Sam Altman posted on X that OpenAI expects $20 billion in annual revenue by year's end and "hundreds of billions by 2030." Three days earlier, his CFO had suggested the government should "backstop" the company's infrastructure loans. She later claimed to have misspoken. A week before that, OpenAI's chief global affairs officer had sent a letter to the White House requesting tax credits originally designed for semiconductor fabs be expanded to cover AI data centers, server manufacturers, and electrical transformers.

The company says it has committed $1.4 trillion in capital expenditures over the next eight years. For context, that figure exceeds the annual GDP of Mexico. It represents roughly 5% of total US GDP spent by a single startup building the computational infrastructure to train increasingly large language models.

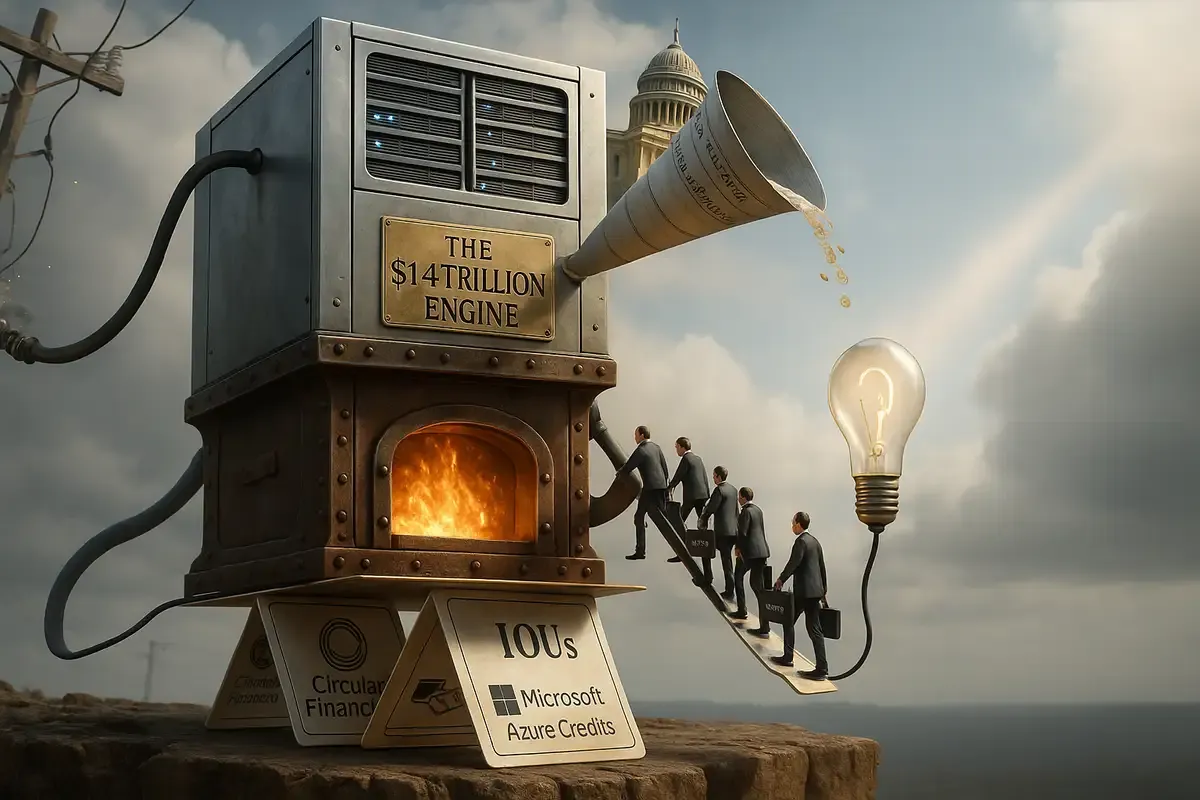

Either OpenAI has identified a path to returns that justifies industrial-scale public subsidy, or the company has constructed a financial architecture that requires perpetual government intervention to avoid collapse.

The Breakdown

• OpenAI committed $1.4 trillion over eight years, exceeding Mexico's annual GDP and 5% of US GDP

• Company lobbies to expand CHIPS Act tax credits to AI data centers while claiming it wants no government bailouts

• The bottleneck shifted from chip supply to power infrastructure with 18-24 month transformer lead times

• Circular financing with Microsoft, Oracle, and Softbank creates structure requiring continuous growth to avoid unwinding

The Infrastructure Trap

OpenAI's October 27 letter to White House science policy director Michael Kratsios reveals the structural bind. The Advanced Manufacturing Investment Credit currently offers a 35% tax rebate for semiconductor manufacturing investments. OpenAI wants that expanded to AI data centers, AI server production, and critical grid components including high-voltage transformers and the specialized electrical steel used to manufacture them.

The request acknowledges something OpenAI hasn't stated plainly elsewhere: the bottleneck is no longer chip supply. The constraint is power infrastructure with lead times measured in years, not quarters. A modern AI training cluster consumes more electricity than a small city. The transformers needed to deliver that power take 18 to 24 months to manufacture. The steel for those transformers comes from a supply chain that China dominates, according to OpenAI's letter.

