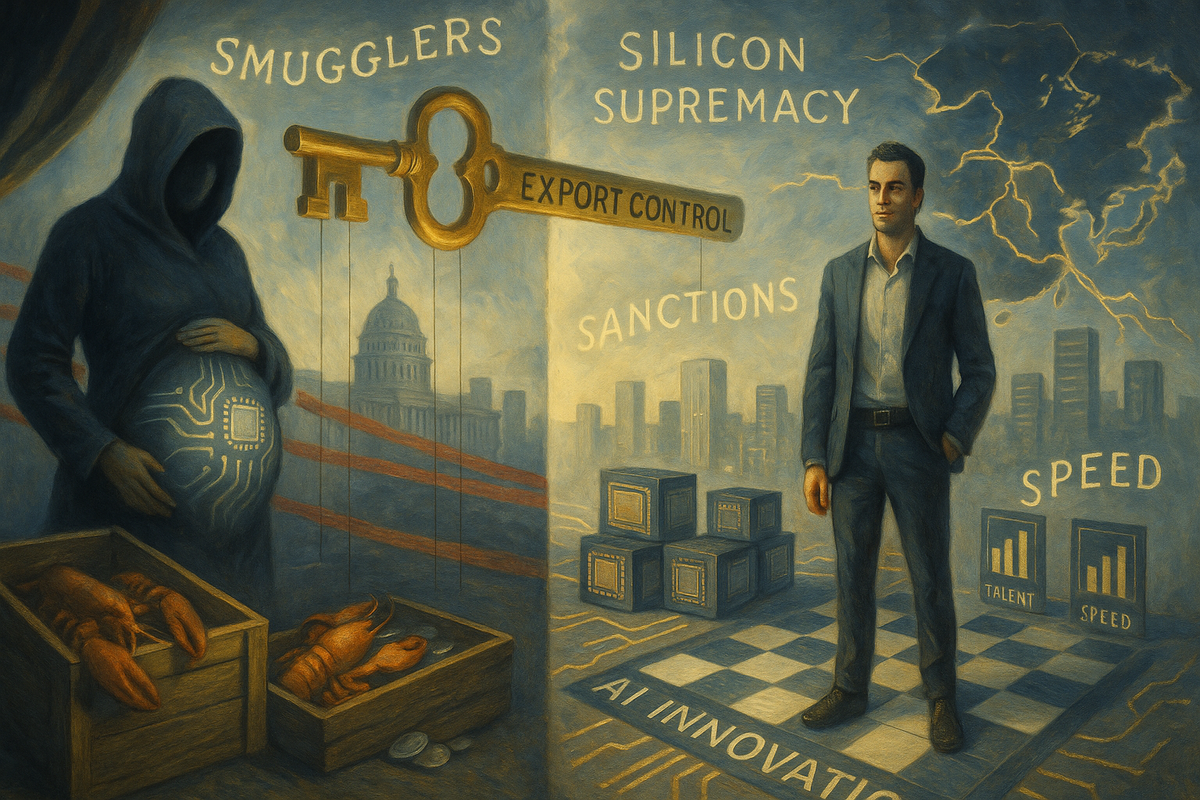

💡 TL;DR - The 30 Seconds Version

👉 Commerce Department issued Nvidia's H20 chip export licenses Friday, 48 hours after CEO Jensen Huang met Trump at the White House.

📊 The approvals ended a 3-week bureaucratic freeze following Trump's July reversal of his April ban—China generates 15.5% of Nvidia's revenue.

🔍 Beijing simultaneously summoned Nvidia to explain alleged "backdoor" security risks in H20 chips, demanding technical documentation without providing evidence.

🏭 Nvidia has 300,000 H20 units on order from TSMC for Chinese customers including universities, research institutes, and military-linked projects.

🎯 China's investigation mirrors past plays like Huntsman Corp, where security reviews became forced technology transfers to domestic competitors.

🚀 Every chip shipment now triggers dual negotiations—Washington controlling exports while Beijing extracts technical disclosures for market access.

Two days after Jensen Huang met President Trump at the White House, the Commerce Department began issuing export licenses for Nvidia’s H20 chips to China—ending a weeks-long delay that had frustrated the company and its customers. The sequence wasn’t subtle: a high-profile visit, then approvals.

What changed—and when

Trump blocked H20 sales in April, taking a harder line than the previous administration. In July, he reversed course after sustained lobbying, including earlier face time with Huang. But reversals don’t move boxes on their own. For weeks, the Bureau of Industry and Security sat on paperwork. Huang returned to the White House on Wednesday. By Friday, licenses were moving.

Nvidia needed this. So did its Chinese customers.

Beijing’s timing looks like leverage

While Washington unlocked approvals, Beijing turned the screws. China’s cyberspace regulator summoned Nvidia over alleged “backdoor” risks in the H20, and a People’s Daily commentary asked for “convincing security proofs.” No technical evidence was presented. The demand was documentation.

It’s a familiar play. Security reviews in China often morph into documentation drives that pry into design details. That can be theater. It can also be pressure. Both readings fit.

From China’s perspective, suspicions aren’t entirely fanciful. U.S. lawmakers have floated “location verification” features for exported chips to deter diversion. From Washington, that’s supply-chain assurance. From Beijing, it smells like a sovereignty risk. Both can be true.

