Nvidia's $100 Billion OpenAI Deal Is Dead. The Relationship Isn't.

Nvidia's $100 billion OpenAI infrastructure deal never progressed past preliminary talks. Jensen Huang says he'll still invest, but the terms have changed.

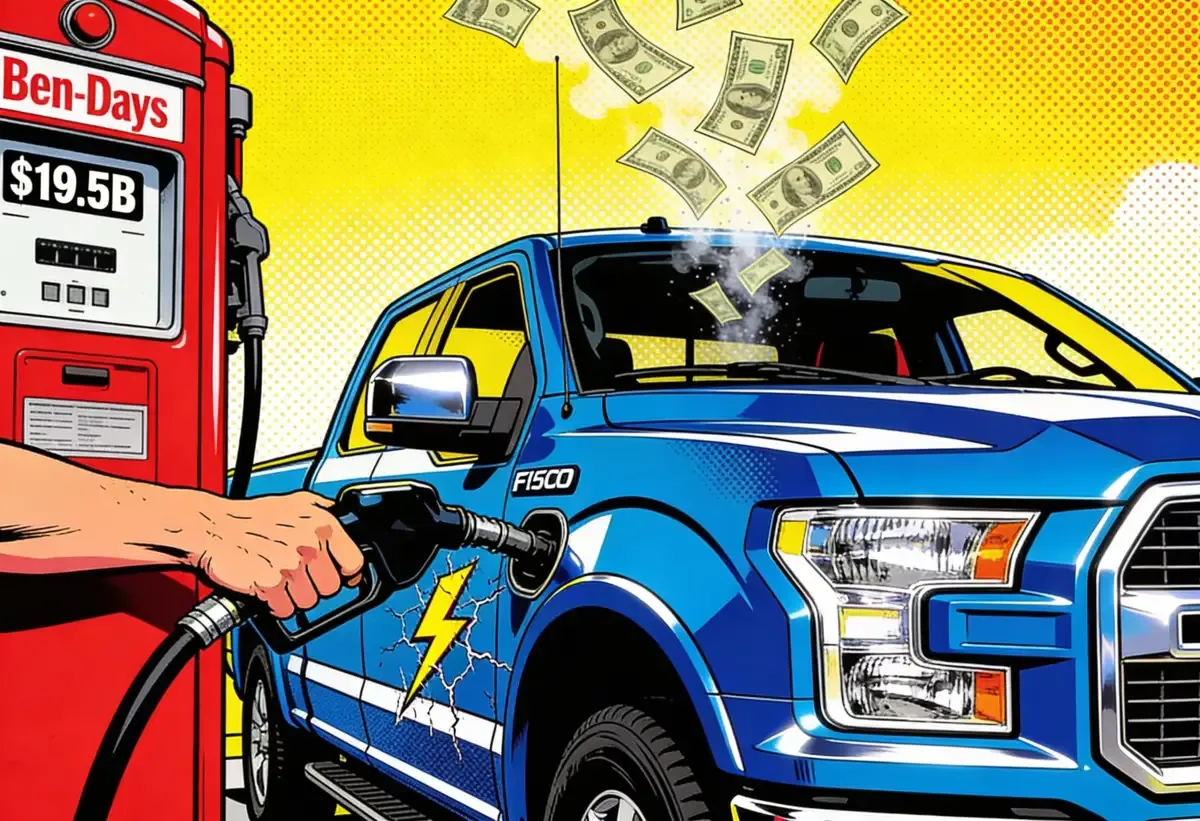

Ford's $19.5 billion EV retreat includes a pivot to energy storage, but the plan relies on Chinese battery technology, faces an 18-month worker gap, and depends on tax credits that could vanish. The math behind the messaging doesn't add up.

Ford's announcement Monday carried the unmistakable odor of corporate capitulation dressed up as strategic vision. The automaker will take $19.5 billion in charges to unwind its electric vehicle ambitions, convert battery factories to energy storage systems, and transform the F-150 Lightning into something that isn't really an EV at all.

The charges represent Ford's admission that it built far too much battery production capacity for vehicles Americans didn't want to buy. Model e, Ford's EV division, lost $5.1 billion last year alone. The bleeding actually started earlier, though. Since 2023, the EV unit has hemorrhaged north of $12 billion. And the trajectory keeps worsening: November's sales collapsed by 60% compared to the same month last year. Call that what you want. Growing pains it is not. More like the vital signs of a strategy that arrived stillborn.

Jim Farley went on Bloomberg to spin the retreat as defiance. "We're not going to cede our future to the Chinese," Ford's CEO declared, insisting the company's upcoming smaller EVs would hold the line against BYD and the wave of Chinese manufacturers now eating into global market share. Strong words, those. The math backing them up? Less so.

