Moltbot Melts Down. SoftBank Goes All In on Altman.

Moltbot rebrand triggers crypto scam and Cloudflare rally. SoftBank risks credit downgrade on $30B OpenAI investment. Plus Claude Code setup guide.

Masayoshi Son sold his entire Nvidia stake to double down on OpenAI. Now he wants to pour another $30 billion into Sam Altman's company. Credit agencies are watching the math closely.

Masayoshi Son sold his entire Nvidia position last month. Five point eight billion dollars, liquidated in weeks. The chip maker had handed SoftBank a comfortable return, but Son wasn't interested in comfortable. He wanted the proceeds funneled into OpenAI.

Now Son is back at the table, negotiating to pour another thirty billion into Sam Altman's company, according to people familiar with the discussions. If completed, the investment would push SoftBank's total stake in OpenAI north of sixty billion dollars, making it one of the largest concentrated bets in venture capital history. SoftBank's stock jumped 8.8% on the news before settling around 3.7% higher in Tokyo trading.

The deal would form part of a funding round that could raise up to one hundred billion dollars for OpenAI, valuing the ChatGPT maker at roughly 830 billion. Only a handful of public companies on Earth carry a larger market cap. Apple. Microsoft. Nvidia. Saudi Aramco. That's the neighborhood Son is trying to buy into. He's 66. He's rebuilt his entire conglomerate around a single thesis. AI will reshape everything, and OpenAI will do the reshaping.

Rating agencies aren't buying it.

You don't have to read balance sheets for a living to feel what's happening here. But the people who do are getting nervous.

The Breakdown

• SoftBank is negotiating to invest another $30 billion in OpenAI, pushing its total stake past $60 billion

• S&P warns the deal could trigger a credit downgrade if loan-to-value hits 35%

• OpenAI is seeking a $100 billion funding round at an $830 billion valuation

• SoftBank spent $16 billion on AI acquisitions in the past year alone

S&P Global Ratings published a note earlier this month that spelled out the arithmetic. If SoftBank commits an additional thirty billion to OpenAI, adjusted loan-to-value could hit 35%, triggering a potential downgrade from its current BB+ rating. The deal would require asset sales and margin loans of at least fifteen billion just to keep reported LTV below the company's stated 25% ceiling.

Sharon Chen, the S&P credit analyst covering SoftBank, pointed to another uncomfortable statistic. With this investment, OpenAI would potentially overtake Arm as SoftBank's largest holding, reaching more than 30% of the portfolio's total value. For a conglomerate that built its modern identity around chip IP, the symbolic transfer of weight matters.

Son has spent the past year systematically repositioning SoftBank for this moment. The company sold down its T-Mobile shares. It unloaded Nvidia entirely. It expanded a margin loan backed by Arm stock, the same Arm that trades 40% below its October peak. Each move freed capital for a singular destination.

"Son is all in," said Amir Anvarzadeh, Japan equity strategist at Asymmetric Advisors. He added that ChatGPT's competitive position looks less secure than it did a year ago, with Google's Gemini and Anthropic's Claude eating into OpenAI's early lead. The assessment captures a dynamic that SoftBank's stock price has already absorbed: shares are down almost 40% from their high.

The capital flowing into OpenAI isn't sitting idle. It's being converted into physical infrastructure at a pace that would have seemed absurd two years ago.

