💡 TL;DR - The 30 Seconds Version

👉 TSMC posted record $13.5 billion quarterly profit, beating forecasts and raising 2025 revenue growth outlook to 30% from mid-20%.

📊 AI and data center chips now generate 60% of TSMC's revenue, up from virtually nothing a decade ago.

💱 Taiwan dollar's 11% surge this year cuts revenue by 260 basis points, forcing gross margins down to 55.5-57.5% from 58.6%.

🏭 TSMC plans to spend $38-42 billion in 2025 expanding capacity, with 30% of advanced 2-nanometer chips eventually made in Arizona.

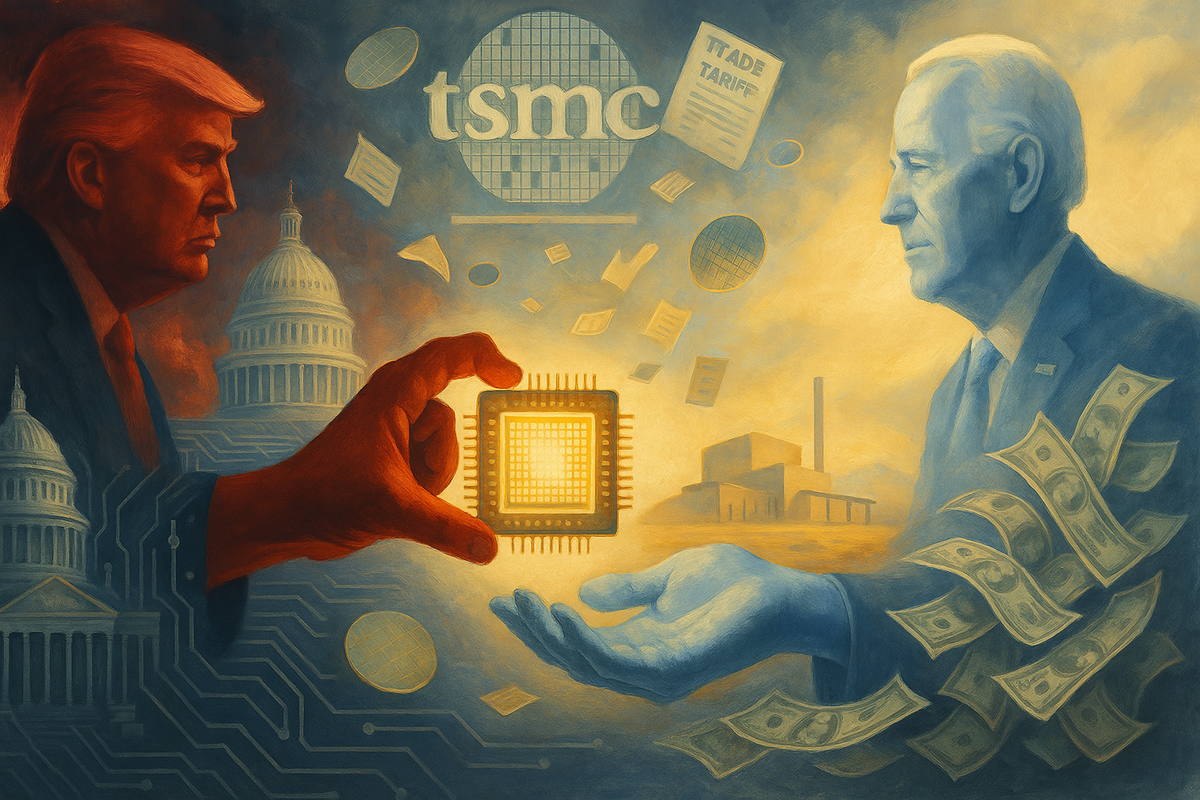

⚡ Trump threatens 32% tariffs on Taiwanese goods by August 1, but TSMC sees no customer behavior changes yet.

🌍 Results suggest AI spending boom continues despite political pressures, contrasting with equipment supplier ASML's cautious 2026 outlook.

Taiwan Semiconductor Manufacturing Company delivered a masterclass in making money from artificial intelligence demand, posting record quarterly profits of $13.5 billion that beat even the most optimistic Wall Street predictions. The world's largest contract chipmaker raised its 2025 revenue growth forecast to 30% from the mid-20% range, sending a clear message that reports of AI spending's death have been greatly exaggerated.

The results landed like a shot of caffeine for investors still jittery from China's DeepSeek moment, when the startup's efficient AI model briefly made everyone wonder if tech companies really needed to spend quite so much money on data centers. TSMC's 61% jump in quarterly profit suggests the answer is still a resounding yes.

CEO C.C. Wei said demand for TSMC's most advanced chips still exceeds what the company can produce. Computing chips for AI and data centers now bring in 60% of TSMC's revenue. These chips run ChatGPT and power self-driving cars. The shift away from smartphones is complete - Apple's iPhone cycles used to drive most of TSMC's business.

The Taiwan Dollar Strikes Back

TSMC's celebration comes with a currency-shaped hangover. The Taiwan dollar has surged more than 11% this year, making it Asia's best-performing currency but also TSMC's biggest headache. Since nearly all of the company's sales come in US dollars while most costs are in Taiwan dollars, every 1% appreciation cuts revenue by the same amount.

Chief Financial Officer Wendell Huang warned that currency moves will slice 260 basis points off gross margins in the third quarter. The company expects its gross margin to fall to between 55.5% and 57.5% from 58.6% in the second quarter. For a company that prints money as efficiently as TSMC does, watching margins compress feels like death by a thousand cuts.

