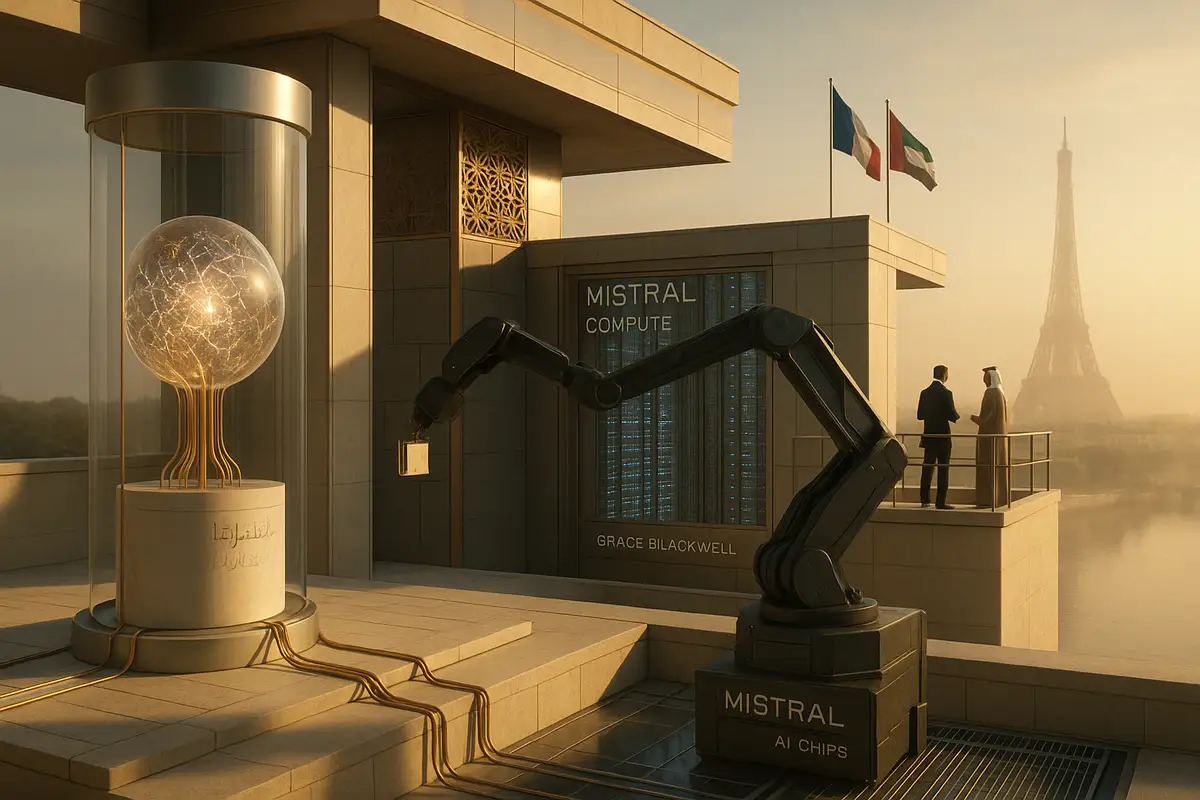

Greenlight unlocks billions for local compute—and a playbook for “trusted” infrastructure deals.

Microsoft says it won a September license to ship Nvidia’s most advanced AI chips to the United Arab Emirates, removing the block that had capped its Gulf build-out. The approval sits inside Microsoft’s detailed $15.2 billion UAE plan, pairing new data centers with skills programs and strict security obligations. One license, many consequences.

The Breakdown

• September license covers 60,400 A100-equivalent GB300 chips, nearly tripling Microsoft's UAE footprint to 81,900 total accelerators

• Forward investment 2026-2029 totals $7.9B: $5.5B capital for infrastructure, $2.4B operating costs and local hiring

• UAE leads global AI adoption at 59.4%, creating sustained demand that justifies local capacity and drives feedback loop

• Access requires binding IGAA framework with ongoing audits, converting private cloud operations into instruments of interstate cooperation

What’s actually new

This is the first advanced-chip export license to the UAE under the current administration, according to Microsoft. It builds on earlier approvals that let the company assemble the equivalent of 21,500 Nvidia A100-class GPUs already running in country. The new license covers Nvidia’s GB300 generation—capacity equal to 60,400 A100s—which would nearly triple the installed footprint. That is a big jump.

The company frames its 2023–2029 commitment at $15.2 billion. Roughly $7.3 billion has already gone into the UAE effort. Microsoft plans another $7.9 billion between 2026 and 2029, with most of it aimed at new AI and cloud sites. Brad Smith outlined the plan in Abu Dhabi during this week’s energy-and-tech gatherings. The venue was the message.

The deal mechanics

Access comes with oversight. The Commerce Department conditions cover cybersecurity, physical security, export controls, and technology transfer, with compliance baked into Microsoft’s operating playbook. In parallel, Microsoft and G42 signed an Intergovernmental Assurance Agreement in 2024—a binding framework shaped with input from Washington and Abu Dhabi—that forces rigorous controls on data handling, customer vetting, and model access. Audits are ongoing. That’s unusual for a private cloud build.

