💡 TL;DR - The 30 Seconds Version

👉 OpenAI raised $8.3 billion at a $300 billion valuation, months ahead of schedule with demand 5x higher than available spots

📊 Revenue jumped to $13 billion annually (from $10 billion in June) with 5 million paying business customers

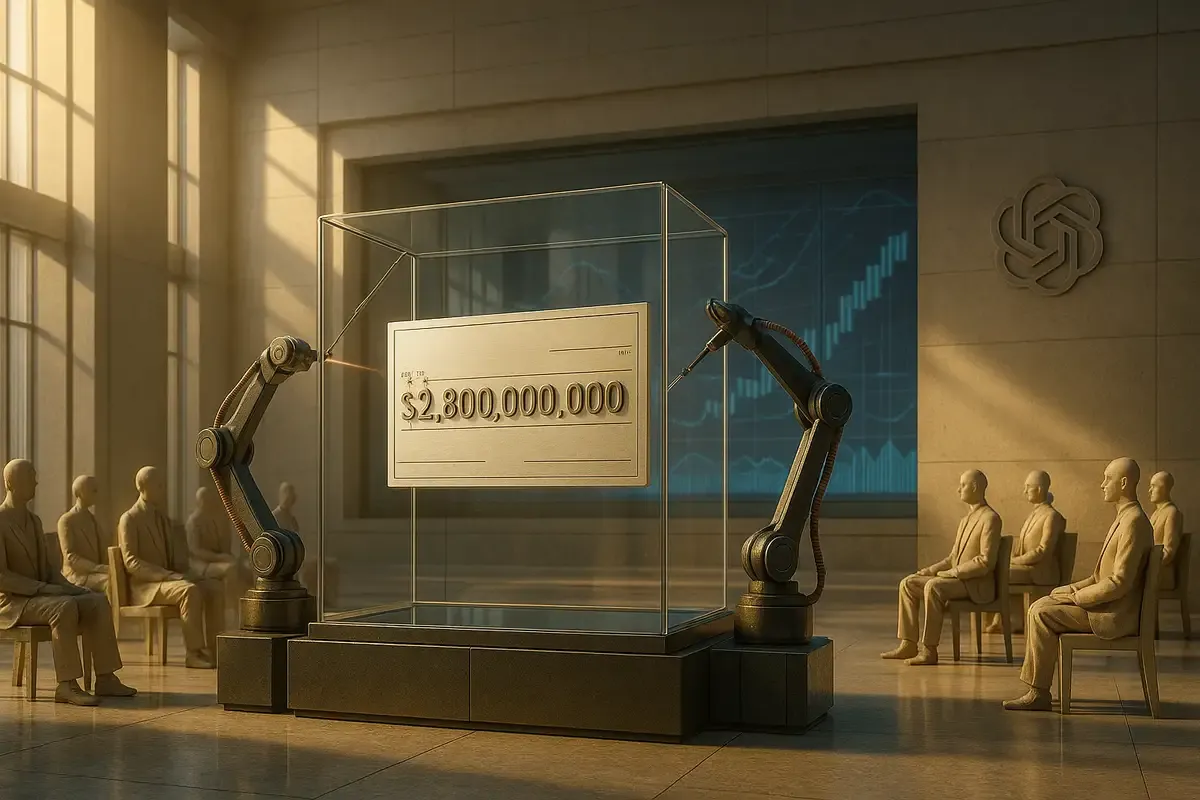

💰 Dragoneer Investment Group wrote a $2.8 billion check, potentially the largest single venture capital investment ever

🏢 Major new investors include Blackstone and TPG, chosen to help push ChatGPT adoption across their portfolio companies

🤝 The funding comes during delicate Microsoft negotiations about OpenAI's transition to for-profit status

🚀 OpenAI now has resources to compete heavily in the AI race while pursuing a potential IPO at astronomical valuations

OpenAI just closed an $8.3 billion funding round that makes most venture deals look like pocket change, according to the New York Times. The company behind ChatGPT hit a $300 billion valuation, months ahead of schedule and with five times more investor interest than it could handle.

The round's standout moment? Dragoneer Investment Group cut a $2.8 billion check. That's not a typo. A single venture firm just wrote what might be the largest check in startup history, representing roughly 10 percent of Dragoneer's total fund.

Some early OpenAI investors aren't thrilled. They got squeezed out as the company chose new partners over longtime supporters. When demand runs that hot, loyalty takes a backseat.