The Breakdown

• Ford's EV division lost $12 billion over two years; November sales collapsed 60% year-over-year, prompting a $19.5 billion strategic retreat

• The Kentucky plant converts to energy storage, but Ford's 20 GWh annual output equals roughly half of Tesla's quarterly deployment rate

• Ford's "China-proof" strategy depends entirely on CATL-licensed battery technology for both storage systems and its upcoming $30,000 EV

• Kentucky workers face 1,600 layoffs now with 2,100 new positions promised in 2027, but no bridging program connects the two workforces

Ford's escape plan centers on converting its Glendale, Kentucky battery plant into an energy storage facility. The $2 billion conversion will produce prismatic lithium iron phosphate cells, the chemistry of choice for data centers and grid-scale storage. Production starts in 2027 with planned annual output of 20 gigawatt-hours.

Lisa Drake, Ford's vice president of technology platform programs, positioned the move as obvious. "The technology of choice for most of these customers was an LFP prismatic type of container system," she told reporters. Ford already had licensing rights to produce the technology. Manufacturing expertise from a century of vehicle production would transfer naturally. It all made sense.

Except for one problem. Tesla has spent a decade building its energy storage business. The company now deploys approximately 10 gigawatt-hours every quarter, meaning Ford's entire annual output would match roughly half of Tesla's quarterly deployment rate. Tesla's Megapack business has established customer relationships, proven technology, and a manufacturing operation that's already humming while Ford's plant sits idle awaiting conversion.

General Motors isn't standing still either. The company has home and commercial battery storage products already in market. Ford enters a competitive field as a late entrant with no track record, no existing customer base, and technology licensed from a Chinese manufacturer.

The demand exists. Utility-scale battery storage capacity rose 50 percent during the first ten months of 2025, reaching nearly 39.3 gigawatt-hours according to Energy Information Administration data. Data centers hungry for AI compute need power buffering. The grid needs modernization. But needing a thing and building a profitable business supplying that thing are different challenges entirely.

Strategic AI news from San Francisco. Clear reporting on power, money, and policy. Delivered daily at 6am PST.

No spam. Unsubscribe anytime.

Ford's "China-proof" strategy contains an awkward dependency. Both the energy storage business and Ford's planned $30,000 electric pickup rely on battery technology licensed from Contemporary Amperex Technology Co. Ltd., better known as CATL. The Chinese company dominates global battery production. Ford's path to profitability runs directly through Beijing.

The Kentucky plant will produce LFP cells using CATL technology. The BlueOval Battery Park Michigan facility, scheduled to begin production in 2026, will also use CATL chemistry for batteries destined for Ford's mid-sized electric truck. Even the residential storage products Ford mentioned will use the same licensed technology.

Farley's claim that Ford won't cede its future to Chinese manufacturers requires careful parsing. Ford isn't buying batteries from CATL. It's licensing the technology to manufacture them domestically. But the intellectual property, the fundamental chemistry enabling Ford's entire battery strategy, originated in China and remains under Chinese control.

This arrangement made sense when Ford needed to move quickly into EV production without the years required to develop proprietary battery technology. It makes less sense as a foundation for declaring independence from Chinese competition. Ford's competitive moat consists of manufacturing capability and customer relationships, not technological differentiation.

Ford's announcement included carefully crafted employment projections. The Kentucky plant conversion will result in 1,600 layoffs during the transition period. When the facility reopens in 2027, Ford plans to hire 2,100 workers to support the energy storage business. Net positive, the company suggested. More jobs than before.

The framing obscures a harder reality. These are not the same jobs. Battery manufacturing for vehicles and battery storage system production require different skill sets, different certifications, different experience. The 1,600 workers losing their positions in Kentucky cannot simply wait 18 months and return to their old stations. They'll need retraining at minimum. Many will find other employment during the gap. Some will relocate.

Ford announced no bridging program, no retention bonuses, no commitment to preferential hiring of displaced workers. The company offered numbers that looked good in a press release while leaving the human logistics unexplained.

The Tennessee factory complicates matters further. Originally planned for electric pickup production, it will now build gas-powered trucks. But not until 2029. The delay from the previous 2028 timeline extends an already lengthy transition. SK On, Ford's former joint venture partner, retains the adjacent battery plant in Tennessee. Workers there face their own uncertainty as the Korean company figures out what to do with capacity built for vehicles that won't be manufactured.

Ford's energy storage pivot rests on policy assumptions that deserve scrutiny. Bloomberg's reporting noted that manufacturers have argued manufacturing tax credits are "critical to make plants economically viable." Cell production is capital-intensive and technically challenging. Margins are thin. The business model works with government support. Without it, the economics become precarious.

The same Trump administration policies that undermined EV demand, slashing consumer incentives and weakening fuel economy standards, could theoretically extend to manufacturing credits. Ford is betting that tax support for domestic battery production will survive intact even as other clean energy incentives disappear. Maybe that bet pays off. The current administration has shown unpredictable preferences, opposing EVs while sometimes supporting domestic manufacturing.

But building a $2 billion factory conversion on policy assumptions introduces risk that Ford's executives didn't acknowledge. The 2027 production timeline means the Kentucky plant will come online during the next presidential administration. Political priorities shift. Tax credits that seem secure today can vanish with a budget reconciliation vote.

