San Francisco | February 12, 2026

OpenAI turned 800 million private conversations into an advertising product this week. The safety staff who might have objected left the building the same day. Zoë Hitzig timed her resignation to a New York Times op-ed warning that the company is compressing Facebook's decade of privacy erosion into months. If you told ChatGPT about your divorce, an algorithm now picks which ad to show you next.

Musk, meanwhile, told xAI employees about a moon factory and electromagnetic catapults for AI satellites. Six of the twelve co-founders have quit. The company he pitched costs $1.5 trillion. The PowerPoint he presented had no blueprints.

Stay curious,

Marcus Schuler

OpenAI Launches ChatGPT Ads for 800 Million Users as Three Safety Leaders Exit in One Week

OpenAI shipped personalized advertising to every free ChatGPT user on Monday. The ads sit below the chatbot's responses and draw on current conversations and past chat threads to decide what to sell. The company says advertisers won't see actual chats. The people who enforced that kind of promise are no longer employed there.

Zoë Hitzig, a safety researcher who shaped how OpenAI's models were built and priced, resigned on launch day. She published a New York Times op-ed calling ChatGPT's conversation archive "an archive of human candor that has no precedent" and warned that the company is running Facebook's playbook on privacy erosion at compressed speed. Ryan Beiermeister, the VP who ran product policy and opposed a planned erotic content feature, was fired in January. The seven-person mission alignment team, the last internal group tasked with verifying whether OpenAI's actions aligned with its stated values, was disbanded in recent weeks.

Forrester found 83% of users would keep using free ChatGPT with ads. Twenty years of social media have trained people to accept the trade. But Facebook monetized vacation photos and status updates, things users posted knowing an audience would see them. OpenAI is monetizing conversations people shared privately, in an interface designed to feel like a confession booth. That's not a difference of degree.

Hitzig proposed structural alternatives: cross-subsidies modeled on the FCC's universal service fund, independent oversight boards, and data trusts. All require internal champions. Every one of those champions cleared out this week.

Why This Matters:

- The voluntary exclusion of health and political topics from ad targeting has no regulatory mandate, no enforcement mechanism, and no internal advocate left to defend it

- If those exclusions narrow over the next six months, the confession booth will have finished its conversion into a storefront

✅ Reality Check

What's confirmed: Ads are live for free-tier users. Three safety personnel departed in the same week. Ad personalization uses conversation data by default.

What's implied (not proven): That the departures were connected to the ad launch, rather than coincidental timing across unrelated decisions.

What could go wrong: The voluntary health/politics ad exclusions shrink under revenue pressure with no internal pushback mechanism.

What to watch next: Whether OpenAI narrows the definition of "sensitive topics" in its ad policy over the next two quarters.

The One Number

64.5% — ChatGPT's share of generative AI web traffic in January 2026, down from 86.7% a year earlier. On mobile, the drop is steeper: 69.1% to 45.3%. Grok climbed from 1.6% to 15.2% over the same period. The AI chatbot monoculture is fragmenting faster than the browser wars did.

Source: Fortune / Similarweb

Musk Pitches xAI Moon Factory and $1.5 Trillion Valuation as Half the Co-Founders Walk Out

Elon Musk told xAI employees the merged xAI-SpaceX entity would build a factory on the moon to manufacture AI satellites, launched by electromagnetic catapult. Six of the twelve co-founders have now left the company. The pitch came with no blueprints, no timeline, and no permits.

Tony Wu and Jimmy Ba both resigned within 24 hours of each other last week, joining four other co-founders who had departed the company, which is less than 3 years old. A dozen additional researchers also left recently. SpaceX has never sent a payload to the moon.

The electromagnetic catapult, based on a 1970s concept by Princeton physicist Gerard O'Neill called a "mass driver," would theoretically fling satellites from the lunar surface into orbit. Musk framed the project as necessary because "we've reached a certain scale." The scale in question: a proposed $1.5 trillion valuation and a potential IPO as early as this summer that could be the largest in U.S. history.

SpaceX reversed its 24-year Mars-first strategy days earlier via a Sunday social media post, pivoting to a "self-sustaining city on the moon." The 1967 Outer Space Treaty prohibits national sovereignty on the moon. A 2015 U.S. law permits Americans to retain extracted lunar resources. No regulatory framework exists for lunar manufacturing.

