The $2 Billion Escape Plan That Beijing Didn't See Coming

Meta's $2B Manus deal triggered reviews by three Chinese agencies. The 'China shedding' playbook for AI startups faces its first test.

Trump approved Nvidia's H200 chip sales to China with a 25% government cut. Beijing's response: limit access to those same chips. Two superpowers racing to prevent their own companies from buying technology that serves their strategic interests.

The Justice Department indicted two men for smuggling chips on Monday; on Tuesday, the President offered to sell the same chips to the same country for a kickback.

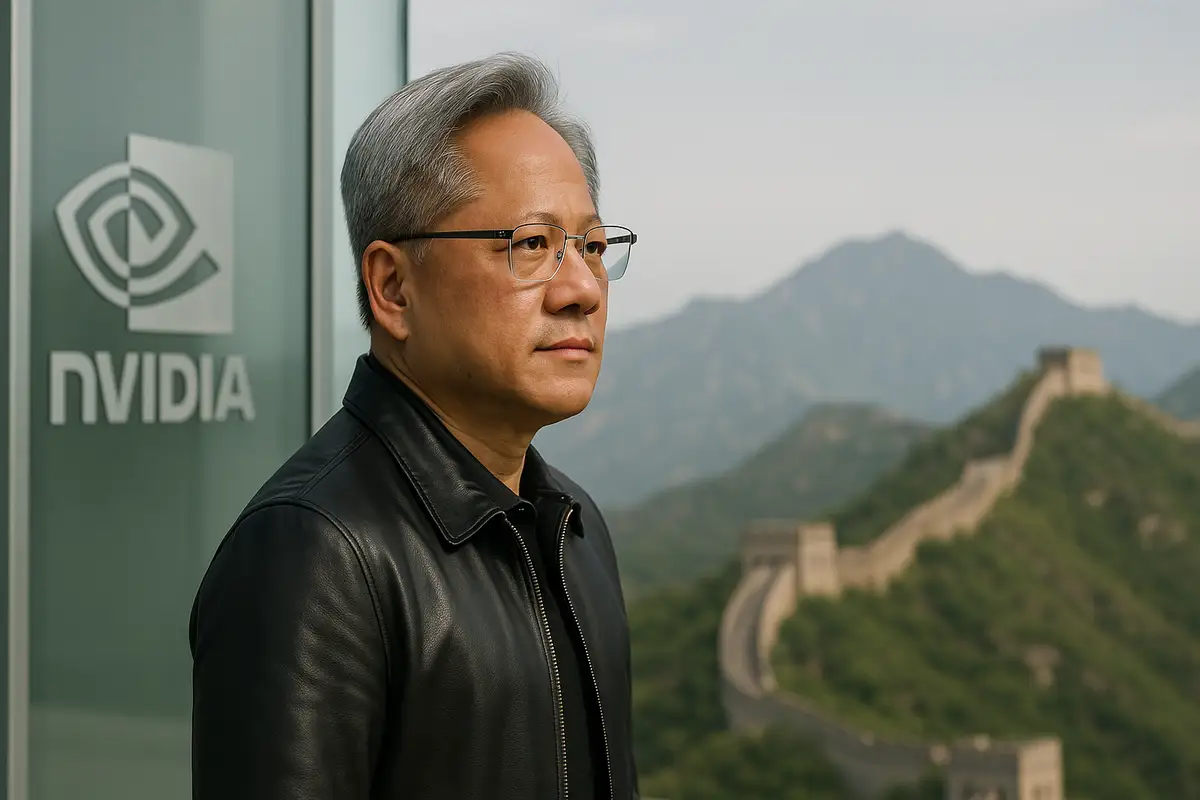

Jensen Huang spent weeks lobbying for this outcome, meeting privately with Trump in Washington to argue that export controls only accelerate Chinese competitors. "We will protect National Security, create American Jobs, and keep America's lead in AI," Trump wrote on Truth Social. The deal includes an unusual sweetener: a 25% cut to the US government on every sale.

