For three years, Tesla has been quietly signing up hundreds of Chinese companies to supply parts for its Optimus humanoid robot, the South China Morning Post reported on Friday. We're talking actuators, motors, reducers, bearings, vision systems, batteries. The works. These firms have shipped sample components and collaborated on hardware design, according to people familiar with the arrangements. Some have started calling themselves part of an "Optimus chain," borrowing the label from Apple's decades-old manufacturing network in China.

The report landed days after Elon Musk admitted on Tesla's Q4 2025 earnings call earlier this week that zero Optimus robots are currently doing useful work in the company's factories. That admission landed on the same call where Musk announced Tesla will kill the Model S and Model X by Q2 2026. The Fremont, California, plant needs the floor space. For robots. One million a year, eventually, is the stated goal.

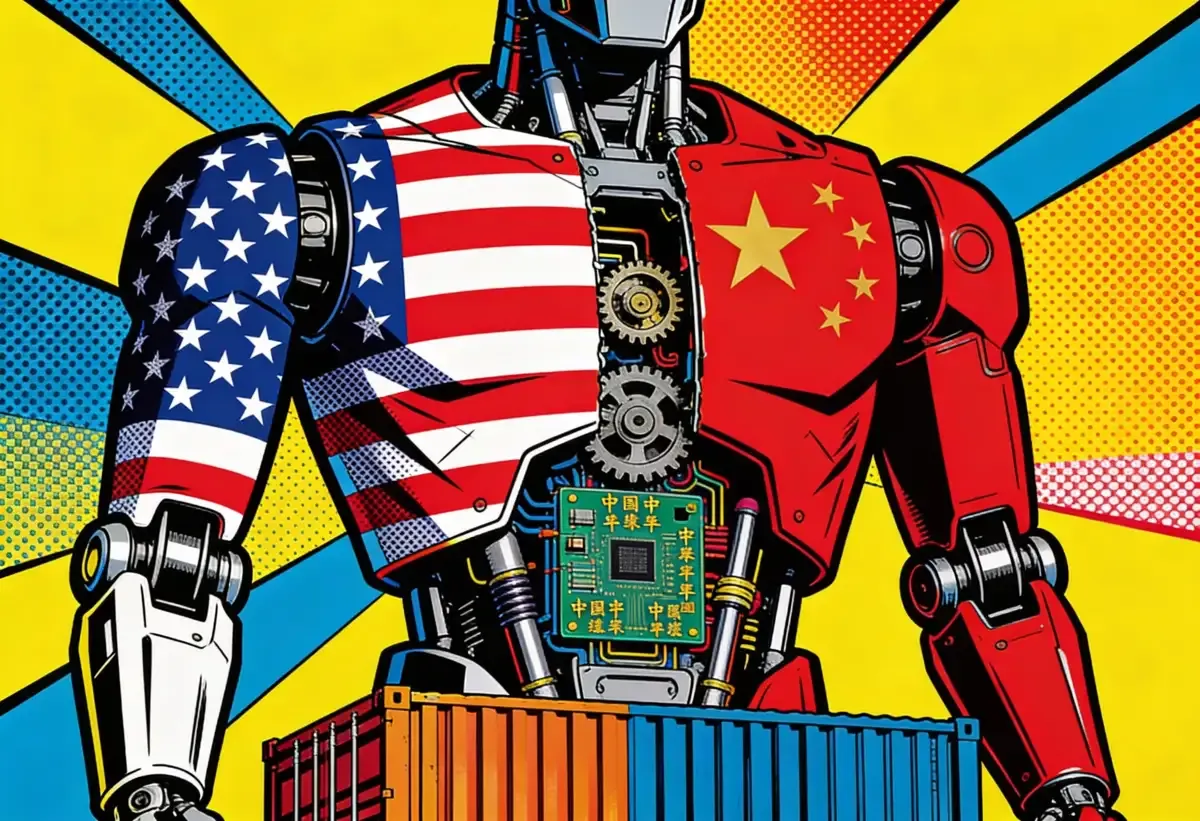

Read that again. Tesla is gutting two car lines to make room for a robot that doesn't work yet, and whose guts will largely arrive from the country Washington is trying to decouple from. If you've watched the EV supply chain fights play out over the past few years, you recognize the shape of this. The specifics are weirder.

What Musk promised, and what showed up

Musk has been selling Optimus timelines for two years. The product hasn't kept up.