The currency pain reflects a broader irony in Taiwan's economy. Foreign investors keep buying Taiwan stocks because they believe in the AI story, but their enthusiasm strengthens the very currency that hurts the companies they're investing in. It's like applauding so hard that you drown out the performance.

Tariff Clouds Gather

President Trump's trade ambitions cast another shadow over TSMC's outlook. The company faces potential tariffs on semiconductors along with a threatened 32% levy on all Taiwanese goods if trade negotiations fail by August 1. Wei acknowledged the uncertainty but said TSMC hasn't seen any changes in customer behavior yet.

The tariff threat creates a peculiar dynamic. Trump wants to bring chip manufacturing back to America, but he's also threatening to tax the very companies that make that possible. TSMC is already spending $165 billion to build facilities in Arizona, up from an initial $65 billion commitment. The company now plans to produce 30% of its most advanced 2-nanometer chips in the US eventually.

Wei said construction of the second and third Arizona plants is being accelerated "by several quarters" to meet demand from US customers. Nothing says "we're serious about this relationship" like fast-tracking a semiconductor fab in the desert.

AI Demand Defies Gravity

The AI boom continues to defy predictions of its demise. High-performance computing now accounts for 60% of TSMC's revenue, up from virtually nothing a decade ago. The company's customers include Nvidia, Advanced Micro Devices, and Apple – essentially anyone who needs chips that can handle complex computations without melting.

Wei welcomed news that Nvidia can resume selling its H20 AI chips to China after Washington lifted licensing restrictions. "China is a big market and my customer can still continue to supply the chip to the big market," Wei said with characteristic understatement. When your biggest customer gets access to the world's second-largest economy, that tends to be good for business.

AI demand at TSMC looks strong while equipment supplier ASML sounds worried about 2026. ASML beat second-quarter forecasts but gave cautious guidance anyway. The difference is clear: chip demand holds up, but the companies that make chip-manufacturing equipment feel trade pressure more.

The Expansion Equation

TSMC will spend $38 billion to $42 billion in 2025 to expand capacity and build new facilities. The company is putting plants in Arizona, Japan, and Germany to spread operations around the world while staying ahead in technology.

The expansion comes at a cost. TSMC expects new facilities to dilute gross margins by 2 to 4 percentage points annually for the next five years. Combined with currency headwinds, the company faces a delicate balancing act between growth and profitability.

But TSMC's definition of "diluted" margins would make most companies weep with envy. Even after accounting for currency impacts and expansion costs, the company expects to maintain long-term gross margins of 53% or higher. Most manufacturers would sacrifice their firstborn for margins half that size.

Apple still matters, bringing in about 20% of annual revenue, but TSMC now depends more on the entire AI ecosystem than any single product cycle.

Looking Ahead

TSMC expects third-quarter revenue between $31.8 billion and $33 billion. That's another big jump. But the company turned cautious about the fourth quarter. Management cited tariff risks and economic uncertainty. Record profits can't shield against political pressure.

TSMC's results serve as a good gauge for the semiconductor industry. If TSMC can keep growing at this pace despite its dominant position in advanced chips, the AI spending boom likely has more fuel left.

Why this matters:

• TSMC's blowout results prove that AI demand isn't just hype – it's driving real revenue growth that more than compensates for currency and political headwinds

• The contrast with equipment supplier ASML's caution suggests chipmakers are weathering trade tensions better than their suppliers, potentially reshaping industry dynamics

❓ Frequently Asked Questions

Q: What is DeepSeek and why did it worry investors?

A: DeepSeek is a Chinese AI startup that created an efficient AI model, making investors question whether tech companies needed to spend so much on data centers and AI chips. The brief scare suggested AI development might require less hardware than expected.

Q: How much is TSMC spending on its Arizona facilities compared to other locations?

A: TSMC increased its Arizona investment from $65 billion to $165 billion total. This compares to $38-42 billion globally in 2025, with additional plants planned in Japan and Germany, making Arizona its largest single investment.

Q: What are 2-nanometer chips and why are they significant?

A: 2-nanometer chips are TSMC's most advanced processors, with components just 2 billionths of a meter wide. They're faster and more efficient than current chips. TSMC plans to make 30% of these cutting-edge chips in Arizona eventually.

Q: How do TSMC's profit margins compare to other manufacturers?

A: TSMC expects long-term gross margins of 53% or higher, even after expansion costs. Most manufacturers would consider 25-30% margins excellent, making TSMC's margins exceptionally high for manufacturing.

Q: What happens if Taiwan and the US don't reach a trade deal by August 1?

A: Taiwan faces a 32% tariff on all exports to the US, including semiconductors. This would significantly impact TSMC's costs and potentially force price increases for customers like Apple and Nvidia.

Q: Why is equipment supplier ASML worried if chip demand is strong?

A: ASML makes the machines that produce chips, not the chips themselves. Trade tensions affect equipment sales more than chip demand because companies delay expansion plans when facing political uncertainty, even if current demand remains strong.

Q: How much revenue does TSMC get from Apple compared to other customers?

A: Apple accounts for about 20% of TSMC's annual revenue, down from being the dominant customer. The remaining 80% now comes from AI and data center customers like Nvidia, AMD, and others.

Q: When will TSMC's Arizona plants start producing chips?

A: TSMC is accelerating construction of its second and third Arizona plants "by several quarters" but hasn't given specific dates. The company expects to eventually produce 30% of its most advanced chips there.