Beijing, however, isn't buying.

According to the Financial Times, Chinese regulators are preparing to limit domestic access to H200s, requiring companies to submit applications explaining why local chips can't meet their needs. Days before Trump's announcement, China's Ministry of Industry and Information Technology added domestic AI processors from Huawei and Cambricon to official government procurement lists for the first time. Written instructions now tell government agencies, public institutions, and state-owned enterprises exactly which chips to buy. American silicon isn't on the list.

Two superpowers racing to prevent their own companies from purchasing chips that serve their strategic interests. The absurdity runs deeper than the headlines suggest.

The Breakdown

• DOJ indicted chip smugglers Monday; Trump announced legal H200 exports Tuesday. The 25% government cut faces constitutional challenges and congressional opposition.

• Beijing added domestic AI chips to official procurement lists and is limiting H200 access, requiring companies to justify why local alternatives won't work.

• DeepSeek built competitive AI models with fewer, weaker chips. If algorithms matter more than hardware, the entire chip war targets depreciating assets.

• Wells Fargo estimates $25-30B revenue potential, but Nvidia's guidance assumes zero China sales. Any upside requires cooperation that may never materialize.

The mechanics of Trump's deal reveal how far both governments will stretch to achieve contradictory goals.

Nvidia's H200 chips will be manufactured in Taiwan, shipped to the United States for a "security review," then forwarded to approved Chinese customers. Picture a Customs agent in Long Beach staring at a crate of processors, stamping paperwork, pretending that act changes something about the silicon inside. The convoluted supply chain exists for one reason: the Constitution forbids export taxes. By routing chips through American ports, the administration can classify its 25% cut as an import tariff rather than an unconstitutional levy on goods leaving the country.

"It isn't clear how a security review of the chips themselves would be substantial," the Wall Street Journal noted. Administration officials provided no specifics on what inspections would actually entail. How do you security-review a semiconductor? Hold it up to the light?

The legal creativity extends further. In August, Nvidia won approval to sell its watered-down H20 chips, agreeing to pay the government 15% of revenues. That deal never took effect. The regulations making payments legal were never written. The IRS cannot collect a tax that doesn't exist from a company that hasn't sold anything yet. The current 25% proposal faces the same structural vacuum.

Congress has shown bipartisan hostility to the entire premise. Senators from both parties introduced legislation last week blocking H200 exports for 30 months. Democratic Senators Jeanne Shaheen, Elizabeth Warren, and six colleagues called the decision "a colossal economic and national security failure." Republican Representative John Moolenaar, who chairs the House Select Committee on China, warned that "China will rip off its technology, mass-produce it themselves and seek to end Nvidia as a competitor."

The administration's response has been revealing. White House officials told Bloomberg they concluded H200 exports carried "lower security risk" because Huawei already offers comparable AI systems. They pointed specifically to Huawei's CloudMatrix 384 platform, claiming it performs as well as Nvidia's more advanced Blackwell-based NVL72 system.

Think about what that admission means. If accurate, it eviscerates the entire rationale for the deal. Why would Chinese companies pay premium prices for American chips offering no performance advantage over domestic alternatives? And if Huawei can match Nvidia's current generation, what exactly is the US "lead in AI" that Trump claims to be protecting?

Chinese foreign ministry spokesperson Guo Jiakun talked about "mutual benefit and win-win results." Xi Jinping reportedly "responded positively" to Trump. Standard diplomatic noises. The bureaucratic machinery, though, tells a different story entirely.

China's two most powerful technology regulators, the National Development and Reform Commission and the Ministry of Industry and Information Technology, have been discussing ways to limit H200 access. Options include banning public sector purchases entirely and requiring private companies to demonstrate that domestic chips cannot meet their needs before buying American.

The procurement list tells the real story. For years, Beijing verbally encouraged companies to buy Chinese. Written instructions represent a harder mandate. The list already includes domestic microprocessors replacing AMD and Intel, plus operating systems substituting for Microsoft Windows. AI chips are now officially part of China's technological import substitution program.