Most coverage focused on the writedown and the Kentucky plant conversion. The F-150 Lightning news got less attention. It probably shouldn't have. Ford's flagship electric truck, the one executives paraded around as proof of their battery-powered future, is getting a gasoline generator bolted onto it. Ford's marketing department landed on "extended-range EV" as the label. The engineering reality is simpler: there's a gas generator under the hood now, and it fires up to feed the battery when charge runs low.

Seven hundred miles of range, Ford claims. Maybe. The Dearborn plant stopped building Lightnings back in October anyway, and the line hasn't restarted. Whenever the assembly line restarts, the new Lightning enters a strange competitive no-man's-land. Pure electric trucks from Rivian and Tesla aren't really the comparison anymore. The closer analog is probably the Chevrolet Volt, which GM pulled from showrooms back in 2019.

What does that conversion actually acknowledge? Ford spent billions trying to prove that American truck buyers would embrace pure electric pickups. They didn't. Range anxiety won. Charging infrastructure gaps won. Customers wanted the ability to fill up in five minutes and drive 500 miles, not hunt for a Supercharger on a road trip through rural Texas. Ford's answer to that problem wasn't developing better batteries or building out charging networks. Ford's answer was to add a fuel tank.

Strategic AI news from San Francisco. No hype, no "AI will change everything" throat clearing. Just what moved, who won, and why it matters. Daily at 6am PST.

No spam. Unsubscribe anytime.

Andrew Frick, head of Ford's EV division, offered the official rationale. "Rather than spending billions more on large EVs that now have no path to profitability, we are allocating that money into higher returning areas." The statement was honest. The admission embedded within it was damning.

Strip away the strategic language and Ford's announcement reduces to a confession. The company misjudged demand for electric trucks. It built manufacturing capacity for vehicles that customers didn't buy. It lost over $12 billion in two years on a strategy that executives now acknowledge had "no path to profitability."

The pivot to energy storage might work. The hybrid emphasis makes commercial sense given current consumer preferences. The $30,000 electric pickup could compete effectively if Ford executes, though Sam Abuelsamid at Telemetry consultancy identified execution as "Ford's perpetual problem." The company generates good plans, he noted. Building the stuff proves more difficult.

Ford's stock rose 1 percent in extended trading after the announcement. Year-to-date gains stand at 38 percent. Wall Street apparently likes retreats when they're packaged as strategic repositioning. The $5.5 billion cash impact, primarily hitting in 2026, will test investor patience.

Erik Gordon at the University of Michigan offered a less sanguine assessment. "Dropping the Lightning might make Ford more China-proof until the day Chinese companies understand American pickup buyers the way Japanese car companies learned to understand American sedan and then SUV buyers," he wrote. "There are no trade secrets to understanding American vehicle buyers."

The observation cuts to the heart of Ford's dilemma. The company is abandoning large EVs because it can't build them profitably. Chinese manufacturers can. When those manufacturers figure out American preferences, and they will, Ford's temporary refuge in hybrids and gas trucks will offer no protection.

Here's the company's current projection: half of global sales by 2030 coming from hybrids, extended-range vehicles, and pure EVs. That's up from 17 percent today. Sounds like ambition. Sounds less impressive when you dig up what Ford was promising back in 2020, before the pivots started piling up. Plans change. Strategies shift. And the $19.5 billion charge? That's the accumulated price tag for all that pivoting.

The company that once aspired to surpass Tesla now enters Tesla's energy storage market as an underdog, armed with Chinese technology and dependent on American tax credits. That's not a strategy for winning.

Q: What's the difference between an extended-range EV and a regular hybrid?

A: In an extended-range EV, electric motors always drive the wheels. The gas engine only generates electricity to recharge the battery when it runs low. In a traditional hybrid, the gas engine can directly power the wheels. The new Lightning will work like the former Chevrolet Volt, not like a Toyota Prius.

Q: Why are LFP batteries preferred for energy storage over other types?

A: Lithium iron phosphate batteries cost less, last longer, and pose lower fire risk than nickel-based alternatives. They're heavier and store less energy per pound, which matters for vehicles but not for stationary storage sitting in a shipping container. Data centers and utilities prioritize durability and safety over weight.

Q: What happened to Ford's joint venture with SK On?

A: The partnership dissolved in early December 2025. Ford took full ownership of the Kentucky battery plant, while SK On kept the Tennessee facility. The split lets each company pursue different strategies. Ford converts Kentucky to energy storage; SK On figures out what to do with capacity built for trucks that won't exist.

Q: Which tax credits does Ford's energy storage business depend on?

A: The Inflation Reduction Act's 45X manufacturing tax credits provide up to $35 per kilowatt-hour for domestic battery cell production. Bloomberg reports manufacturers consider these credits "critical" for economic viability. The credits currently run through 2032, but future administrations could modify or eliminate them through budget legislation.

Q: Is Ford abandoning electric vehicles entirely?

A: No, but the focus is shifting dramatically. Ford still plans a $30,000 mid-sized electric pickup for 2027 using CATL battery technology. The company projects 50% of global sales will come from hybrids, extended-range EVs, and pure electrics by 2030, up from 17% today. Large battery-electric trucks, however, are effectively dead.

Get the 5-minute Silicon Valley AI briefing, every weekday morning — free.