Good Morning from San Francisco,

Sam Altman promised one AI that follows you everywhere. The bill arrived. OpenAI signed $1 trillion in compute deals while burning $5 billion annually against $12 billion in revenue. The math gets interesting around 2027.

Nvidia invested $100 billion, then sold OpenAI the chips. The money makes a circle. AMD took 10% equity for future capacity. Oracle built data centers on spec. Everyone's aligned—or everyone's trapped.

Meanwhile, Google shipped browser automation three days behind OpenAI. Their model won't touch your desktop—just web browsers. They call it focus. Others call it caution.

One startup's infrastructure bet now shapes earnings for multiple chip makers. The well runs deep.

Stay curious,

Marcus Schuler

Altman's bet: one AI everywhere, hardware empire required

Sam Altman laid out OpenAI's plan in a rare CEO interview: build one AI assistant that follows users everywhere, backed by a trillion-dollar compute buildout.

ChatGPT becomes the interface layer. Apps plug in for specialized workflows. The API extends the same intelligence across surfaces. The company positions as both consumer platform and anchor tenant for multi-vendor infrastructure spanning chips, memory, and power.

The execution surface is vast. OpenAI will help partners finance capacity ahead of revenue to avoid sequential bottlenecks. Altman frames this through his investor training—capital allocation for exponential bets. The company burns $2.5 billion annually and must now fund both operations and long-term capacity commitments. Sora hit 30% creator activation versus the typical 1% rule, validating latent creative demand but requiring paid generations rather than ad subsidy.

Three risks loom: capacity promises outpacing power and chip delivery, ecosystem developers hedging if discovery feels opaque, and revenue failing to cover the infrastructure bill.

Why this matters:

• Platforms that own identity, memory, and checkout can reshape consumer software economics if one AI becomes the default interface for intent.

• Multi-year compute lock-in shifts competition from algorithmic tricks to industrial execution, favoring firms with capital access and partner networks over research talent alone.

AI Image of the Day

Prompt:

glamorous male witch with two black doberman dogs, luminescent room, music technology everywhere, altar table with offerings and statues, in the contemporary photo portrait style of Diane Arbus

OpenAI's trillion-dollar tab comes due by 2027

OpenAI signed $1 trillion in compute deals spanning Nvidia, AMD, Oracle, and CoreWeave—20 gigawatts of capacity stretching to 2029.

The company burns $5 billion annually against $12 billion in revenue. The obligations assume cash flows it doesn't yet generate.

Nvidia's structure shows the mechanics: invest $100 billion for equity, then OpenAI uses that capital to buy Nvidia's chips. The money makes a round trip.

AMD granted warrants for up to 10% equity to secure a 6-gigawatt deployment starting in 2026. Oracle built Stargate data centers explicitly for OpenAI workloads. It's vendor financing at industrial scale—powerful alignment that concentrates failure risk.

OpenAI needs revenue reaching $25-30 billion by 2027 to service near-term commitments without perpetual fundraising.

Current run rate: $12 billion. That's near-doubling in 24 months. Three signals matter: revenue acceleration, renegotiation announcements disguised as "phased optimization," and relative model efficiency from competitors. The pitcher keeps going to the well.

Why this matters:

• Systemic interdependence: One unprofitable startup shapes earnings projections for multiple $100B+ vendors, amplifying disruption risk across chips and cloud

• Infrastructure lock-in: Vendor-financed buildouts accelerate AI progress but hard-wire decade-long obligations that become millstones if demand underdelivers