Why This Matters:

- Half the founding team leaving a pre-IPO company signals internal doubts that the public valuation pitch cannot address

- The moon factory announcement gives the IPO narrative a hardware story, but SpaceX has zero lunar landing experience to back it up

AI Image of the Day

Prompt: POV: Standing on a wet stone path within a quiet, tree-lined square in an upscale Brazilian neighborhood, a single wooden bench soaked by recent rain. Relief painting with Van Gogh-esque touches.

🧰 AI Toolbox

How to Turn a Text Prompt Into a Polished Presentation with Gamma

Gamma generates complete slide decks from a text description. Paste in meeting notes, a project brief, or bullet points, and Gamma builds a designed presentation with layout, imagery, and content. No design skills required, and the free tier includes 400 AI credits.

Tutorial:

- Visit gamma.app and sign up for a free account (400 AI credits included)

- Click "Generate" and choose "Presentation" as the output type

- Describe your content in plain language or paste in source material like notes or a brief

- Review the AI-generated outline and rearrange, add, or remove sections as needed

- Click "Continue" to build the full deck with professional design and stock images

- Edit individual cards: swap images, change the theme, adjust text, or add charts and embeds

- Present directly from Gamma, share via link, or export as PDF or PowerPoint file

URL: https://gamma.app

What To Watch Next (24-72 hours)

- Applied Materials: Q1 earnings after market close today. The largest semiconductor equipment maker is the clearest read on whether AI chip fabrication demand holds through 2026. Any sign of order softening moves the entire chip supply chain.

- Amazon v. Perplexity: Preliminary injunction hearing tomorrow in Seattle. Amazon claims Perplexity's Comet shopping agent disguised automated browsing as human activity. The ruling could set the first legal precedent for whether AI agents can browse and transact on platforms that don't want them.

- Anthropic Funding: The $20 billion round, double the original target, is expected to close this week at a $350 billion valuation. Watch whether the final investor list includes sovereign wealth funds staking positions in the AI infrastructure race.

🛠️ 5-Minute Skill: Sort 50 Emails Into Priorities in 60 Seconds

It's Monday morning. You have 47 unread emails from the weekend, a mix of client requests, internal updates, newsletters, and one thread that might be on fire. You could spend 45 minutes reading each one, or you could sort the pile in under a minute and start with the message that actually matters.

Your raw input:

From: CFO ([email protected])

Subject: RE: Q1 budget — need your sign-off

Preview: Can you approve the revised numbers by EOD Tuesday? Finance is waiting on...

From: Jira ([email protected])

Subject: [PROJ-4521] Bug: Login timeout on mobile

Preview: Priority changed from Medium to Critical by @DevOps. Assigned to your team...

From: Newsletter ([email protected])

Subject: The AI spending binge

Preview: Big Tech committed $650B to AI infrastructure in 2026...

From: Client ([email protected])

Subject: Urgent — demo broken before board meeting

Preview: The dashboard we showed last week is returning errors. Board meets Thursday...

From: HR ([email protected])

Subject: New PTO policy effective March 1

Preview: Please review the updated policy document attached. No action needed until...

From: Colleague ([email protected])

Subject: FYI — competitor launched new feature

Preview: Saw this on TechCrunch, they shipped the thing we've been scoping. Link...

From: AWS ([email protected])

Subject: Your January invoice — $47,892.31

Preview: Your AWS charges for January are ready for review. View detailed breakdown...

From: Recruiter ([email protected])

Subject: Interview feedback needed — Senior Engineer candidate

Preview: Panel was yesterday. Can you submit your scorecard by Wednesday? Link to...

From: Legal ([email protected])

Subject: RE: DPA update for EU clients

Preview: Updated template attached. Need your team to confirm data flows by Friday...

From: Slack digest ([email protected])

Subject: 23 new messages in #product-roadmap

Preview: @team: Q2 priorities discussion. @PM: Pushed the API deadline. @Design: New mockups...

The prompt:

You are my executive assistant triaging my inbox. I need to process these emails in under 2 minutes.

Categorize each email into exactly one bucket:

- ACT NOW (needs my response or decision within 24 hours)

- SCHEDULE (needs attention this week, not today)

- DELEGATE (someone on my team should handle, suggest who)

- ARCHIVE (read later or no action needed)

For each email, provide:

- Category

- One-sentence reason

- If ACT NOW: what the response should contain (not the full response, just the gist)

- If DELEGATE: who should handle it and what to tell them

Emails:

[paste your inbox list here]

Rules:

- Be ruthless. Most emails aren't urgent. Default to SCHEDULE or ARCHIVE unless there's a real deadline within 24 hours.

