Good Morning from San Francisco,

Startups voted with their wallets this summer. Mercury banking data reveals which AI tools actually generate revenue. The results contradict everything traffic rankings suggest about adoption. Revenue tells a different story than page views.

OpenAI hit $500 billion Thursday. Employees sold $6.6 billion in stock. They left $3.4 billion authorized but unclaimed. Both numbers tell stories.

Goldman bankers built a test for AI models on real professional work. Best score: 64%. The gap between demonstration and deployment persists. Getting two-thirds of a financial model right creates cleanup work, not leverage.

This week: where startup budgets actually flow, why unsold shares signal as much as sold ones, and what production-grade benchmarks reveal.

Stay curious,

Marcus Schuler

Where startups spend on AI

A16z analyzed spending from 200,000 Mercury customers across June-August 2025, revealing which AI tools startups actually fund.

The inversion matters: Replit ranked third overall, generating roughly 15x more revenue than traffic-favorite Lovable among startups, because production features justify higher price points than prototyping speed.

Horizontal tools captured 60% of spending, with creative suites as the largest category—Freepik placed fourth, ElevenLabs fifth. Vertical tools split twelve-to-five between copilots that augment workers and autonomous agents that replace workflows, suggesting reliability thresholds still favor human oversight.

Nearly 70% of products started consumer-first, then got "yanked into enterprise" through bottom-up adoption. Meeting tools remain fragmented across five competitors without consolidation.

Why this matters:

• Spending reveals product-market fit more reliably than traffic—budgets expose which capabilities justify recurring costs versus curiosity trials, signaling where switching costs and network effects may concentrate.

• The copilot-to-agent transition accelerates as model capabilities improve, compressing the window between augmentation and automation faster than previous software cycles reshaped knowledge work.

AI Image of the Day

Prompt:

A professional portrait photograph against a plain

gray background features a confident individual with a short, layered blonde pixie cut featuring subtly darker roots and wispy bangs playfully swept to one side. Their features are framed by a black blazer and a delicate gold necklace displaying a circular pendant, complemented by understated gold stud earrings, enhancing their sophisticated and approachable demeanor. Soft, diffused lighting gently illuminates their face, accentuating the dimensional quality of their blonde hair and natural makeup, while creating subtle shadows that add depth and dimension. The background remains a clean gray, allowing the subject to take center stage with an overall muted color palette that emphasizes the warm tones of their hair and creates a polished, timeless aesthetic.

AI scores 64% on real work

Goldman bankers wrote the test, Models need chaperones

Mercor's APEX benchmark tested 23 AI models on 200 professional tasks designed by experts from Goldman Sachs, McKinsey, Latham & Watkins, and Mount Sinai. GPT-5 led at 64.2%. Grok 4 hit 61.3%. Gemini 2.5 Flash reached 60.4%.

Tasks mirrored actual deliverables—valuation memos, legal research, patient diagnoses—taking humans 1-8 hours each. Roughly 100 specialists averaging 7+ years experience created rubrics with 29 criteria per task. Each included 5.8 source documents averaging 26,000 tokens.

Law scored highest (GPT-5 at 70.5%). Medicine lowest (62%). The gap tracks consequences, not complexity. Legal work rewards synthesis. Medical errors harm patients.

Mercor's verdict: none meet the production bar. A model that gets two-thirds of a financial model right creates cleanup work, not leverage. Mercor spent $500,000 building 200 tasks at $2,500 each—signaling benchmark economics shifting from crowdwork to specialist design.

Why this matters:

• 60-70% reliability falls short of autonomous deployment across professional domains—partial completion at scale can help or hurt depending on oversight costs

• Enterprise ROI depends on cutting human review time, but APEX confirms mandatory expert supervision for high-stakes work, reshaping automation economics

OpenAI employees sell $6.6 billion at $500 billion valuation—but leave $3.4 billion authorized shares unsold

OpenAI closed a secondary share sale Thursday valuing the company at $500 billion, surpassing SpaceX to become the world's most valuable private firm.

