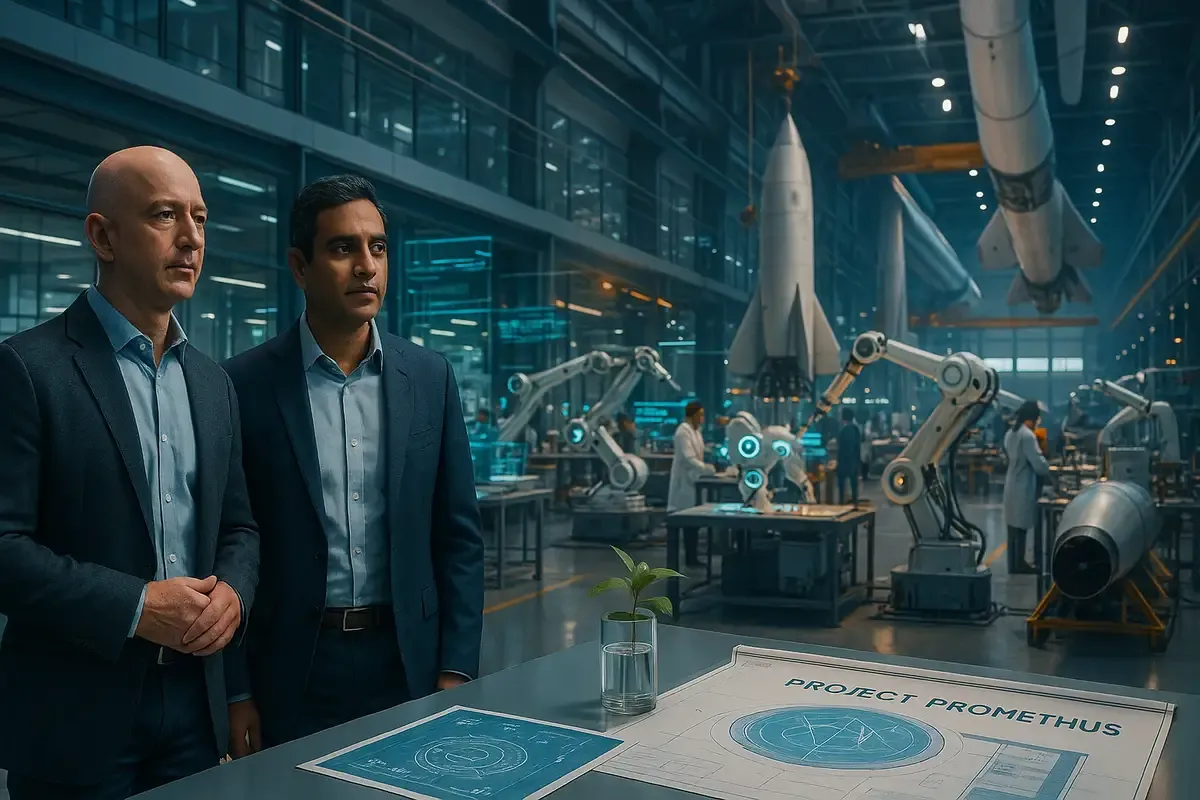

Six weeks after warning that artificial intelligence had entered an "industrial bubble" where "every experiment gets funded, the good ideas and the bad ideas," Jeff Bezos committed $6.2 billion of his own money to Project Prometheus. A physical AI startup. Where he'll serve as co-CEO.

The October 3 comments at Italian Tech Week in Turin emphasized how investors struggle to "distinguish between the good ideas and the bad ideas" during periods of technological excitement. November 17 brought the announcement: Bezos returns to operational management for the first time since leaving Amazon's C-suite in 2021.

Not contradiction. Calculation.

Key Takeaways

• Bezos commits $6.2 billion to Project Prometheus six weeks after warning AI entered an 'industrial bubble' where investors can't distinguish good ideas from bad.

• Physical AI startup already employs 100 people poached from OpenAI, DeepMind, Meta with 20x more funding than competitor Periodic Labs' $300 million seed round.

• Prometheus targets aerospace manufacturing and materials innovation, aligning with Blue Origin's needs eight days after New Glenn rocket's first successful booster landing.

• Project likely serves as vertical integration for Bezos's space ambitions rather than standalone commercial AI venture, providing proprietary R&D for Blue Origin's supply chain.

What Changed in Six Weeks

Nothing about the technology fundamentally shifted between Bezos's bubble diagnosis and his Prometheus investment. Large language models haven't suddenly cracked physical experimentation. Robotics labs still face the same generalization challenges. The "internet as training data" exhaustion problem Bezos's own Periodic Labs investment ($300 million in September) aimed to solve remains unsolved.

Bezos apparently decided he'd rather own the winners than watch from the sidelines.

