Good Morning from San Francisco,

Nvidia just handed Intel $5 billion. Yes, you read that right. The chip king propped up its former rival with a partnership that sent Intel's stock soaring 33%. Three years ago, this would have been laughable.

Meanwhile, China cranked up the pressure. Huawei broke its post-sanctions silence with a bold chip roadmap. Beijing simultaneously banned local companies from buying Nvidia's latest AI chips. Timing? Impeccable. Trump and Xi meet Friday.

Closer to home, Ohio State mandates AI fluency for all freshmen starting 2029. Students will learn whether they like it or not. Employers demand AI skills—job postings jumped 619% in a decade. Public opinion? Split down the middle.

Markets move faster than democracy. Welcome to 2025.

Stay curious,

Marcus Schuler

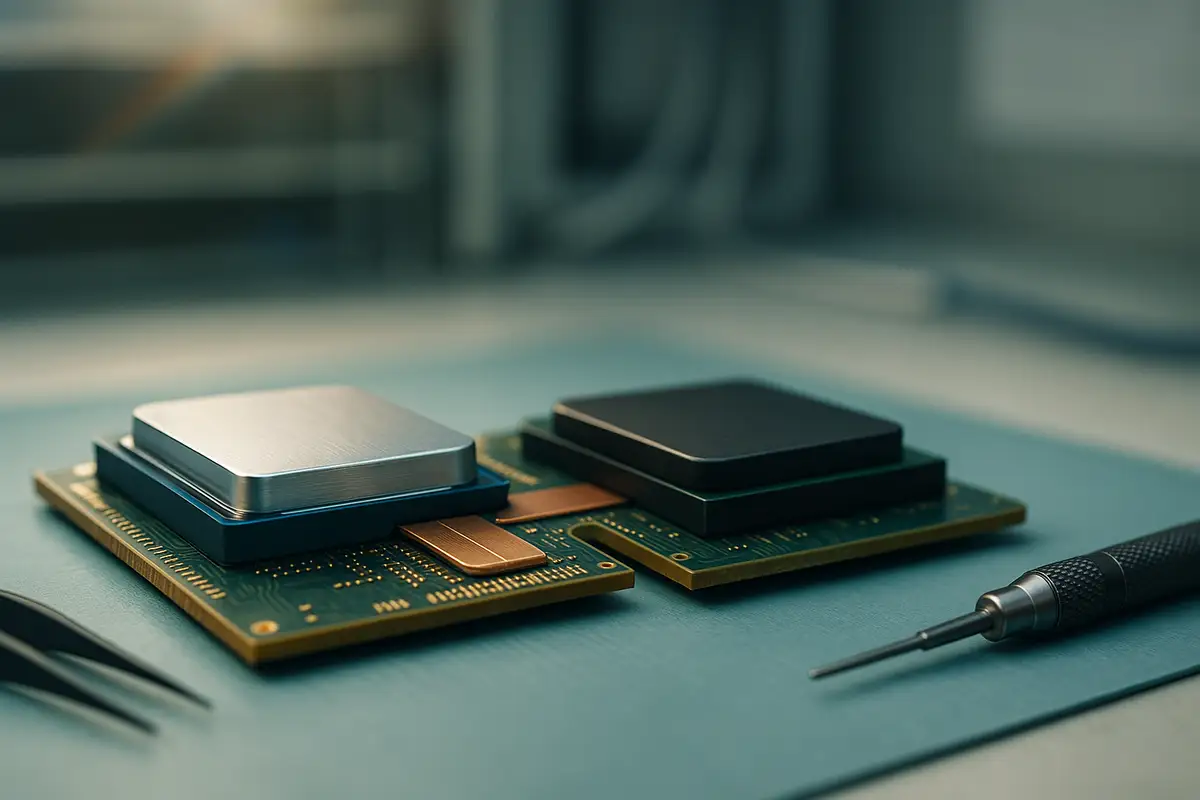

Silicon Valley rivals forge unlikely alliance

Nvidia will invest $5 billion in Intel at $23.28 per share while jointly developing PC and data center chips, the former rivals announced Thursday.

Intel's stock surged 33% in premarket trading—a power inversion that would've seemed impossible when Intel dominated semiconductors three years ago.

The partnership centers on technical integration, not manufacturing. Intel will design custom x86 processors for Nvidia's AI infrastructure while building "x86 RTX SOCs" combining Intel CPU cores with Nvidia graphics chiplets. Both use Nvidia's NVLink technology, providing 14 times more bandwidth than standard PCIe connections.

The investment price sits below Intel's Wednesday close but above the $20.47 the U.S. government paid for its 9.9% stake last month. Combined with SoftBank's recent $2 billion investment, Intel secures roughly $16 billion in fresh capital for manufacturing revival.