An executive at a state-owned financial institute told the Financial Times what this looks like in practice. His firm allocated 100 million yuan—$14 million—to buy domestic AI chips this year. Most of those processors are now sitting idle. Gathering dust in server racks. The firm's quantitative trading models were built on Nvidia's architecture, and the Huawei chips use a completely different programming framework. His engineers would need to learn an unfamiliar language, port years of legacy code, and rebuild systems from scratch. They haven't started. The deadline keeps slipping.

"The growing pains are unavoidable," one Chinese policymaker acknowledged. "But we have to get there."

This is the actual battlefield, and neither government's public statements acknowledge it. The fight isn't primarily about hardware specifications or manufacturing capacity. Nvidia's CUDA platform spent two decades becoming the default language for AI development. Every model trained on CUDA, every engineer who learned CUDA, every line of code written for CUDA represents switching costs that no procurement list can eliminate by decree. Beijing can mandate purchases. It cannot mandate competence.

White House officials justified the H200 decision partly by claiming Huawei has closed the performance gap faster than acknowledged. They estimated the Shenzhen company would produce "a few million" Ascend 910C accelerators in 2026, up from a June estimate of just 200,000 units this year.

The production gap remains enormous despite those projections. Nvidia moved about 3.76 million data center GPUs in 2024 alone. Huawei's most optimistic 2026 forecast still falls short of a quarter of that figure, and the difference in total installed chips worldwide is far wider.

But raw production numbers miss what actually happened this year. DeepSeek, a Chinese startup operating under export restrictions, built AI models that matched or exceeded American competitors on key benchmarks. They did it with fewer chips, less compute, and a fraction of the budget. The breakthrough prompted a brief panic in US markets and raised uncomfortable questions about the massive GPU buildouts at American hyperscalers.

DeepSeek proved something the hardware obsessives don't want to hear: the code matters more than the silicon. Algorithmic efficiency can substitute for raw compute. If Chinese developers can achieve frontier performance with constrained resources, the entire chip war is a contest over rapidly depreciating assets.

"DeepSeek should have been a wakeup call about the dangers of selling advanced semiconductor chips to the CCP," said Representative Michael McCaul. "Using less powerful NVIDIA chips, China developed the most advanced open-source models on the planet."

McCaul meant that as an argument against H200 exports. Read it again. Using less powerful chips, China built competitive models. The export controls didn't stop them. They routed around the obstacle. The ban is theater if the bottleneck isn't hardware.

Gary Marcus, the AI researcher and persistent skeptic, raised an uncomfortable possibility: "Maybe, just maybe, China's reticence to stock up on H200s is also a sign that China has realized that GPUs aren't the royal road to AGI." Maybe Beijing grasped something Washington hasn't. The infrastructure buildout is a bet on scaling laws that may be weakening. Loading up on depreciating silicon might not be the strategic advantage everyone assumed.

Strip away the national security rhetoric and a simpler story emerges.

Nvidia has excluded China data center revenue from its financial forecasts entirely. Jensen Huang pegged the lost opportunity at $50 billion this year. Wall Street analysts at Wells Fargo estimate H200 exports could add $25-30 billion in revenue and 60-70 cents to earnings per share. At current valuations, that translates to $14-17 per share in stock price upside.

The 25% government cut, if it ever materializes, would generate $6-7.5 billion for US coffers. Real money. Roughly equivalent to the National Science Foundation's annual budget. Also an obvious incentive structure rewarding the administration for approving exports regardless of security implications. The more chips sold, the more revenue collected. National interest and Nvidia interest become indistinguishable.

"The interests here are not really those of the country, they are those of Nvidia," said Chris McGuire, who worked on export controls in the Biden administration.

China's subsidies flow in the opposite direction toward the same end. Beijing recently increased energy subsidies that cut electricity bills by up to half for data centers using domestic chips. The policy compensates for the lower efficiency of Chinese processors, which consume more power to match Nvidia's performance. Industrial policy dressed as national security. Same as the American version, different jersey.