🧰 AI Toolbox

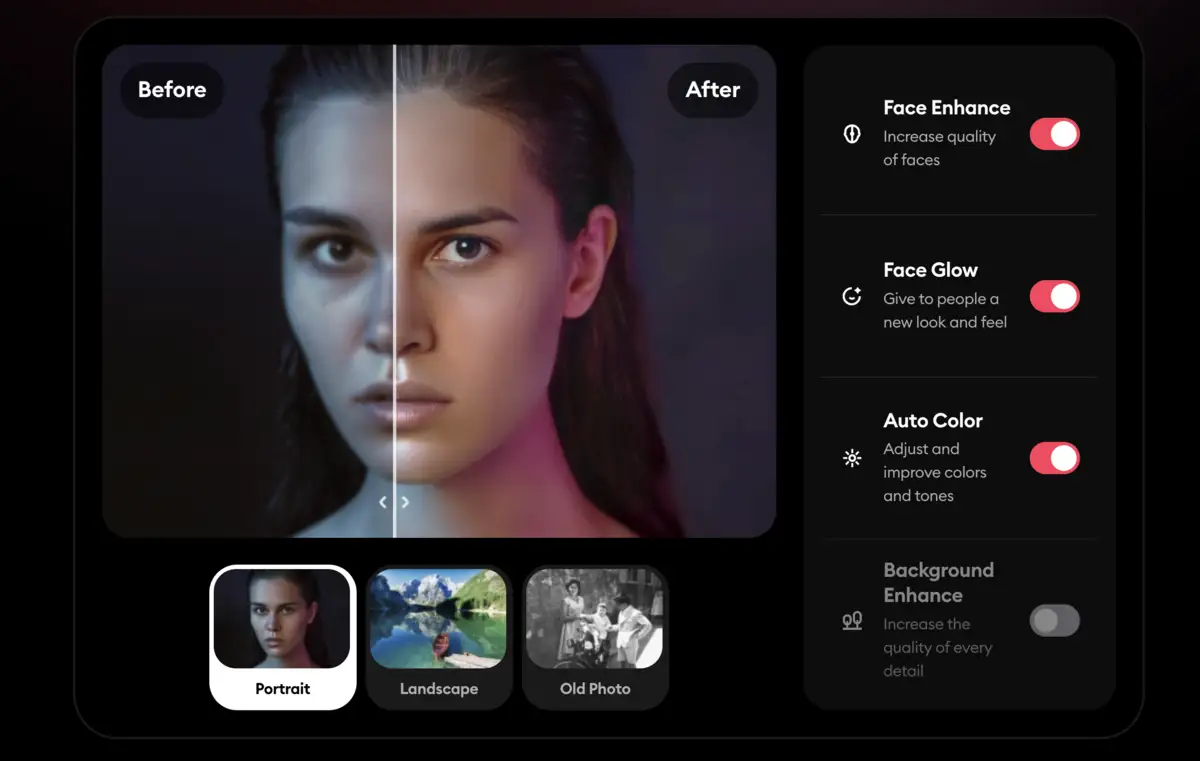

How to Enhance Your Photos with AI

Remini turns blurry, old, or low-quality photos into sharp, clear images. Upload any photo and the AI analyzes and enhances it automatically, fixing blur, improving resolution, and restoring details you thought were lost.

Tutorial:

- Go to the Remini website

- Upload a photo you want to enhance

- The AI processes your image and sharpens details automatically

- Compare the before and after versions side by side

- Download your enhanced photo in high resolution

- Use it to restore old family photos or improve recent ones

- Get professional-quality results in seconds

URL: https://remini.ai/

Better prompting...

Today: Pricing strategy optimization

We're revisiting our pricing strategy for [product/service name]. Help me evaluate pricing models and make a recommendation.

Context:

- Current pricing: [Describe current model and price points]

- Product/service: [Brief description, key features, target market]

- Business goals: [e.g., maximize revenue, increase market share, improve margins, acquire new segments]

- Customer segments: [Who are your primary/secondary customers? Their willingness to pay, price sensitivity]

- Competitive landscape: [How are competitors priced? Our positioning - premium/value/mid-market?]

- Cost structure: [Approximate COGS, marginal costs, fixed costs if relevant]

- Customer value metrics: [What outcomes do customers achieve? How do they measure ROI?]

Please provide:

- 3 pricing model options suited to our situation, such as:

- Tiered/freemium

- Usage-based/consumption

- Value-based

- Flat-rate subscription

- Per-seat/per-user

- Hybrid models

- For each model, analyze:

- How it aligns with our goals and customer behavior

- Revenue predictability and growth potential

- Pros and cons (including customer psychology, sales complexity, competitive response)

- Implementation challenges

- Estimated impact on key metrics

- Recommendation: Which model best fits our situation and why? What's the suggested rollout approach?

