Good Morning from San Francisco,

🟡 Meta offered a co-founder enough money to leave his eight-month-old startup just three months after it raised $2 billion. He took it.

🟡 The Netherlands used three executives to seize control of a Chinese-owned chipmaker without nationalizing it. Wingtech still owns 99% of the shares but controls absolutely nothing.

🟡 A German billionaire just parked €175 million in South Park betting enterprise AI lives or dies by contracted savings, not clever demos.

🟡 And Silicon Valley's rightward turn? Jacob Silverman traces it to 2022, when cheap money ended and the FTC finally showed up. Convictions followed constraints.

Stay curious,

Marcus Schuler

Meta poaches Thinking Machines co-founder after $2B raise

Andrew Tulloch left Thinking Machines for Meta on Friday. Weeks after the AI startup shipped its first product and three months after closing a $2 billion round at $12 billion valuation.

The timing crystallizes a brutal market truth: even post-launch, well-funded startups can't hold co-founders against nine-figure platform offers.

Tulloch spent 11 years at Meta before jumping to OpenAI in 2023, then co-founded Thinking Machines with Mira Murati in February. The Wall Street Journal reported Meta pitched him on a package "that could reach $1.5 billion"—Meta called that number "ridiculous," but he's going back regardless. Meanwhile, Meta's hired 50-plus researchers from OpenAI, DeepMind, Apple, and Anthropic since summer, guiding to $66–72 billion in 2025 capex largely for AI infrastructure. Zuckerberg personally courted over a dozen Thinking Machines staffers; most stayed, but losing a technical co-founder weeks after launch shifts execution risk sharply.

Why this matters:

• Individual AI researchers now command valuations rivaling startup exits—talent liquidity overwhelms company loyalty.

• Retention becomes the bottleneck: platforms extract builders faster than startups can convert capital into products.

Dutch seize Nexperia control through executive mutiny

Three European executives petitioned an Amsterdam court October 1. Same day, the Dutch government invoked a 70-year-old emergency law.

Same day, the court suspended Wingtech chairman Zhang Xuezheng from Nexperia's board. Wingtech owns 99% of shares but lost 100% voting control.

This isn't nationalization—it's boardroom mutiny with state backing. The Netherlands used Nexperia's own senior management (Dutch CLO, German CFO, COO) as the trigger. Wingtech keeps all profits but can't change strategy, IP, operations, or personnel for a year. An independent director now holds decisive voting power. Production runs. Strategy stops.

The 12-day delay between action (September 30) and announcement (October 12) signals coordination, not crisis. China announced rare earth restrictions October 10. Beijing locked the supply. The Hague locked the board. Wingtech's shares crashed 10%, hitting Shanghai's daily limit.

Why this matters:

• Governance seizure without nationalization gives European governments control of strategic assets while dodging expropriation's diplomatic cost.

• Chinese-owned firms with European management now face coordination risk from their own executives triggering state intervention.

AI Image of the Day

Prompt:

A blonde girl with model-like appearance is standing sideways; she is wearing wireless Apple AirPods Max headphones, gray.

