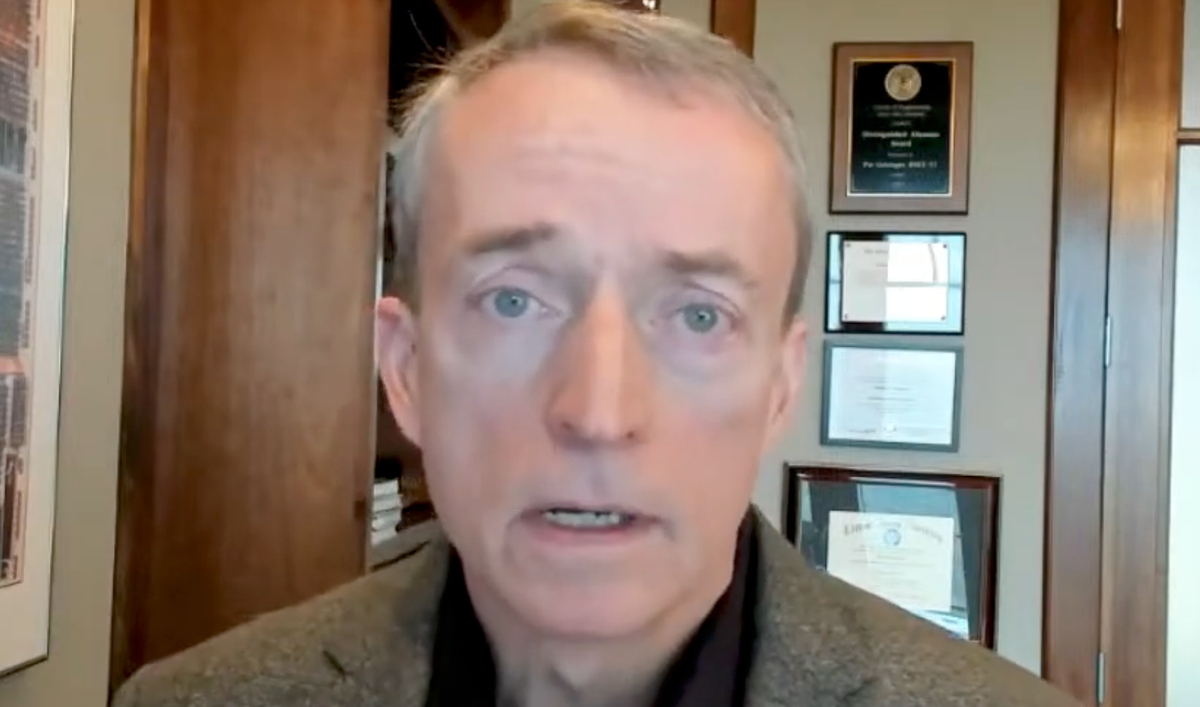

Pat Gelsinger asked to say grace before the soup arrived.

At a wood-panelled restaurant in Portola Valley, maybe fifteen minutes from Menlo Park's venture capital nerve center, the former Intel CEO bowed his head and thanked God for the chance to talk with the Financial Times. Not the standard opening for a tech executive's post-departure press tour. But Gelsinger got pushed out of Intel last December, and he's apparently done pretending.

The interview that followed reads less like damage control than like a man unburdening himself. Intel's institutional collapse. His own blind spots. Washington's fumbled attempt at industrial policy. And a few observations about strategic vulnerabilities elsewhere in the industry that other executives would never say on the record.

