SpaceX Eats xAI. OpenAI Eats Cash. Apple Reads Faces.

SpaceX and xAI merge ahead of $1.5T IPO. OpenAI raises $100B at $830B valuation. Apple pays $2B for silent speech tech startup Q.AI.

SpaceX and xAI merge ahead of $1.5T IPO. OpenAI raises $100B at $830B valuation. Apple pays $2B for silent speech tech startup Q.AI.

San Francisco | Friday, January 30, 2026

Elon Musk filed two shell companies in Nevada nine days before Reuters confirmed SpaceX and xAI are merging ahead of the largest IPO in history. The pitch: orbital data centers powered by solar. The reality: financial engineering at $1.5 trillion, with a $200 million Pentagon contract doing the quiet work.

Sam Altman wants $100 billion more before going public at $830 billion. His biggest investors are also his biggest vendors. The money flows in a circle, and nobody can afford to step off the ride.

Apple, meanwhile, paid $2 billion for an Israeli startup that reads your face. Silent speech recognition for future wearables. The acquisition signals Cupertino's answer to Siri's failures and Meta's smart glasses.

Stay curious,

Marcus Schuler

Two shell companies. One CFO. A $50 billion listing that would dwarf Saudi Aramco. SpaceX and xAI are merging, and the orbital data center pitch is covering for something simpler: financial engineering on a scale Wall Street has never priced.

K2 Merger Sub Inc. and K2 Merger Sub 2 LLC appeared in Nevada on January 21, both listing SpaceX CFO Bret Johnsen as an executive. Nine days later, Reuters confirmed merger talks. Under the proposed deal, xAI shares convert to SpaceX stock ahead of a summer IPO targeting $1.5 trillion.

The problem: SpaceX generated $24 billion in revenue last year. At that valuation, buyers pay 60 times revenue. Musk's answer is orbital data centers powered by solar energy. No working prototype exists. Google and Blue Origin are researching similar concepts, but neither has proposed merging their AI divisions with their launch companies to justify the math.

The quieter rationale is defense. xAI holds a $200 million Pentagon contract for Grok. SpaceX's classified Starshield satellites already run AI-powered sensors for a U.S. intelligence agency. The merged entity becomes a one-stop contractor for military AI. Pentagon contracts won't dazzle an IPO roadshow, but the revenue is real.

Ross Gerber, whose firm holds stakes in both Tesla and xAI, offered the most honest assessment: "It's like a bunch of overvalued companies merging together into one big overvalued mess run by Elon. But it's a pure play now. You want to invest in Elon? Here you go."

Why This Matters:

✅ Reality Check

What's confirmed: Two shell companies filed in Nevada list SpaceX's CFO. Reuters confirmed merger talks. xAI holds a $200 million Pentagon contract for Grok integration.

What's implied (not proven): Orbital data centers justify the merger on technical merit, not just financial engineering ahead of an IPO at 60x revenue.

What could go wrong: Absorbing xAI's cash burn and unproven AI revenue dilutes SpaceX's launch business, the one segment investors actually understand.

What to watch next: S-1 filing timeline and whether xAI's Grok revenue gets broken out separately. Polymarket puts merger odds at 48% by mid-year.

Sam Altman smiled for cameras in Seoul. His finance team was hiring the people you bring on when you're about to go public. The photo ops were for the press. The hires were for Wall Street.

OpenAI is preparing to list in Q4 2026 while closing a pre-IPO round that could exceed $100 billion. Amazon CEO Andy Jassy is personally negotiating up to $50 billion. SoftBank is discussing $30 billion. Nvidia could put in $20 billion. Microsoft, already the largest investor, is in talks for another $10 to $20 billion.

The circular dependency is the story. Three of those investors are also OpenAI's largest infrastructure providers. They sell the company chips, cloud computing, and data center capacity. When they invest, some of that money flows directly back to them as revenue. Microsoft disclosed this week that OpenAI accounts for 45 percent of its $625 billion in future contracts. Microsoft shares dropped nearly 10 percent.

OpenAI generated $13 billion in revenue last year and expects to triple that in 2026. But the company has locked in $1.4 trillion in long-term compute commitments. Anthropic projects breakeven by 2028. OpenAI says 2030. Altman himself said on a podcast in December: "Am I excited to be a public company CEO? 0%."

Why This Matters:

Apple just made its second-largest acquisition ever. The target: an Israeli startup with 100 employees that reads your face.