The DeepSeek shadow

All of this unfolds against a messy backdrop. DeepSeek’s rise—and claims of GPT-class performance at lower cost—has intensified scrutiny of how Chinese labs source compute. U.S. agencies are probing GPU smuggling routes and diversion risks. Controls raise costs and slow timelines. They haven’t stopped research.

Nvidia’s public line stays consistent: curbs don’t halt China’s progress; they just hand share to domestic rivals like Huawei. The company is arguing for engagement, not containment.

The numbers behind the drama

This isn’t a symbolic market. Nvidia recently placed orders for roughly 300,000 H20 units at TSMC tied to mainland demand. China contributed about 13% of Nvidia’s revenue last fiscal year—down from prior peaks, but still material. If licenses flow steadily, that share stabilizes. If they don’t, domestic stacks will keep filling the gap.

The revenue stakes are large. So are the politics.

The politics under the hood

The White House is pitching a familiar strategy: export America’s AI “stack” to partners and fence-sitters—software, models, services, and, where permitted, hardware. The goal isn’t perfect denial. It’s dependency.

China’s counter is patient. Squeeze for disclosures, accelerate domestic capacity, and use regulatory levers—antitrust reviews, security probes—to remind multinationals who controls access. Meanwhile, ask for proof there are no “kill switches” or remote-control features in silicon. The levers are plentiful.

In short: Washington wants managed diffusion; Beijing wants conditional access. Nvidia wants predictability. None gets everything.

What happens next

Expect more rounds. Each tranche of licenses invites fresh scrutiny, and each new chip variant triggers another compliance dance—spec sheets on one side, “security proofs” on the other. Nvidia will keep arguing that selling controlled-performance parts into China serves U.S. interests by preserving mindshare and standards. Security hawks will counter that any sale accelerates a competitor’s military-civil fusion. Neither camp is retreating.

The immediate story is simple: licenses are finally moving. The structural story is not. Controls morph, workarounds spread, and geopolitics seep into the bill of materials.

Why this matters

- The U.S.–China chip fight now runs through license desks and PR campaigns, turning every shipment into a political bargaining chip.

- Market access is being traded for technical disclosures and strategic dependence, pulling private companies into statecraft on both sides.

❓ Frequently Asked Questions

Q: What's an H20 chip and why is it different from Nvidia's regular AI chips?

A: The H20 is Nvidia's deliberately weakened AI chip designed to comply with U.S. export restrictions. It has reduced computing power compared to flagship chips like the H100, but still performs well enough that Chinese companies ordered 300,000 units. Think of it as the "export edition" - powerful enough to be useful, weak enough to be legal.

Q: How much money does Nvidia actually make from China?

A: China generated 15.5% of Nvidia's revenue as of April 2025, down from higher peaks before export controls. That translates to roughly $4-5 billion annually based on Nvidia's recent earnings. The company needs this market - losing China entirely would hurt quarterly earnings and stock price significantly.

Q: What backdoors is China worried about in these chips?

A: China fears location verification systems or remote control features that U.S. lawmakers have proposed for exported chips. These would let America track where chips end up or potentially disable them remotely. Nvidia denies any such features exist, but China wants technical proof - likely to understand the chip's design rather than find actual backdoors.

Q: Who's Jensen Huang and why can he get Trump to change policy?

A: Huang is Nvidia's CEO and founder who built the company into a $3 trillion AI powerhouse. His personal lobbying carries weight because Nvidia dominates AI chips globally - controlling roughly 80% of the market. When he argues export controls hurt American competitiveness, politicians listen. Two White House visits got results where bureaucratic channels failed.

Q: What's the DeepSeek smuggling situation mentioned?

A: DeepSeek, a Chinese AI startup, claimed its model matches ChatGPT's performance at lower cost - allegedly using smuggled high-end Nvidia chips that were banned from export. This demonstrated that export controls weren't stopping China's AI progress, just creating black markets. The incident helped Huang argue controls were ineffective and only hurt legitimate sales.

Q: What's the Mellanox acquisition issue China is investigating?

A: Nvidia bought Mellanox, an Israeli networking chip company, for $6.9 billion in 2020. China conditionally approved the deal with certain requirements. Now Chinese regulators claim Nvidia violated those conditions - though they haven't specified how. It's another pressure point Beijing can use to extract concessions or technical information from Nvidia.

Q: Which Chinese companies are trying to replace Nvidia?

A: Huawei leads with its Ascend AI chips, while Semiconductor Manufacturing International Corporation (SMIC) handles production. Baidu, Alibaba, and startups like Biren Technology are also developing AI chips. They're still behind Nvidia technically, but Chinese government subsidies and forced domestic purchasing could help them catch up if Nvidia loses access.

Q: What happens if this escalates and China blocks Nvidia entirely?

A: Nvidia loses $4-5 billion in annual revenue while Chinese competitors fill the gap domestically. Chinese AI development might slow temporarily but wouldn't stop - they'd use domestic chips, smuggled goods, or cloud services. Long-term, it accelerates China's chip independence while fragmenting the global AI market into American and Chinese spheres.