Google must double its AI computing capacity every six months. That's the stark directive Amin Vahdat delivered to employees at a November all-hands meeting, a target that translates to a 1000-fold increase in capability within five years. Vahdat, Google's VP for AI infrastructure, wasn't presenting a wish list. He was outlining the minimum requirement to keep pace with demand for AI services already straining the company's data centers to their limits.

The doubling mandate captures something fundamental about the AI race: it's become an infrastructure war first, an algorithms competition second. Google's most advanced AI products are hitting capacity walls before they reach users. Meanwhile, competitors from Microsoft to OpenAI are pouring hundreds of billions into their own computing buildouts. The company that once scaled search to billions of queries now faces a different challenge. AI demands orders of magnitude more computing per interaction.

Key Takeaways

• Google mandates doubling AI compute capacity every six months, targeting 1000× increase by 2029-2030

• Capacity constraints limited Veo rollout and capped Google Cloud's $15B quarterly revenue, which could've grown faster

• Alphabet raised 2025 capex forecast to $91-93B, leveraging custom Ironwood chips with 30× efficiency gains

• Pichai sees underinvestment as bigger risk than bubble burst, calls 2026 "intense" for infrastructure competition

Compute Constraints Are Limiting Product Rollouts

Sundar Pichai admitted the bottleneck directly. When Google launched Veo, its AI video generator, user demand crashed into finite server capacity. "If we could've given it to more people, we would have gotten more users but we just couldn't because we are at a compute constraint," Pichai told the November meeting. The constraint applies across Google's AI product portfolio. Gemini 3, the company's latest flagship model designed to challenge GPT-4, faces similar limitations on availability.

This represents new territory for Google. The company built its reputation on scaling services rapidly, from Gmail to YouTube. AI requires different economics. Training a large language model can consume millions in computing resources. Serving real-time AI responses to millions of users simultaneously demands massive parallel processing. Google's infrastructure teams are racing to build capacity while product teams wait to expand rollouts.

Financial results tell the story. Google Cloud grew 34% year-over-year in Q3, hit $15 billion in revenue, carries a $155 billion contract backlog. Pichai said more compute capacity would've pushed those numbers higher. Revenue growth limited by server availability. Most companies would kill for that problem, but it explains why Vahdat's team is operating under such pressure.

