Mercury transaction data upends traffic-based leaderboards; vibe coding is now enterprise-scale.

Traffic darlings don’t win procurement. A new cut of spend from 200,000 Mercury customer accounts shows which AI products startups actually fund, not just try—and it tells a different story than web traffic rankings. The analysis comes in a16z’s AI Application Spending Report for June through August 2025, a window that captures the first clean summer of post-agentic hype.

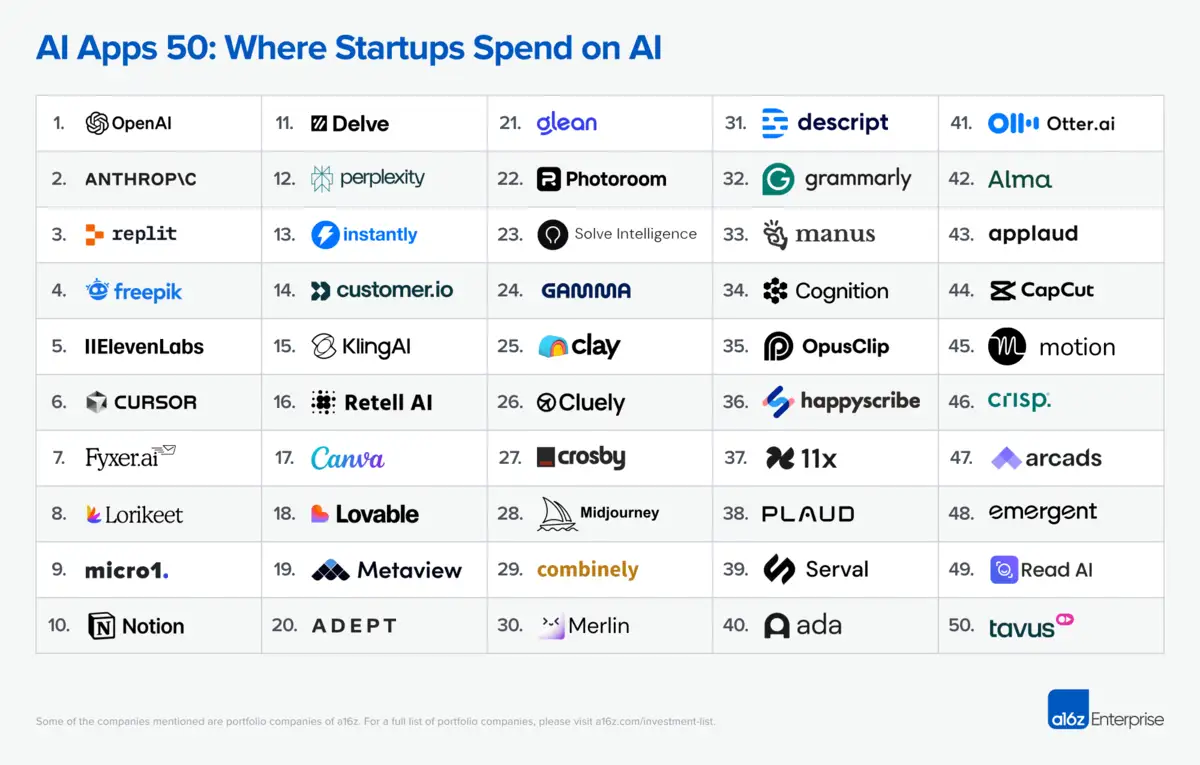

A leaderboard built from invoices, not visits

OpenAI took the top slot, Anthropic the second. The surprise sits at #3: Replit, a vibe-coding platform, outran better-known productivity suites and generated roughly 15x the Mercury-visible revenue of its traffic-rich rival Lovable, which placed #18. That inversion matters. Budgets don’t lie.

Spending data explains the flip. Replit’s agent can run autonomously for hours and ships with built-ins—databases, auth, secure publishing, governance—that map to production work. Lovable lowers the barrier to prototyping and UI scaffolding, which attracts tinkerers and early-stage builders. When teams move from mockups to durable apps, the purchasing logic changes.

What spend reveals—and traffic conceals

The ranking covers 50 AI-native application companies across a three-month snapshot. Twelve names appear on both the consumer Top 100 and this enterprise-spend list, often in different order. ElevenLabs landed #5 on spend, signaling that startups pay for polished synthetic audio even if attention flows elsewhere. Midjourney appears on both lists, but most of its revenue remains consumer-led. Context matters.

Two horizontal trends stand out. First, general LLM assistants are fragmented: OpenAI (#1), Anthropic (#2), Perplexity (#12), and Merlin AI (#30) split wallets rather than consolidating them. Second, “LLM workspaces” that sit on your files—Notion (#10) and Manus (#33)—are gaining share. The UI layer is far from settled. It’s early.

Horizontal tools lead; creative tops the category stack

Horizontal software captured 60% of spend, with creative suites as the single largest slice. Freepik ranked #4, ahead of many developer tools. Image and video tools—Canva, Photoroom, Midjourney; Descript, Opus Clip, CapCut—and text-to-speech (ElevenLabs at #5) round out a category that no longer lives in a design pod. Everyone is a creator now. That’s new.