🧰 AI Toolbox

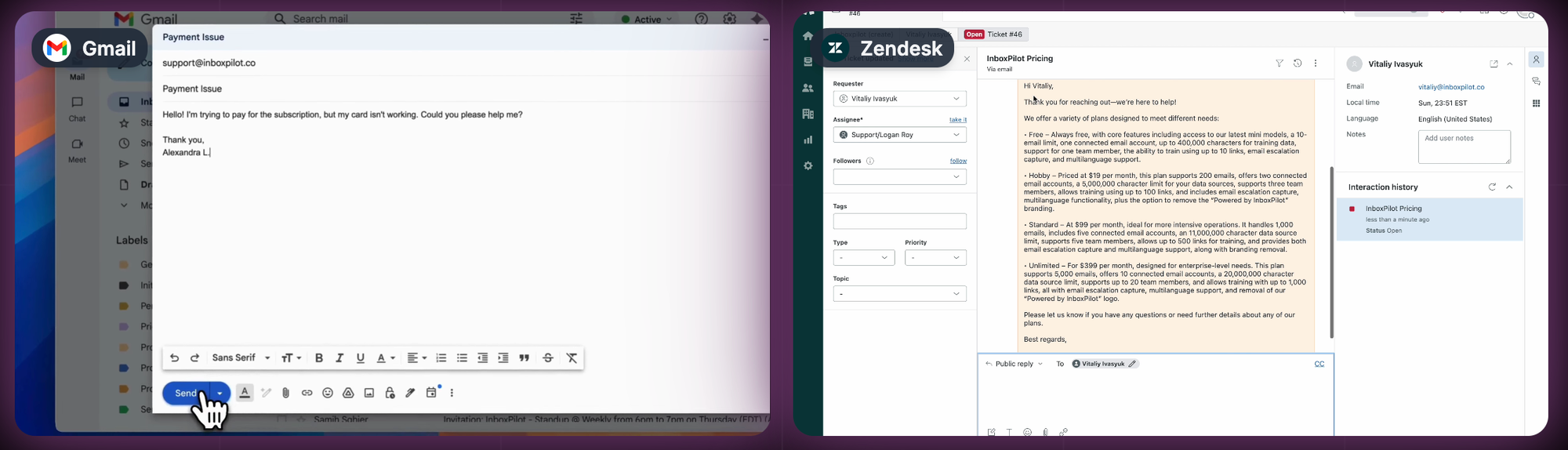

How to Automate Your Customer Support Emails

InboxPilot automates email responses for customer support by connecting to your Gmail, Outlook, or Zendesk account. It learns from your company data to draft or send personalized replies 24/7, handling high-volume inboxes while escalating complex issues to your team.

Tutorial:

- Go to the InboxPilot website

- Create an account and connect your email service (Gmail, Outlook, or Zendesk)

- Upload your company data (website, FAQs, past emails, or documents)

- The AI trains on your data to match your brand voice

- Choose draft mode (review before sending) or auto-send mode

- The AI responds to customer emails instantly with personalized answers

- Complex inquiries get flagged for your team to handle personally

URL: https://www.inboxpilot.co/

Better prompting...

Today: Daily priorities

Rank these tasks by priority: [paste tasks here]

Context: You have one workday—about 8 hours. You won't finish everything.

What I need:

- Order the tasks from most to least important

- Explain why the top 3-5 should go first

- Note if any can wait or be dropped

Focus on impact and urgency, not just what's easiest.

Tech billionaires turned on Biden when cheap money dried up

Jacob Silverman's Gilded Rage argues Silicon Valley's Trump embrace wasn't ideological. It was transactional.

Musk, Andreessen, Thiel, and Sacks turned right when zero-interest rates ended in 2022 and they faced mild FTC enforcement for the first time in a decade. The radicalization followed constraints, not convictions.

Under Biden, tech flourished. Schmidt's drones operated in Ukraine. Anduril secured defense contracts. AI development faced minimal limits. The actual friction? Lina Khan brought antitrust cases. Interest rates rose. Andreessen complained about an unrealized gains tax affecting only billionaires—never implemented. The complaints were material. The volume was cultural.

Saudi Arabia provided the template. The kingdom became Twitter's largest outside shareholder at 5.2%, poured $3.5 billion into Uber, and ran a spy ring inside Twitter tracking dissidents. When Musk bought the platform, Prince Alwaleed rolled his $1.89 billion stake into the new entity. Andreessen Horowitz negotiated a $40 billion AI fund with Riyadh while gushing about the Crown Prince as "a founder."

Why this matters:

• Tech's rightward shift reflects wealth defending itself through political capture, not ideological awakening or grassroots conservatism.

• Saudi partnerships normalized authoritarian governance that billionaires now impose domestically—exit strategies, charter cities, sovereignty without democratic oversight.

AI & Tech News

Three Economists Win Nobel Prize for Innovation Research

The 2025 Nobel Prize in Economics has been awarded to Joel Mokyr, Philippe Aghion, and Peter Howitt for their groundbreaking research on how innovation and technological progress drive economic growth. The economists were recognized for demonstrating that society must carefully monitor and understand the factors that generate technological advancement to sustain long-term economic development.

Benioff calls for National Guard in San Francisco from private plane

Salesforce CEO Marc Benioff called for National Guard troops to patrol San Francisco during a New York Times interview from his private plane, expressing support for Trump days before Dreamforce brings 45,000 visitors to the city. His public approach—mentioning Windsor Castle dinners with Trump and sharing photos with Musk—differs from the quieter accommodation strategies used by Cook and Altman, who also have significant federal contract exposure.

Slack Testing AI-Powered Slackbot Assistant for 2025 Launch

Slack is currently testing an upgraded, AI-powered version of its Slackbot that will function as a personalized assistant capable of creating plans, scheduling meetings, and finding files. The enhanced bot will operate through Amazon Web Services' virtual private cloud infrastructure and is expected to roll out to users by the end of 2025.