- "Urgent" in the subject line doesn't automatically mean ACT NOW. Check for actual deadlines.

- If an email requires both action and delegation, pick the one that unblocks the situation fastest.

What you get back:

ACT NOW

Client: "Urgent, demo broken before board meeting" — Client-facing breakage with a Thursday board deadline. Respond within the hour acknowledging the issue, confirm your team is investigating, and give an ETA for the fix.

CFO: "Q1 budget, need your sign-off" — Direct request from the CFO with an EOD Tuesday deadline. Review the numbers and approve or flag questions today.

SCHEDULE

Legal: "DPA update for EU clients" — Friday deadline for confirming data flows. Block 30 minutes Wednesday to review with your team.

Recruiter: "Interview feedback needed" — Scorecard due Wednesday. Takes 10 minutes. Do it tomorrow morning.

DELEGATE

Jira: "Bug: Login timeout on mobile" — Escalated to Critical. Forward to your engineering lead with "please triage and update the ticket with an ETA by EOD."

Colleague: "Competitor launched new feature" — Forward to product lead with "worth reviewing, let me know if this changes our Q2 scope."

ARCHIVE

Newsletter: Morning Brew — Read during lunch or skip.

AWS billing — Routine monthly invoice. Glance at the total, archive unless it's 20%+ above last month.

HR: PTO policy — No action until March. Archive.

Slack digest — Skim the #product-roadmap thread when you have 5 minutes. Not time-sensitive.

Why this works

The four-bucket system forces binary decisions instead of "I'll deal with this later," which is how inboxes grow to 500 unread. The "be ruthless" rule overrides the instinct to treat everything as urgent. And requiring a one-sentence action plan for each email means you leave the triage with a to-do list, not just a sorted pile.

Where people get it wrong: Asking AI to "summarize my emails." Summaries are a reading list, not a decision framework. You don't need shorter emails. You need to know which ones require you and which ones don't.