Google ships browser agent days after OpenAI with speed claims

Google released Gemini 2.5 Computer Use on October 7, three days after OpenAI expanded computer control features.

The model automates web browsers through clicks, typing, and scrolling—but won't touch desktop apps or operating systems. Google says this narrow focus delivers faster, more accurate results on web tasks.

The model supports 13 actions: clicking coordinates, typing text, scrolling, navigating URLs, hovering menus, and drag-and-drop. Pricing matches Gemini 2.5 Pro at $1.25-$2.50 per million input tokens, but has no free tier. Early users report strong results: Poke.com claims 50% faster performance versus alternatives; Google's payments team says the model now fixes 60% of failed UI tests that previously took days to debug.

The bet: most enterprise work lives in browsers—CRMs, payroll, procurement, data entry. Reliable web automation covers the majority of repetitive work without the complexity of full OS control. Anthropic and OpenAI control entire systems; Google argues browsers are enough.

Why this matters:

• Browser-only scope reduces risk and edge cases while covering most business workflows—restraint might beat breadth if quality differs enough

• Internal deployment before public release proves scale but creates information gap between Google's teams and external developers

AI & Tech News

AI Market Faces Scrutiny Over Circular Deals

Concerns are mounting that Nvidia and OpenAI's interconnected business deals and partnerships may be artificially inflating the trillion-dollar AI market through circular transactions. Industry observers worry that these strategic alliances between major AI players could be creating an unsustainable bubble in the rapidly expanding artificial intelligence sector.

Data Center Investments Drive Nearly All US Economic Growth in Early 2025

Harvard economist Jason Furman has calculated that investments in data centers and information-processing software were responsible for an overwhelming 92% of US GDP growth during the first half of 2025. This analysis reveals that America's economic expansion in early 2025 was almost entirely concentrated in technology infrastructure rather than being broadly distributed across multiple sectors of the economy.

US House Panel Condemns Chip Equipment Makers' China Business

US House lawmakers released a report sharply criticizing major semiconductor equipment manufacturers including Dutch company ASML and Japan's Tokyo Electron for allegedly helping to strengthen China's chip manufacturing capabilities. ASML's stock dropped more than 7% following the congressional panel's accusations that the company has been boosting China's semiconductor industry despite ongoing geopolitical tensions over technology transfer.

AI Adoption Reaches 15% of Global Workforce as Usage Data Reveals Massive Scale

According to new data from Microsoft's AI for Good Lab and other detailed AI usage reports, approximately 15% of the world's working population is now actively using artificial intelligence tools in their daily operations. The scale of AI adoption is highlighted by OpenAI's revelation that ChatGPT receives more than 18 billion messages per week, demonstrating how millions of users have successfully integrated AI technology into their everyday personal and professional workflows.

Anthropic plants flag in India's enterprise AI race

Anthropic will open a Bengaluru office in early 2026—its second Asia Pacific location after Tokyo—targeting India's enterprise market where Claude already ranks second globally in consumer usage behind only the US. The bet hinges on India's technical workforce using Claude heavily for programming tasks, creating a wedge into the country's export-focused IT services industry while competitors race for the same developer and enterprise accounts.

Chinese Venture Capital Funds Near $1.1 Billion Fundraising Milestone in 2025

Top Chinese venture capital firms are approaching $1.1 billion in total USD-denominated fund raises for 2025, representing the first significant signs of a thaw in the sector that has been severely impacted by geopolitical tensions between China and Western nations. This development marks a tentative return of international capital to Chinese technology investments, suggesting renewed investor confidence despite ongoing regulatory and diplomatic challenges.

TikTok Algorithm Proves Highly Effective at Increasing User Engagement Among Heavy Users

A Washington Post analysis of watch histories from over 800 U.S. TikTok users across six months in 2024 demonstrates the platform's remarkable effectiveness at encouraging increased viewing time, even among its heaviest users. The study examined user data to understand the mechanisms behind why certain individuals become "power users" who spend multiple hours daily scrolling through the platform's content.

