💡 TL;DR - The 30 Seconds Version

👉 Trump administration proposes annual "site licenses" for Samsung and SK Hynix China plants, replacing indefinite waivers that expire December 31st.

📊 The change adds roughly 1,000 license applications per year, giving Washington granular visibility into every tool and material shipped to Chinese facilities.

🏭 China stockpiled 13 million HBM stacks before December controls kicked in, with Samsung alone shipping 7 million stacks in one month.

🌍 High-bandwidth memory, not logic dies, represents the real bottleneck for China's AI accelerator production capabilities going forward.

🚀 The framework signals a shift toward "managed diffusion" rather than blanket bans, calibrating pressure while preserving allied company operations.

Revocation of indefinite approvals gives Seoul continuity—with red tape and U.S. visibility.

The Trump administration is pitching South Korea on annual “site licenses” that would govern every restricted tool and material shipped to Samsung and SK Hynix plants in China, replacing the expiring fast-track waivers. The idea, reported as a proposal for annual site licenses, lands six days after the Commerce Department formally moved to end the companies’ VEU status effective December 31, 2025. Relief meets oversight.

What’s actually new

Instead of perpetual permissions, Korean chipmakers would file once a year for precisely enumerated quantities—gear, parts, and spares—to keep Chinese fabs running. The message: operations can continue, but not upgrades or expansions that raise China’s compute ceiling. It’s a targeted shift.

BIS has signaled the direction of travel already. Its rulemaking to revoke VEUs comes with a promise to allow licenses that maintain existing lines, and a warning that technology-raising shipments won’t fly. That’s the line Washington wants.

The mechanics—and the friction

Commerce estimates the VEU rollback alone adds roughly 1,000 license applications per year to the pipeline. The paperwork is the point. It yields granular visibility into who ships what, when, and why.

But spare parts fail unpredictably. Forecasting a year of emergency replacements from a clean desk in September is a stretch for any fab manager. Forecasting is hard.

Seoul’s bind widens

For South Korea, the proposal is both guardrail and tripwire. It avoids a “no-ship” cliff while embedding recurring checks that could snarl fixes. The timing also comes amid fresh diplomatic strain after U.S. immigration raids at a Hyundai–LG battery venture near Savannah, an episode that rattled Korean boardrooms already navigating export-control whiplash. Trust is thinner than executives like to admit.

Yet Samsung and SK Hynix need continuity in China, where they’ve sunk billions into memory lines serving phones, PCs, and data centers. Annual licenses at least define the hoops. It’s a compromise Seoul can live with—nervously.

