The phrase "Napster era" appeared in the press release announcing Cloudflare's acquisition of Human Native on Thursday. Dr. James Smith, co-founder of the UK startup, used it deliberately. "We started Human Native with the goal of getting Generative AI out of its Napster era," he said. "We believe that creators should have control, compensation and credit when their work is used to power AI products."

The analogy does real work here.

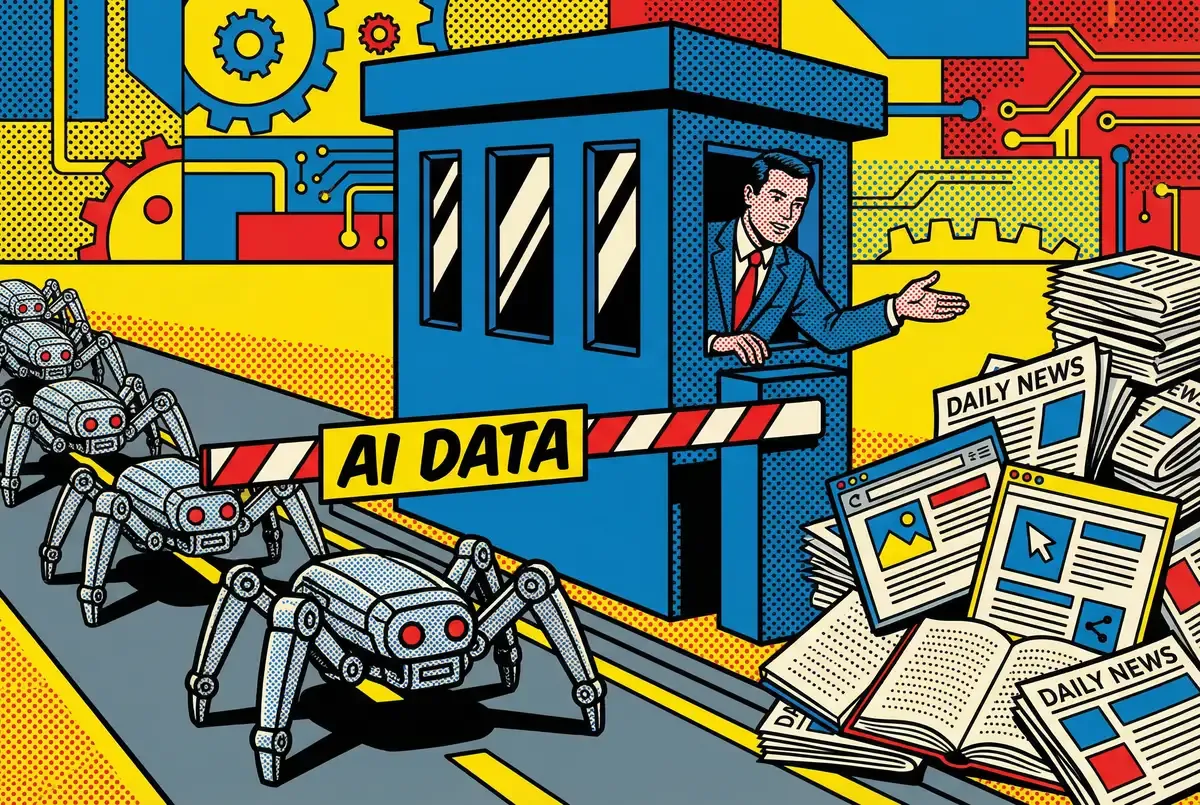

In 1999, Napster proved that digital distribution could obliterate the old gatekeepers. It also killed the business model for the people making music. Artists got nothing. Turns out "free" works better for distributors than creators. Here we are, twenty-seven years on, watching AI training data follow the same trajectory. The difference is scale. We're talking billions now, not millions. Cloudflare sits between roughly a quarter of the internet's traffic and the companies trying to crawl it. That position at the chokepoint has made the company bold.