Current and former employees sold $6.6 billion in stock to Thrive Capital, SoftBank, Dragoneer, Abu Dhabi's MGX, and T. Rowe Price.

The uptake tells its own story. OpenAI authorized over $10 billion for the tender; roughly 36% stayed unsold. The company frames this as confidence in future value. It could also reflect saturation from November's $1.5 billion SoftBank tender, or caution while the nonprofit-to-public benefit corporation restructuring navigates regulatory approval in California and Delaware.

The valuation sits 67% above March's $300 billion primary round—a spread that reflects different market mechanics. Primaries negotiate governance; secondaries trade scarcity. Both readings fit.

The timing addresses competitive pressure. Meta has recruited at least 10 OpenAI researchers since June, offering packages exceeding $100 million. OpenAI counters with liquidity without exit—turning paper into deposits while keeping talent in seats.

Profitability remains distant. The company generated $4.3 billion in first-half 2025 revenue while burning $2.5 billion, projecting cash-flow positive status only in 2029 at $125 billion in annual revenue.

Why this matters:

• Liquidity as retention infrastructure: Repeat secondaries let AI leaders stay private indefinitely while offering employees exit economics—reshaping late-stage compensation models across capital-intensive industries.

• Valuation logic shifts: A $500 billion price on a company burning $2.5 billion semi-annually signals investors value platform position over near-term profitability—raising capital requirements across the competitive landscape.

🧰 AI Toolbox

How to Automate Your Inbox and Meeting Notes

Fyxer AI connects to your email and calendar to draft replies, organize messages, and take meeting notes. It learns your writing style and handles routine email work so you can focus on what matters.

Tutorial:

- Go to the Fyxer AI website

- Connect your Gmail or Outlook account in a few clicks

- The AI reads your past emails and learns how you write

- Check your inbox to find emails sorted into categories and drafts ready to send

- Let Fyxer join your video meetings to record and take notes

- Review meeting summaries and pre-drafted follow-up emails after each call

- Save an hour a day on email and meeting admin

URL: https://fyxer.com/

Better prompting...

Today: Strategic Skill Development

Show me case studies of companies successfully using [your topic/skill]. For each case, include:

- Brief overview

- Problems they faced

- How they solved them

- Results

I want to see how this works in practice to apply similar ideas to my business.

AI & Tech News

Amazon's Q Business AI Assistant Faces Accuracy Problems in First Year

Amazon's Q Business AI assistant experienced significant accuracy and data processing problems during its inaugural year, according to an internal document that prompted user complaints about the service's performance. Amazon has responded by stating that the document in question is outdated and does not reflect the current state of the AI assistant's capabilities.

Apple Removes ICE-Tracking App Following DOJ Pressure

Apple has removed ICEBlock from its App Store following a request from the Department of Justice, according to Attorney General Pam Bondi. The app allowed users to anonymously report sightings of Immigration and Customs Enforcement (ICE) officers, with Bondi confirming the DOJ contacted Apple on Thursday demanding the application's removal.

Nvidia-UAE AI Chip Deal Faces Mounting Delays

A multibillion-dollar deal announced in May to supply Nvidia's AI chips to the United Arab Emirates has encountered significant delays, causing frustration among key figures including Nvidia CEO Jensen Huang and Trump administration officials such as David Sacks. The Commerce Secretary has reportedly pushed back on the agreement, demanding certain U.S. investments from the UAE before proceeding with the chip exports.

OpenAI Seeks Dismissal of xAI Trade Secrets Lawsuit

OpenAI has filed a motion asking a federal judge to dismiss a lawsuit brought by Elon Musk's xAI company, which alleges that OpenAI improperly hired away xAI employees in order to steal trade secrets. OpenAI is defending against the claims by characterizing the legal action as part of what it describes as Musk's pattern of "ongoing harassment" against the company.

Google Prepares to Separate Life Sciences Unit Verily

Alphabet Inc. has been working for two years to technologically separate its life sciences subsidiary Verily from Google's infrastructure in preparation for a potential sale or spinoff, according to a Google executive. The extended decoupling process indicates Alphabet's strategic shift toward divesting non-core business units to focus resources on its primary search and advertising operations.