The Efficiency Strategy Against Infinite Spending

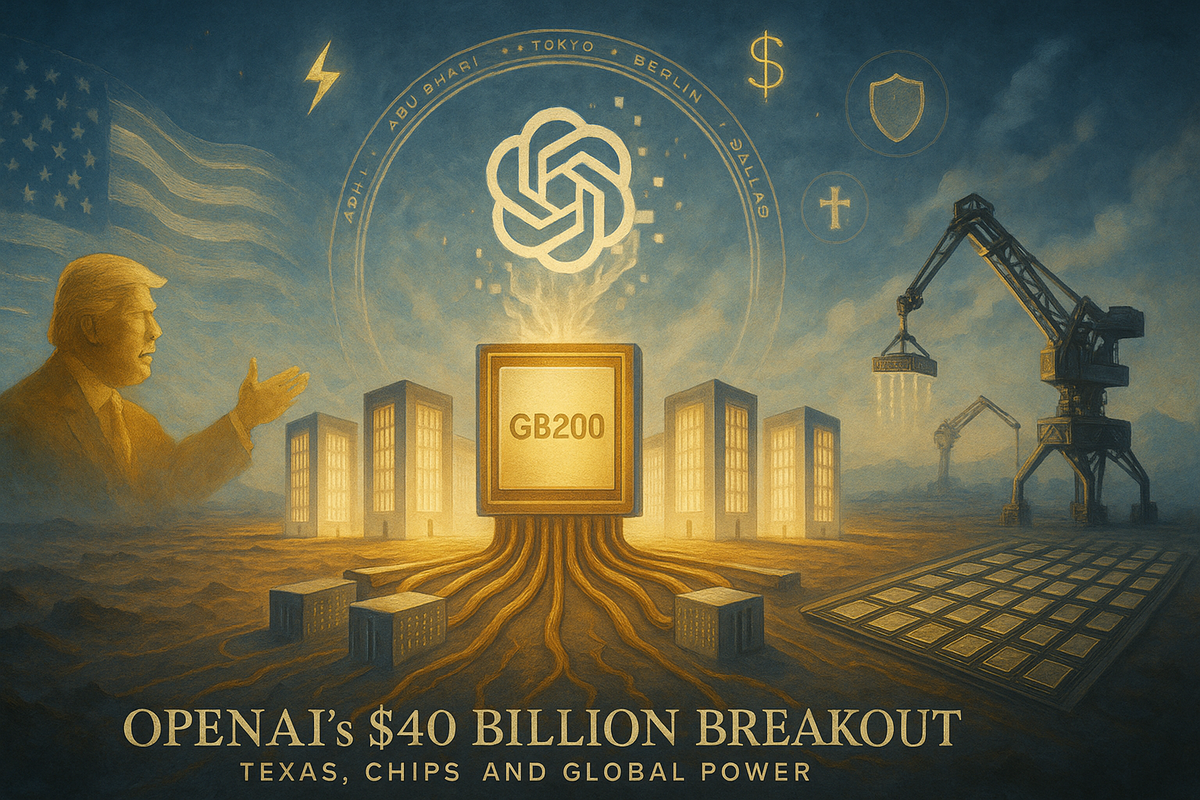

"Our job is to build this infrastructure, but not to outspend the competition, necessarily," Vahdat emphasized. Google is entering the most capital-intensive phase of the AI race, but executives insist brute-force spending isn't the answer. Alphabet raised its 2025 capital expenditure forecast to $91-93 billion, with a "significant increase" projected for 2026. Microsoft, Amazon, Meta, and Google collectively expect to spend over $380 billion this year on AI and cloud infrastructure.

Google's response combines three approaches. First, custom silicon provides performance advantages that generic hardware can't match. The company's seventh-generation Tensor Processing Unit, code-named Ironwood, delivers nearly 30× the power efficiency of its first-generation Cloud TPU from 2018. Each TPU generation reduces the cost per computation through co-designed hardware and software optimization. Ironwood scales to 9,216 chips per pod, offering 42.5 exaflops of compute in a single cluster.

Second, model efficiency improvements reduce the computing load per query. Google's research into sparse neural networks, where only parts of the model activate for each request, can dramatically lower resource requirements. These software optimizations compound with hardware gains.

Third, Google's relationship with DeepMind provides visibility into future model architectures. Vahdat highlighted this advantage: anticipating what AI workloads will look like in 2027 allows infrastructure teams to design for those requirements now. The collaboration between research and engineering teams enables co-design at a scale few competitors can match.

"We need to be able to deliver 1,000 times more capability, compute, storage, networking for essentially the same cost and the same energy," Vahdat told employees. Achieving exponential capacity growth without proportional cost increases requires engineering breakthroughs across the stack. It's the only way to square the circle of massive capability expansion with financial discipline.

Bubble Talk Meets Underinvestment Risk

An employee question at the November meeting cut to the core anxiety: "Amid significant AI investments and market talk of a potential AI bubble burst, how are we thinking about ensuring long-term sustainability and profitability if the AI market doesn't mature as expected?"

Pichai acknowledged the concern has entered the zeitgeist. Days earlier, he told the BBC that "elements of irrationality" exist in parts of the AI market, noting no company would be immune if a bubble burst. His message to employees took a different tack though. Play it safe now and watch hungrier competitors grab market share if AI proves transformational? "The risk of underinvesting is pretty high," Pichai said.

CFO Anat Ashkenazi doubled down on the aggressive spending. "The opportunity in front of us is significant and we can't miss that momentum." Google's diversified business model, strong balance sheet, and growing cloud revenue provide cushion that pure-play AI startups lack. "We are better positioned to withstand misses than other companies," Pichai noted.

Market signals remain mixed. Nvidia beat estimates with 62% revenue growth. Stock dropped 3.2% the next day anyway. CoreWeave and Oracle, the supposed AI infrastructure winners, have shed value through November despite strong fundamentals. Alphabet fell 1.2% on November 16. Wall Street wants perfection, gets nervous at the first hint of deceleration.

Google's leadership sees more risk in hesitation than overcommitment. Looking ahead, Pichai told employees 2026 will be "intense." The buildouts and competitive dynamics separate winners from laggards. "You can't rest on your laurels," he said. "We have a lot of hard work ahead."

The Infrastructure Arms Race Intensifies

AI competition has turned into a race over computing infrastructure. Vahdat called it "the most critical and also the most expensive part of the AI race." Six-month doubling cycles push Google's infrastructure teams beyond anything resembling traditional hardware deployment schedules. Moore's Law was a leisurely 24-month cadence by comparison.

Google operates some of the planet's most sophisticated data centers. That buys maybe six months of breathing room at current growth rates. Then obsolete. Each TPU generation, every server rack addition, networking upgrades throughout. The workloads keep multiplying. Physical buildouts pair with chip improvements, software optimization runs parallel to architectural innovation.