Apple acquired Q.AI for close to $2 billion, gaining machine learning models that track facial skin micro-movements to decode silent and whispered speech. The system uses small embedded cameras in devices like glasses or earbuds to interpret jaw, lip, and throat muscle contractions without requiring audible sound.

Q.AI founder Aviad Maizels has been here before. He sold PrimeSense to Apple in 2013 for $350 million. That technology became Face ID across more than one billion iPhones. The deal represents roughly an 80x return on Q.AI's total venture funding of $24.5 million.

Two use cases drive the acquisition. Input: users could ask Siri questions by mouthing words through AirPods on a crowded train. Audio enhancement: combining facial movement data with microphone input for better speech recognition in noisy environments. Both feed directly into Apple's 2026-2027 smart glasses development timeline.

"We combined advanced machine learning with physics to build something truly deep and unique," Maizels said. Johny Srouji, Apple's hardware VP, called the technology "pioneering."

Why This Matters:

Prompt: a portrait of a mantis girl fusion, bio-metamorphosis, character design, highly realistic digital illustration in the style of Tran Nguyen

50 million to 300 million — JioHotstar's subscriber count before and after moving IPL cricket behind a paywall in early 2025. Four months. That's what happens when you control the content 1.4 billion people actually want to watch. Netflix has 20 million subscribers in India. Amazon Prime has 65 million. Cricket has the upper hand.

Source: India Dispatch / HSBC

Workflow of the Day: "Turn an earnings call into an executive brief"

Who: A product strategist or investor who needs to extract signal from quarterly earnings transcripts without listening to two hours of corporate filler.

Problem: Earnings calls bury the important information under prepared remarks, hedging language, and analyst crosstalk. Reading the full transcript takes 45 minutes. Skimming misses the deflections that matter most.

Workflow (with Claude or ChatGPT):

Payoff: A focused executive brief in 15 minutes instead of a 45-minute transcript slog, with the deflections highlighted, not buried.

Gotcha: AI tools sometimes confuse analyst estimates with management guidance. Always verify whether a number came from a question or an answer.

Tools: Claude | Seeking Alpha

Your AI can read a balance sheet faster than you can find the right tab. These prompts turn it into a junior analyst who never sleeps.

The Circular Dependency Mapper

"Here is [company]'s latest investor list and revenue breakdown: [paste]. Map every case where an investor is also a customer or supplier. For each link, calculate what percentage of the company's revenue comes from its own investors. Flag any dependency above 15%."

Best on: Claude (handles complex relationship mapping) or Perplexity (can pull current financial data)

The IPO Red Flag Scanner

"Review this S-1 filing or earnings transcript: [paste]. List every risk factor, related-party transaction, and forward-looking statement that uses hedge language ('may,' 'could,' 'expects'). Rank the top 5 risks by financial exposure. For each, state what would make it worse."

Best on: Claude (long document analysis, subtext detection)

The Valuation Sanity Check

"Company X has [revenue], [growth rate], and is valued at [valuation]. Compare this to 5 public companies in the same sector at the time of their IPO. Show me the price-to-revenue multiple for each. Is Company X's valuation in line, aggressive, or historically unprecedented? Show your math."

Best on: Perplexity (real-time comparable data) then Claude (analysis and comparison)

The best financial analysis doesn't start with the numbers. It starts with asking who benefits from the way those numbers are presented.