The Numbers Behind the Success

OpenAI's business keeps accelerating at an almost absurd pace. Annual revenue hit $13 billion, jumping from $10 billion just three months ago. The company now serves five million paying business customers, up from three million recently.

Those aren't vanity metrics. They represent real companies paying real money for AI tools that actually work. OpenAI expects revenue will top $20 billion by year-end, putting it in rare territory for a company that barely existed in its current form just a few years ago.

The funding fits into OpenAI's broader plan to raise $40 billion this year. SoftBank committed $30 billion back in March, with OpenAI initially planning to raise another $7.5 billion by December. Instead, they pulled in $8.3 billion months early.

Meet the Mystery Player

Dragoneer Investment Group doesn't grab headlines like other Silicon Valley firms, but it should. Founded in 2012 by Marc Stad, the San Francisco firm manages $24.9 billion and made early bets on Airbnb, Spotify, and Uber.

The OpenAI investment represents a massive public bet on what many consider the defining tech platform of the next decade. Stad's firm usually stays behind the scenes, but a $2.8 billion check tends to draw attention.

Other major players joined the round: Blackstone, TPG, T. Rowe Price, Fidelity, and the usual Silicon Valley suspects like Sequoia and Andreessen Horowitz. Blackstone and TPG don't usually back AI companies, but OpenAI courted them because they can push ChatGPT adoption across their massive portfolio companies.

The Microsoft Factor

This funding comes during tricky talks with Microsoft, OpenAI's biggest investor and business partner. OpenAI wants to become a for-profit company, but needs Microsoft's blessing to make it happen.

An IPO hangs in the balance. If OpenAI can restructure successfully, it could go public at mind-bending valuations. Microsoft holds the keys here because of how deeply the two companies are tied together technically and financially.

The timing isn't coincidental. OpenAI likely wants power in those Microsoft talks, and having $8.3 billion in fresh capital certainly helps your position.

What Comes Next

This fundraising blitz shows investors still believe AI will reshape entire industries. Never mind the recent market jitters or questions about when these companies will actually make money. Competition is heating up from Google, Anthropic, and Chinese startups, but that hasn't spooked backers.

OpenAI now has enough cash to spend freely on the things that matter most: computing power, top talent, and better products. They won't need to worry about fundraising again for quite some time.

Why this matters:

• OpenAI's fundraising speed and scale show investors still believe AI will reshape entire industries, despite recent market ups and downs around the sector.

• Dragoneer's massive bet signals that even traditionally careful firms are willing to make enormous wagers on AI platforms they see as infrastructure plays for the next decade.

❓ Frequently Asked Questions

Q: What exactly is Dragoneer Investment Group?

A: Marc Stad started Dragoneer in San Francisco back in 2012. The firm handles $24.9 billion and got into Airbnb, Spotify, and Uber early. Their $2.8 billion OpenAI check represents about 10% of everything they manage.

Q: What does "5x oversubscribed" actually mean?

A: Investors wanted to put in $41.5 billion, but OpenAI only took $8.3 billion. That means five times more money was on the table than they needed, which shows huge demand.

Q: Why does OpenAI need Microsoft's approval to go for-profit?

A: Microsoft owns a big chunk of OpenAI and powers their technology. When you want to change how profits get split up, your biggest partner gets a say in the decision.

Q: How does OpenAI's $300 billion valuation compare to other companies?

A: That puts OpenAI in the same league as Meta ($800B) or Tesla ($400B). Pretty wild for a company that only started looking like this a few years back.

Q: What will OpenAI use the $8.3 billion for?

A: The money goes toward compute power (expensive AI training), talent acquisition, and product development. Running AI models requires massive computing resources, and top AI researchers command huge salaries.

Q: Why did early OpenAI investors get smaller allocations?

A: OpenAI chose to bring in new strategic investors like Blackstone and TPG who can help promote ChatGPT adoption across their portfolio companies, rather than just give more money to existing backers.

Q: How fast is OpenAI's revenue growing compared to other tech companies?

A: OpenAI went from $10 billion to $13 billion in just three months - that's 30% growth. Meta grew 22% for the entire year of 2023. OpenAI thinks they'll hit $20 billion by December.

Q: Is $2.8 billion really the largest single VC check ever?

A: While exact records are hard to verify, $2.8 billion from a single venture firm is extraordinary. Most mega-rounds involve many investors writing smaller checks. This level of concentration from one firm is virtually unprecedented.