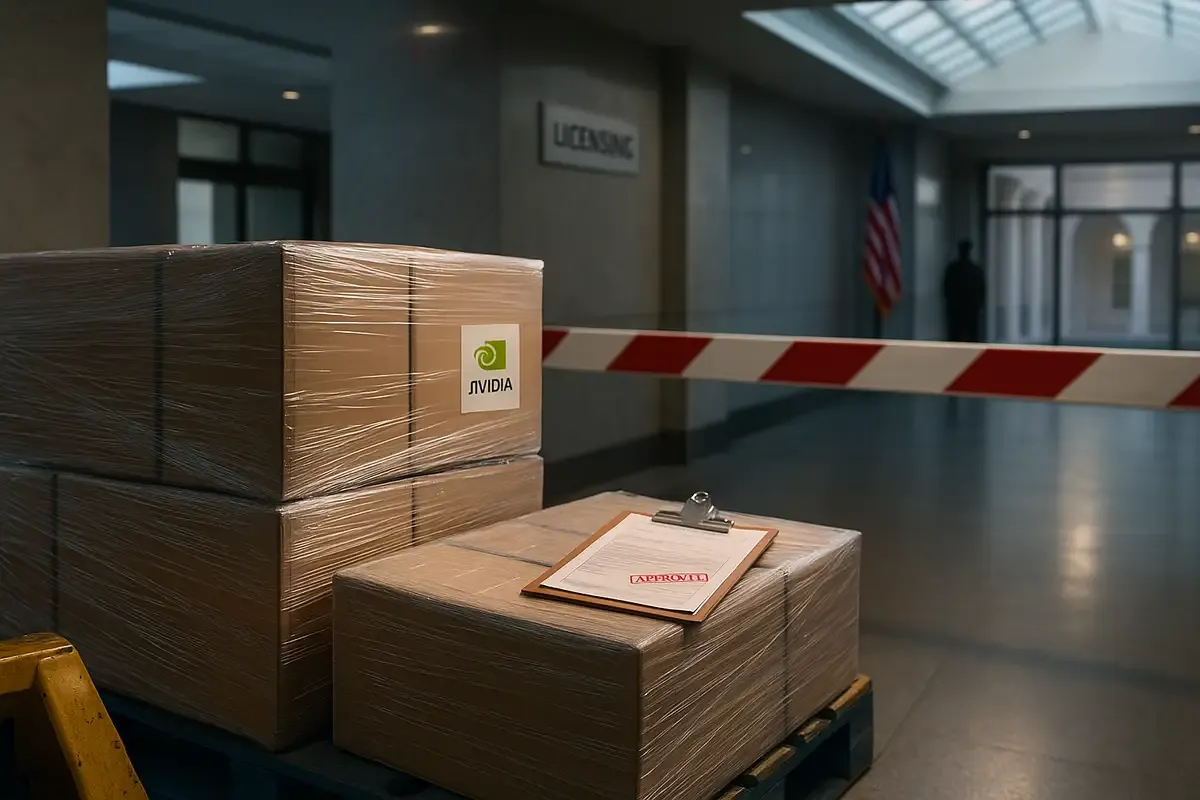

Export controls turn transactional; approvals followed a White House meeting.

💡 TL;DR - The 30 Seconds Version

👉 U.S. government will take 15% of Nvidia and AMD revenue from AI chip sales to China as condition for export licenses—first time Washington has monetized export controls.

📅 Licenses began flowing Friday after Jensen Huang's Wednesday White House meeting, reversing April ban on H20 and MI308 chip sales to China.

💰 Deal could generate over $2 billion for U.S. Treasury based on projected sales of $15 billion (Nvidia) and $800 million (AMD) through 2025.

🏛️ Arrangement transforms export policy from binary bans to graduated revenue sharing, setting precedent for government partnerships with private companies.

🌍 Other countries may now demand similar revenue cuts for market access, fundamentally changing how tech companies operate in restricted markets.

The U.S. will take 15% of Nvidia and AMD revenue from AI-chip sales to China as a condition of export licenses. It’s the first clear attempt to monetize export controls through a revenue share with private firms. The signal is blunt: access comes with a toll.

What changed—and when

In April, the administration barred sales of Nvidia’s H20 and AMD’s MI308 to China. By July, President Trump had privately indicated a path to restore access. The missing piece arrived after Jensen Huang’s Wednesday meeting at the White House; licenses began moving Friday. The reversal came fast.

How the money moves

Instead of on/off rules, Washington is attaching a meter to specific China shipments. Treasury gets 15% of the covered revenue; chipmakers keep the rest and their foothold in the market. The exact mechanism—collection, auditing, and scope—has not been published. Details will decide outcomes.

