💡 TL;DR - The 30 Seconds Version

👉 OpenAI scrapes Google Search results through SerpApi to help ChatGPT answer real-time queries, despite positioning itself as Google's search rival.

📊 Google searches average 4.06 words while ChatGPT prompts average 20 words, showing users want conversation over simple retrieval.

🏭 OpenAI admits it serves nowhere near its goal of 80% traffic from its own search index, forcing reliance on competitors' data.

🌍 AI search sends 95.7% less traffic to publishers than Google but converts 4.4 times higher, creating a quality-over-quantity paradox.

🚀 Search fragmentation across TikTok, Instagram, and AI platforms requires brands to optimize for multiple discovery paths simultaneously.

The new search reality: Rivals fight in public—and share the same pipes in private

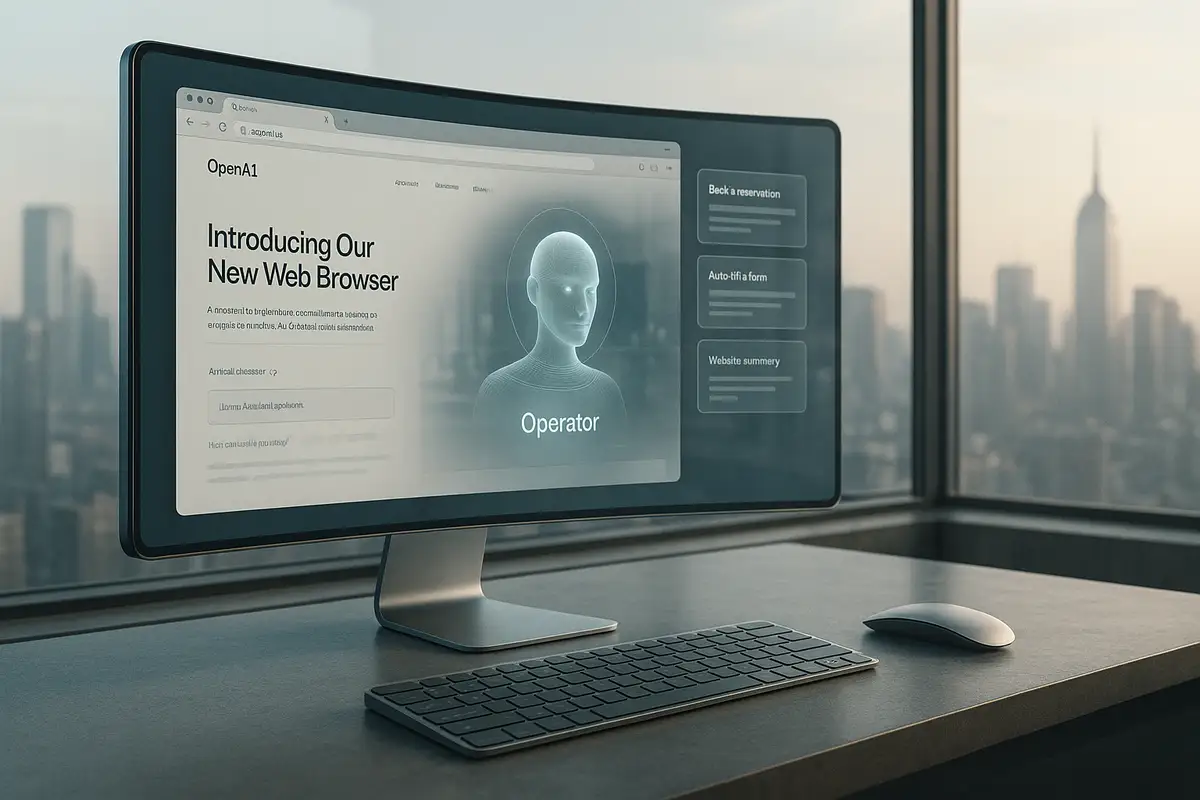

A report says OpenAI has been tapping Google Search data via a third-party service to help ChatGPT answer timely questions. That’s a striking twist for a company positioning itself as a Google rival.

What’s new

According to reporting summarized by Tom’s Guide and others, OpenAI has used SerpApi, a search-results scraping tool, to pull Google’s listings and snippets for real-time topics such as news, sports, and markets. The practice allegedly continued even after Google declined OpenAI’s request for formal access to its index, as revealed in court records tied to the Justice Department’s antitrust case. The tension is obvious. Compete in public, depend in private.

SerpApi’s customer list reportedly includes Meta, Apple, and Perplexity, highlighting how AI players mix competition and entanglement across the same pipes. Google, for its part, hasn’t moved to shut the service down.