SoftBank to Acquire ABB's Robotics Division for $5.4 Billion

SoftBank Group has agreed to purchase ABB's robotics business for $5.4 billion, acquiring a division that generated $2.3 billion in sales during 2024. The transaction between the Japanese conglomerate and the Swiss engineering company is expected to finalize in mid-to-late 2026.

Fediverse Creator Evan Prodromou Discusses Origins and Future of Decentralized Social Media

Evan Prodromou, widely recognized as the "inventor of the Fediverse," was interviewed by Matthias Pfefferle on Open Channels FM about the development of ActivityPub protocol and the evolution of decentralized social platforms from early projects like Identica to modern Mastodon. The discussion covered Mastodon's emphasis on privacy protection and the potential for federated platforms to expand beyond traditional microblogging into new forms of social interaction.

Amazon Introduces Pharmacy Kiosks for In-Office Medication Dispensing

Amazon has announced the launch of Amazon Pharmacy kiosks designed to dispense medications quickly to patients immediately after their medical appointments. The company is initially rolling out these pharmacy kiosks at its One Medical office locations in Los Angeles, eliminating the traditional gap between receiving a prescription and filling it at a separate pharmacy location.

Meta and Apple Near EU Antitrust Settlement After €700M in Fines

Meta and Apple are reportedly in the final stages of settling two European Union antitrust cases, with both companies prepared to agree to significant changes in their business practices following €700 million in Digital Markets Act (DMA) fines. The potential settlement would help the US tech giants avoid a series of escalating financial penalties from Brussels regulators who have been cracking down on Big Tech's market dominance in Europe.

Synthetic Diamonds Being Tested to Cool AI Data Center Chips

Researchers are exploring the use of synthetic diamonds as a cooling solution for AI data center chips, which currently waste enormous amounts of electricity through heat generation. De Beers-owned Element Six, which has established experience using diamonds in satellite chip applications, is involved in the development as scientists believe diamond's unique physical properties could provide an effective solution to the overheating problem plaguing energy-intensive AI computing facilities.

Polymarket Reveals $205 Million in Previously Undisclosed Funding Rounds

Polymarket CEO Shayne Coplan disclosed that the prediction platform raised two previously unreported funding rounds totaling $205 million, with a $55 million round at a $350 million valuation in 2024 and a $150 million round at a $1.2 billion valuation earlier in 2025. The disclosure reveals the startup's rapid valuation growth, more than tripling in value over the span of approximately one year.

Microsoft Postpones Xbox Game Pass Price Increases for Select Countries

Microsoft has announced a delay to its Xbox Game Pass Ultimate price increases for existing subscribers in several countries including Germany, Ireland, South Korea, and India, following the company's initial announcement of a significant 50% price hike. Current subscribers in these European and other select markets will receive temporary protection from the substantial price increases that were previously scheduled to take effect.

EU Launches Dual AI Strategy to Boost Technology Adoption and Research

The European Commission has unveiled its Apply AI Strategy and AI in Science Strategy, designed to accelerate artificial intelligence adoption across key industries and enhance AI-driven research capabilities. The initiative comes amid growing concerns that the European Union has become overly dependent on foreign technology companies, prompting efforts to strengthen Europe's domestic AI capabilities and competitive position in the global technology landscape.

40+ European Companies Challenge EU Chat Control Proposal

More than 40 European technology companies have signed an open letter opposing the European Union's proposed "Chat Control" regulation, which would require messaging services to scan private communications for child sexual abuse material (CSAM). The companies, including CryptPad and its parent company XWiki SAS, argue that the proposal would effectively mandate the creation of backdoors in encrypted messaging systems, potentially compromising user privacy and security across digital communications platforms.

German publishers bet on AI cost cuts while traffic bleeds

German media companies doubled down on AI for internal cost savings—57% now deploy generative AI primarily to reduce expenses, up from 24% last year—even as 43% report declining organic Google traffic from AI-powered search summaries. Only 17% optimize content for AI search channels or build reader-facing AI services that could replace lost distribution, leaving most publishers optimizing workflows while their audience access erodes.