The Breakdown

• Tesla has quietly built a network of hundreds of Chinese suppliers for Optimus robot components over three years, SCMP reports

• Musk admitted on Wednesday's earnings call that zero Optimus robots are doing useful work in Tesla factories

• Chinese firms AgiBot, UBTech, and Unitree are already shipping thousands of humanoids at a fraction of Western costs

• Tesla plans to kill Model S and X production at Fremont to make room for one million robots per year

The escalation is worth tracing. Mid-2024, Tesla's social team posted that two bots were "performing tasks in the factory autonomously." Weeks later, Musk was on stage telling shareholders he saw a thousand, maybe two thousand robots humming along in Tesla factories by 2025. By the earnings call a year ago, the target had ballooned to ten thousand units. "Will those several thousand Optimus robots be doing useful things by the end of the year? Yes, I'm confident they will do useful things," he told analysts.

None of that happened. By the end of 2025, there was no public evidence of even hundreds being built, let alone thousands. Electrek reported that multiple supply chain sources throughout the year described the Optimus program as being in "shambles." Tesla's head of robotics departed. Public demonstrations showed robots performing rudimentary tasks, handing out water bottles, mostly under teleoperation by human controllers rather than genuine autonomy.

On Wednesday's earnings call, Musk conceded the point. "We are still very much at the early stages of Optimus. It's still in the R&D phase," he said. "It's not in usage in our factories in a material way." Asked directly how many Optimus units Tesla had built, he did not answer the question.

Tesla did offer something forward-looking: a Gen 3 version of Optimus, described as "our first design meant for mass production," will be unveiled in Q1 2026. Production lines are being prepared, with start of production planned before year-end.

The supply chain that won't decouple

Here is the uncomfortable part. Even if Tesla nails the Gen 3 design and starts producing robots at scale, the parts will flow from China.

The SCMP report lays out a supplier network running across hundreds of Chinese manufacturers. Not peripheral vendors bolting on accessories. These companies make the parts that let a humanoid walk: joint actuators, the motors driving them, reducers that convert motor speed into torque, bearings, vision systems. One of these sources shipped new prototypes of Optimus' curved-glass head to Tesla in recent months. Sample batches, testing feedback loops, design collaboration. The relationship goes deep.

This mirrors a pattern that anyone covering Apple's supply chain will recognize instantly. Final assembly happens in the destination market, America in this case, but the component manufacturing stays in China because nobody else can match the speed, cost, or engineering iteration that Chinese suppliers provide. The "Optimus chain" nickname these suppliers have adopted is a deliberate callback to the supplier networks that made Apple and, ironically, Tesla's EV business possible in China.

Join 10,000+ AI professionals

Strategic AI news from San Francisco. No hype, no "AI will change everything" throat clearing. Just what moved, who won, and why it matters. Daily at 6am PST.

No spam. Unsubscribe anytime.

Jigsaw puzzle, assembled in California, pieces cut in Shenzhen. Call the finished picture American-made if you want. The picture needs Shenzhen to exist.

Nobody in Washington would look at this arrangement and feel comfortable. Export controls tightened throughout 2025. Supply chain diversification has been the official line for years, especially in advanced tech. Commerce Secretary Howard Lutnick has been meeting with robotics CEOs about an accelerated industry plan, Politico reported earlier this month, and an executive order on robotics may be coming. And yet here's Tesla, building its next flagship product on Chinese parts.

The competition isn't waiting

While Musk talks about production targets, Chinese firms are hitting theirs.

AgiBot's 5,000th humanoid robot came off the line this month. Five thousand. UBTech Robotics just raised roughly $400 million through a Hong Kong share placement. Management says 5,000 humanoids ship this year and 10,000 the year after, with production costs falling 20 to 30 percent annually. Bold numbers. But UBTech is actually manufacturing and selling robots right now, which puts it ahead of Tesla on the only metric that counts. Unitree, the Hangzhou-based company targeting a $7 billion IPO, sells humanoids for as little as $5,700, about the price of a used Honda Civic.

More than 150 humanoid robot companies are operating in China, according to the NDRC, China's top economic planning agency. The US has about 16 prominent firms building humanoids, WIRED reported. The numbers are lopsided enough that the NDRC itself warned in November of a potential bubble, with too many companies chasing similar products.

"China currently leads the United States in the early commercialization of humanoid robots," Andreas Brauchle, a partner at consultancy Horvath, told CNBC. "While both countries are expected to build similarly large markets over time, China is scaling more rapidly in this initial phase."