How it allegedly works

Google’s featured snippets are built through proprietary methods and are hard to replicate at scale. Even with Microsoft Bing’s API and its own crawler, OpenAI appears to have leaned on Google-derived results to boost recall on long-tail or obscure queries. That’s the claim. It speaks to a gap between AI assistants’ conversational prowess and their live web coverage, where freshness and trust signals still matter.

One developer test made the rounds: a former Google engineer created pages visible only in Google’s index. When asked, ChatGPT reportedly surfaced details from those pages, suggesting indirect use of Google’s corpus through a middleman. It’s a clever probe. It’s not a full audit.

Evidence and limits

OpenAI executives have acknowledged that building a first-party index big enough to cover the open web is an ambitious, unfinished job. Public testimony earlier this year framed a goal of serving a large majority of traffic from an in-house index—while conceding the company is “nowhere near” that threshold today. Ambition meets operations.

None of this proves wholesale replication of Google’s search. It does imply that, in 2025, even leading AI systems still assemble answers from a messy stack: their own training data, licensed feeds, partner APIs—and, yes, scraped results gathered by third parties. Everyone improvises around licensing, latency, and cost.

The behavior shift underneath

User behavior is shifting in ways that favor AI. An analysis of 3.6 million Google searches found an average of about four words per query. A year of ChatGPT prompts from a large account averaged roughly 20 words. Longer inputs carry context. Context makes assistants more useful.

Discovery is also layering. People start with an AI for framing, bounce to traditional search for products or policies, then check social or community forums for peer validation. Gen-Z leans into TikTok and Instagram for local and lifestyle search. Amazon owns much of product search. LinkedIn is ascendant for B2B. Search isn’t shrinking. It’s splintering.

Economics and strategy

Fragmentation complicates monetization for everyone. Google is threading generative answers into search while protecting an ads engine tuned to keywords and clicks. AI assistants are testing ads and affiliate models to monetize “summary first” behavior without sending traffic away. Publishers, meanwhile, report thinner referrals from AI—but often higher conversion among the smaller slice that does click through. Fewer visitors, clearer intent.

For brands, this points to “search-everywhere optimization.” Content needs to be structured for three contexts at once: source material for AI summaries, rankable pages for traditional SEO, and short-form, searchable video for social. One asset, many surfaces. Winners design for reuse.

The caveats

The scraping narrative rests on reporting, developer tests, and legal filings—not a comprehensive technical disclosure from the companies involved. Both the scale and recency of any SerpApi-sourced use matter, and those details remain murky. It’s also plausible that practices evolved as licensing deals, models, and legal risk changed. Treat the story as a window, not a verdict.

Why this matters

- Competition and dependency now coexist: Even the biggest AI labs rely on rivals’ infrastructure and data, blurring clean narratives about who “owns” search.

- Discovery has fractured: To stay visible, publishers and brands must design content for AI summaries, classic SEO, and social search simultaneously.

❓ Frequently Asked Questions

Q: What exactly is SerpApi and how does it work?

A: SerpApi is an Austin-based service that scrapes search engine results in real-time through automated requests. It captures Google's search listings, featured snippets, and structured data, then provides this information via API to customers like OpenAI, Meta, and Apple for integration into their own products.

Q: Is it legal for OpenAI to scrape Google's search results this way?

A: The legal status remains murky. Google hasn't taken action against SerpApi, possibly due to DOJ antitrust pressure that may force search index access for competitors. Scraping publicly available search results typically falls into legal gray areas, with outcomes depending on specific methods and terms of service violations.

Q: How much does OpenAI pay for this scraping service?

A: SerpApi's pricing isn't disclosed for enterprise customers like OpenAI. Standard plans start at $75/month for 5,000 searches, but high-volume users like OpenAI likely pay millions annually. This represents a fraction of OpenAI's projected $10 billion revenue, making Google dependency affordable relative to building competing infrastructure.

Q: Do other major AI companies rely on Google search data too?

A: Yes. SerpApi's reported customer list includes Meta, Apple, and Perplexity, suggesting widespread reliance on Google's search corpus across the AI industry. This creates an ironic situation where Google's competitors depend on Google's proprietary search infrastructure while building rival products.

Q: Why doesn't Google just block SerpApi to stop competitors from using its data?

A: Google faces regulatory constraints from the DOJ antitrust case that may require opening its search index to competitors. Blocking SerpApi could trigger additional scrutiny about monopolistic practices. Additionally, Google earns revenue from these companies using Google Cloud services, creating mixed incentives around restricting access.