 billion commitment spanning multiple years.