Project Prometheus enters a market segment he accurately identified as overheated, armed with capital that dwarfs competitors by an order of magnitude. When asked about six-person companies receiving billions in funding at that Turin conference, Bezos called it "very unusual behavior." His new venture employs approximately 100 people with $6.2 billion backing. That's $62 million per employee before shipping anything.

Consider the timeline. Bezos invested in both Periodic Labs (materials science AI, $300 million seed) and Physical Intelligence (robot brains, $400 million Series B) before launching his own competing effort. With twenty times Periodic's capital. Physical Intelligence's CEO Karol Hausman noted their software "has to operate in the real world" unlike ChatGPT. Bezos heard the pitch, wrote the check, then built his own.

The Physical AI Promise and Its Technical Reality

"Physical AI" has become venture capital's favorite phrase for 2025. The technical differentiation from existing robotics remains murky. Google DeepMind's Gemini Robotics models, released earlier this year, demonstrate vision-language-action (VLA) systems that "turn visual information and instructions into motor commands." Academic research on autonomous laboratory systems dates to at least 2010. The concept of "Robot Scientists" that generate hypotheses, design experiments, and analyze results has produced working prototypes—Adam and Eve systems in yeast genetics research.

Project Prometheus focuses on "AI for engineering and manufacturing" across computers, automobiles, and spacecraft. Same territory Periodic Labs targets with superconductor discovery. Same domain Physical Intelligence addresses with generalist robot policies. The pitch converges: learning from physical experimentation rather than text, building systems that interact with real materials instead of processing digital information.

Technical challenges remain substantial. Current robotic platforms "struggle with generalization, typically handling only narrow, predefined tasks without the flexibility to adapt across different experimental contexts," according to recent autonomous generalist scientist (AGS) research. A 2025 IEEE workshop on laboratory automation emphasized that "addressing emerging scientific challenges involves developing robust automation solutions that can support large-scale, long-term experiments while integrating with existing hardware."

Cost structures tell the real story. Early Robot Scientist prototypes are "not currently considered 'cost-effective' in comparison to human scientists" due to "initial capital outlay and user training" plus "ongoing servicing and maintenance costs." Prometheus's $6.2 billion provides runway to burn through those inefficiencies. Whether that translates to breakthroughs or just better-funded experimentation remains unclear.

Bajaj's Moonshot Factory Credentials

Vik Bajaj brings the pedigree Bezos needs to make Prometheus credible. Physicist and chemist who worked closely with Sergey Brin at Google X. Operated inside the "Moonshot Factory" that produced Wing (drone delivery) and Waymo (self-driving cars). In 2015, Bajaj co-founded Verily, spinning out from Google Life Sciences. By 2018 he'd moved on to launch Foresite Labs—incubating AI and data science startups in precision medicine.

The pattern suggests Bajaj excels at translating ambitious research into organizational structures. Not necessarily at shipping products.

Waymo burned billions before achieving limited commercial deployment. Wing operates in select Australian suburbs. Verily pivoted from consumer health tracking to enterprise clinical research tools. These aren't failures, they're moonshots that discovered Earth's gravity remains strong.

Bajaj's LinkedIn profile still lists him as CEO of Foresite Labs as of November. NYT sources say he "recently left that job to focus on Project Prometheus." The overlap raises questions about transition timing. His five incubated companies (three public, two stealth) may or may not continue receiving his attention. Academic appointments at Stanford Medical School and Lawrence Berkeley National Laboratory provide technical credibility. His track record shows facility with building research organizations that explore ambitious ideas over extended timelines.

Precisely the profile for a venture where commercial viability arrives years after capital deployment.

When Capital Becomes the Product

Project Prometheus already hired nearly 100 employees "poached from top AI companies such as OpenAI, DeepMind and Meta," according to three people familiar with the company who spoke to the NYT. Brain drain from incumbents represents immediate value. OpenAI's o3 model team loses researchers. DeepMind's materials science group sees departures. Meta's robotics efforts face talent competition.

Compare to other heavily-funded AI startups:

- Thinking Machines Lab (former OpenAI employees): $2 billion

- Periodic Labs (Fedus + Cubuk from OpenAI/DeepMind): $300 million seed

- Physical Intelligence: $400 million Series B led by Bezos

- Applied Compute (more ex-OpenAI talent): $100 million valuation

Prometheus enters with 3x more capital than the previous high-water mark. And 20x Periodic's funding despite targeting overlapping problem spaces. That disparity can't be explained purely by technical approach or team pedigree. Simpler answer: Bezos writing checks from personal wealth rather than assembling institutional investors.