Stakeholders, incentives, bets

Washington. Commerce Secretary Howard Lutnick has cast the approach as managed dependence: keep Chinese buyers on a constrained U.S. stack while funding domestic leadership. It’s control by throttle, not blockade. That is the bet.

Beijing. Regulators recently summoned Nvidia over alleged “backdoor” risks, and state media has nudged buyers toward domestic alternatives. Expect selective purchases, louder security demands, and more support for Huawei-led designs. Pragmatism over confrontation.

Chipmakers. For Nvidia and AMD, the 15% cut is the price of staying in China. Jensen Huang argues bans would hand share to Chinese vendors and speed their progress. The framework preserves business while sacrificing margin. It also ties Washington’s take to corporate performance. Awkward.

Evidence and dissent

The license restart is visible; the fee is being acknowledged by people familiar with the arrangement. Security veterans warn that H20-class parts still accelerate frontier AI work, even if they sit below top-end thresholds. Their case is simple: a skim today may fuel capability tomorrow. Legal scholars add a separate concern: whether a revenue-based condition functions as an export tax by another name. Critics see risk drift.

Precedent—and how it spreads

This is the first revenue share linked to commercial tech export licensing. It echoes defense “offsets” but moves the logic into semiconductors. If it holds, other jurisdictions will test their leverage. Allies may seek their own slices as a condition of local access. Competitors could reply with surcharges, security reviews, or investment mandates. Companies will hedge with multisourcing and heavier policy insurance. Friction rises.

The managed-diffusion shift

Old export policy tried to stop sensitive technology outright. The new approach assumes diffusion and aims to meter it while keeping relative advantage through pace and platform lock-in. It’s an engineer’s answer to geopolitics: shape the flow you can’t eliminate. That only works with tight feedback loops as Chinese suppliers improve and routing tactics evolve. Calibration is hard.

What to watch

The fine print matters most: how revenue is measured, where funds are booked, and what triggers license suspension or clawbacks. Expect China-focused committees in Congress to probe the legal basis and oversight plan. In parallel, watch China’s procurement patterns, state-media cues, and any retaliatory taxes or “security” probes aimed at U.S. vendors. One variable dominates: performance parity. If domestic accelerators close the gap quickly, the meter loses bite. Speed wins.

Why this matters:

• Export controls are shifting from binary bans to revenue-linked throttles, changing how the U.S. manages sensitive technology flows.

• Tying government income to private China sales aligns incentives—and risks bending security judgments toward cashflow.

❓ Frequently Asked Questions

Q: How exactly will the U.S. government collect this 15% revenue share?

A: The specific collection mechanism hasn't been published yet. Companies will likely report China sales revenue and transfer 15% to Treasury, similar to tax payments. The arrangement will require auditing systems to track which sales qualify and prevent avoidance through third-party routing.

Q: What exactly are H20 and MI308 chips and how do they differ from top-tier AI chips?

A: H20 (Nvidia) and MI308 (AMD) are "China-specific" AI chips with reduced capabilities compared to their most advanced models. They're designed to stay below U.S. export control thresholds while still providing meaningful AI acceleration for training and running machine learning models.

Q: Has the U.S. ever demanded revenue sharing for export licenses before?

A: No. This is the first commercial technology export license tied to revenue sharing. The closest precedent is defense "offset" agreements where foreign buyers invest in U.S. production, but those involve different industries and structures than direct government revenue participation.

Q: How much money could this actually generate for the U.S. government?

A: Based on analyst projections, over $2 billion through 2025. Nvidia was expected to sell around $15 billion worth of H20 chips to China, while AMD projected $800 million in MI308 sales. At 15%, that's $2.37 billion combined.

Q: Could other countries now demand similar revenue cuts from U.S. tech companies?

A: Yes, this sets a precedent that market access can be tied to government revenue sharing. The EU already levies digital services taxes on American tech companies, and countries may now view direct revenue sharing as an acceptable condition for market access.

Q: What happens if companies try to avoid the payments or refuse to pay?

A: Export licenses would likely be suspended or revoked, cutting off China access entirely. The arrangement makes government revenue directly dependent on continued compliance, creating strong enforcement incentives for both collection and monitoring of sales routing.

Q: Why did Trump reverse the April ban after meeting with Jensen Huang?

A: Huang argued that blocking sales would hand market share to Chinese competitors like Huawei, potentially accelerating their development. The revenue-sharing compromise lets U.S. companies compete while funding government programs designed to maintain technological leadership.