The Productivity Gap Nobody Measured.

Executives claim AI saves 8 hours weekly. Workers report under 2. Apple bets on wearable AI. Anthropic publishes 80-page philosophy for Claude.

Good Morning from San Francisco,

OpenAI just bought 6 gigawatts worth of AMD chips. They paid with equity warrants—up to 10% of the entire company. AMD's stock surged 21%.

The math gets interesting here. OpenAI generated $13 billion last year. Their infrastructure commitments now exceed $1 trillion. They remain unprofitable. Their suppliers keep funding them to buy their own products.

Meanwhile, we tested the AI email assistants flooding your inbox. Some draft competently. Others hallucinate meeting times and invent commitments you never made. We'll show you which tools earn trust and which ones require more supervision than they save.

Stay curious,

Marcus Schuler

OpenAI committed Monday to deploy 6 gigawatts of AMD processors—and handed the chipmaker a warrant for up to 160 million shares, roughly 10% of AMD.

The stock surged 21%. The warrant vests as OpenAI hits deployment milestones and AMD's share price climbs to targets including $600. Friday's close: $164.67.

The deal follows a $100 billion Nvidia agreement two weeks prior and pushes OpenAI's infrastructure commitments past $1 trillion across 23 gigawatts. OpenAI generated $13 billion in revenue last year and remains unprofitable. AMD secures its largest AI customer for inference workloads—the computations behind ChatGPT's 700 million weekly users. The first gigawatt deploys in late 2026 using MI450 chips designed to challenge Nvidia's dominance.

The financing model repeats: suppliers invest in the customer buying their products. Nvidia funds OpenAI to purchase Nvidia chips. Oracle extends $300 billion in cloud credits. Now AMD offers equity for guaranteed orders.

Why this matters:

• Supplier, investor, and customer roles collapse into circular dependencies—amplifying both growth potential and systemic risk across the handful of companies anchoring AI infrastructure economics.

• Multi-sourcing at this scale elevates AMD as a credible Nvidia alternative for inference, creating pricing pressure and reducing vendor lock-in in a market where concentration has been nearly absolute.

Prompt:

A vibrant, surreal editorial photo against a bold electric blue background. A modern Saudi girl with sits at a table. she holds a small round white paper takeout noodle cup with chopsticks lifting noodles into the air. Her outfit is modern, oversized streetwear. She wears a baggy all-black outfit with a bold, fashion-forward cut. The scene feels playful, artistic, and fashion-forward, with saturated colors, sharp contrasts, and a surreal pop-art mood. Ultra-detailed, hyper-realistic, 8K editorial photography.

Gmail made AI drafting and summaries free for Workspace users in January 2025—technically $2 per seat, rolled into base pricing.

That move reset the market overnight. Startups that raised rounds pitching "AI that drafts your emails" suddenly competed against unlimited free drafting from Google.

The market response split three ways: premium tools like Fyxer ($30-50 monthly) pushed into full automation that actually sends on your behalf. Specialists like Mailman ($8 monthly) solved single problems—inbox calming, batched delivery—and stayed cheap. Complete email clients like Superhuman and Shortwave ($30-40 monthly) justified switching costs through interface polish, making AI one feature among many rather than the entire offering.

Technical users built custom stacks via Make.com and LLM APIs for $30-40 total, replicating 80% of premium features at half the cost.

Why this matters:

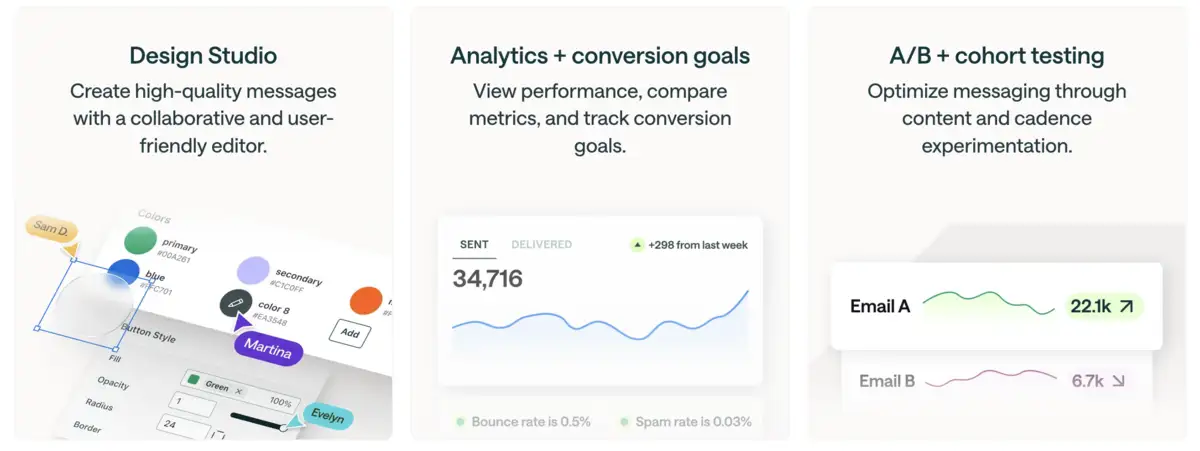

Customer.io is a marketing automation platform that helps you create personalized, multi-channel campaigns across email, SMS, push notifications, and in-app messaging. It uses real-time customer data and behavior to trigger targeted messages that engage customers at exactly the right moment.