What to use

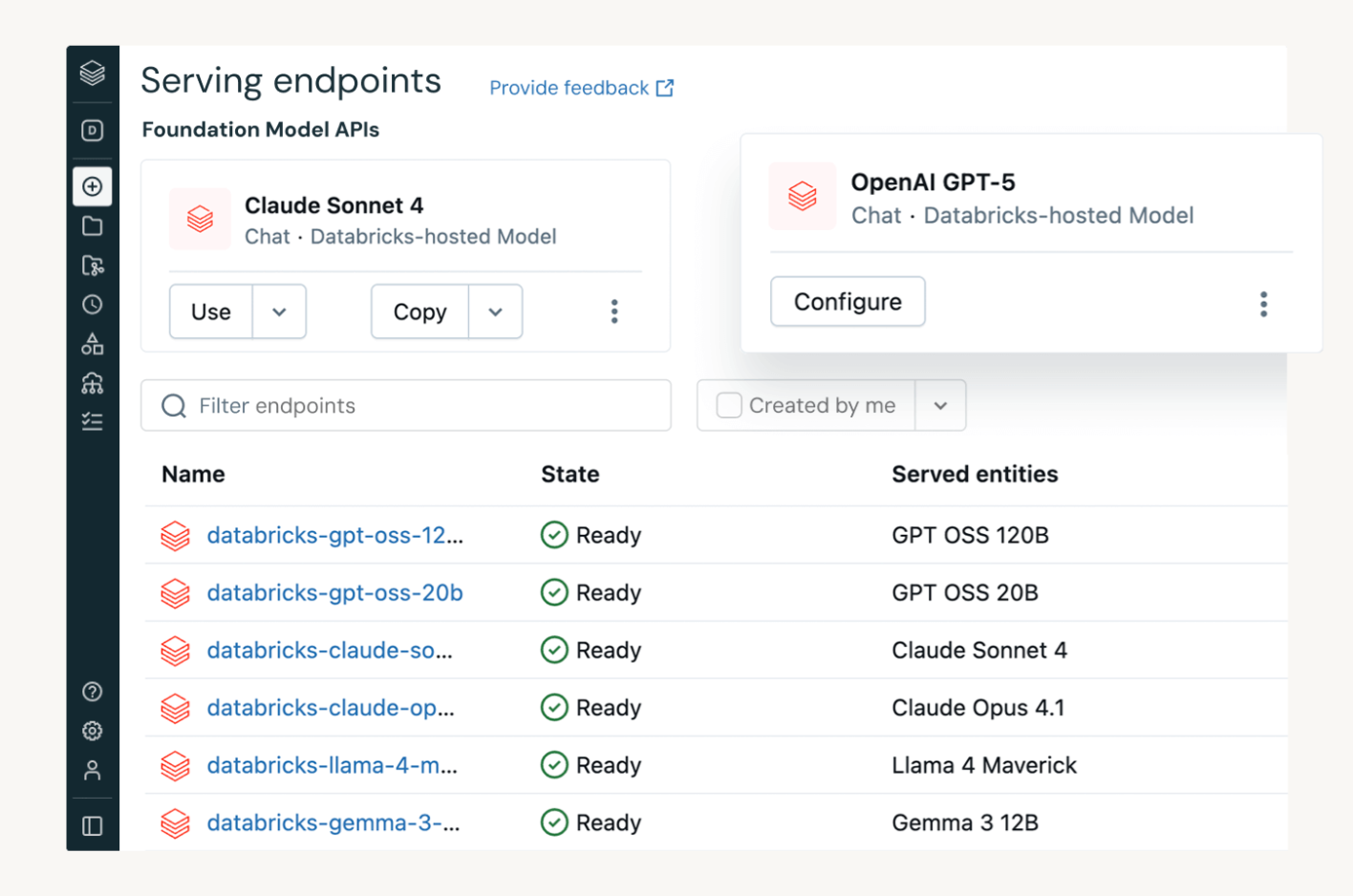

Claude (Sonnet 4.5 via claude.ai): Best at the "be ruthless" instruction. Won't promote everything to urgent. Handles ambiguous priority well. Watch out for: Can be too conservative with ACT NOW, sometimes bumping genuine urgencies to SCHEDULE.

ChatGPT (GPT-4o): Clean formatting with clear categories. Good at extracting deadlines from email previews. Watch out for: Tends to over-categorize as ACT NOW. If half your emails come back urgent, the triage failed.

Gemini (Gemini 2.5 Pro via Google AI Studio): If you connect your Gmail, it can read the inbox directly instead of copy-paste. Watch out for: Privacy implications of granting AI access to your email. Only use with a work account you control and an admin-approved integration.

Bottom line: Claude for accurate prioritization. ChatGPT for clean output. Gemini if you want to skip the copy-paste step entirely.

AI & Tech News

Samsung Ships First Commercial HBM4 Memory for AI Chips

Samsung Electronics began commercial shipments of HBM4, the next-generation high-bandwidth memory required for AI accelerators including Nvidia's latest chips. The move gives Samsung an early lead over rivals SK Hynix and Micron in the race to supply the AI hardware boom.

EY Raises Red Flag Over Meta's $27 Billion Off-Balance-Sheet Data Center

Meta's auditor Ernst & Young included an unusual cautionary note in the company's annual report about how Meta structured its $27 billion Hyperion data center project to keep it off the balance sheet. The flag puts Meta's AI infrastructure accounting under scrutiny.

AI Threatens Private Equity's Biggest Bet on SaaS Companies

Dealmakers and lenders face what industry observers call a "Darwinian moment" as AI risks making established SaaS products obsolete. Private equity has poured billions into software-as-a-service companies over the past decade, and the Financial Times reports investors are now reassessing the durability of those holdings.

1,500 Amazon Engineers Push for Claude Code Over In-House Kiro Tool

Amazon employees are organizing internally to demand access to Anthropic's Claude Code after leadership mandated its in-house Kiro assistant for production code. The revolt, first reported by Business Insider, reflects growing frustration among engineers who consider the third-party tool superior.

Anthropic Donates $20 Million to AI Safety Super PAC Ahead of Midterms

Anthropic poured $20 million into Public First, a super PAC pushing for AI guardrails and transparency, setting up a direct political clash with OpenAI-backed committees before the 2026 elections. The New York Times reports the move marks the most aggressive political spending yet by an AI lab.

Google Reveals 100,000-Prompt Cloning Attack on Gemini

Google's Threat Intelligence Group disclosed that commercially motivated actors bombarded Gemini with over 100,000 prompts in a single campaign attempting to replicate the model's capabilities. The extraction attacks highlight a growing threat where competitors try to duplicate proprietary AI through large-scale prompt harvesting.

