💡 TL;DR - The 30 Seconds Version

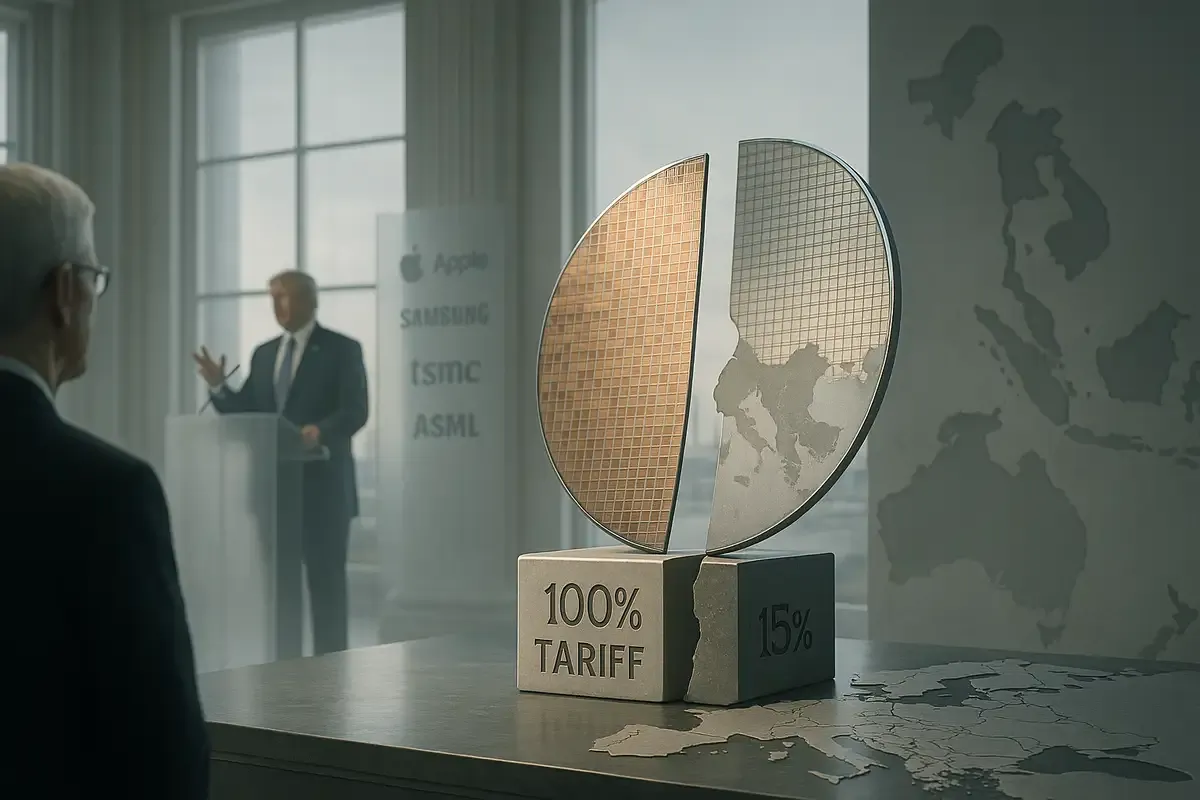

🎯 Trump announced 100% tariffs on chip imports Wednesday, but exempted any company building or promising to build in the US.

💰 Apple pledged $100 billion more in US manufacturing (total: $600 billion) and secured its exemption alongside TSMC, Samsung, and SK Hynix.

🇪🇺 Europe negotiated a 15% tariff cap on semiconductors, while smaller nations like Philippines and Malaysia face the full 100% rate.

📈 Tech stocks rallied globally Thursday—TSMC hit record highs (+4.9%), Apple gained 3.3%, and European chipmaker ASML jumped 3%.

📱 The real impact comes next week when Trump announces tariffs on all products containing chips—everything electronic could face levies.

🎭 Trump's tariff functions as leverage for US manufacturing commitments rather than actual policy—only companies without US deals face real costs.

President Donald Trump announced a 100% tariff on semiconductor imports Wednesday. Within hours, it became clear most major chipmakers won't pay it.

The exemptions started flowing before Trump finished speaking. Any company manufacturing in the United States or promising to do so gets a pass. European Union chip exports face a maximum 15% tariff under a separate deal. South Korea says Samsung and SK Hynix are exempt. Taiwan's TSMC, with its Phoenix factories, appears safe.

Tim Cook was there when Trump made the announcement, standing in the Oval Office after pledging to spend another $100 billion on U.S. manufacturing. Apple already promised $500 billion. The choreography worked—Apple got its exemption while India, where many iPhones are made, got hit with 50% tariffs.

"We're going to be putting a very large tariff on chips and semiconductors," Trump said. "But the good news for companies like Apple is, if you're building in the United States, or have committed to build, without question, committed to build in the United States, there will be no charge."

Markets interpreted the announcement as mostly theater. Tech stocks rallied globally Thursday. TSMC hit record highs, climbing 4.9%. Apple gained 3.3% in premarket trading. European chipmaker ASML jumped 3% once investors understood the EU's 15% cap protected them from real damage.

Europe Cuts Its Deal

The European Commission confirmed Thursday that Washington committed to cap semiconductor tariffs at 15% for EU exports, regardless of levies on other countries. "We look forward to the U.S. implementing this commitment," said Commission spokesperson Olof Gill.

That's a relief for companies like ASML, which supplies critical chip-making equipment. The Dutch company had warned last month it couldn't guarantee 2026 growth amid tariff uncertainty, wiping $30 billion from its market value. Thursday's rally recovered some losses.