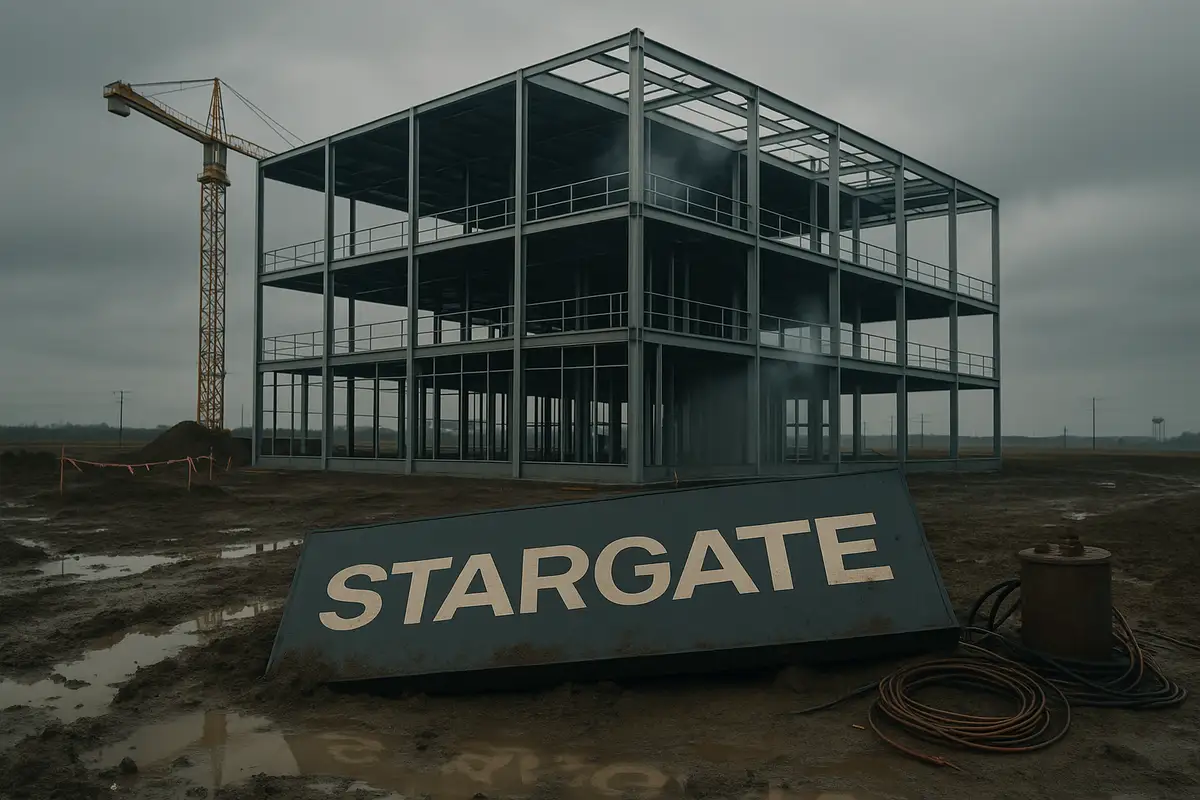

In Milam County, Texas, SoftBank subsidiary SB Energy is building a 1.2-gigawatt data center campus for Stargate, the five-hundred-billion-dollar initiative that OpenAI, SoftBank, and Oracle announced at the White House last January. SB Energy already operates the 900-megawatt Orion Solar Belt near Austin, powering Google's Texas facilities. The company is developing two more multi-gigawatt sites, one explicitly earmarked for AI workloads.

OpenAI and SoftBank each invested 500 million into SB Energy earlier this month, a billion-dollar joint commitment designed to accelerate Stargate construction. Greg Brockman, OpenAI's president, put it bluntly. "The result is a fast, reliable way to scale compute through large, highly optimized AI data centers." Manufacturing language. Factory logic.

Strategic AI news from San Francisco. No hype, no "AI will change everything" throat clearing. Just what moved, who won, and why it matters. Daily at 6am PST.

No spam. Unsubscribe anytime.

That language tells you something. OpenAI talks about data centers the way Henry Ford talked about River Rouge. The company has signed infrastructure deals worth more than 1.4 trillion over the coming decade, and revenue hit twenty billion in annualized run rate last year. Still bleeding billions, though. Training and running the models costs more than customers pay. Nobody at OpenAI pretends profitability is coming soon. Scale first. Margins later. Maybe.

Japanese retail investors had piled into SoftBank as a proxy for OpenAI, treating the stock like a publicly traded bet on generative AI's future. That trade worked beautifully through mid-2024. Then it stopped working.

Walk the corridors of SoftBank's Tokyo headquarters and you'll find a company that has organized itself around one man's conviction. Whiteboards in conference rooms map infrastructure timelines. Presentations circulate with Stargate capacity projections. The question nobody asks aloud is whether Son's attachment to Altman has clouded what was once considered one of the sharpest deal instincts in technology. Executives answer the question anyway, with their body language and their silence when the topic comes up.

Some of Son's lieutenants have grown anxious, according to people familiar with internal discussions. The December funding round required Son to scramble for capital, slowing most other dealmaking at SoftBank's Vision Fund to a crawl. The pace hasn't recovered. While SoftBank chases OpenAI, competitors like MGX, the Abu Dhabi sovereign fund, and Amazon are also circling the same funding round. Nvidia is in discussions. So is the Abu Dhabi Investment Authority.

OpenAI's cap table is starting to resemble a geopolitical summit. Microsoft owns close to 27%. SoftBank holds 11% after the December investment. Thrive Capital, Khosla Ventures, and various Gulf wealth funds fill out the roster. An IPO is expected within the next year or two, which would finally give these investors a path to liquidity. Until then, the stakes keep rising.

Son hasn't just been investing in OpenAI. He's been building an entire AI supply chain around it, and the pace has turned frantic.

Ampere Computing for 6.5 billion. ABB's robotics division for 5.4 billion. DigitalBridge for 4 billion. Son wrote those checks inside twelve months. Each deal stacked another brick onto SoftBank's AI infrastructure wall. Arm, the chip architecture company Son took private back in 2016, is about to announce its own AI chip. A shot across Nvidia's bow. SoftBank has turned itself into a machine that converts cash into AI-adjacent assets.

There's a manic quality to the accumulation. SoftBank isn't hedging. It's doubling, tripling, quadrupling down. Each deal commits the company further to a future where AI demand justifies these prices. If that future arrives, Son looks prophetic. If it doesn't, the portfolio becomes a monument to overreach.

What the acquisitions reveal is a founder who thinks in systems rather than single bets. Son wants SoftBank to own a slice of every link in the AI chain: the models, the compute, the silicon, the applications. It's a vertically integrated vision that echoes Carnegie's steel empire more than a typical venture portfolio. That comparison doesn't flatter Son. Carnegie cornered steel when the railroads were already laying track coast to coast. Demand was proven. Technology was stable. Son is building his in a market where the leading product didn't exist three years ago and competitors are closing fast.