Key Takeaways

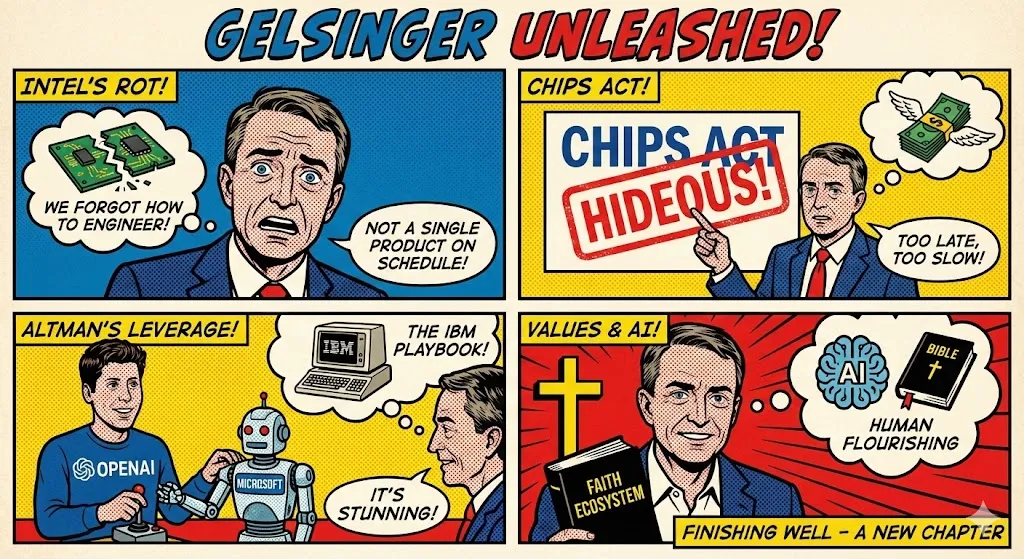

• Intel couldn't deliver a single product on schedule for five years before Gelsinger's return; TSMC was already manufacturing Intel's own chips.

• The Chips Act's biggest corporate advocate now calls its two-and-a-half-year rollout "hideous" and validates portions of Trump administration critiques.

• Gelsinger compares OpenAI-Microsoft to Gates-IBM in the 1980s: Altman controls the IP while Microsoft provides distribution, creating structural risk.

• He predicts quantum computing will displace GPUs by decade's end and could trigger an AI bubble correction within a few years.

Intel's Engineering Culture Had Already Died

When Gelsinger returned to Intel in 2021, the turnaround assignment looked difficult. It was worse than difficult.

"Not a single product was delivered on schedule" in the five years before he showed up. That's not spin. That's an indictment. Engineering discipline had collapsed so thoroughly that Gelsinger's reaction, recounted to the FT, was disbelief: "It's like, wow, we don't know how to engineer anymore!"

And here's the part that should have been a screaming alarm for anyone paying attention. TSMC, the Taiwanese foundry that Intel had spent decades dismissing as a contract manufacturer, was by then fabricating some of Intel's own processors. Intel, the company that essentially invented the modern semiconductor industry, was outsourcing its core work to a competitor because it couldn't execute internally. Margins took a hit. The reputational damage cut deeper.

Gelsinger committed to delivering Intel's 18A manufacturing node, the process technology that would prove the company could still compete at the frontier, within five years. The board removed him after four. His successor Lip-Bu Tan then shipped 18A inside that original five-year window.

Gelsinger's assessment of the irony was characteristically direct: "a touch of irony."

What's more interesting is his self-diagnosis. Most fired CEOs blame the board, or markets, or macro conditions. Gelsinger blamed his own attention allocation. "I was very focused on managing 'down.' Should I have managed 'up' more? Probably." He wishes he'd fought harder for semiconductor expertise on the board. Clean accountability. No deflection.

The Chips Act's Biggest Champion Now Calls It 'Hideous'

Pat Gelsinger lobbied for the 2022 Chips Act harder than any CEO in America. More time in Washington. More congressional meetings. More public advocacy. The legislation eventually delivered $53 billion in federal funding earmarked for domestic semiconductor manufacturing. Bipartisan passage. Historic ambition.

Gelsinger's current verdict on how it was implemented: "hideous."

"Two and a half years later and no money is dispensed? I was very upset about it." Biden administration officials, in his account, sat on the funds until the very end. Caution that backfired.