IBM Launches Granite 4.0 Open Source AI Model Family

IBM has released Granite 4.0, a new family of open source large language models designed specifically for enterprise use, featuring a hybrid architecture that the company claims significantly reduces RAM requirements compared to traditional LLMs. The "enterprise-ready" model family represents IBM's latest effort to provide businesses with more efficient AI solutions that can operate with lower hardware demands while maintaining performance capabilities.

Replit Pivots Strategy After Nine Years, Reaches $3 Billion Valuation

After nine years of gradual development, coding platform Replit has achieved a $3 billion valuation by pivoting away from professional developers to target non-technical white-collar workers instead. CEO Amjad Masad discussed the company's deliberate shift in strategy during a recent interview, highlighting how Replit's patient approach contrasts with newer AI coding startups like Cursor that have raised significant funding after just three years in operation.

Supabase Secures $100M Series E at $5B Valuation

Supabase, an open-source alternative to Google's Firebase, has successfully raised $100 million in Series E funding led by Accel and Peak XV Partners, achieving a $5 billion valuation. The funding round brings the company's total raised capital to over $500 million as it continues to compete in the backend-as-a-service market.

Groq Announces Aggressive Data Center Expansion for 2026

AI chip startup Groq, valued at $6.9 billion, announced plans to break ground on more than 12 new data centers in 2026, following the establishment of 12 data centers throughout 2025. The company, which develops specialized chips and software for running artificial intelligence models, is pursuing an aggressive infrastructure expansion to support the growing demand for AI computing services.

Uber Acquires Belgian AI Startup Segments.ai to Boost Data Labeling Capabilities

Uber Technologies has acquired Belgian data labeling startup Segments.ai in an acquihire deal aimed at strengthening the company's lidar data labeling capabilities and expanding its AI services business. The acquisition will see Segments.ai's founders and entire staff join Uber AI Solutions as the ride-hailing company seeks to grow its nascent data-labeling operations beyond its core transportation services.

Huawei Found Using TSMC, Samsung Components in Advanced AI Chips

Analysis firm TechInsights has discovered that Huawei Technologies used advanced components from major Asian technology companies including TSMC, Samsung, and SK Hynix in some versions of its Ascend 910C AI processors. TSMC has confirmed that the analyzed chip dies were manufactured before October 2024, indicating the components were sourced prior to that timeframe.

Indonesia Suspends TikTok Operating License Over Data Dispute

Indonesia has suspended TikTok's local operating license after the social media platform failed to provide complete livestream activity data during nationwide protests that occurred in August. The government had requested the data following the protests, but TikTok refused to fully comply with the data-sharing requirements, prompting authorities to take action against the company's operations in the country.