The cost gap tells you more than the unit counts. SemiAnalysis, the consulting firm, tore down Unitree's Go2 quadruped, priced around $8,000 retail. The full component bill, sensors, motors, gearbox, battery, computer, came to $3,272. Unitree sells lower-end configurations for $1,600. McKinsey, by contrast, pegs the cost of advanced humanoid prototypes in the West between $150,000 and $500,000 per unit. Those costs need to fall to somewhere between $20,000 and $50,000 to compete with human labor, the firm's Karel Eloot told CNBC.

Where the brains don't match the body

China's lead isn't total. The same suppliers feeding Tesla's Optimus chain also depend on American technology, most prominently Nvidia's chips. "I think there's a very high reliance on U.S. chips, for example, Nvidia chips," Jacqueline Du, head of China industrial tech research at Goldman Sachs, said on CNBC's "The China Connection."

American firms hold the advantage in AI software and algorithmic development, according to Horvath's Brauchle. McKinsey's Eloot described US companies as "betting on vertical integration," controlling everything from the actuators to the AI, on the theory that owning the full stack delivers better performance and stronger IP protection.

That sounds plausible in a strategy deck. The problem is that it hasn't produced a shippable product. Tony Zhao, CEO of California-based Sunday Robotics, was blunter in an interview with WIRED. "The iteration speed, the US is losing there," he said. "And honestly I don't know how we can win." So Zhao did the pragmatic thing. He hired an executive from a Chinese robotics company, someone with deep supply chain connections, to help Sunday Robotics compete. "The only way we can beat Chinese companies is to build a China team."

Some US executives, including Demis Hassabis of Google DeepMind, have told WIRED they expect robotics to follow the smartphone model, where China builds the hardware and America builds the brains. That worked for the iPhone. Whether it works for a humanoid robot, which must integrate physical movement with AI cognition in ways a phone never needed to, is a different bet.

The factory floor in Fremont

Tesla plans to convert the Model S and Model X production lines at Fremont into Optimus manufacturing capacity. Musk described the target: one million robots per year, eventually. That's a number borrowed from the iPhone playbook, the same playbook that required Foxconn's Zhengzhou factory and hundreds of thousands of Chinese workers to execute.

The robotics version of that playbook hasn't been written yet. But the first chapter is already familiar. Curved-glass heads prototyped in China. Actuators tested in Chinese labs. Bearings and reducers shipped in sample batches from Chinese factories to Tesla's engineers. Final assembly, maybe, in California.

Musk's $1 trillion compensation package, approved by shareholders, requires him to build at least one million robots. The Fremont floor space is being cleared. The Gen 3 design is reportedly weeks from its unveiling. And the parts, the actual physical components that will make these machines move, walk, and maybe one day work, will arrive in shipping containers from across the Pacific. Same supply chain Tesla has spent three years building. Same country Washington says it wants to depend on less.

The conveyor belts at Fremont are being stripped. What arrives to fill them will tell you more about the real state of US-China technological dependence than any executive order.

Frequently Asked Questions

Q: How many Optimus robots has Tesla actually built?

A: Musk declined to answer that question directly on the Q4 2025 earnings call. He admitted the program is 'still in the R&D phase' and that Optimus is 'not in usage in our factories in a material way.' No public evidence exists of hundreds being produced.

Q: What is the 'Optimus chain' of Chinese suppliers?

A: Hundreds of Chinese manufacturers supplying actuators, motors, reducers, bearings, vision systems, and batteries for Tesla's Optimus robot. These firms have shipped sample components, collaborated on hardware design, and modeled their supplier relationship on Apple's manufacturing network in China.

Q: How much cheaper are Chinese humanoid robots compared to Western ones?

A: Unitree sells humanoids for as little as $5,700. A SemiAnalysis teardown found Unitree's Go2 quadruped has a total component cost of $3,272. McKinsey pegs Western humanoid prototypes at $150,000 to $500,000 per unit. Costs need to drop to $20,000-$50,000 to compete with human labor.

Q: When will Tesla start producing Optimus robots?

A: Tesla says Gen 3 Optimus, described as its first mass-production design, will be unveiled in Q1 2026. Production lines are being prepared at Fremont with start of production planned before end of 2026. The target is eventual capacity of one million robots per year.

Q: Why can't Tesla just use American suppliers for Optimus?

A: China's manufacturing supply chain offers unmatched speed, cost, and engineering iteration for robotics components. The US has about 16 prominent humanoid firms versus 150+ in China. Even US robotics startup Sunday Robotics hired a Chinese executive specifically to access China's supply chain.