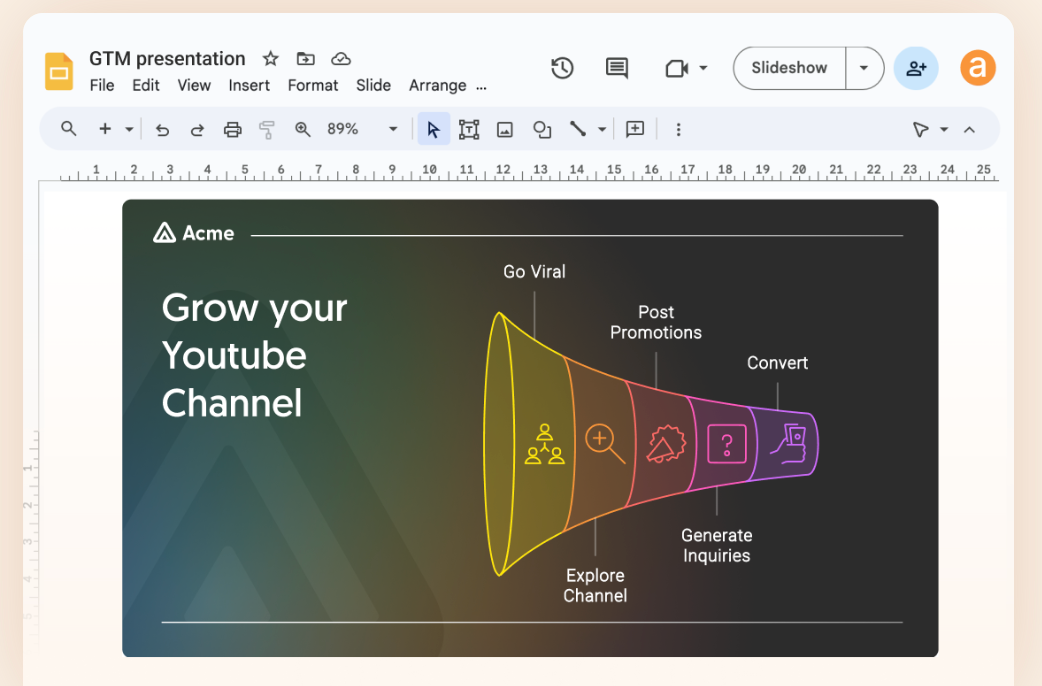

How to Turn Any Text Into Visual Diagrams

Napkin AI converts written explanations into clean diagrams, flowcharts, and infographics with no design skills required. Paste a paragraph describing a process, competitive overview, or system architecture, and the tool generates multiple visual options. Edit colors, layout, and labels directly. Export as PNG or SVG for presentations.

Tutorial:

Beijing has conditionally approved DeepSeek's purchase of Nvidia's H200 AI chips, a move that could accelerate the Chinese startup's already formidable capabilities. The regulatory conditions attached to the deal are still being finalized, but the approval signals China's intent to keep its top AI lab competitive.

AI search startup Perplexity has signed a three-year, $750 million cloud agreement with Microsoft to deploy its models through Azure and Foundry. The deal diversifies Perplexity's infrastructure beyond its existing AWS partnership amid an ongoing dispute with Amazon.

Apple beat Wall Street estimates and projected Q2 growth of 13-16%, well above the 10% consensus. The company flagged iPhone processor supply constraints and warned that memory costs will rise after Q2.

Greater China revenue surged 38% to $25.5 billion, Apple's strongest quarter in the region in four years. CEO Tim Cook credited customers upgrading and switching from competing platforms to iPhone 17.

OpenAI will discontinue GPT-4o, GPT-4.1, and o4-mini from ChatGPT next month. The company says only 0.1% of users still select GPT-4o, though the model retains a dedicated following among users who prefer its style.

Cloudflare mitigated the largest DDoS attack ever publicly disclosed, a 31.4 terabits-per-second assault by the Aisuru botnet that peaked at 200 million requests per second. The December 2025 attack represents a significant escalation in botnet capabilities.

The French government vetoed a €550 million deal that would have sold Eutelsat's ground antenna business to private equity firm EQT. Paris cited the need to preserve Europe's only competitor to SpaceX's Starlink constellation.

Google DeepMind CEO Demis Hassabis shared his outlook on AGI research, citing breakthroughs in continual learning and revealing plans for AI-powered smart glasses. He pushed back on claims that AI progress is slowing down.

Sequoia-backed insurtech Ethos Technologies debuted on Nasdaq at $19 per share, raising $200 million. The $1.1 billion market cap at listing represents a steep decline from the company's $2.7 billion private valuation in 2021.

Director Darren Aronofsky released a short-form series created with Google DeepMind AI tools while retaining human voice actors for performances. The project, produced through his company Primordial Soup, blends automated visual generation with traditional talent to depict events from 250 years ago.

