💡 TL;DR - The 30 Seconds Version

👉 Atlassian buys The Browser Company for $610 million cash to transform Dia into an AI browser designed specifically for enterprise knowledge work.

📊 Only 10% of organizations use secure browsers despite 85% of enterprise workflows happening in web browsers, creating a massive market opportunity.

🏭 The Browser Company will operate independently with CEO Josh Miller staying in place while accelerating Dia's rollout across Mac, Windows, iOS and Android platforms.

🌍 Arc browser struggled with mainstream adoption as its advanced features resembled "a highly specialized professional tool" rather than mass-market product.

🚀 Dia aims to become the control plane for knowledge work by connecting email, docs, and calendars across vendors with AI skills and personal work memory.

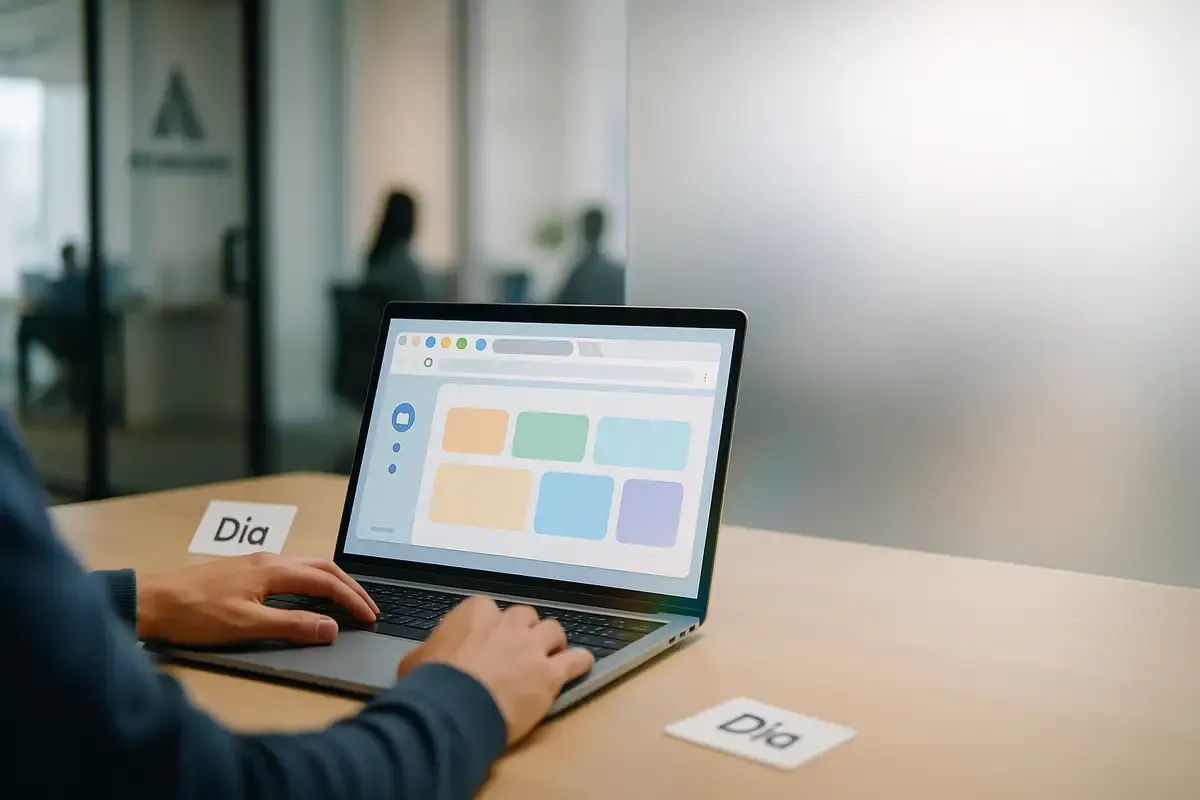

Atlassian is buying The Browser Company for $610 million in cash, a wager that the next big productivity platform isn’t an app—it’s the browser itself. The company says Dia, The Browser Co.’s new AI-forward browser, will be developed as “the browser for knowledge workers,” and laid out that case in Atlassian’s acquisition announcement.

Claim vs. reality

Browsers were built for browsing; modern work lives inside them. That tension is Atlassian’s entry point. The company argues most enterprise tasks now happen in tabs, yet today’s browsers treat every tab the same and lack work context or automation. It wants Dia to change that. The bet is bold.

What’s actually new

Dia, not Arc, is the centerpiece. The Browser Company paused new Arc feature work in May and has been shipping Dia in early access since June, positioning it as a chat-first, agentic browser that can understand pages, reference multiple tabs, and take actions across web apps. The acquisition gives Dia distribution, compliance muscle, and a direct line into IT buyers.

Atlassian will run The Browser Company as an independent entity. CEO Josh Miller stays in place; the existing team remains intact. Arc and Arc Search aren’t being killed, but the resources point to Dia and cross-platform rollout—Mac, Windows, iOS, Android, and, crucially, enterprise. Speed matters here.