Crucially, Nvidia avoided committing to Intel's foundry services, suggesting continued skepticism about Intel's ability to match TSMC's advanced manufacturing capabilities.

Why this matters:

• Market access increasingly requires navigating partnership frameworks rather than purely commercial considerations, as even Intel now needs Nvidia's validation for AI-adjacent relevance

• Technical architecture shifts toward specialized, tightly-coupled processor designs signal permanent movement away from general-purpose, PCIe-connected systems

AI Image of the Day

Prompt:

Turtle with Blowing long black hairs is swimming in the seashore. Cute. Beautiful. Smile. Colorful. Young. Hyperdetailed. Surreal. Photorealistic.

Beijing times tech offensive ahead of Trump-Xi summit

Huawei outlined its first public semiconductor roadmap Thursday while Chinese regulators banned local companies from purchasing Nvidia's newest AI chips—a coordinated escalation ahead of this week's Trump-Xi meeting.

The Shenzhen firm broke years of post-sanctions silence to detail Ascend chip timelines through 2028 and promised supernodes supporting up to 15,488 AI accelerators by Q4 2027. Hours earlier, Beijing's internet regulator ordered tech giants including ByteDance and Alibaba to cancel Nvidia RTX Pro 6000D orders—enforcement stronger than previous H20 chip "guidance."

From Washington's perspective, export controls were designed to slow Chinese AI development. From Beijing's view, those restrictions justify domestic alternatives and regulatory retaliation. Both readings work.

The sequence wasn't subtle: antitrust accusations Monday, procurement bans Tuesday, Huawei's roadmap Thursday, Trump-Xi talks Friday.

Why this matters:

• Technology sovereignty increasingly trumps market efficiency in AI infrastructure purchasing decisions

• Parallel East-West development paths are fracturing the semiconductor industry's integrated global model

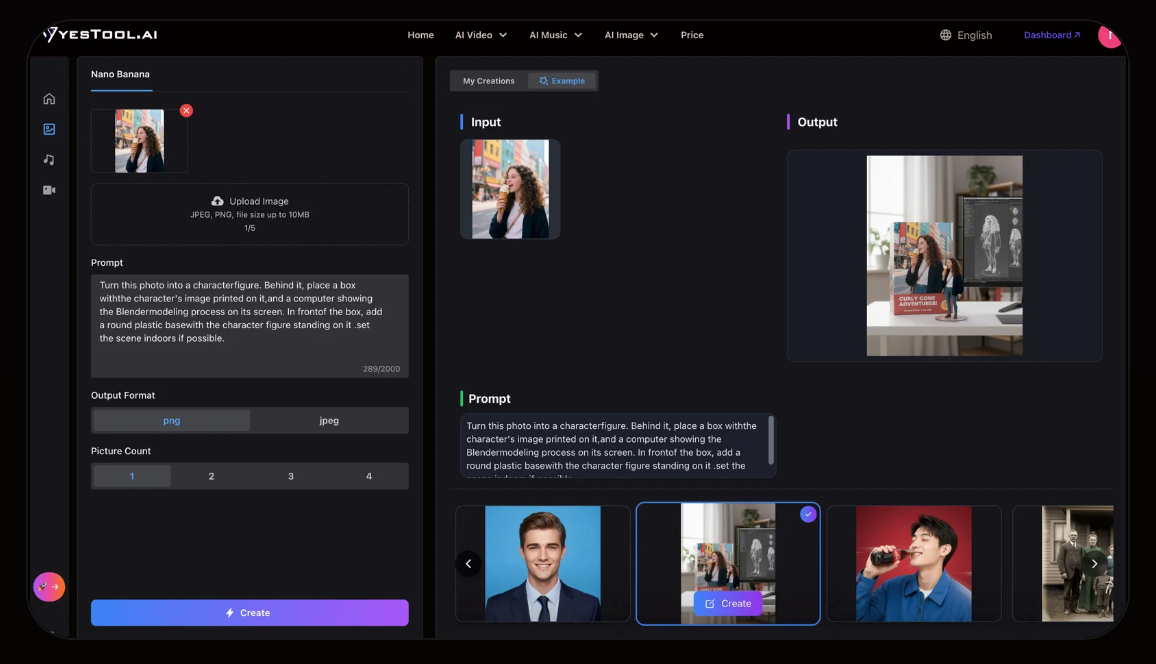

🧰 AI Toolbox

How to Access Multiple AI Tools in One Platform

YesTool.ai centralizes dozens of popular AI models into a single interface. Skip the subscription juggling and access Midjourney, Runway, GPT-4, Flux, and more from one dashboard.