For competitors, this creates asymmetric warfare. Periodic Labs aims to build a physical lab in Menlo Park where robots conduct experiments at scale. Prometheus can build three identical facilities simultaneously as A/B testing infrastructure. Physical Intelligence develops generalist robot policies trained on multi-task datasets. Prometheus can license their work, hire their scientists, or simply outspend them on data collection. The $6.2 billion doesn't guarantee success. It guarantees competitors can't outbid for talent or outlast through capital endurance.

Blue Origin's Strategic Substrate

Bezos has another operational role: founder of Blue Origin. Eight days before the Prometheus announcement, the aerospace company successfully landed its New Glenn rocket booster. First time. New Glenn carries 45 metric tons to low Earth orbit, serious competition for SpaceX on commercial and government contracts.

Aerospace manufacturing at scale needs materials innovation. Manufacturing process optimization. Supply chain automation. Prometheus targets exactly these domains.

Rocket engine design could accelerate with AI systems learning from physical experiments. Exotic alloys for space applications need testing. Manufacturing tolerances for reusability require optimization. The synergies between Prometheus's stated focus (computers, automobiles, spacecraft) and Blue Origin's needs line up.

Bezos mentioned at that October conference his vision for "giant gigawatt data centers in space" within 10-20 years. Thermal management challenges need solving. Space-rated computing hardware requires development. Autonomous maintenance systems become necessary. Project Prometheus studying AI for spacecraft engineering directly supports that infrastructure vision.

The strategic logic clarifies: Prometheus isn't a standalone bet on physical AI's commercial viability. It's vertical integration for Bezos's space ambitions. Funded at a scale that lets Blue Origin effectively own its supply chain innovation engine. Whether Prometheus sells products to external customers becomes secondary if it's solving manufacturing and materials challenges for New Glenn's successors.

That reframes the bubble question. Bezos isn't denying the AI market shows speculative excess. He's arguing industrial bubbles create lasting infrastructure even when individual companies fail. Positioning himself to capture that infrastructure value through ownership rather than investment.

Why This Matters

For AI incumbents (1-2 years): Talent wars intensify as Prometheus raids research teams with compensation packages anchored to personal wealth rather than venture rounds. OpenAI, DeepMind, and Meta face retention challenges that escalate hiring costs across the sector, pressuring runway calculations for companies still burning toward profitability.

For aerospace and manufacturing (3-5 years): Partial success at autonomous experimentation gives Blue Origin proprietary materials and processes. SpaceX built manufacturing advantages through vertical integration. Prometheus could provide similar strategic moats—AI-driven R&D running continuously at scales human teams can't match.

For physical AI startups (immediate): The valuation ceiling just reset. Periodic Labs raised $300 million at impressive terms. Prometheus demonstrates 20x that amount reaches market for the right team and vision. But it also establishes Bezos as competitor-investor who writes checks before building directly competitive ventures, complicating future fundraising dynamics for anyone in adjacent spaces.

❓ Frequently Asked Questions

Q: What makes "physical AI" different from regular AI like ChatGPT?

A: Physical AI systems learn from real-world experiments rather than text. Instead of training on internet data, they control robots that mix chemicals, test materials, and analyze results. Google's Robot Scientist prototypes from 2010 ran physical experiments to identify yeast genes. The approach costs more but generates fresh training data as lab work scales up.

Q: How much has Bezos invested in AI companies this year?

A: At least $6.9 billion across three physical AI ventures. He led Physical Intelligence's $400 million Series B in 2024, participated in Periodic Labs' $300 million seed round in September 2025, then committed $6.2 billion to Project Prometheus in November. All three companies focus on AI for robotics and scientific discovery in physical environments.

Q: Why did Blue Origin's rocket landing matter for the Prometheus announcement?

A: New Glenn successfully landed its booster on November 9, proving Blue Origin can compete with SpaceX for commercial contracts. Eight days later, Bezos announced Prometheus targeting aerospace manufacturing. The timing suggests Prometheus will develop proprietary materials and processes for Blue Origin's rockets, similar to how SpaceX built competitive advantages through vertical integration.

Q: What happened to the companies Vik Bajaj founded before Prometheus?

A: Verily (co-founded 2015) pivoted from consumer health tracking to enterprise clinical research and remains active under Alphabet. Foresite Labs (2018) incubated five companies including Esker Therapeutics and Interline Therapeutics, which raised $92 million Series A. Bajaj's LinkedIn still lists him as Foresite CEO as of November 2025 despite joining Prometheus.

Q: How is Project Prometheus different from Periodic Labs if both do physical AI?

A: Periodic Labs focuses specifically on materials science and superconductor discovery with $300 million funding. Prometheus targets broader aerospace and manufacturing applications with $6.2 billion—20x more capital. Periodic builds one lab in Menlo Park. Prometheus can fund multiple facilities simultaneously and hire aggressively from competitors, creating different strategic positioning despite technical overlap.