Meeting support is crowded and unconsolidated: Fyxer (#7), Happyscribe (#36), Plaude (#38), Otter.ai (#41), and Read AI (#49) all earned dollars without producing a runaway winner. The same pattern shows up across horizontal assistants. Choice is the norm. Standardization can wait.

Vibe coding, explained—and why Replit vaulted

Four AI app builders made the spend list: Replit (#3), Cursor (#6), Lovable (#18), and Emergent (#48). Cognition—operator of enterprise-oriented coding tools like Devin and Windsurf—came in at #34. The throughline is simple: companies will pay for tools that turn prompts into running software with minimal hand-holding, and they’ll pay more when those tools include deployment, data, and controls. Production beats prototypes. Always.

Will the space fragment or consolidate? Both paths are plausible. Switching costs are still low, and differentiation vectors—speed to usable UI, backend robustness, vertical specialization—support multiple winners. Yet ecosystems harden around shared components, templates, and talent. Consolidation can arrive quickly once a de facto stack emerges. Watch that axis.

Copilots outnumber agents—twelve to five

Vertical AI split into augmentors and substitutes. Of 17 vertical apps, 12 are copilots that speed human work; five pitch “AI employees” able to run workflows end-to-end. Customer service exemplifies augmentation—Lorikeet (#8), Customer.io (#14), Ada (#40), Crisp (#46). Sales and recruiting follow suit: Instantly (#13), Clay (#25), Micro1 (#9), Metaview (#19), Applaud (#43). The framing is pragmatic. Reliability still rules.

The five substitution plays are early but notable: Crosby Legal (#27, an agentic law firm), Cognition (#34, AI engineer), 11x (#37, automated GTM), Serval (#39, IT service desk), and Alma (#42, immigration law). The pitch is clear: fewer tickets, fewer handoffs, fewer headcount lines. The bar is higher. Trust takes time.

Consumer pull is now an enterprise channel

Nearly 70% of the ranked products can be adopted by an individual without an enterprise license. Employees bring favorites to work; IT formalizes the relationship later. This compresses product-led growth timelines and forces go-to-market decisions earlier: harden security and sales today, or ride bottoms-up momentum and bolt on enterprise features later. Both paths are visible in the data. The wall between B2C and B2B is porous. Very.

This prosumer pipeline also explains the odd pairings in the list. CapCut and Midjourney show up alongside Manus and Delve (#11, compliance automation) and Combinely (#29, accounting). The buyer is the same person across modes—user on Saturday, procurement voice on Monday. Design your SKUs accordingly.

Methodology and caveats you shouldn’t skip

This dataset is powerful and imperfect. It’s Mercury-visible spend—ACH, IO card, wires—from June to August 2025. It excludes cloud platforms and GPU sellers by design, and Google spend bundles Cloud and Gemini. Some startup purchases may sit on non-Mercury cards or be reimbursed through other flows. It’s a three-month slice. Directionally strong, not gospel.

Even with those limits, the signals are useful: who captures real budgets, which categories are fragmenting, and where the next consolidation battles might break out. Use it as a nowcast for buyer intent. Not a prophecy.

Why this matters

- Budgets, not clicks, reveal product-market fit: spend shows which AI capabilities justify recurring invoices, which stay as trials, and where procurement is willing to live with new risks.

- The copilot-to-agent shift will reshape teams as reliability improves, with vibe-coded apps and embedded workspaces accelerating the move from prototypes to production across the stack.

❓ Frequently Asked Questions

Q: What exactly is "vibe coding" and why does it matter?

A: Vibe coding refers to AI platforms that turn natural language prompts into functional software. Instead of writing code line-by-line, developers describe what they want and the AI builds it. Four vibe coding platforms made the spending list—Replit (#3), Cursor (#6), Lovable (#18), and Emergent (#48)—showing startups now treat this as production infrastructure, not just prototyping toys.

Q: Why did Replit beat Lovable 15x in revenue despite lower web traffic?

A: Replit includes enterprise features that justify higher prices: autonomous agents that run for hours, built-in databases, authentication systems, and secure publishing infrastructure. Lovable optimizes for rapid UI prototyping with a lower barrier to entry, attracting individual experimenters. When startups move from mockups to production apps, they pay for Replit's deployment capabilities.

Q: What's the practical difference between copilots and autonomous agents?

A: Copilots assist humans in making decisions faster—like AI notetakers or tools that draft customer service responses for review. Autonomous agents complete entire workflows without supervision—like an AI lawyer that reviews contracts end-to-end. Currently, copilots outnumber agents twelve to five on the spending list because reliability requirements are lower when humans stay in the loop.

Q: How reliable is Mercury data as a measure of the AI market?

A: Mercury tracks 200,000+ startup customers but only captures transactions on Mercury cards—ACH, wires, and IO card spend from June-August 2025. It excludes purchases on non-Mercury cards, cloud platform spending, and GPU purchases. The data reveals startup buyer priorities directionally but isn't comprehensive. Some major enterprise deals won't appear if paid through other banking channels.

Q: When will autonomous agents start replacing copilots at scale?

A: A16z partner Seema Amble expects the shift as underlying model capabilities improve, but gave no specific timeline. The transition depends on reliability thresholds—agents must complete work without supervision, not just accelerate it. Five companies already position as "AI employees" (Crosby Legal, Cognition, 11x, Serval, Alma), testing whether businesses will trust end-to-end automation.