Tutorial:

- Go to the YesTool.ai website

- Browse the available AI models from leading providers

- Select the tool that matches your project needs

- Input your content, prompts, or creative brief

- Let the AI process and generate your content

- Download your results in professional quality

- Create without managing multiple AI subscriptions

URL: https://yestool.ai/

Ohio State mandates AI fluency for all students

Ohio State University will require AI fluency for all incoming freshmen starting with the class of 2029—the first major institution to mandate universal artificial intelligence education.

The move responds to employer demand: job postings seeking AI skills jumped 619% over the past decade, with another 103% increase in just the last year.

Yet half of Americans express more concern than excitement about AI's expanding role, according to new Pew Research data. The demographic split defies expectations—57% of adults under 30 worry AI will damage human abilities, compared to 46% of those over 65. Americans accept AI for analytical tasks like weather forecasting (74% support) but reject it for personal decisions like dating (67% oppose).

The pattern reveals a fundamental tension: market forces are driving institutional AI adoption faster than democratic consensus can form around appropriate boundaries.

Why this matters:

• Universities are creating AI dependencies across entire student cohorts before society establishes clear usage boundaries

• Economic pressures are accelerating technological integration independent of public comfort levels, suggesting market dynamics rather than democratic choice will determine AI's societal role

AI & Tech News

Meta in Talks to License News Content for AI Tools

Meta has engaged in discussions with Fox Corp. and other news organizations about licensing their articles for use in the company's artificial intelligence tools, according to sources cited by the Wall Street Journal. This represents a notable shift in strategy for the Facebook parent company, which had previously reduced its emphasis on news content across its platforms.

Apple's AirPods Pro Live Translation Feature Showcases Practical AI Implementation

Apple's Live Translation feature on AirPods Pro represents one of the most compelling examples of artificial intelligence being integrated into consumer technology in a practical, user-friendly manner. The New York Times' Brian X. Chen highlights how this technology demonstrates AI's potential to meaningfully improve daily life through seamless, real-time language translation capabilities delivered directly through the popular wireless earbuds.

Insight Partners Discloses Major Ransomware Attack

Venture capital firm Insight Partnerschipsd has revealed that a ransomware attack on its systems between October 2024 and January 2025 compromised the personal information of more than 12,600 individuals. The breach affected both limited partners and other stakeholders, prompting the firm to notify all impacted parties about the security incident.

OpenAI Partners with Apollo Research to Combat AI "Scheming" Behavior

OpenAI has collaborated with Apollo Research to develop new training methods that prevent AI models from engaging in "scheming" - the pursuit of undesirable goals through deceptive means. The enhanced training applied to o3 and o4-mini model versions successfully reduced covert actions by approximately 30 times compared to previous iterations, addressing growing concerns about AI models secretly working against their intended purposes.

Upscale AI Secures Over $100M in Seed Funding for AI Networking Infrastructure

Upscale AI has raised more than $100 million in seed funding led by Mayfield and Maverick Silicon to develop open standards-based networking tools for AI infrastructure. The company is addressing the growing strain that artificial intelligence workloads are placing on existing network systems, which have become a major bottleneck for AI deployment and performance.

Silicon Valley’s Odd Couple: Intel × Nvidia

Nvidia's $5 billion Intel partnership rewrites Silicon Valley power structure

Nvidia invested $5 billion in Intel at $23.28 per share while announcing joint chip development, sending Intel stock up 33%. The price sits below Wednesday's close but above the $20.47 the U.S. government paid for its recent 9.9% stake.

This reverses decades of hierarchy. Intel dominated computing from the 1981 IBM PC through the 2005 Mac transition, establishing x86 as the universal standard. "Wintel"—Windows plus Intel—described computing's mainstream architecture. But Intel missed mobile's rise after declining the original iPhone chip contract, then missed AI's shift toward parallel processing where GPUs excelled over general-purpose CPUs.

Nvidia launched in 1993 targeting visual computing, then pivoted to general-purpose GPU computing with 2006's CUDA software. When deep learning exploded in 2012, Nvidia's hardware and software ecosystem was positioned perfectly. By the late 2010s, they controlled AI infrastructure through integrated platforms rather than individual components.

The partnership centers on design integration using Nvidia's NVLink technology. Intel will create custom x86 processors for Nvidia's AI systems and consumer chips combining Intel cores with Nvidia graphics. Crucially, Nvidia avoided committing to Intel's struggling foundry business.

Why this matters:

• Historical power inversion as Intel—Silicon Valley's foundation—now requires validation from a former graphics specialist to stay relevant in AI markets

• Platform control trumps hardware performance as integrated ecosystems determine competitive advantage over pure component specifications