The bargain is explicit: privileged chips in exchange for verifiable guardrails. It formalizes trust.

Why the UAE—and why now

Demand is already there. Microsoft’s own diffusion data puts the UAE at 59.4% generative-AI usage among working-age adults, ahead of Singapore at 58.6%. No other country tops 50%. At that scale, shaving milliseconds of latency matters for retention and cost. Proximity helps.

Local rules matter too. Data-localization requirements in public services and finance push compute closer to ministries and banks. Add aggressive skills programs—government workers, students, and teachers are being trained at pace—and you get a flywheel: high usage justifies local capacity, which improves service quality, which drives even higher usage. It’s a feedback loop. And it’s working here.

The export-control calculus

For Washington, the UAE is a test of whether “trusted” capacity can extend beyond the Five Eyes while keeping pressure on China. Export controls on top-tier accelerators now decide who can build frontier-grade AI and who cannot. Allowing GB300 shipments to Abu Dhabi while maintaining curbs on Chinese entities draws a bright line without naming names. That’s policy by allocation.

The bar is high by design. Meeting custody, telemetry, and transfer rules is expensive and operationally heavy. Microsoft cleared it; many peers cannot or will not. Scarcity amplifies leverage. That is the point.

Concentration—and lock-in

The bigger picture holds. Most compute still sits in the United States and China, and only a few countries have produced frontier-level models. The leaders are closing the performance gap, but concrete growth is slow, capital-intensive, and constrained by permits and power. Steel and substations take time.

Once a government adopts an IGAA-style framework and a provider commits billions, switching stacks becomes costly. Microsoft’s forward plan aligns the UAE with U.S. chips, clouds, and standards through the decade. The template is portable. Expect similar offers in other regions that want advanced GPUs without breaching U.S. controls.

Risks and open questions

First-of-kind governance will get stress-tested. The audit cadence, physical security specs, and export-control safeguards have not operated at this scale while meeting commercial SLAs. Power is a constraint as GPU density rises; water and grid reliability trail close behind. Supply chains for accelerators remain tight and politicized.

Politics can shift, too. A change in Washington’s posture—or an incident that raises diversion concerns—could slow renewals or add new conditions mid-stream. The same oversight that unlocked chips can pause them. That risk is priced in.

The strategic bet

For Microsoft, the UAE is both a high-utilization market and a proof point that aligned infrastructure can compete with Chinese alternatives in the Global South. For Abu Dhabi, the trade is sovereignty through compliance: accept unprecedented oversight now to secure durable access to compute, skills, and models later. It’s a wager on rules. Uptime will decide.

Why this matters

- Export licenses are becoming diplomatic tools, binding cloud build-outs to shared security rules and creating de facto AI alliances.

- Countries that accept IGAA-style terms gain first-rank chips but surrender flexibility; after billions are sunk, switching stacks is costly.

❓ Frequently Asked Questions

Q: What is G42 and why does it keep appearing in this story?

A: G42 is the UAE's sovereign AI company, backed by Abu Dhabi's government and focused on building Arabic-language models and regional AI infrastructure. Microsoft bought a $1.5 billion stake in April 2024 and co-signed the IGAA framework with them. G42 operates as the local partner that makes Microsoft's UAE presence politically acceptable to both Washington and Abu Dhabi.

Q: What does the IGAA actually require Microsoft to do?

A: The Intergovernmental Assurance Agreement sets binding standards for cybersecurity, physical security of data centers, export control enforcement, technology transfer restrictions, data protection, and customer verification (know-your-customer) practices. Both Microsoft and G42 submit to ongoing audits by entities from the US and UAE governments, giving both countries visibility into operations that would normally be private corporate matters.

Q: Why does the UAE have the world's highest AI adoption rate?

A: Three factors converge: widespread English proficiency eliminates the language barrier that limits adoption elsewhere, concentrated government investment in digital skills (120,000 government workers and 175,000 students trained in the past year), and top-tier internet infrastructure. The UAE also benefits from high GDP per capita, which correlates strongly with AI adoption across all countries Microsoft studied.

Q: Can other countries get similar chip export deals?

A: Yes, if they meet Washington's requirements. The IGAA creates a template that can be replicated elsewhere. Countries need strong diplomatic relationships with the US, willingness to accept ongoing government audits of private infrastructure, and ability to enforce cybersecurity and export control standards. The UAE qualified; most countries cannot or will not accept these terms.

Q: What makes GB300 chips different from the A100s Microsoft already has in the UAE?

A: GB300s are Nvidia's latest generation, offering roughly 3-4x the performance per chip for AI inference tasks compared to A100s. Microsoft uses "A100-equivalent" as a common measuring unit: the 60,400 A100-equivalent GB300s they're approved to ship represent far fewer physical chips than 60,400 actual A100s would be, but deliver comparable or better total computing capacity.