This puts Gelsinger in strange company. President Trump has called the Chips Act "a horrible thing" and prefers tariffs to subsidies. Gelsinger, who worked for years to get the law passed, now agrees with portions of the Trump critique. "For this administration to come in and say: we have to fix 'terrible,' there are pieces of that I agree with."

He's not abandoning industrial policy. He still believes tariffs can help rebalance global supply chains. He knows people in the Trump administration who share his appetite for disruption, what he calls a "willingness to blow things up." But his core point is grimmer. Subsidies won't be enough. Manufacturing won't return to American soil without real pain. "You have to create economic dislocation for that to occur."

The architect of the Chips Act lobbying effort is now saying the execution was a mess and the theory of change was probably insufficient anyway. That's a significant data point for anyone betting on future industrial policy.

Sam Altman Is Running the IBM Playbook on Microsoft

Nothing in the interview was more striking than Gelsinger's read on Microsoft's AI position.

"Essentially, Sam Altman is doing to Microsoft what Bill Gates did to IBM."

The history: In the 1980s, IBM needed an operating system for personal computers. Microsoft was tiny. Bill Gates licensed MS-DOS to IBM but retained ownership of the underlying intellectual property. IBM distributed. Microsoft owned. By the 1990s, the power relationship had inverted completely. Microsoft dominated. IBM became an afterthought in consumer computing.

Gelsinger sees the same dynamic now. OpenAI controls the models, the IP that actually matters. Microsoft provides compute and distribution. The $13 billion Microsoft investment looked like Satya Nadella locking up the AI future. But OpenAI has since signed infrastructure deals worth over $1 trillion. It's moving into hardware. It's building direct relationships with governments and enterprises that bypass Microsoft entirely.

"The analogy is stunning," Gelsinger said.

He's not forecasting Microsoft's collapse. He's identifying a dependency that the stock price doesn't reflect. "You can't make many mis-steps when you've essentially created that much leverage in your future business model." OpenAI can renegotiate from strength as it scales. Microsoft cannot.

Would Gelsinger be building hardware in Altman's position? No, he says. Too much execution risk. But the structural observation stands. Anyone long Microsoft because of AI should think carefully about who actually owns what.

Religious Values Meet Foundation Model Policy

After Intel, Gelsinger took a role leading technology at Gloo, a platform he describes as serving "America's faith ecosystem." Part of the job involves building guardrails into AI models that promote what he calls "human flourishing" rooted in Christian principles.

Easy to dismiss as a quirky retirement project. Probably a mistake to dismiss it.

OpenAI recently updated its content policies to permit erotic material on ChatGPT. Gelsinger's response was immediate: "The first thing Sam has done that I really fundamentally disagree with. I have to actively say people shouldn't use those models, because they degrade human values."

Foundation models aren't neutral infrastructure. When ChatGPT allows certain content, it normalizes that content for hundreds of millions of users. When it prohibits other content, it imposes constraints at a scale that governments struggle to match. These are value judgments dressed up as product decisions.

Gelsinger wants models that bring users "into a relationship with God and other people." That position won't command majority support in San Francisco. But religious communities globally represent billions of potential AI users. They will push for models reflecting their values. Secular technologists will push back. The fights over Twitter moderation will look trivial by comparison.

Quantum in Two Years, Not Twenty

Jensen Huang puts mainstream quantum computing two decades out. Gelsinger says two years.

The incentive structures here are obvious. Nvidia's $3 trillion valuation assumes GPUs remain central to AI compute for the foreseeable future. Gelsinger now holds stakes in quantum startups through his position at Playground Global, including PsiQuantum and xLight.

Still, his framing deserves attention. Quantum represents, in his telling, the third element of a computing "holy trinity" alongside classical processors and AI accelerators. He expects GPUs to "start getting displaced by the end of the decade." And he believes a quantum breakthrough could "pop" the AI bubble, not tomorrow, but within a few years.