X Subscriptions Hit $1 Billion in Annualized Revenue

X's subscription products, ranging from $3 to $40 per month, have reached $1 billion in annualized recurring revenue, head of product Nikita Bier disclosed at an xAI all-hands meeting. Bier did not share advertising revenue or broader xAI financials.

Alibaba's Qwen Chatbot Generates 120 Million Shopping Orders in Six Days

Alibaba reported its Qwen AI chatbot drove more than 120 million e-commerce orders from Chinese consumers over six days before Lunar New Year. The company offered shopping vouchers to incentivize adoption of AI-powered purchasing.

Waymo Targets 1 Million Weekly Paid Robotaxi Rides by Year-End

Waymo co-CEO Tekedra Mawakana said Alphabet's self-driving unit expects to surpass 1 million paid weekly rides by the end of 2026, more than doubling its current 400,000 weekly trips across six cities. The milestone would mark the largest commercial scaling of autonomous vehicle operations to date.

Steve Yegge Warns AI Coding Tools Create "Vampire" Burnout Effect

Software engineer Steve Yegge published an essay arguing that tools like Opus 4.6 genuinely deliver 10x productivity but drain developers through an addictive, unsustainable pace he calls the "AI Vampire" effect. The post challenges prevailing optimism about AI-augmented coding by documenting widespread burnout among engineers who can't stop using the tools.

🚀 AI Profiles: The Companies Defining Tomorrow

Databricks

Databricks wants to own the data layer underneath every AI application on Earth. The San Francisco company builds a unified platform for data engineering, analytics, and machine learning that lets enterprises train models on their own data without stitching together a dozen tools. 🏢

Founders

Ali Ghodsi co-founded Databricks in 2013 at UC Berkeley alongside six researchers who created Apache Spark, the open-source engine now running inside most Fortune 500 data stacks. Ghodsi serves as CEO. Matei Zaharia, Spark's original creator, returned as CTO in 2023 after a decade teaching at Stanford. The company has grown past 7,500 employees across 40 countries.

Product

A lakehouse platform that merges data warehouses and data lakes into one architecture. Enterprises use it for everything from SQL queries to training custom AI models on proprietary data. Runs on all three major clouds. Recent additions include Mosaic AI for fine-tuning and deploying foundation models, and Unity Catalog for governing data across the organization. More than half the Fortune 500 are customers.

Competition

Snowflake is the primary rival with $3.4 billion in product revenue. Google BigQuery and Amazon Redshift compete on the cloud-native side. Palantir targets government and defense. Databricks controls the data preparation step that every AI project starts with, and that position is harder to dislodge than a compute provider.

Financing 💰

$5 billion Series K plus $2 billion in debt at a $134 billion valuation, announced February 2026. Goldman Sachs, Morgan Stanley, and Qatar Investment Authority led. Previous round: $10 billion at $62 billion in December 2024. Annualized revenue passed $5.4 billion, up 65% year over year. AI products alone hit $1.4 billion annualized.

Future ⭐⭐⭐⭐

Every enterprise AI deployment starts with data preparation. Databricks owns that step. The $134 billion valuation prices an IPO before it happens, and the company has said it will go public "when the time is right." The risk: Snowflake and the cloud providers are adding similar AI features fast. But doubling your valuation in 14 months while growing revenue 65% suggests the market isn't waiting for alternatives. 📊

🔥 Yeah, But...

Companies including Amazon, UPS, and Duolingo cited AI as the reason for laying off a combined 80,000+ workers since early 2025. A Harvard Business Review analysis published last month found most of these companies don't have mature AI applications ready to replace the jobs they cut. Inc. reported this week that half are expected to quietly rehire.

Sources: Harvard Business Review, January 2026 | Inc., February 2026

Our take: The playbook is elegant: fire humans, tell Wall Street it's AI efficiency, watch the stock price tick up. The part nobody rehearsed is what happens when the chatbot can't actually do the job. Turns out replacing a customer service team with a model that hallucinates return policies creates its own kind of inefficiency. So the recruiting team, which is also AI now, starts rebuilding the department it helped eliminate six months earlier. HBR's word for it was "potential, not performance." A more honest label: investor bingo. The companies didn't automate the work. They automated the earnings call talking point.