Evidence and economics

The price is all cash from Atlassian’s balance sheet. That avoids dilution and signals conviction that browsers can become orchestrators for SaaS workflows rather than passive shells. Atlassian says 85% of enterprise workflows already occur inside a browser, but fewer than 10% of organizations have adopted a secure browser. That gap is the target market.

The Browser Company arrives with $128 million raised and a 2024 valuation of $550 million. Arc built a devoted following, but its advanced features saw limited mainstream use. Miller has said adoption patterns resembled “a highly specialized professional tool” more than a mass-market product. Dia’s stronger early engagement—and its fit with IT-led deployment—explains the pivot.

The strategic logic

Distribution and credibility decide category creation. Atlassian sells into millions of seats across Jira, Confluence, Trello, and Loom and claims penetration at more than 80% of the Fortune 500. Those relationships unlock the hard parts of a new browser category: security reviews, tenant controls, device management, and procurement. Without that, a novel UX can stall at the proof-of-concept stage. Scale wins.

For Atlassian, a browser that understands “work context” is a way to pull its suite—and third-party tools—into a single surface. The plan isn’t to wrap Atlassian apps in a skin. It’s to add “AI skills” and a “personal work memory” that connect email, docs, issue trackers, and calendars, regardless of vendor. If it works, Dia becomes the control plane for knowledge work. That’s the upside.

Competitive timing

The window is open but narrowing. Perplexity’s Comet is pushing an AI search-plus-browser model. Microsoft is packaging Edge with Copilot and Microsoft 365 hooks, and Edge remains a default in many corporate images. Brave has Leo; Opera is talking up an agentic Neon. Chrome still sits on roughly two-thirds market share worldwide, and inertia is powerful.

Two forces make 2025 different from prior browser tussles. First, agentic features such as multi-tab reasoning, data movement between pages, and page-aware automations are genuinely new for mainstream users. Second, enterprise security teams are more willing to standardize on a “work browser” if it ships with policy controls, identity integration, and logging. Those are Atlassian’s lanes.

The integration challenge

Product craft meets compliance checklists. Atlassian must add admin controls, SOC-2-ready logging, and data handling guarantees without crushing the speed that made Arc and Dia interesting. The Browser Company must keep its consumer-grade polish while accepting enterprise realities: SSO nuance, data residency, conditional access, and long tail web compatibility. It will be a grind.

Dia will also have to prove it is faster for real jobs, not just a cooler tab manager. “Ask my tabs,” “fill this form,” and “move this data across these three pages” are compelling demos. They need to survive messy corporate stacks, stubborn iframes, and rate limits. Show-to-ship discipline is everything. So is latency.

Risks and unknowns

This category could collapse into a feature of Edge and Chrome if incumbents replicate the basics, bundle tightly with office suites, and lean on existing deployability. Regulatory approvals still apply to the deal, and Dia’s cross-platform timeline is ambitious. Finally, agent reliability matters: if the AI gets things wrong in a ticketing or billing flow, trust evaporates quickly. One bad click can be costly.

Still, the direction of travel is clear. Work is web-first; tabs are tasks; context is king. Atlassian is paying to own the surface where those decisions happen. That’s a bigger swing than another copilot tucked into a sidebar. It could also be the start of a new default.

Why this matters

- The “AI browser for work” reframes the browser as an automation layer that can move data and actions across apps, not just display them.

- If Atlassian lands enterprise-grade security and distribution, Dia could become the control plane for knowledge work—and challenge the Chrome-Edge duopoly from above.

❓ Frequently Asked Questions

Q: What makes Dia different from Chrome or Edge?

A: Dia can understand and interact with multiple browser tabs simultaneously. It can move data between three open spreadsheets, check your Gmail and tell you what's next on your calendar, or chat about content across several tabs at once. Regular browsers treat each tab as separate.

Q: Why did Arc fail to gain mainstream adoption despite positive reviews?

A: CEO Josh Miller said Arc's metrics resembled "a highly specialized professional tool" rather than a mass-market product. Most users didn't adopt Arc's advanced features like automatic tab archiving and customizable interfaces, leading to the company's pivot toward Dia.

Q: When will businesses be able to use Dia?

A: Atlassian expects to close the acquisition in December 2025. Dia is currently in early access on macOS, with plans to accelerate rollouts to Windows, iOS, Android, and enterprise versions. The companies haven't announced specific enterprise availability dates.

Q: How does the $610 million price compare to Browser Company's previous valuation?

A: The Browser Company was valued at $550 million in its 2024 Series B round, making the $610 million acquisition price an 11% premium. The startup had raised $128 million total since its 2019 founding.

Q: What happens to existing Arc users after the acquisition?

A: Arc and Arc Search will continue to exist and receive support, according to both companies. However, new feature development for Arc stopped in May 2025, with The Browser Company's resources now focused on developing and expanding Dia.