The H200 deal faces multiple points of failure.

Congress could pass blocking legislation. The SAFE Act would codify existing export restrictions. Both parties have constituencies opposed for different reasons. National security hawks see capitulation. Economic nationalists see competitor assistance. The only enthusiastic supporters are Nvidia shareholders and an administration hunting for trade wins.

The Commerce Department must finalize regulations making the 25% payment legally viable. The previous H20 arrangement never achieved this step. Constitutional scholars have questioned whether any administrative workaround survives judicial review.

Chinese regulators could kill demand through arduous approval processes or public sector bans. The procurement list addition suggests this is already underway. Even without formal restrictions, the message to state-owned enterprises is clear.

And then there's the market reality. Nvidia's H200 is a generation behind the Blackwell chips now shipping to American customers. By the time export logistics, security reviews, and Chinese approvals align, the H200 may be two generations behind cutting-edge deployments. The 18-month advantage the White House cited could stretch longer.

Meanwhile, in a server room at a Chinese state-owned bank, $14 million worth of Huawei processors sit in racks. Engineers walk past them on the way to the Nvidia machines that still run the trading models. The new chips require a programming language called MindSpore. The documentation is incomplete. The deadline for migration was supposed to be October, then December. Now they're talking about Q2. The growing pains the policymaker mentioned? They haven't even started.

• For investors: Nvidia's China revenue remains at zero in forward guidance. Any upside requires regulatory, legal, and Chinese government cooperation that may never align. The stock trades at 24x forward earnings with 31% projected growth. The China option has value, but pricing it demands heavy discounting.

• For US policymakers: Charging DOJ with prosecuting chip smuggling while licensing legal exports of identical chips sends no coherent signal. If Huawei truly matches Nvidia's performance, export controls have already failed. If it doesn't, the security rationale for loosening them collapses.

• For Chinese technology firms: The procurement list marks mandatory import substitution. Companies that built on Nvidia's ecosystem face years of painful migration. The idle chips are just the beginning.

Q: What's the difference between Nvidia's H200 and H20 chips?

A: Both come from Nvidia's Hopper architecture, but the H200 is far more powerful. According to Georgetown's Center for Security and Emerging Technology, the H200's processing performance is nearly 10 times the limit previously allowed for China exports. The H20 was specifically designed to fall just below export restrictions. It's like comparing a sports car to a sedan with the same engine family.

Q: Why is Trump's 25% cut legally questionable?

A: The US Constitution explicitly forbids export taxes. To work around this, chips manufactured in Taiwan will be shipped to US ports first, letting the government classify the 25% fee as an import tariff. The previous 15% arrangement on H20 chips never took effect because no one wrote the regulations making it legal. This deal faces the same problem.

Q: What is CUDA and why does it make switching chips so difficult?

A: CUDA is Nvidia's programming platform for AI development, built over 20 years into the industry standard. Most AI models, developer skills, and existing code are written for CUDA. Switching to Huawei means learning a different framework called MindSpore, rewriting legacy systems, and retraining engineers. That's why $14 million in Huawei chips sit unused at one Chinese bank.

Q: What did DeepSeek actually achieve that spooked US markets?

A: DeepSeek, a Chinese startup operating under export restrictions, built AI models matching or exceeding American competitors using fewer chips, less compute, and a fraction of the budget. Their breakthrough suggested algorithmic efficiency can substitute for raw hardware power. If that's true, the chip war is a fight over depreciating assets rather than strategic advantage.

Q: What is the SAFE Act and could it block this deal?

A: The SAFE Act is bipartisan legislation that would codify existing US restrictions on advanced chip exports to China. A related bill introduced last week would block H200 exports for 30 months. Both parties have constituencies opposed to the deal. National security hawks see it as capitulation, while economic nationalists see it as helping a competitor.

Get the 5-minute Silicon Valley AI briefing, every weekday morning — free.