🚀 AI Profiles: The Companies Defining Tomorrow

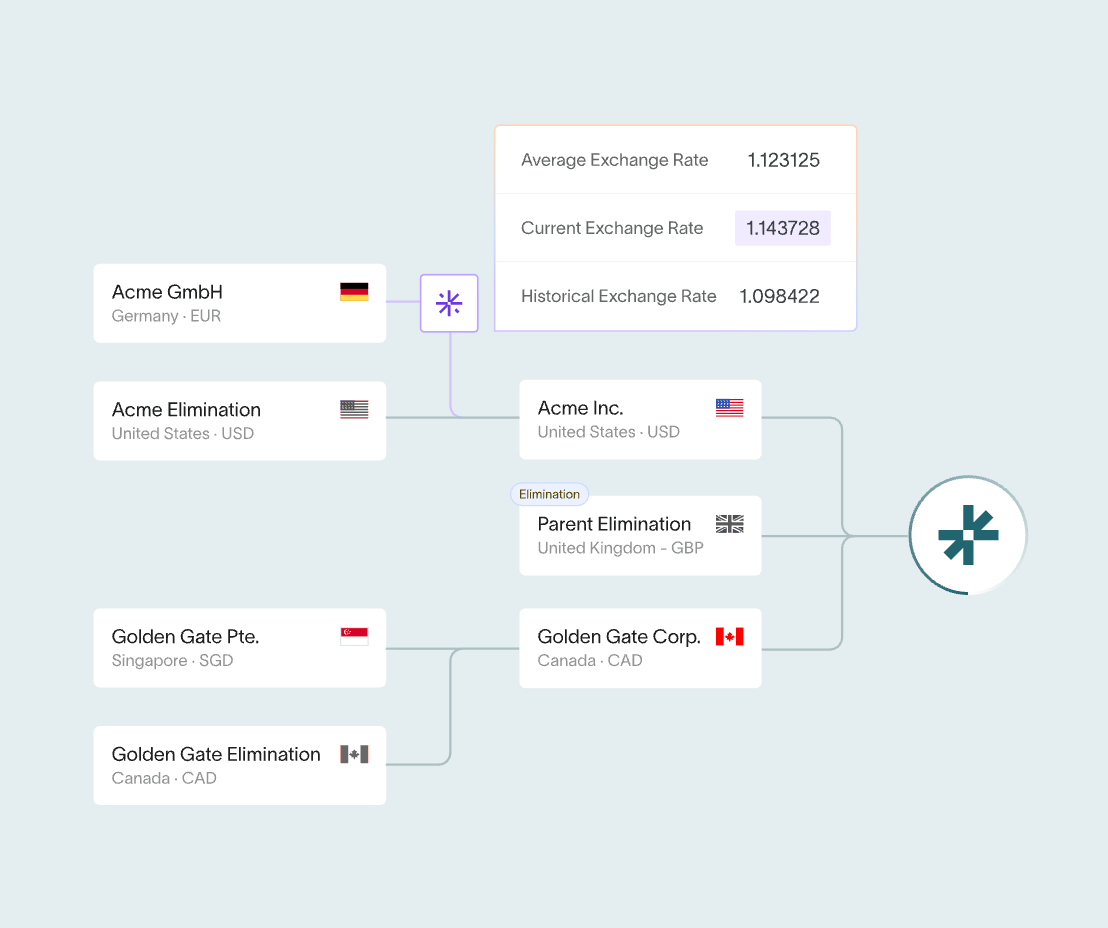

DualEntry

DualEntry promises to move your company off QuickBooks and into a full ERP in 24 hours, not nine months. The AI-native accounting platform targets mid-market firms stuck between starter tools and legacy nightmares.

The founders

Santiago Nestares (CEO) and Benedict Dohmen launched DualEntry in 2024 after selling Benitago, their nine-figure consumer business. They'd lived through two failed ERP migrations—six-figure consulting bills, manual data entry, months of pain. So they built the system they wished existed. The ~40-person team works out of 7 World Trade Center in New York.

The product

Full ERP suite covering GL, AR, AP, cash management, revenue recognition (ASC 606/IFRS 15), lease accounting (ASC 842), subscriptions, and tax. The "NextDay Migration" engine pulls historical data from legacy systems in 24 hours. AI reads invoices, matches transactions, suggests journal entries, flags anomalies, drafts flux commentary. Integrates with 13,000+ banks and 15,000+ apps. SOC 2 compliant. Pricing starts at $1,000/month—published, not hidden behind sales calls.

The competition

Oracle NetSuite, Sage Intacct, Microsoft Dynamics 365, SAP, and Acumatica own this space. All are adding AI features. DualEntry's edge: migration speed turns a nine-month project into a 30-day sprint. If the data lift really happens in a day, controllers can say yes without betting the quarter.

Financing

$90M Series A in October 2025, led by Lightspeed and Khosla, with GV joining. $415M valuation. The company raised over $100M in 15 months.

The future ⭐⭐⭐⭐

Timing's decent. Three-quarters of CPAs retire in the next decade. Software must absorb the grunt work. DualEntry's bet: speed plus compliance beats slow and painful. If NextDay Migration holds up at scale, word spreads fast. If it slips, controllers retreat to the devil they know. Incumbents won't sit still. The proof lands at quarter-end. 📊