ClaimSorted Raises $13.3M to Accelerate Insurance Claims with AI Technology

New York and London-based insurtech startup ClaimSorted has raised $13.3 million in seed funding led by Atomico to expand its AI-powered insurance claims processing platform. The company, which currently works with over 20 insurers, aims to address the notoriously slow and cumbersome insurance claims settlement process through artificial intelligence technology.

Amazon Maintains Holiday Hiring at 250,000 Workers for 2025

Amazon plans to hire 250,000 seasonal workers for the 2025 holiday season, maintaining the same hiring target as the previous two years. The positions will include both full-time and part-time roles with an average hourly wage of $19, as the company prepares for its peak shopping period.

Parisians Protest Shein's New Paris Store Opening

Parisians and staff from the BHV Marais department store are protesting against Chinese fast-fashion retailer Shein's plan to open a 1,000-square-meter physical store scheduled to launch November 1. The protests occur as the French government actively works to limit Shein's presence and influence in the country, reflecting growing concerns about the online retailer's expansion into traditional retail spaces.

Wayve Seeks $8B Valuation in Major Funding Round

London-based autonomous driving technology startup Wayve is in early-stage discussions with Microsoft and SoftBank to raise between $1 billion and $2 billion in funding, according to sources familiar with the matter. The funding round would value the self-driving tech company at approximately $8 billion, reflecting strong investor appetite for fast-growing artificial intelligence startups in the autonomous vehicle sector.

Germany's "Shark Tank" investor brings €175M contrarian bet to Valley

Carsten Maschmeyer closed a €175 million growth fund and opened a South Park office with a blunt thesis: AI winners get defined by contracted savings, not clever demos.

The German billionaire—household name at home, anonymous here—runs three vehicles spanning pre-seed to Series A. He spends first weeks post-deal inside portfolio sales huddles doing objection handling and pipeline hygiene. That's unusual for a TV investor. It's also practical.

His portfolio leans where AI already has budget: call-center tooling, legal synthesis, data-center power optimization. Thin "wrapper" plays that live on other people's models won't hold pricing power once procurement compares costs.

Alstin III writes €2–€7 million Series A checks; seed+speed does €750k–€1.5M initials. Combined deployment runs €30–€50 million yearly in new deals before reserves.

His policy critique bites: Europe's regulating the platform wave while underfunding compute, power, and talent. Germany's nuclear phase-out lifted industrial costs and dented planning certainty.

Why this matters:

• Enterprise AI returns will track contracted cost reductions more than model novelty—procurement beats demos when budgets tighten.

• Europe's competitiveness hinges on permitting speed and option policy as much as chip capacity—time compounds faster than regulation protects.

🚀 AI Profiles: The Companies Defining Tomorrow

Wayve

Wayve builds AI brains for cars that learn to drive without maps. The London startup wants to license its end-to-end neural network to automakers tired of the HD-mapping treadmill.

The founders

Alex Kendall and Amar Shah launched Wayve in 2017 out of Cambridge, betting that one big neural network could replace the brittle rule-books plaguing autonomous driving. The UK became their test track—if the model survives London's double-parked vans and jaywalking tourists, it can handle anywhere. Team's grown to power a global AI-500 city roadshow in 2025.

The product

AI Driver is software that fuses perception, prediction, and control into one learning system. Strengths: generalizes fast to new cities without fresh maps, runs on cheaper sensors, updates over the air. The stack includes GAIA (generative world model for simulation) and LINGO-1 (vision-language model for explainability). Nissan signed up for FY2027 integration. 🚗

The competition

Waymo runs robotaxis in three US cities with maps and maturity. Zoox deploys custom bi-directional pods in Vegas. Mobileye ships ADAS at scale through Tier-1 channels. Tesla's FSD learns end-to-end but stays in-house. Wayve's angle: license a mapless brain to multiple OEMs instead of burning capital on fleet ops.

Financing

SoftBank led the $1.05B Series C (May 2024). Microsoft and NVIDIA are in, supplying Azure compute and silicon muscle. Now in talks for another $1–2B at an $8B valuation. NVIDIA floated a $500M letter of intent. Eclipse Ventures backed the early rounds.

The future ⭐⭐⭐⭐

Wayve has capital, cloud partnerships, and a production deal with Nissan. If the model proves safe at scale and generalizes like promised, it's positioned to ride the OEM autonomy wave. Risk: regulators tighten after every headline crash, and sensor costs must drop. But London to Yokohama in one model? That's the bet. 🌍