This is not a software problem with software economics. OpenAI has backed into running what amounts to a utility-scale infrastructure buildout while trying to maintain the valuation multiples of a technology company. The AMIC expansion request essentially asks the government to reclassify AI data centers as strategic manufacturing, putting racks of Nvidia GPUs in the same policy category as TSMC's Arizona fab.

The distinction matters because semiconductor fabs produce a commodity the entire economy needs. An OpenAI data center produces compute capacity that primarily serves OpenAI's models. Expanding the tax credit would socialize the capital risk while the revenue stays private.

The Messaging Disaster

Sarah Friar's November 6 comments at a Wall Street Journal event set off the crisis. She suggested the government should "backstop the guarantee that allows the financing to happen." The phrasing was careful, ambiguous enough to mean either direct loan guarantees or broader infrastructure support.

The reaction was immediate and hostile. David Sacks, the White House AI czar, posted flatly: "There will be no federal bailout for AI." Republican governors and Democratic senators both signaled opposition to what sounded like socializing OpenAI's risk.

Friar walked it back on LinkedIn, claiming she had "misspoken" and that OpenAI was not seeking government backstops. Altman followed with a 15-paragraph post emphasizing OpenAI neither has nor wants government guarantees for data centers. He framed any government role as focused on semiconductor manufacturing and domestic chip supply chains, not underwriting OpenAI's infrastructure debt.

The problem is that OpenAI's October 27 letter explicitly discusses loan guarantees, grants, and cost-sharing agreements for manufacturers in the AI supply chain. The letter advocates for direct federal funding to "help shorten lead times for critical grid components" from years to months. It proposes that the government create strategic reserves of copper, aluminum, and rare earth materials needed for AI infrastructure.

This is not a semantic dispute. Either OpenAI wants direct federal financial support for its buildout, or it wants tax incentives that reduce the effective cost of that buildout by 35%. Both involve government money. The distinction between a loan guarantee and a tax credit is meaningful for accounting purposes but less so for public perception when a startup is requesting subsidies exceeding many countries' annual budgets.

The Circular Financing Problem

Bloomberg noted in passing that OpenAI's spending plans have "drawn scrutiny as the unprofitable startup pursues creative financing arrangements, including deals that have been criticized for being circular." This deserves expansion.

OpenAI has announced partnerships with Oracle, Softbank, and Microsoft involving data center construction and GPU procurement. Many of these deals involve OpenAI committing to buy compute capacity from infrastructure it helped finance, using revenue from products hosted on that same infrastructure. Microsoft invests in OpenAI, provides the Azure capacity OpenAI trains on, and takes a share of OpenAI's revenue from ChatGPT and API sales.

This works until it doesn't. Growth covers a multitude of structural problems. What happens when customer acquisition costs rise faster than revenue? What happens if GPT-5 trains for eight months and shows marginal improvement over GPT-4? The circular arrangements start looking less like sophisticated financial engineering and more like a house of cards where every player is simultaneously creditor and debtor.

That's when federal support stops being a policy preference and becomes a bailout. OpenAI is effectively telling Washington: we've committed to infrastructure spend that exceeds our ability to finance privately, but the national interest requires this buildout to happen anyway.

Historical Precedents Offer Little Comfort

There aren't many useful comparisons for a startup committing $1.4 trillion in infrastructure spending. The scale demands looking at sovereign projects, not venture-backed companies.

China's Belt and Road Initiative has deployed roughly $1 trillion since 2013 across 150 countries. Beijing accepted that returns would arrive in decades, not quarterly earnings calls. The US interstate highway system cost $530 billion in inflation-adjusted terms and took 35 years to complete. Both were explicitly government projects with public-good justifications that didn't require proving market viability first.

OpenAI is attempting something closer to SpaceX's Starlink, but with capital requirements an order of magnitude larger and a less defined customer base. Starlink works because rural broadband has clear demand and measurable willingness to pay. OpenAI's bet assumes continuous exponential improvement in model capabilities, sustained enterprise appetite for AI services, and margins high enough to cover infrastructure costs that now include upgrading regional power grids.

Break any one of those assumptions and the math stops working. The urgency of the AMIC lobbying suggests OpenAI's leadership has run the numbers and seen the gap.

Three Possible Futures

The optimistic case has OpenAI hitting its revenue projections. The company reaches $20 billion in annual revenue by December and maintains growth rates that retrospectively justify the infrastructure commitments. The AMIC expansion passes, cutting costs across the AI hardware stack. OpenAI threads the needle from startup to industrial operator, and five years from now the government tax credits look like smart policy that helped the US lock in AI leadership.

The muddle-through version is more interesting. Revenue grows but falls short of projections. OpenAI quietly walks back the $1.4 trillion figure through a series of restructurings that don't trigger headlines. The company focuses on monetizing existing models rather than training progressively larger ones. Microsoft's ownership stake increases through a combination of negotiated equity and distressed-asset positioning. Some hybrid of tax credits and direct Microsoft subsidy keeps the core business alive. The AI industry collectively discovers that foundation model development has natural limits, and the next breakthroughs come from application layer companies working with existing base models.