The prediction should be treated skeptically. Quantum computing has been promising imminent arrival for decades. Gelsinger's venture portfolio creates obvious bias. A two-year timeline would require advances that most working physicists consider unlikely.

But if he's even partially right, the current infrastructure buildout, hundreds of billions pouring into GPU clusters and data centers, faces obsolescence risk that nobody is pricing. Nvidia's position looks permanent until it doesn't.

Finishing Well

Gelsinger gives away more than half his gross income, somewhere between 52 and 53 percent. His phone case displays photos of his eight grandchildren. Two days after the Intel board pushed him out, his wife Linda told him he wasn't finished. He conducted something like a hundred interviews over the following hundred days before landing at Playground Global.

"I'm going to finish well," he told the FT. His voice carried emotion. "Through my grandkids, through my marriage, through the CEOs I get to mentor."

Few people in the technology industry sound like Pat Gelsinger. A Pennsylvania farm kid who joined Intel at eighteen, wrote down a personal goal to become CEO, achieved it, lost it, and now offers assessments that serve no discernible career purpose. His religious faith provides a framework outside quarterly earnings and stock prices.

Maybe that's why he's willing to say what others won't. The Chips Act rollout was hideous. Microsoft may be repeating IBM's mistake. OpenAI's content policies degrade human values. Intel had forgotten how to engineer years before he arrived.

Not the statements of someone angling for another board seat. The statements of someone who measures success in currencies Wall Street doesn't recognize.

Why This Matters

- Microsoft's AI position: Gelsinger's IBM parallel identifies structural risk in the OpenAI partnership. Altman owns the IP. Nadella provides distribution. That leverage shifts as OpenAI builds independent scale.

- Industrial policy credibility: The Chips Act's most important corporate backer now validates Trump administration critiques of its execution. Future programs need faster, cleaner implementation to survive political transitions.

- Infrastructure investment risk: An order-of-magnitude disagreement between Huang and Gelsinger on quantum timelines brackets real uncertainty. If GPUs face displacement before 2030, current data center investments may carry stranded asset exposure that markets haven't considered.

❓ Frequently Asked Questions

Q: What is Intel's 18A node and why does it matter?

A: Intel 18A is a cutting-edge chip manufacturing process measured in angstroms (one-tenth of a nanometer). It represents Intel's attempt to match TSMC's most advanced technology. Delivering 18A successfully would prove Intel can still compete at the frontier of semiconductor fabrication, where smaller nodes mean faster, more efficient chips.

Q: How much Chips Act funding did Intel actually receive?

A: Intel received approximately $11 billion in direct grants from the Chips Act, approved just weeks before Gelsinger's departure. The company also secured up to $7.86 billion in additional loans. This made Intel the largest single recipient of Chips Act funding, though Gelsinger criticized the two-and-a-half-year delay in disbursing the money.

Q: Who is Lip-Bu Tan and what's his background?

A: Lip-Bu Tan is Intel's current CEO, appointed after Gelsinger's departure in December 2024. He previously founded Cadence Design Systems, a major chip design software company, and served on Intel's board. His background in semiconductor design tools gives him deep industry expertise, though he lacks Gelsinger's manufacturing experience.

Q: What exactly happened between IBM and Microsoft in the 1980s?

A: In 1980, IBM needed an operating system for its new personal computer. Microsoft licensed MS-DOS to IBM but critically retained ownership of the software. IBM got distribution rights; Microsoft kept the intellectual property. As PCs became commoditized, IBM's hardware advantage vanished while Microsoft's software became the industry standard, eventually making Microsoft far more valuable.

Q: What quantum computing companies is Gelsinger invested in through Playground Global?

A: Gelsinger mentioned two quantum-related investments: PsiQuantum, which is developing photonics-based quantum computers using light particles instead of superconductors, and xLight, which works on next-generation semiconductor manufacturing. PsiQuantum has raised over $700 million and claims its approach can scale more easily than competing quantum methods.