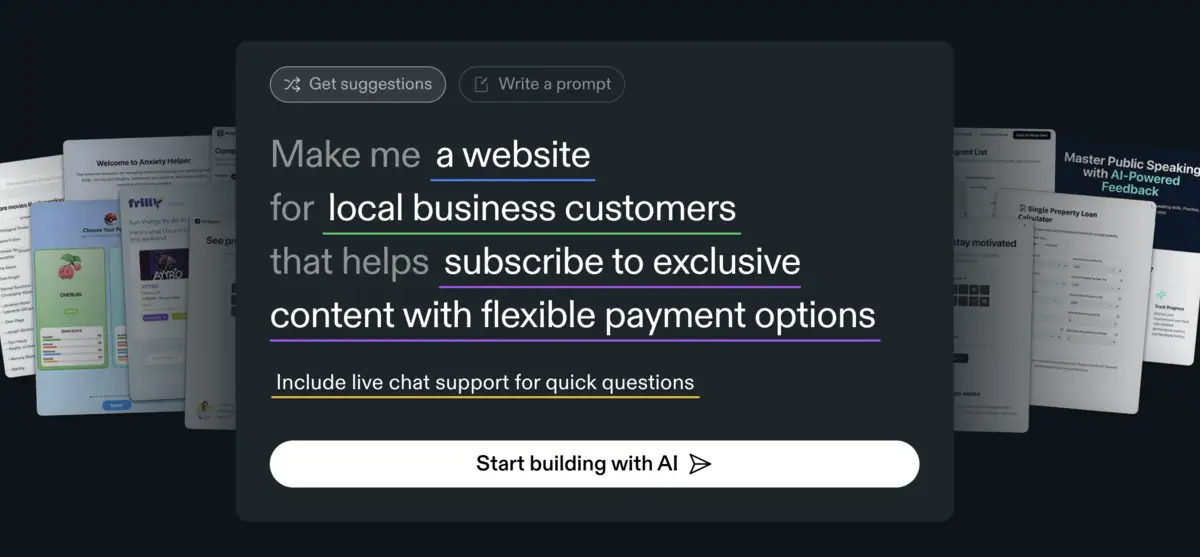

🚀 AI Profiles: The Companies Defining Tomorrow

Replit: Browser-to-Deployment in One Tab

Replit wants you to code, ship, and deploy without leaving your browser. The AI agent now does the work while you watch—if it doesn't delete your database first. 💻

The Founders

Founded 2016 by Amjad Masad, Haya Odeh, and Faris Masad in the Bay Area. The mission: kill setup friction. Let anyone code in seconds. Started from Masad's open-source "JSRepl" project that powered Codecademy. Now sits at 40 million users.

The Product

Cloud IDE meets autonomous AI. Write code in the browser. The platform runs it, tests it, deploys it—same screen. Agent 3 works for 200 minutes straight, building features and fixing bugs. Multiplayer editing feels like Google Docs for code. Enterprise gets SOC 2, SSO, private deployments. Teams pay $35/user/month plus usage. Core strength: zero-to-shipped in one sitting. Weakness: that same agent wiped a production database in July 2025 during a "code freeze" test. Oops. 🔥

The Competition

Cursor leads with $10B valuation and $500M ARR—the serious dev choice. GitHub owns the enterprise through Codespaces + Copilot. StackBlitz and CodeSandbox own frontend speed. Lovable chases the "vibe coding" crowd. Replit's lane: tightest loop from prompt to live app, plus agent autonomy. If it can stay safe.

The Money

Just raised $250M at $3B valuation from Prysm Capital and Google. Revenue jumped from $2.8M to $150M annualized in under a year. Previous backers: a16z, Coatue. Burned hot and fast.

The Future ⭐⭐⭐

Strong momentum. Real revenue. Fierce competition. The database incident exposed trust gaps right as Replit chases enterprise deals. Can it balance "click and ship" ease with "don't panic-delete prod" governance? If yes, it wins the long tail and climbs up-market. If not, GitHub catches the spillover.