The collapse case writes itself. Models plateau. Enterprise AI adoption proves narrower than projected. OpenAI cannot service its infrastructure commitments. The circular financing unwinds in ways that expose how much of the company's apparent health depended on everyone simultaneously pretending the emperor wore clothes. Microsoft absorbs OpenAI in a merger that wipes out other investors. Or Washington steps in explicitly, nationalizing the technology while preserving operations. Or bankruptcy, with key researchers scattering to Anthropic, Google, and well-funded startups that learned from OpenAI's mistakes.

The tell is in the lobbying strategy versus the public messaging. Altman projects confidence and hockey-stick growth. His policy team asks for industrial support designed for manufacturers who need help surviving the valley of death before reaching profitability. Companies with sustainable models don't typically need CHIPS Act interventions before they've proven the market exists.

OpenAI has built a machine that requires everything to work perfectly, continuously, for years. Software companies have room for error. Infrastructure businesses do not. The $1.4 trillion commitment was either a negotiating position to extract government support, or a genuine projection that OpenAI now realizes exceeds what private markets will finance at terms the company can sustain.

The collapse question is no longer hypothetical. It's a matter of which direction the music stops, and whether Washington decides catching OpenAI counts as industrial policy or corporate welfare.

Why This Matters

For Microsoft (next 18 months): The company has $13 billion invested and provides OpenAI's cloud infrastructure. If OpenAI cannot reach profitability or service its commitments, Microsoft faces either absorbing the company in a forced merger or writing down the investment. The Azure partnership that looked strategic in 2023 could become a liability requiring billion-dollar restructuring decisions by mid-2026.

For Congress (6-12 months): The AMIC expansion request forces a choice between industrial policy and corporate welfare. Approving it sets precedent that any company calling itself "strategic" can claim semiconductor-style subsidies. Rejecting it signals limits to government AI support, but risks ceding infrastructure leadership if China subsidizes equivalents. The decision will define America's AI industrial strategy before the 2026 midterms.

For enterprise developers (immediate): Companies building products on OpenAI's APIs face platform risk. If OpenAI's financing structure forces pricing changes or service degradation, products built exclusively on GPT-4 become vulnerable. Smart teams are already maintaining fallback integrations with Anthropic or Google. The next 12 months will show whether vendor lock-in to OpenAI was brilliant or reckless.

For AI startups and investors (2-3 years): OpenAI's trajectory determines whether foundation model development is a viable business or requires permanent subsidy. If OpenAI needs government support despite ChatGPT's dominance, it signals that competing foundation models cannot reach profitability at any realistic scale. That makes Anthropic, Cohere, and similar companies acquisition targets rather than independent businesses. It also means the next generation of AI companies will focus on applications, not base models.

❓ Frequently Asked Questions

Q: What is the CHIPS Act tax credit OpenAI wants expanded?

A: The Advanced Manufacturing Investment Credit (AMIC) currently gives semiconductor manufacturers a 35% tax rebate on fab construction and equipment. It was increased from 25% to 35% in July 2025. OpenAI wants it expanded to cover AI data centers, server production, and electrical grid components like transformers. This would effectively reduce OpenAI's infrastructure costs by over $450 billion on their $1.4 trillion commitment.

Q: How does OpenAI currently make money?

A: OpenAI generates revenue through ChatGPT subscriptions ($20/month for Plus, $200/month for Pro) and API access where developers pay per token to use GPT-4 and other models. The company projects $20 billion in annual revenue by end of 2025, but remains unprofitable due to massive compute costs. Each ChatGPT query costs OpenAI roughly 4 cents in infrastructure expenses.

Q: What does "circular financing" mean in OpenAI's case?

A: OpenAI commits to buying compute capacity from data centers it helped finance, using revenue from products running on that same infrastructure. Microsoft invests in OpenAI, provides Azure cloud capacity for training, and takes a percentage of ChatGPT revenue. The arrangement works during growth but becomes fragile if revenue slows, since every partner is simultaneously creditor and customer.

Q: How much electricity does an AI training cluster actually need?

A: Modern AI training clusters consume 100-300 megawatts continuously, equivalent to powering 75,000-225,000 homes. Meta's planned AI data centers will each use 1 gigawatt. The high-voltage transformers needed to deliver this power take 18-24 months to manufacture, creating bottlenecks. Training GPT-4 consumed roughly 50 gigawatt-hours, enough to power 4,500 US homes for a year.

Q: Who owns OpenAI and what's Microsoft's stake?

A: OpenAI operates as a capped-profit company controlled by a nonprofit board. Microsoft invested $13 billion and holds roughly 49% of the for-profit subsidiary, with rights to 75% of profits until receiving a specific return. Other investors include Thrive Capital, Khosla Ventures, and employees. The nonprofit board retains ultimate control and can override commercial interests, as demonstrated when they briefly fired Sam Altman in November 2023.