The Breakdown

• Cloudflare acquired Human Native, a UK startup that transforms web content into licensed AI training datasets

• A second acquisition, web framework Astro, creates a full content pipeline from creation to AI licensing

• The company already controls 25% of internet traffic and launched Pay Per Crawl in 2025

• Cloudflare is positioning itself as the Spotify of AI training data, with similar consolidation risks

The infrastructure play hiding inside a values pitch

Matthew Prince, Cloudflare's CEO, framed the acquisition around protecting creators. His words: "Content creators deserve full control over their work, whether they want to write for humans or optimize for AI." Genuine idealism, that. Also strategic.

So what did Cloudflare actually get? Human Native transforms unstructured web content into datasets that AI developers can license. Skip the lawyers, skip the six-month negotiation dance. Human Native has been around since 2024, backed by LocalGlobe and Mercuri. Total raised before the acquisition: $3.56 million. Terms weren't disclosed. But look at the profile. Pre-revenue. Small team, mostly former DeepMind, Google, Figma, and Bloomberg engineers. This has acqui-hire written all over it.

If you've watched Cloudflare over the past year, the acquisition makes immediate sense. Last summer, the company launched AI Crawl Control, which lets website operators block AI scrapers entirely or charge them for access. Pay Per Crawl followed. Cloudflare was already building the tollbooth. Human Native gives them the catalog.

Think of it as vertical integration for the attention economy's next phase. You can't just block bots anymore. Publishers who do that forfeit whatever AI-derived traffic and revenue might come their way. But negotiating individual licensing deals with every AI lab? That's not scalable. Cloudflare is betting it can sit in the middle: indexing, pricing, processing transactions, taking a cut of everything that flows through.

The lawsuit-shaped hole in AI's business model

There's a reason this pitch resonates now. OpenAI, Anthropic, Meta, and every other foundation model builder face lawsuits over training data. The New York Times complaint alone runs hundreds of pages, with exhibits showing verbatim reproductions of copyrighted articles. Legal teams billing by the hour. Discovery requests piling up. The labs aren't just facing pressure. They're exposed.

AI companies have responded with a mix of defenses. Fair use. Transformative works. The argument that you can't copyright facts, and models just learn facts. Some of these arguments might win in court. None of them solve the reputation problem. When the New York Times sues you, "technically legal" is cold comfort.

Stay ahead of the AI infrastructure shift

Analysis like this, every morning. Who's building the rails for AI, who's paying for content, and who gets squeezed. Daily at 6am PST.

No spam. Unsubscribe anytime.

Human Native's marketplace offers an alternative. Licensed datasets, acquired with consent, priced transparently. For AI labs facing regulatory scrutiny in Europe, where GDPR and the AI Act create genuine compliance headaches, "ethically sourced" training data becomes a legal shield wearing a marketing pitch as a mask.

But the marketplace model has a chicken-and-egg problem. Publishers won't prepare their content for AI licensing unless buyers show up. Buyers won't show up unless there's enough quality content to matter. Cloudflare's network solves this by giving Human Native distribution. Millions of websites already use Cloudflare. One toggle in a dashboard, and suddenly their content becomes available for licensing. The distribution problem vanishes.

The Astro acquisition tells you where this is heading

Cloudflare announced a second acquisition on Friday. The Astro Technology Company, makers of a popular open-source web framework. Two deals in two days. On the surface, unrelated. Look closer and you see the connection.

Astro builds what its creators call "content-driven websites." Blogs. Documentation. Marketing sites. Publications. The kind of websites that contain the text and images AI models want to ingest. Astro already powers developer documentation for Microsoft, Google, and Cloudflare itself. Platforms like Webflow Cloud and Wix Vibe use it to let their customers deploy sites to Cloudflare's network.

The Astro team couldn't figure out how to make money. Fred Schott, the co-founder, was remarkably candid: "Attempts to introduce paid, hosted primitives into our ecosystem fell flat." Database products, e-commerce layers, nothing stuck. GitHub stars piled up while the Stripe dashboard stayed flat. Nearly a million downloads per week, hundreds of thousands of developers, and no path to revenue. The exhaustion of being popular but poor finally ended with this acquisition. Astro is now a utility, and utilities get paid.