South Korea moved fast to secure its own deal. Trade Minister Yeo Han-koo told local broadcaster SBS that Samsung and SK Hynix won't face the 100% rate. Both companies have U.S. facilities—Samsung runs two plants in Texas, SK Hynix is building in Indiana.

Taiwan's government said TSMC is exempt, though other Taiwanese firms might not be. Japan secured assurances it won't face worse rates than other countries.

The losers? Smaller nations without U.S. manufacturing presence. Dan Lachica, president of the Philippine semiconductor industry association, called the potential impact "devastating." The Philippines exports 70% of its electronics as semiconductors. Malaysia's trade minister warned parliament the country risks losing "a major market."

The Numbers Game

Since Trump returned to office, tech companies have announced roughly $1.5 trillion in U.S. investments. Much represents existing plans repackaged or commitments stretched over decades, but the pledges keep coming.

TSMC promised $165 billion for U.S. manufacturing. Nvidia pledged $500 billion for AI infrastructure over four years. GlobalFoundries committed $16 billion for New York and Vermont facilities. Texas Instruments announced $60 billion for seven U.S. chip plants.

Apple's Wednesday announcement adds $100 billion to its previous $500 billion commitment. Partners include Corning, which will dedicate an entire Kentucky factory to Apple glass production. Samsung's Austin plant will supply Apple chips. Applied Materials and Texas Instruments join the effort.

Trump claimed victory. "Look, he's not making this kind of an investment anywhere in the world, not even close," Trump said of Cook. "Apple's coming back to America."

Cook had earlier told Trump that final iPhone assembly "will be elsewhere for a while." Translation: not happening. But component manufacturing apparently sufficed.

Missing Details

Critical details remain missing. What qualifies as "committed to build"? How much U.S. manufacturing triggers the exemption? One facility? Ten percent of production? Majority manufacturing?

Trump warned companies against fake commitments. "If, for some reason, you say you're building and you don't build, then we go back and we add it up, it accumulates, and we charge you at a later date." Enforcement mechanisms weren't specified.

More concerning: Trump promised separate tariffs next week on all products containing semiconductor chips. That covers virtually every electronic device—phones, cars, refrigerators, medical equipment. Given Wednesday's pattern, expect broad exemptions for cooperative companies.

The approach differs sharply from Biden's CHIPS Act, which offered $52.7 billion in subsidies to attract semiconductor manufacturing. Trump prefers threats to incentives, even if he rarely follows through.

UBS analysts described Trump's strategy as "open high, negotiate down." Phelix Lee at Morningstar said the 100% figure "fits Trump's approach" but predicted the final rate would be "similar to reciprocal tariffs to limit inflation."

China's SMIC and Huawei won't receive exemptions. But Chinese chips mostly enter the U.S. embedded in finished products. Unless next week's component tariffs have teeth, the impact stays limited.

The Semiconductor Industry Association stayed quiet. Intel and Nvidia didn't answer questions.

Why this matters:

• Trump's 100% semiconductor tariff works better as a threat than a policy. Big companies already cut deals through U.S. manufacturing promises or government agreements. Smaller countries without leverage face the real pain.

• Watch next week for tariffs on products with chips inside them. That means phones, cars, refrigerators—basically anything electronic. But if Wednesday showed us anything, companies that play ball with Trump's America-first push will find a way out.

❓ Frequently Asked Questions

Q: How does Trump's tariff approach differ from Biden's CHIPS Act?

A: Biden handed out $52.7 billion in subsidies to get companies to build chip factories here. Trump threatens 100% tariffs unless they build here. Same goal, different methods. Biden paid companies to come. Trump makes it expensive to stay away. His way doesn't cost taxpayers anything upfront.

Q: Which companies or countries will actually pay the 100% tariff?

A: Primarily smaller Asian nations without US manufacturing. The Philippines (70% of electronics exports are chips) and Malaysia face the full rate. China's SMIC and Huawei won't get exemptions. Major players like TSMC, Samsung, SK Hynix, and European companies all secured exemptions or caps.

Q: What happens if companies promise to build US factories but don't deliver?

A: Trump claims retroactive tariffs would apply—companies would owe accumulated taxes from when they made the promise. He said charges would "add up" and companies would "have to pay" later. However, no enforcement mechanism was specified, making this threat legally questionable.

Q: How much are tech companies actually investing in the US?

A: Tech companies have pledged $1.5 trillion since Trump returned. The big ones: Apple promised $600 billion, Nvidia $500 billion, TSMC $165 billion, Texas Instruments $60 billion, GlobalFoundries $16 billion. But these aren't all new—many were already planned or spread over many years.

Q: Which products could get hit with tariffs if Trump goes after anything with chips?

A: Pretty much anything electronic. Your phone, your car, your fridge, washing machine, medical devices, computers, TVs. Even your alarm clock. Trump said this announcement comes next week. Based on Wednesday's pattern, expect exemptions for companies with US manufacturing commitments.

Q: When do these tariffs take effect?

A: Trump didn't specify implementation dates for the chip tariffs. The announcement wasn't formal policy, just verbal comments. Related tariffs on India (50%) and Vietnam (20%) took effect Thursday. Component tariffs on products containing chips are expected next week.

Q: Can smaller tech companies that don't manufacture chips get exemptions?

A: Unknown. Trump only mentioned exemptions for companies "building" or "committed to build" in the US. Companies that design chips but outsource manufacturing to TSMC or Samsung might benefit if their suppliers have US facilities. Details on qualification criteria haven't been released.