The competition isn't waiting. OpenAI's rapid ascent was enabled by Microsoft's willingness to pour billions into Azure AI supercomputers dedicated to OpenAI's use. Meta is building its own massive AI infrastructure. Amazon's AWS is racing to provide AI services to enterprise customers. The infrastructure layer has become as important as the models themselves.

One Google engineer's observation captures the stakes: models may come and go, but data centers are forever. The company that builds superior infrastructure can iterate faster on models, serve more users, and capture more of the AI market. Infrastructure advantage compounds over time.

Revenue Strategy To Fund the Buildout

The capital spending surge requires new revenue streams to maintain financial health. Ashkenazi pointed to enterprise cloud migration as a key opportunity. Many large companies still operate their own data centers. Google sees a chance to migrate those businesses to Google Cloud, where they can access Google's AI infrastructure rather than buying expensive hardware themselves.

Every major enterprise contract that moves workloads to Google's cloud adds revenue while achieving greater economies of scale. More customers sharing capacity means lower unit costs. Infrastructure investment funds better services, better services attract more customers, more customers justify further investment. It's a flywheel if it works.

Google has trimmed costs elsewhere to prioritize AI. The company's "Other Bets" portfolio has been reduced. Workforce reductions and project cancellations in non-core areas freed resources for AI investments. Even within Google Cloud, there's been a refocus on profitability over pure growth.

Wall Street has largely approved of Google's aggressive AI spending, as long as core businesses remain strong. Alphabet's stock is up significantly in 2023. Investors will want proof eventually though. Tangible returns on these capital expenditures, new revenue streams, expanded market share. Something concrete beyond infrastructure readiness.

Why This Matters

For Google's competitors: The doubling-every-six-months mandate sets the pace for the infrastructure race. Companies that can't maintain similar investment levels risk falling behind permanently, as computing advantages compound over time through better model training and broader service availability.

For enterprise AI buyers: Capacity constraints at major providers mean access to advanced AI services remains a competitive advantage. Organizations with secured compute allocations from Google, Microsoft, or AWS can develop AI applications that smaller competitors simply cannot run, creating a new form of infrastructure-based moat.

For AI investment skeptics: Google's infrastructure bottleneck offers concrete evidence of actual demand, not speculation. The company is throttling product rollouts and capping revenue growth because it lacks sufficient capacity. Users want more access than Google can provide. That's not bubble behavior.

❓ Frequently Asked Questions

Q: What are TPUs and why does Google build its own chips instead of buying Nvidia GPUs?

A: Tensor Processing Units (TPUs) are Google's custom AI accelerator chips designed specifically for training and running machine learning models. The seventh-generation Ironwood TPU delivers 30× better power efficiency than Google's 2018 version and scales to 9,216 chips per pod. Custom chips let Google optimize hardware and software together, reducing cost per computation compared to generic alternatives.

Q: How does doubling capacity every six months compare to normal tech industry growth?

A: Moore's Law, the traditional benchmark for chip advancement, predicted doubling every 24 months. Google's six-month doubling cycle is four times faster than that historic pace. This aggressive timeline means infrastructure built in early 2025 becomes inadequate by mid-2025, forcing continuous parallel construction of new data centers while upgrading existing ones.

Q: What's actually in Google Cloud's $155 billion contract backlog?

A: The backlog represents signed but not-yet-delivered cloud service contracts, primarily from enterprise customers committed to multi-year agreements. These contracts cover AI services, data storage, and computing resources. The backlog grew despite capacity constraints, meaning Google has secured revenue but lacks sufficient infrastructure to deliver all services immediately, hence Pichai's comment about missing growth opportunities.

Q: Why does Google specifically need 1000× more compute capacity by 2029-2030?

A: The 1000× target aligns with expected AI application demands this decade, from fully AI-generated video content to widespread AI assistants requiring real-time processing. Each new AI feature demands exponentially more computing than traditional services. Training larger models and serving millions of simultaneous AI interactions requires orders of magnitude more parallel processing than current infrastructure supports.

Q: How does Google's infrastructure strategy differ from Microsoft's approach with OpenAI?

A: Microsoft poured billions into Azure AI supercomputers dedicated specifically to OpenAI's use, essentially funding a partner's infrastructure. Google builds integrated infrastructure across its own products while leveraging DeepMind research for internal co-design. Microsoft's strategy bets on external AI innovation, while Google emphasizes full-stack control from custom silicon through software optimization to reduce long-term costs.