Tutorial:

URL: https://customer.io/

Elon Musk's artificial intelligence company xAI is reportedly set to spend over $18 billion to acquire approximately 300,000 additional Nvidia chips for its Colossus 2 data center project in Memphis, bringing the total chip count to the previously announced 550,000 units. The massive expansion of AI infrastructure has created division in Memphis over the project's substantial power and water demands, as xAI races to compete in the rapidly evolving artificial intelligence arms race.

OpenAI has received more than 800 applications from potential locations across the United States for its Stargate data centers since January, according to CNBC reporting. The artificial intelligence company has now narrowed its search down to 20 finalist sites as it works to expand its data center infrastructure to support its growing computational needs.

Small modular reactors (SMRs) are attracting significant investment from government, tech companies, and private investors who see them as a solution to power the growing energy demands of artificial intelligence infrastructure. However, mounting concerns over the cost-effectiveness and commercial viability of these smaller nuclear reactors could undermine the $9 billion investment push, potentially making SMRs too expensive to serve as a practical energy source for the AI boom.

Riley Walz, a San Francisco-based technologist, has gained attention for creating tech-related pranks that serve as social commentary, most notably a viral website that tracks parking police throughout the city. His projects demonstrate how technical expertise can be used to highlight urban issues and create public discourse about municipal services and oversight.

Technology writer Cory Doctorow has detailed how Amazon's "flywheel" business strategy has evolved to prioritize company profits over merchant and customer experience, contributing to what he terms the platform's "enshittification." The analysis highlights growing concerns about declining search quality, increased AI-generated advertisements, and proliferation of low-quality product listings that have degraded the user experience on the e-commerce giant's platform.

Melbourne-based Heidi Health has raised $65 million in Series B funding led by Point72, bringing the company's total funding to $96.6 million as it develops AI agents designed to assist doctors with their work. The healthcare technology startup, founded by trauma surgeon Dr. Tom Kelly, aims to address the growing administrative burden that doctors face in their daily practice by leveraging artificial intelligence to streamline medical workflows.

Technology companies in the United Kingdom, Canada, and other countries are actively seeking to attract skilled workers as the United States implements stricter H-1B visa policies under the Trump administration. However, industry analysts remain divided on whether these U.S. immigration restrictions will generate a significant technology sector boom in other countries, with some experts expressing skepticism about the potential impact on international tech markets.

AstraZeneca has entered into a $555 million agreement with a San Francisco-based biotechnology company that specializes in artificial intelligence to develop gene-editing therapies. The pharmaceutical company joins a growing number of industry leaders investing in AI technology to accelerate the drug development process and advance precision medicine capabilities.

A basket of 10 European data center operators and infrastructure providers has surged 23% in 2025, outperforming the Nasdaq 100 as the artificial intelligence boom drives unprecedented demand for data infrastructure. The strong performance reflects how Europe's AI momentum is flowing primarily into the critical infrastructure sectors needed to power and support AI technologies rather than traditional tech stocks.

SoftBank Group has established SoftBank Robotics Group, a new holding company that consolidates 20 robotics-related companies from across its portfolio. The restructuring combines 13 companies from SoftBank's main group with 7 companies from Vision Fund 2, signaling the Japanese tech conglomerate's strategic shift toward advancing its robotics business beyond its well-known Pepper robot platform.

The Paris prosecutor's office has referred a criminal investigation into Apple's Siri voice recording practices to France's Office for Combating Cybercrime following a complaint filed by a human rights organization. The probe focuses on how Apple collects, processes, and potentially shares voice recordings captured through its Siri digital assistant, raising significant privacy and data protection concerns for French users.

Alvys makes transportation management software for trucking companies that are tired of duct-taping five systems together. The platform runs dispatch, billing, compliance, and driver ops in one place—no spreadsheets, no swivel chairs.

The Founders

Nick Darman started Alvys after running an asset-based brokerage and watching hours vanish into fragmented tools. Leo Gorodinski, ex-VP of Engineering at Jet.com, joined as CTO in 2020 to build something that actually scaled. They founded the company in Solana Beach, California, and now employ 100+ people. The origin story: Darman needed software that didn't suck, so he built it.

The Product

Alvys handles the full quote-to-cash loop. Dispatch, load planning, tracking, accounting, payroll, compliance, and a driver mobile app all live under one roof. The system offers 100+ integrations, native EDI, and built-in compliance tools. It bundles PC*Miler routing at no extra cost, cutting a common third-party fee. The pitch: one workflow, less clicking, cleaner data. Customers report fewer calls to drivers and faster reconciliation. That's the bar in freight—save time or go home.

The Competition

Legacy players like McLeod and Trimble own the enterprise. Cloud challengers like Rose Rocket, Turvo, and AscendTMS fight in the mid-market. Visibility platforms (FourKites, project44) nibble at the edges. Alvys competes on unified architecture and usability. It targets carriers and hybrids that want depth without bloat.

Financing

Raised $77M total: seed from Bonfire Ventures, Series A from Titanium Ventures, Series B from RTP Global and Alpha Square Group. Valuation stays private, but the company calls it an "up round" in a down market. Revenue tripled two years running and should double again in 2025.

The Future ⭐⭐⭐⭐

Freight rewards persistence, not flash. Alvys ships fast, adds integrations, and keeps dispatchers happy. If they sustain that, the runway looks long. 🚛

Get the 5-minute Silicon Valley AI briefing, every weekday morning — free.