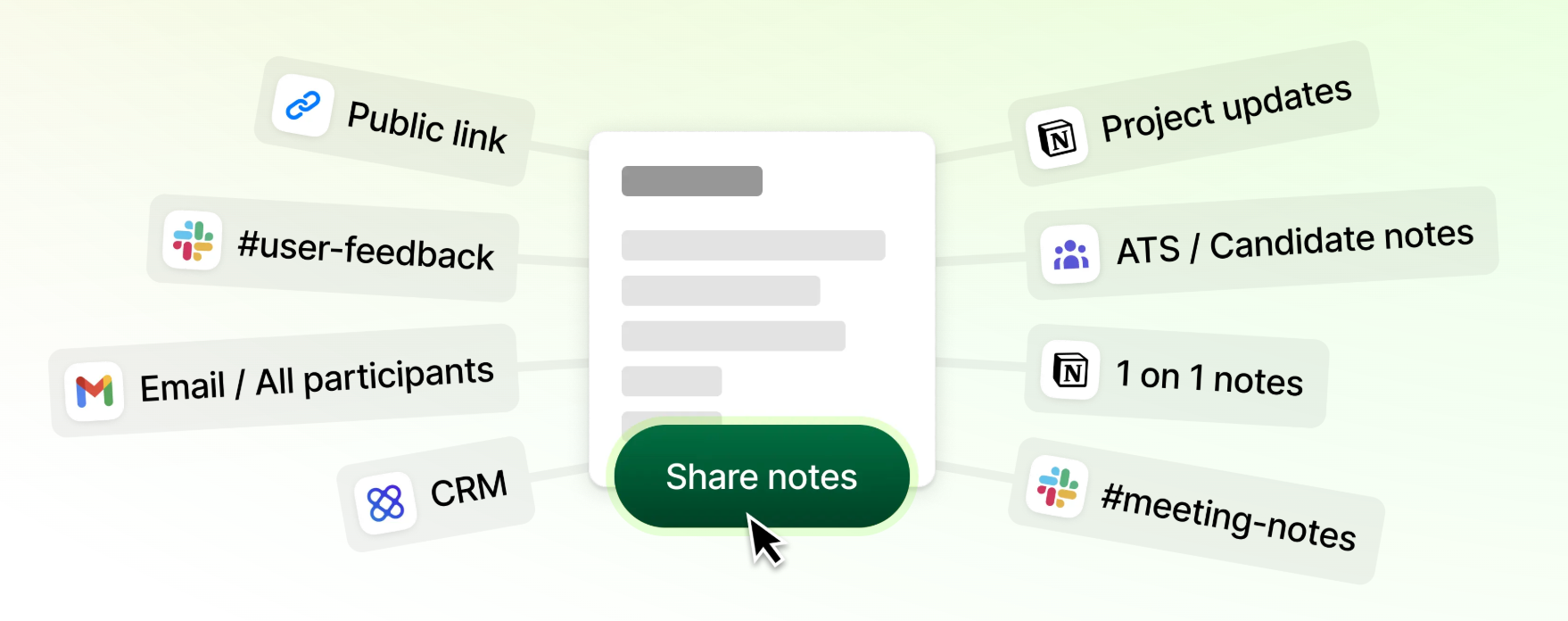

Granola turns your meetings into structured, searchable notes without recording anyone's voice. The New York-based company runs a local AI model that watches your screen during calls and generates organized summaries the moment you hang up. 📝

Founders

Chris Pedregal and Sam Witteveen launched Granola in 2024. Pedregal previously co-founded a Y Combinator-backed startup. The team has grown to roughly 30 employees, most of them engineers focused on on-device AI processing.

Product

A macOS app that sits quietly during video calls, captures screen context and your rough notes, then produces clean meeting summaries organized by topic, action items, and decisions. No bot joins your call. No audio leaves your machine. The AI runs locally, which sidesteps the privacy objections that kill most meeting tools at enterprise procurement.

Competition

Otter.ai, Fireflies, and Fathom all record and transcribe meetings using cloud-based AI. Microsoft Copilot in Teams offers similar functionality inside the Microsoft ecosystem. Granola differentiates by not recording audio at all, a distinction that matters in industries where legal, compliance, or client confidentiality blocks recording tools entirely.

Financing 💰

Raised $20 million in a round led by Lightspeed Venture Partners. The company reports strong organic growth driven by word-of-mouth among consultants, lawyers, and product managers, roles where meeting density is high and recording consent is hard to get.

Future ⭐⭐⭐⭐

Granola's bet is that privacy constraints, not features, determine which AI tools get adopted in enterprises. If the regulatory environment tightens around workplace recording (GDPR enforcement, state wiretapping laws), Granola's architecture becomes a structural advantage. The risk: Apple or Microsoft builds the same capability natively into their OS. The upside: most meetings still produce zero written output, and that gap is enormous. 🎯

Get the 5-minute Silicon Valley AI briefing, every weekday morning — free.