Sam Altman issued a code red to OpenAI staff in December, urging employees to focus on ChatGPT's core product and shelve secondary projects. The message reflected genuine competitive anxiety. Google's Gemini 2.0 benchmarks had rattled leadership. Anthropic was gaining enterprise market share. The research lead that OpenAI enjoyed in 2023 had compressed into something closer to a three-way tie.

Tomoichiro Kubota, senior market analyst at Matsui Securities, offered a measured take on SoftBank's fundraising enthusiasm: "Progress in OpenAI's fundraising is positive for SoftBank shares in the near term, as it shows there are investors willing to acquire shares of the ChatGPT maker at these valuations." But Kubota added a caveat that landed harder. "The competitive environment is getting more severe."

Daily at 6am PST

No breathless headlines. No "everything is changing" filler. Just who moved, what broke, and why it matters.

Free. No spam. Unsubscribe anytime.

That severity shapes everything about this deal. OpenAI needs the capital because compute costs are crushing its margins. SoftBank needs the stake because Son has already made the narrative commitment. Neither party can afford to blink. The negotiations are reportedly close to completion, with an agreement possible within days.

OpenAI's corporate restructuring last year complicated the investor dynamics. The company has been pushing to convert from its original nonprofit structure into a for-profit corporation, a shift that would make an IPO far cleaner. Elon Musk sued. He co-founded OpenAI before walking away over strategy fights, and now he wants the courts to block the conversion. A federal judge ruled last month that his case can go to trial. Investors haven't flinched, but the lawsuit adds noise to an already complicated path toward public markets.

Andrew Jackson, head of Japan equity strategy at Ortus Advisors, framed the investment news in terms of market psychology rather than fundamentals. SoftBank's stock has been "a decent underperformer" in recent weeks, Jackson said. "As a high-beta laggard, it's going to suck people in on headlines like this." The observation captures something important about how markets are processing the SoftBank-OpenAI story. Retail investors trade on narrative momentum. Credit analysts trade on balance sheets. The two camps haven't agreed on SoftBank in months.

Milam County doesn't look like the future of artificial intelligence. Flat land. Scrub brush. But construction crews there are building facilities that will draw more electricity than most small cities. The Stargate campus alone runs 1.2 gigawatts. West Texas has more coming. New Mexico too. Even the Midwest is getting facilities. Five point five gigawatts of planned capacity when you tally it all. That's five nuclear reactors' worth of power, pointed at AI workloads.

SB Energy's co-CEO Rich Hossfeld framed the project in national terms: "SB Energy's strategic partnership with OpenAI accelerates our delivery of advanced AI data center campuses and associated energy infrastructure at the scale required to advance Stargate and secure America's AI future."

The language about securing America's future echoes a message that played well at the White House announcement last year. But trace the financing behind that rhetoric and you find a Japanese conglomerate whose creditworthiness now depends on a startup that loses billions annually. Son has wagered that OpenAI will eventually generate returns large enough to justify the risk. Credit agencies aren't convinced the math works. And the shovels in Texas keep moving dirt regardless.

Thirty billion more dollars headed toward San Francisco. Rating agencies muttering about downgrade triggers. A founder who has remade his company around a single thesis. The outcome remains unclear, but the scale of the commitment no longer is. Son has placed his bet, and Milam County will show whether it pays.

Q: Why is S&P worried about SoftBank's credit rating?

A: If SoftBank invests another $30 billion in OpenAI, its adjusted loan-to-value ratio could hit 35%, triggering a potential downgrade from its current BB+ rating. The company would need at least $15 billion in asset sales or margin loans just to stay within its stated 25% LTV ceiling.

Q: What is Stargate and how much power will it consume?

A: Stargate is a $500 billion data center initiative launched by OpenAI, SoftBank, and Oracle to build AI training and inference infrastructure. The facilities under development across Texas, New Mexico, and the Midwest will require 5.5 gigawatts of power, equivalent to five nuclear reactors.

Q: How much of OpenAI does SoftBank currently own?

A: SoftBank holds an 11% stake in OpenAI after investing $22.5 billion in December. Microsoft remains the largest shareholder at close to 27%. If the new $30 billion investment closes, OpenAI could overtake Arm as SoftBank's largest holding.

Q: Why did Sam Altman issue a 'code red' at OpenAI?

A: Altman told staff in December to focus on ChatGPT and shelve secondary projects after Google's Gemini 2.0 benchmarks rattled leadership. Anthropic has also been gaining enterprise market share, compressing OpenAI's research lead into something closer to a three-way tie.

Q: What other investors are circling OpenAI's funding round?

A: Amazon, Nvidia, the Abu Dhabi Investment Authority, and MGX (the Abu Dhabi sovereign fund) are all in discussions for the round, which could raise up to $100 billion. Existing investors include Microsoft, Thrive Capital, and Khosla Ventures.

Get the 5-minute Silicon Valley AI briefing, every weekday morning — free.