Cloudflare gets something specific from Astro: a pipeline. Content created in Astro, hosted on Cloudflare Pages, indexed by Human Native, licensed to AI developers, payments flowing back to creators. The stack is complete.

Why publishers should be nervous anyway

If you're a publisher deciding whether to license your content through Cloudflare's future marketplace, you face a fundamental question: what's your content actually worth?

The uncomfortable truth is that most content is worth very little to AI developers individually. Models need training data at scale. They don't need your specific article. They need millions of articles. The Times can negotiate directly with OpenAI. They have the lawyers and the leverage. The blog you started three years ago? You're selling into a commodity market where the buyer has all the leverage.

Cloudflare's counter-argument is that aggregation creates value, that bundling thousands of small publishers into something coherent lets individual sites access deals they couldn't negotiate alone. Whether Cloudflare's cut, plus Human Native's cut, plus transaction costs, leaves enough for actual creators to feel compensated rather than exploited is the question nobody can answer yet.

Daily at 6am PST

Don't miss tomorrow's analysis

The deals, the lawsuits, the infrastructure plays. Who's winning, who's paying, and what it means for your business.

Free. No spam. Unsubscribe anytime.

The infrastructure company as content broker

There's something unsettling about the same company that handles your traffic also brokering deals for your content. Cloudflare already knows which AI bots visit which sites, how often, and what they're looking at. They know which publishers block crawlers and which ones welcome them. That's a lot of market intelligence for a would-be middleman.

Prince's statement hints at the tension: "The real goal has always been to help create a new economic model that actually works for the next phase of the Internet." Economic models require someone to design them, and the designer usually builds in advantages for themselves. Cloudflare isn't doing this out of altruism. They're building a toll road and positioning themselves as the only reasonable booth operator.

But the alternatives are worse. Individual negotiations don't scale. Lawsuits benefit lawyers, not creators. Blanket opt-outs mean you get nothing. Cloudflare's bet is that an imperfect marketplace beats no marketplace at all.

Whether that bet pays off depends on details that won't be clear for years. How will pricing work? What percentage does Cloudflare take? Can publishers access the same data about AI usage that Cloudflare already has? Will the marketplace actually attract enough AI buyers to matter?

The acquisition announcement contained precisely zero answers to these questions. What it contained was a statement of intent. Cloudflare wants to be the place where AI meets content, and where content gets paid. The company already controls the pipes. Now they're building the meter.

James Smith's Napster analogy was apt, but incomplete. Napster died because it couldn't figure out how to pay artists. Spotify eventually solved that problem, more or less, by becoming the dominant distribution platform and setting rates that favor scale over quality. Cloudflare is hoping to become the Spotify of AI training data. Publishers have watched that movie before. They know how it ends for the musicians.

Frequently Asked Questions

Q: What is Human Native and what does it do?

A: Human Native is a UK-based startup that transforms unstructured web content into licensed, AI-ready datasets. Founded in 2024, it connects publishers with AI developers who want to license training data legally rather than scraping it without permission.

Q: How does this connect to Cloudflare's existing AI products?

A: Cloudflare launched AI Crawl Control and Pay Per Crawl in 2025, letting publishers block or charge AI scrapers. Human Native adds the licensing marketplace. Together, they form a complete system: block, charge, or license.

Q: Why did Cloudflare also acquire Astro?

A: Astro is a web framework used by nearly a million developers weekly to build content-driven sites. Acquiring it gives Cloudflare a pipeline: content created in Astro, hosted on Cloudflare, indexed by Human Native, and licensed to AI developers.

Q: Will small publishers actually benefit from this marketplace?

A: That's uncertain. AI developers need scale, not individual articles. Cloudflare argues aggregation creates value, but after Cloudflare's cut, Human Native's cut, and transaction costs, the remaining payout for small publishers may be minimal.

Q: How much did Cloudflare pay for Human Native?

A: Terms weren't disclosed. Human Native raised $3.56 million from LocalGlobe and Mercuri before the acquisition. Given the pre-revenue status and small team of ex-DeepMind and Google engineers, this appears to be an acqui-hire.