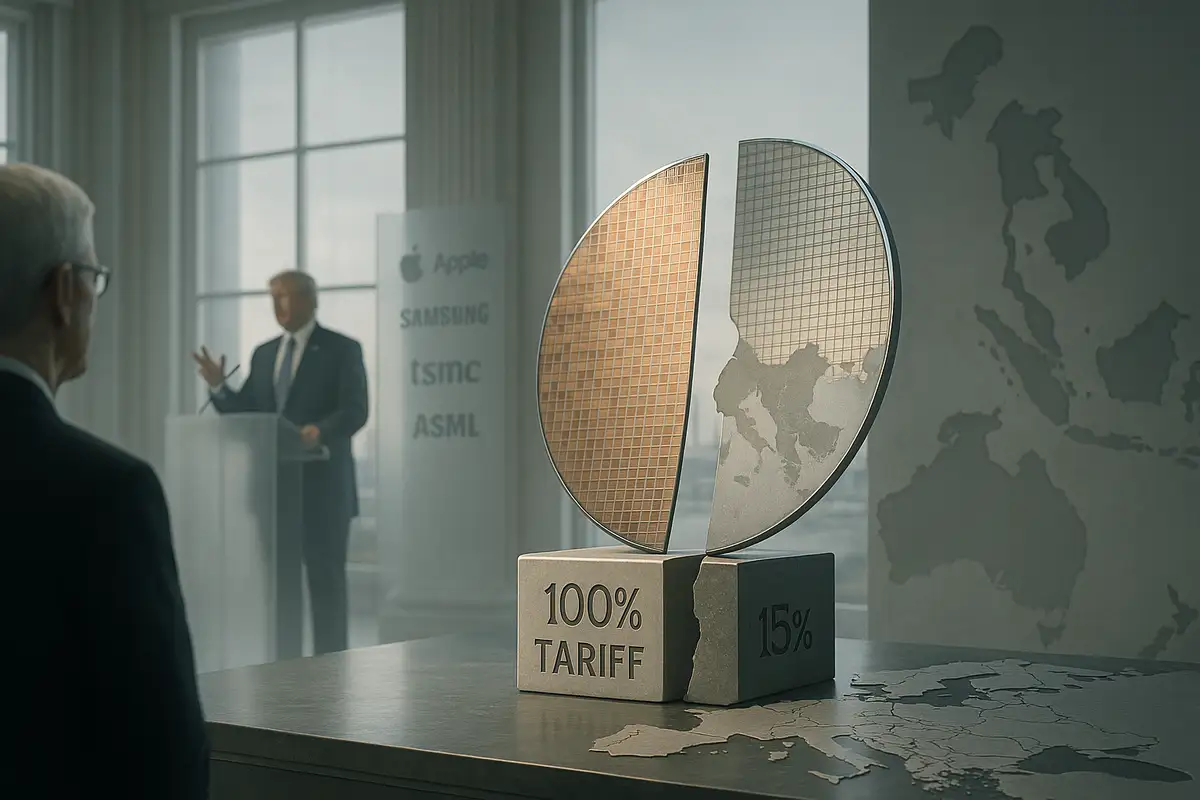

The real choke point is memory

Washington’s core aim is slowing China’s AI compute buildout without wrecking allied firms. On the ground, the tightest constraint isn’t logic die. It’s high-bandwidth memory. Analysts at SemiAnalysis argue Chinese buyers amassed about 13 million HBM stacks before tougher rules kicked in—enough, in theory, to package roughly 1.6 million Huawei Ascend AI processors. They also estimate Samsung shipped an eye-popping 7 million stacks in a single pre-enforcement month. These are claims, but they illustrate the leverage.

Domestic HBM capacity lags. SemiAnalysis projects CXMT could make on the order of 2 million HBM stacks next year, supporting only 250,000–300,000 top-end Ascend packages. If true, HBM—not lithography—remains the binding constraint on China’s AI accelerator output. Memory is the throttle.

Managed diffusion, not a blanket ban

The site-license model fits a broader U.S. pattern: keep friendly fabs alive, meter shipments that would raise China’s performance frontier, and collect more telemetry along the way. That mirrors the GPU regime, where some Nvidia parts are licensed while top-tier chips stay blocked. It’s calibrated, not chaotic.

For Korean firms, the price of access is administrative agility. They’ll need stronger parts forecasting, pooled safety stock outside China, and fast-lane legal teams to amend licenses when a critical module dies mid-quarter. Small delays compound. So do costs.

What to watch next

Three things decide how disruptive this gets. First, how specific Commerce makes the bill of materials—overly narrow SKUs will force constant amendments. Second, how quickly emergency requests turn around when a line is down. Third, whether BIS issues clear guidance on what counts as “maintenance” versus a de-facto upgrade. The definitions will bite. Hard.

Politically, watch whether Seoul extracts predictability commitments in exchange for cooperation on stricter HBM enforcement. Memory controls move the market more than rhetoric. That’s where the game is.

Why this matters

- Annual licenses turn a binary waiver into a policy lever—giving Washington fine-grained visibility and control while raising compliance costs across allied supply chains.

- HBM, not logic, is China’s real bottleneck; tightening memory flows can curb AI compute growth more than blocking incremental fab tools.

❓ Frequently Asked Questions

Q: What exactly were VEUs and why did they matter so much?

A: Validated End User status gave Samsung and SK Hynix permanent approval to ship pre-approved quantities of restricted equipment to China without individual licenses. It was essentially a fast-pass system that saved months of paperwork for every shipment, making operations predictable and profitable.

Q: How much money do Samsung and SK Hynix actually make from their China plants?

A: Samsung's China semiconductor operations contribute meaningfully to its $200 billion annual revenue, while SK Hynix generates roughly 30% of its total revenue from China. Both companies have invested billions in Chinese manufacturing facilities over the past decade, making operational continuity crucial for profitability.

Q: Why is high-bandwidth memory more important than regular computer chips?

A: HBM acts like super-fast short-term memory for AI processors, enabling them to access training data quickly. Without it, AI chips become severely bottlenecked. China's domestic HBM production capacity is only about 2 million stacks annually—enough for roughly 250,000 advanced AI processors versus millions of logic chips.

Q: What happens if a critical piece of equipment breaks and isn't on the annual license?

A: Companies would need emergency approval from the Commerce Department, potentially causing days or weeks of downtime. A single advanced semiconductor production line can lose $1-2 million per day when offline, making spare parts forecasting and emergency procedures critical for profitability.

Q: Will this affect prices for phones, computers, and other electronics?

A: Probably not directly. Samsung and SK Hynix's China plants primarily produce memory chips for global markets, not advanced processors. The annual licensing adds administrative costs but shouldn't disrupt production volumes significantly, meaning consumer electronics supply chains remain largely intact.